The latest new vehicle sales data from California New Car Dealers Association shows continued but slowing growth in California’s purchases of new cars and trucks. California consumers are now buying qualifying zero emission vehicles at an annual rate of 71,000, but will need to bump these purchases up to 175,000 a year in order to meet the state’s 2025 goal. Key findings from the data are below. Additional details on definitions and background are in the Center’s earlier report.

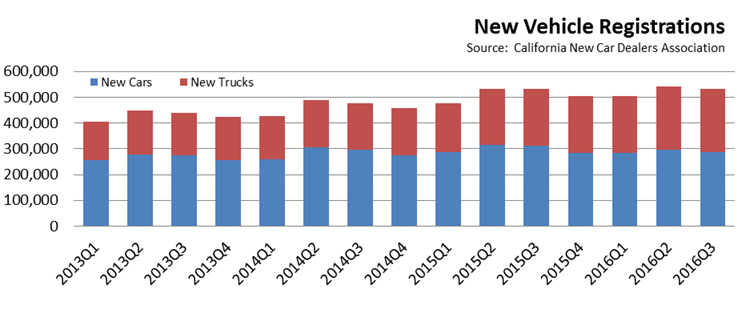

Californians Continue to Buy More Light Trucks as Fuel Prices Drop

- Total light vehicle sales in 2016 Q3: 531,514. Essentially level with 2015 Q3 sales.

- Light vehicle market share, cars: 53.7%. Down from 58.8% in 2015 Q3.

- Light vehicle market share, light trucks: 46.3%. Up from 41.2% in 2015 Q3.

- California average price per gallon regular gasoline, 2016 Q3: $2.77. Down from $3.47 in 2015 Q3.

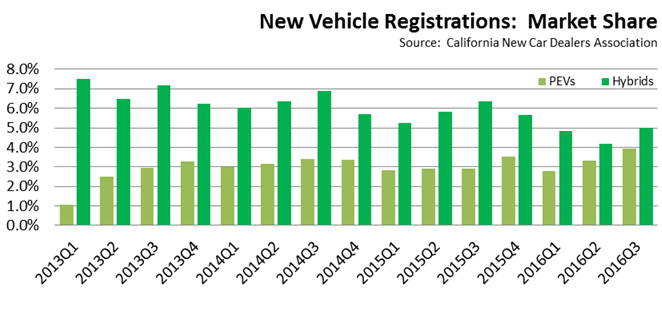

PEV Sales Up, Offset by Larger Drop in Hybrid Sales

- PEV sales continue to grow at the expense of hybrid sales rather than bringing in significant new market share.

- PEV sales (plug-in hybrids and battery electric vehicles) up 5,597 vehicles from 2015 Q3. Total market share for PEVs was 3.9% (20,972 vehicles) of light vehicle sales, up from 2.9% (15,375) in 2015 Q3 and the highest level since 2013.

- Hybrid sales (except for plug-in hybrids) down 7,203 vehicles from 2015 Q3. Total market share was 5.0% (26,667), down from 6.4% (33,880) in 2015 Q3.

