The latest new vehicle sales data from California New Car Dealers Association shows that as expected, the above trend ZEV sales in Q4 2017 were likely consumer responses to the potential sunset of related federal subsidies. The Q1 sales of true ZEVs (battery and fuel cell vehicles) were slightly below the quarterly levels from a year prior. Total PEV sales (plug-in hybrids and ZEVs) were up solely as a result of continued shifts from hybrid to plug-in hybrid sales, likely reflecting continued consumer acceptance issues related to range, higher purchase price, and reliability of the new technologies. Key findings from the data:

Light Trucks Sales Share Continues Growing

-

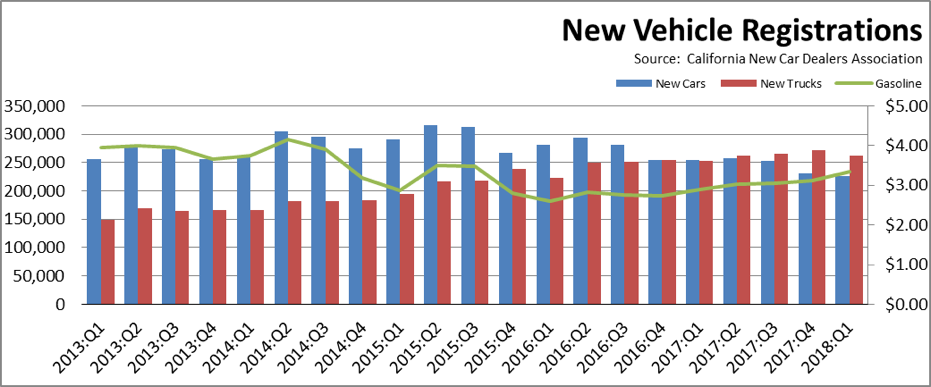

- Total California light vehicle sales in Q1 2018: 487,741. Down 3.8% from Q1 2017.

- Light truck market share was 53.7%, up from 49.8% in Q1 2017. The growing consumer preference for larger vehicles continues to be a contra-trend affecting the state’s ability to achieve its ZEV goals, as fewer models are available in this market component at price points that would achieve broader sales below the higher income segments.

- Consumer shifts to light trucks for the US as a whole was even more pronounced, accounting for fully two-thirds of new light vehicle sales in the first quarter.

- The trend towards light trucks came even in spite of higher fuel prices. The average California price for regular gas in Q1 2018 was $3.34 a gallon, compared to $2.89 the year prior.

PEV Sales Up in Fourth Quarter – ZEV Sales Little Changed

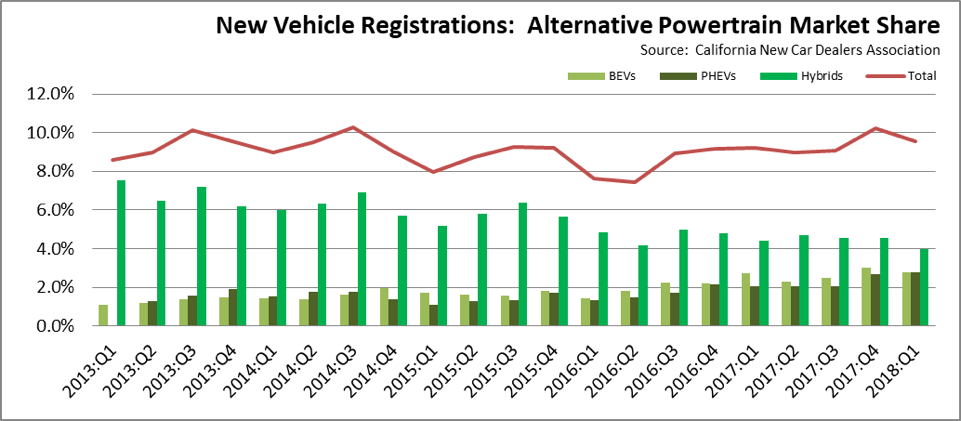

- 2018:Q1 PEV sales (plug-in hybrids and battery electric vehicles) at 27,191 vehicles, up from 24,270 in 2017:Q1 but down from 28,478 in 2017:Q4. Total market share for PEVs was 5.6%, up from 4.8% in 2017:Q1.

