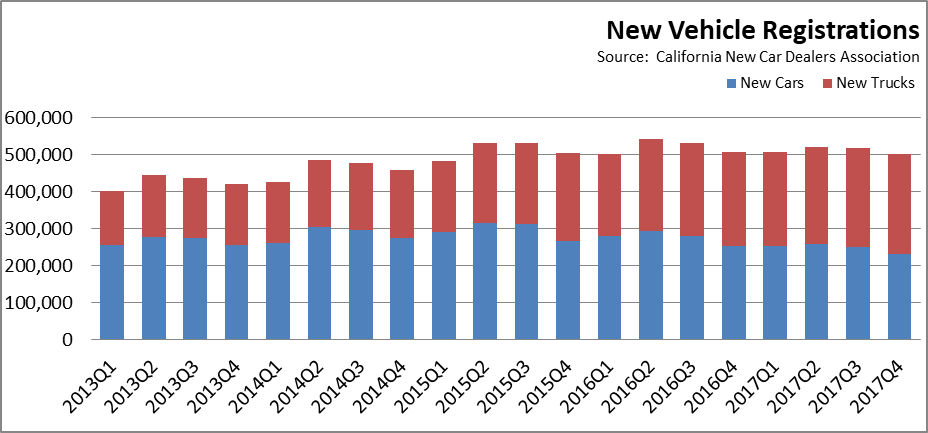

The latest new vehicle sales data from California New Car Dealers Association shows that while Californians’ purchases of new cars and trucks remains above the 2 million mark, total sales have eased slightly from their 2016 peak. Key findings from the data:

Light Trucks Now Over Half of New Vehicle Sales

- Total light vehicle sales in 2017: 1.051 million. Down 2.0% from 2016.

- 2017 Market share, cars: 48.7%. Down from 53.1% in 2016.

- 2017 Market share, light trucks: 51.3%. Up from 46.9% in 2016.

- California average price per gallon regular gasoline, 2017:Q4: $2.74. Down from $2.79 in 2016:Q4.

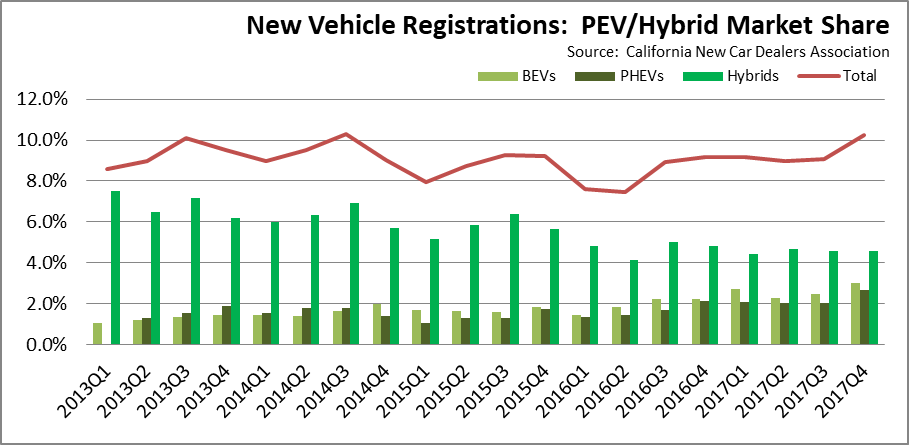

PEV Sales Up in Fourth Quarter

- 2017:Q4 PEV sales (plug-in hybrids and battery electric vehicles) at 28,478 vehicles, up from 22,183 in 2016:Q4. Total market share for PEVs was 5.7%, up from 4.4% in 2016:Q4.

- True EV sales (battery electric vehicles) at 15,121 vehicles, up from 11,300 in 2016:Q4, with market share going from 2.2% in 2016:Q4 to 3.0% in 2017:Q4.

- Hybrid sales (except for plug-in hybrids) at 22,991, down from 24,404 in 2016:Q4. Total market share was 4.6%, down from 4.8% in 2016:Q4.