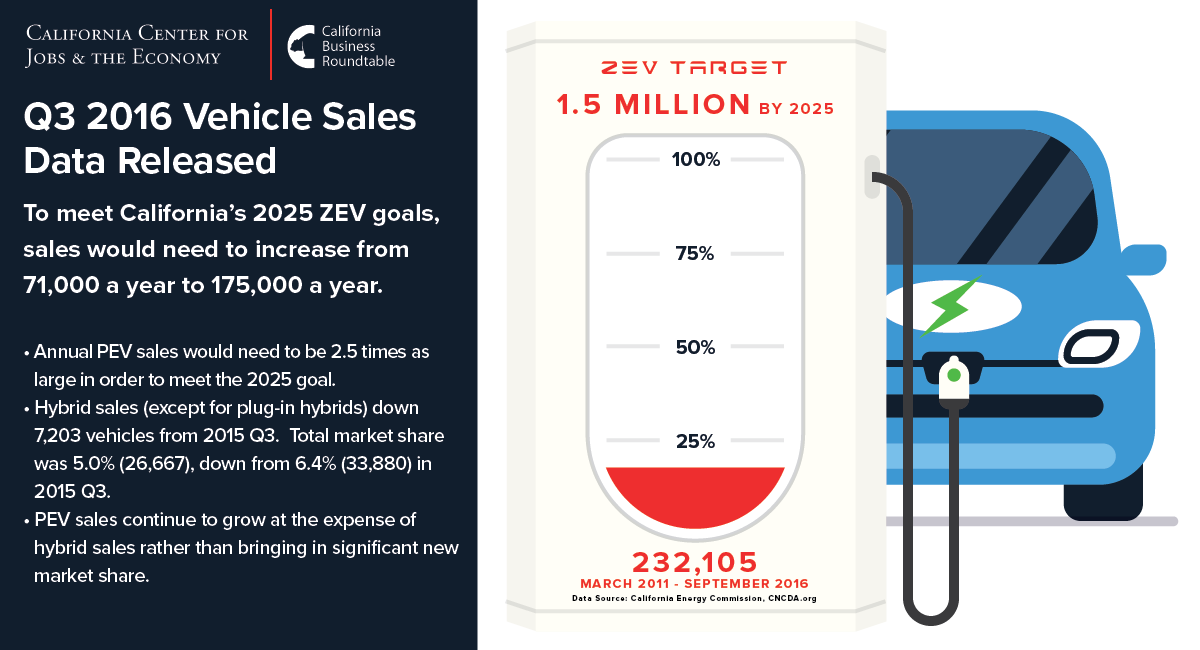

Total PEVs at 15.5% of 2025 Goal

- As part of the AB 32 climate change program, Executive Order B-16-2012 administratively created a goal of 1.5 million zero-emission vehicles (ZEVs) on California roads by 2025, with a sub-goal that their market share is expanding at that point. The order also established interim mileposts primarily related to infrastructure support for recharging along with more qualitative targets for manufacturing capacity and commercial viability of these vehicles.

- Accounting for normal fleet turnover rates and reductions from persons moving out of California, annual PEV sales would need to be 2.5 times as large in order to meet the 2025 goal, going from current annual sales of 71,000 to 175,000 a year.

- The chart below is based on the Energy Commission’s baseline estimate of 146,000 PEVs between March 2011 and July 2015, and updated with the New Car Dealers’ quarterly sales data. This approach provides an overestimate of the number of PEVs actually registered in the state as it does not account for vehicles withdrawn from the fleet due to accidents, returns, trade-ins, owners moving out of the state, and other actions causing vehicles to be removed from the in-state fleet. This factor will be adjusted as the Commission updates its estimates in periodic reports.

Manufacturing Provisions of the Executive Order Still Not Implemented

- Executive Order B-16-2012 also contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

- [By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

- [By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

- [By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

- Rather than increasing the state’s competitiveness for an expanded manufacturing base, recent actions have instead increased the difficulty of siting and operating these facilities in California, including increasing the complexity and therefore litigation risks associated with the state’s employment laws, regulatory actions that contribute to industrial electricity rates that are 80% higher than the national average, the continuing expansion of the state’s already extensive California-only regulations, and a permitting and siting decision process that can take years to complete.

- While Tesla has announced plans to pursue expansion of its Fremont facility to add up to another 3,000 employees, its November purchase of Grohmann Engineering will add 1,700 manufacturing design employees in Germany. Also in November, SF Motors, Inc.—headquartered in the Bay Area—announced a new research and development facility in Michigan.

- No data currently exists on the overall level of the relevant manufacturing jobs in California. US Bureau of Labor Statistics previously began development of a green jobs data series, but this effort was eliminated as a cost savings measure after 2011.