Below are the monthly updates from the most current December 2018 fuel price data (GasBuddy.com) and October 2018 electricity and natural gas price data (US Energy Information Agency).

California vs. US Diesel Price

Above US Average

(CA Average)

The December average price per gallon of diesel in California dropped 17 cents from November to $3.88. The California premium above the average for the US other than California ($2.99) remained essentially constant by easing to 88.2 cents, a 29.5% difference.

In December, California had the 2nd highest diesel price among the states and DC, behind only Hawaii.

Range Between Highest and Lowest Prices by Region

Above US Average

(Central Coast Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.04 in the Sacramento Region (average December price of $3.30), to $1.28 in Central Coast Region (average December price of $3.54).

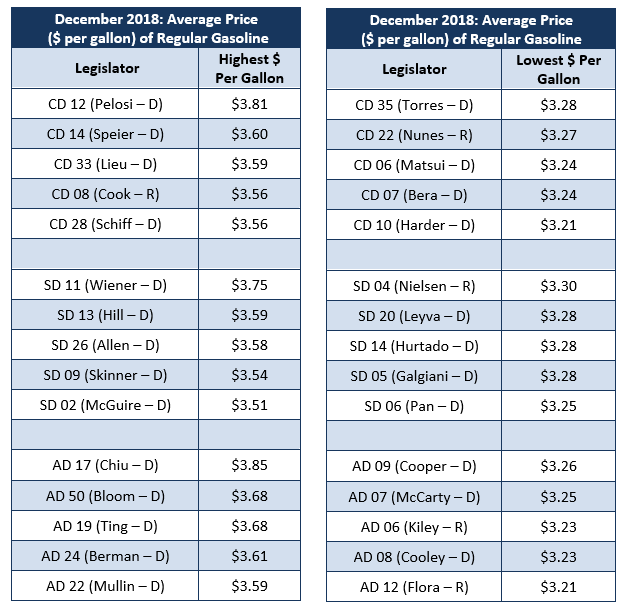

Highest/Lowest Fuel Prices by Legislative District:

California Residential Electricity Price

Rest Of US

California average Residential Price for the 12 months ended October 2018 was 18.84 cents/kWh, 50.7% higher than the US average of 12.50 cents/kWh for all states other than California. California’s residential prices remained the 7th highest in the nation.

California Residential Electric Bill

For the 12 months ended October 2018, the average annual Residential electricity bill in California was $1,230, or 23.7% higher ($236) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 4.4% ($60).

Electricity use, however, differs significantly across the state, with estimated 2017 household use up to 68% higher in the interior regions compared to the coastal regions. As a consequence, the lower income interior regions pay a disproportionate share of the growing cost from the state’s energy policies.

Impact on Residential Ratepayers

US Average Price

For the 12 months ended October 2018, California’s higher electricity prices translated into Residential ratepayers paying $5.7 billion more than the average ratepayers elsewhere in the US using the same amount of energy.

California Commercial Electricity Price

Rest Of US

California average Commercial Price for the 12 months ended October 2018 was 16.32 cents/kWh, 61.1% higher than the US average of 10.13 cents/kWh for all states other than California. California’s commercial prices remained the 5th highest in the nation.

California Industrial Electricity Price

Rest Of US

California average Industrial Price for the 12 months ended October 2018 was 13.27 cents/kWh, 102.0% higher than the US average of 6.57 cents/kWh for all states other than California. California’s industrial prices remained the 6th highest in the nation.

Impact On Commercial And Industrial Ratepayers

US Average Price

For the 12 months ended October 2018, California’s higher electricity prices translated into Commercial & Industrial ratepayers paying $10.4 billion more than ratepayers elsewhere in the US using the same amount of energy.

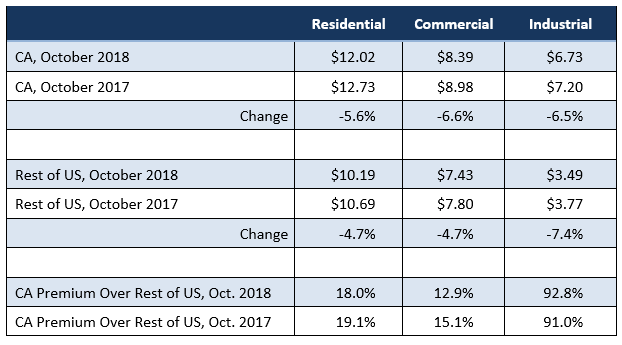

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended October 2018 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at centerforjobs.org/ca/methodology