- While the market share for plug-in vehicles was up in the quarter, a contributing factor likely was consumer concerns over possible elimination of the associated tax credit in the federal tax reform. The credit was restored only in the final version, at which point only two weeks remained in the quarter. Whether this uptick is finally a change in consumer preferences or a shift of potential sales from 2018 into the 4th quarter remains to be seen.

- Putting this potential shift aside, the market for alternative fuel vehicles has remained relatively stable since 2014, with sales continuing to shift among the three components shown in the chart below as the number of models with improved ranges has increased and consumers open to this market shift from hybrids to BEVs and PHEVs.

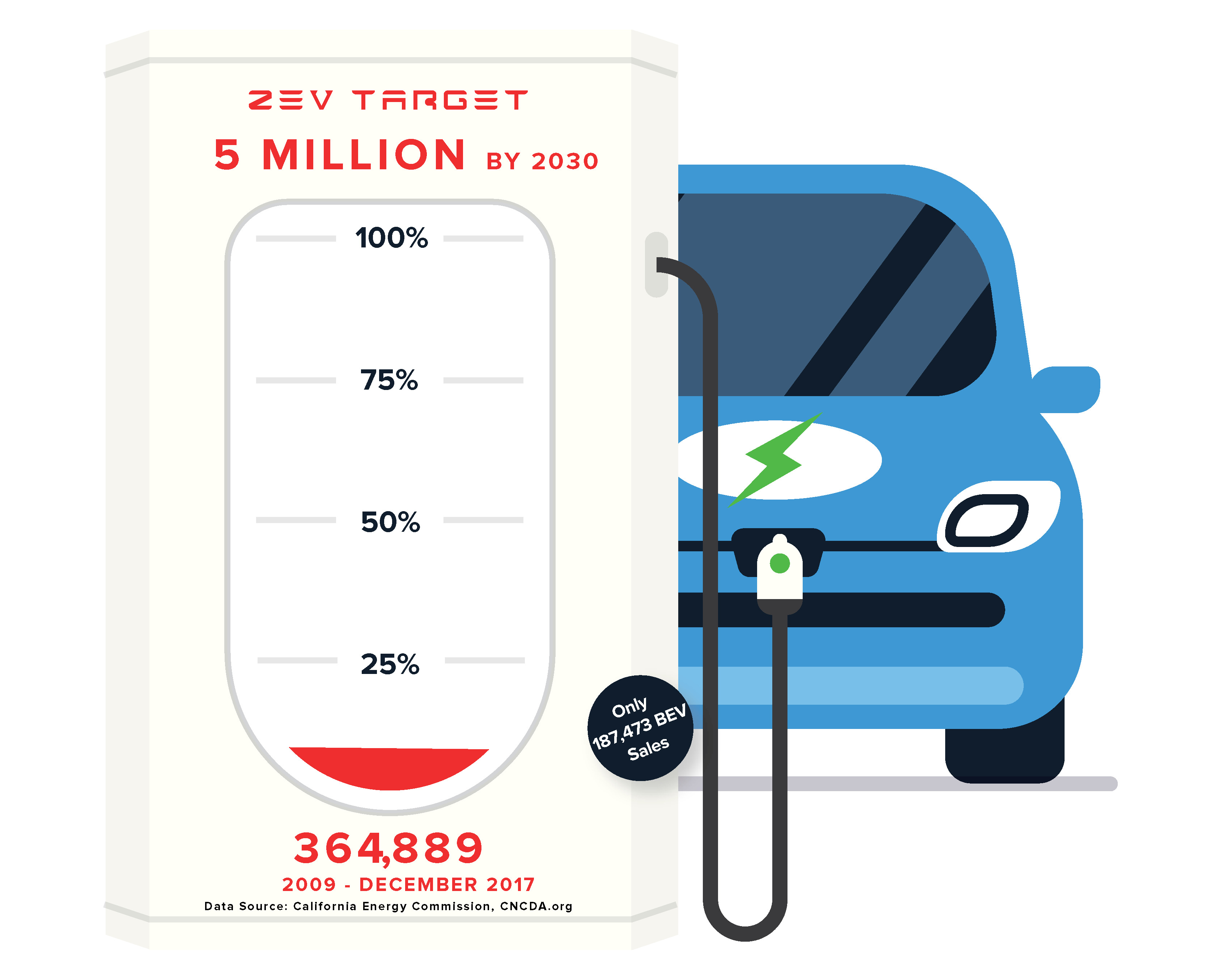

Cumulative PEV Sales at 7.3% of 2030 Goal—True ZEVs at 3.7%

As part of the AB 32 climate change program, Executive Order B-48-18 administratively created a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030. This action expands on the prior Executive Order B-16-2012, which set a goal of 1.5 million by 2025, with a sub-goal that their market share is expanding at that point.

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both ZEVs (battery electric vehicles (BEV)) that run only on electricity and plug-in hybrids (PHEV) which run on both electricity and motor fuels. Consequently, only a portion of the vehicles being counted to meet the zero emission goal—roughly half based on current sales volumes—will in fact produce zero emissions. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but to date, just over 300 have been registered in the state.

Using this broader interpretation, total PEV sales since 2009 account for 7.5% of the 2030 goal. True ZEV sales (BEVs), however, account for only 3.7%.

The original Center updates were based on the then most current Energy Commission estimates for ZEVs registered and actually operating on California’s roads, updated with the CNCDA quarterly sales data. The most recent Energy Commission update, however, has shifted from tracking progress based on registrations to reporting of cumulative PEV sales based on estimates from an outside organization. The numbers, therefore, overestimate the number of applicable vehicles actually operating in the state by not taking into account those that have been moved out of state, traded in, involved in accidents, or otherwise removed from operation on the state’s roads. The tracking graphic below, however, conforms to the Energy Commission’s current approach.

