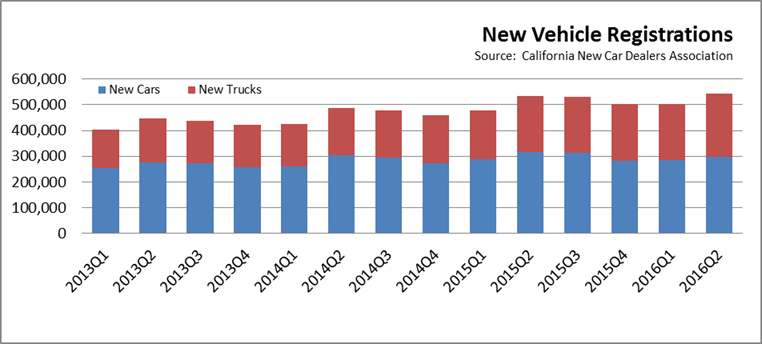

The latest new vehicle sales data from California New Car Dealers Association shows continued but slowing growth in California’s purchases of new cars and trucks. Key findings from the data:

Californians Continue to Buy More Light Trucks as Fuel Prices Drop

- Total light vehicle sales in 2016 Q2: 542,565. Up 1.8% from 2015 Q2.

- Market share, cars: 54.8%. Down from 59.3% in 2015 Q2.

- Market share, light trucks: 45.2%. Up from 40.7% in 2015 Q2.

- California average price per gallon regular gasoline, 2016 Q2: $2.81. Down from $3.50 in 2015 Q2.

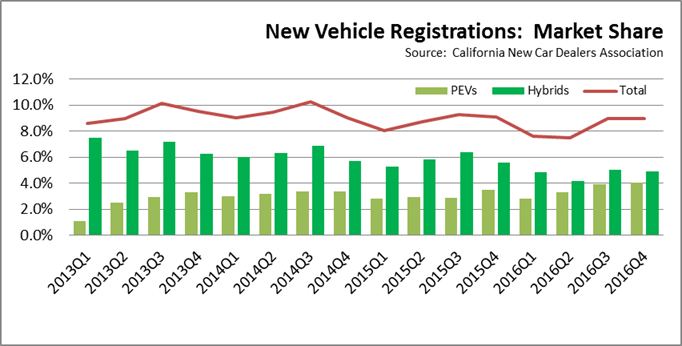

PEV Sales Up, Offset by Larger Drop in Hybrid Sales

- 2016 PEV sales (plug-in hybrids and battery electric vehicles) totaled 73,573, up 11,374 vehicles from 2015. Total market share for PEVs was 4.1%, up from 3.5% in 2015.

- True EV sales (battery electric vehicles) totaled 40,347 in 2016, up 5,870 vehicles from 2015, with market share going from 1.8% in 2015 to 2.2% in 2016.

- Hybrid sales (except for plug-in hybrids) totaled 98,763 in 2016, down 19,799 vehicles from 2015. Total market share was 4.9%, down from 5.6% in 2015.

- These numbers suggest that hybrid buyers are now becoming more comfortable with the ranges offered by PEVs to make the switch, but the overall core market for alternative fuel vehicles (PEVs plus hybrids) has not yet substantially changed, dropping from 180,761 in 2015 to 172,336 vehicles in 2016.

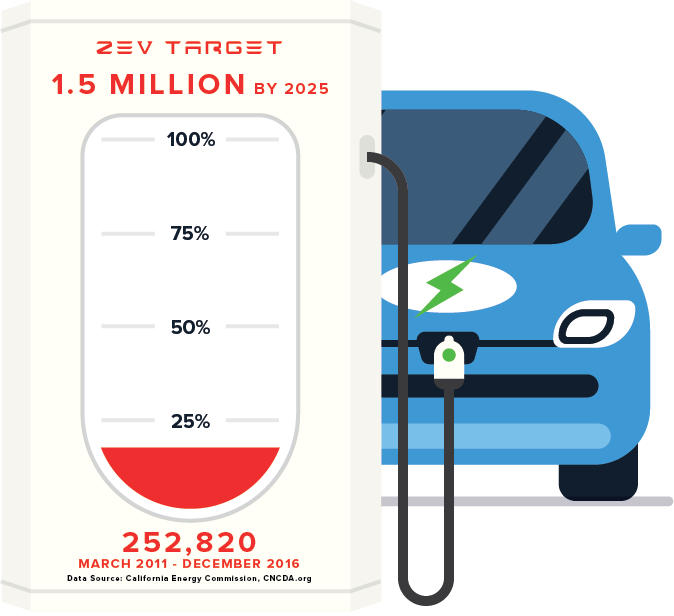

Total PEVs at 16.9% of 2025 Goal

- As part of the AB 32 climate change program, Executive Order B-16-2012 administratively created a goal of 1.5 million zero-emission vehicles (ZEVs) on California roads by 2025, with a sub-goal that their market share is expanding at that point. The order also established interim mileposts primarily related to infrastructure support for recharging along with more qualitative targets for manufacturing capacity and commercial viability of these vehicles.

- Accounting for normal fleet turnover rates and reductions from persons moving out of California, PEV sales would need to be 2.4 times as large in order to meet the 2025 goal.

-

The chart below is based on the Energy Commission’s baseline estimate of 146,000 PEVs between March 2011 and July 2015, and updated with the New Car Dealers’ quarterly sales data. This approach provides an overestimate of the number of PEVs actually registered in the state as it does not account for vehicles withdrawn from the fleet due to accidents, returns, trade-ins, owners moving out of the state, and other actions causing vehicles to be removed from the in-state fleet. This factor will be adjusted as the Commission updates its estimates in periodic reports, although the baseline number is not updated in the Commission’s most current update report.

Manufacturing Provisions of the Executive Order Still Not Implemented

- Executive Order B-16-2012 also contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

- [By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

- [By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

- [By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the expansion of the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the ZEV Action Plan instead calls primarily for data collection and conversations:

Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.

Since the last update, the following investments have been announced to locate ZEV-related manufacturing jobs outside of California:

- In their February 22, 2017 earnings call, Tesla confirmed their Buffalo, NY plant as Gigafactory 2. In December, Tesla announced a 1,400-worker expansion of this facility for joint production of solar cells with Panasonic.

- In January, Tesla announced an additional $350 million, 500-worker expansion of their Nevada Gigafactory 1 to make components for the Model 3 sedan.

- In February, Honda and Hitachi announced joint production of electric vehicle motors at existing plants in Berea, KY and Japan, along with a potential site in China.

- In November, Silicon Valley-based Lucid Motors announced a $700 million, 2,000-employee EV production plant in Casa Grande, AZ.

- In January, Rivian Automotive closed on the purchase of former Mitsubishi Motors plant in Normal, IL for EV production beginning in 2019.

- In February, Mexico’s Giant Motors announced an agreement with China’s JAC Motors to build 40,000 vehicles annually of JAC’s S2 and S3 SUVs.

- In February, Volkswagen announced formation of a $2 billion subsidiary to build electric charging facilities in the US. The new company, Electrify America, LLC, is headquartered in Reston, VA.

- In January, Honda and General Motors announced the addition of joint production of fuel cell power systems at an existing GM plant in Brownstown, MI.

- In February, LG Chem announced expansion of its battery plants in Holland, MI and China to meet expected demand from Chevy Bolt, Chevy Volt, and Chrysler Pacifica Hybrid.