As an indication of the significance of this change, the previous Energy Commission estimate of registrations showed an 8% drop-off from the then-current cumulative sales number, a factor consistent with fleet-turnover rates for vehicles of this type. Applying this factor to the latest sales total, the actual progress rate consistent with the Executive Order language of “vehicles on California’s roads” would be 6.7% rather than the 7.3% shown in the chart below.

Accounting for normal fleet turnover rates and reductions from persons moving out of California, PEV sales would need to be 4.8 times higher to meet the 2030 goal. True ZEV sales would have to be 9.0 times higher.

Manufacturing Job Provisions of Executive Order B-16-2012 Still Not Implemented

Like its predecessor, Executive Order B-48-18 contains some language referencing the economic and jobs potential associated with expansion of the ZEV market in California. However, the primary language shows a shift in focus to developing temporary construction jobs through installation of charging infrastructure rather than the permanent manufacturing and associated jobs development originally envisioned in B-16-2012. However, because this earlier order was not repealed, its provisions would still remain in effect.

Executive Order B-16-2012 contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

- [By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

- [By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

- [By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the ZEV Action Plan instead calls primarily for data collection and conversations:

Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.

Since the last update, the following investments have been announced to locate ZEV-related manufacturing jobs outside of California:

- Farraday Future is still the primary manufacturer other than Tesla still reported to be considering a plant in California. However, three years after making the announcement, no progress has been reported on their proposed facility in Hanford. Funding also remains in question due to events affecting their primary backer.

- While Tesla’s Nevada gigafactory expects to have production capacity for 35 gigawatt hours of batteries by 2020, Chinese producers have announced plans in the past year for production additions for 150 gigawatt hours over the next 3 to 4 years.

- Dyson continues with the development of three electric models. Production sites being considered are United Kingdom, Singapore, Malaysia, and China.

- Volkswagen announced production goals of 1,500 electric vehicles a day at its Zwickau factory in Germany.