- True EV sales (battery electric vehicles) at 13,657 vehicles, down from 13,804 in 2017:Q1 and 15,071 in 2017:Q4, with market share going from 2.7% in 2017:Q1 to 2.8% in 2018:Q1.

- Hybrid sales (except for plug-in hybrids) at 19,416, down from 22,328 in 2017:Q1. Total market share was 4.0%, down from 4.4% in 2017:Q1.

- The quarterly growth in PEV sales came solely as consumers shifted from hybrids to plug-in hybrids, again suggesting consumer reluctance from price, range, or other concerns to make the full shift to all-electric vehicles. As illustrated in the chart below, the overall market for alternative powertrain vehicles has remained largely stable at only 10% or below the total market, with this segment continuing to be defined more by income level.

- While the market share for plug-in vehicles was up in 2017:Q4, a contributing factor likely was consumer concerns over possible elimination of the associated tax credit in federal tax reform. The credit was restored only in the final version, at which point only two weeks remained in the quarter. The lower sales in 2018:Q1 suggests the higher prior quarter results came at the expense of the 2018 sales, as consumers moved their purchases ahead to secure the subsidy payments.

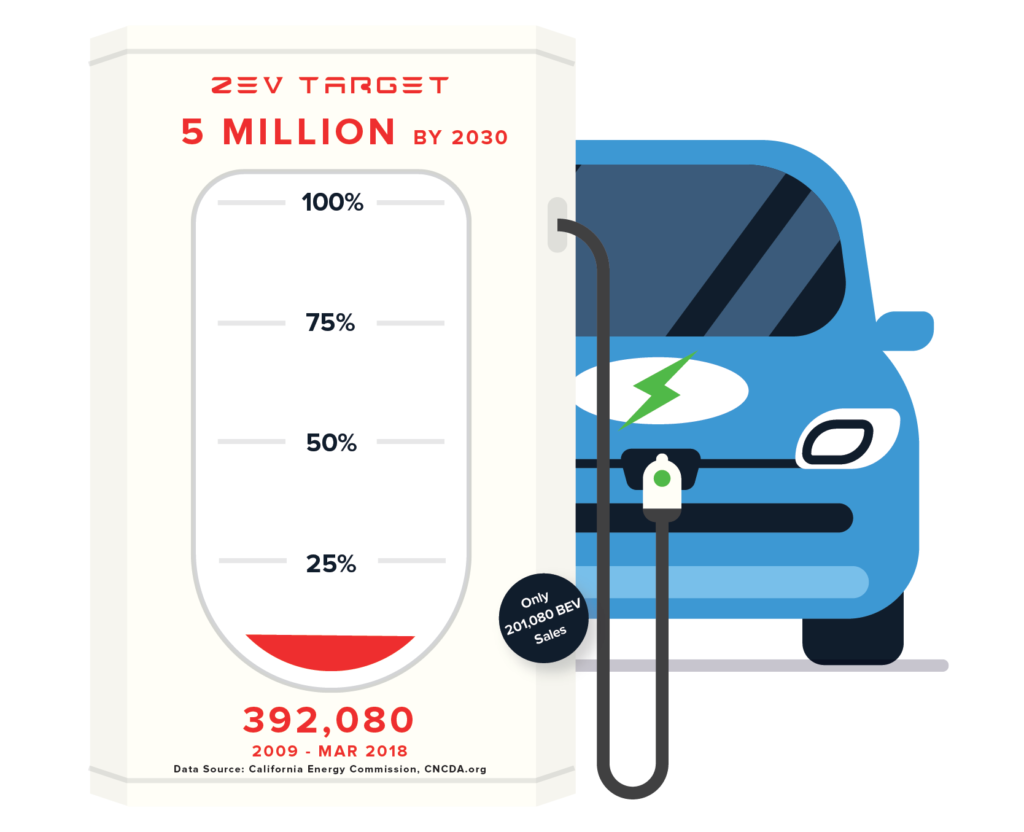

Cumulative PEV Sales at 7.8% of 2030 Goal—True ZEVs at 4.0%

As part of the AB 32 climate change program, Executive Order B-48-18 administratively created a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030. This action expands on the prior Executive Order B-16-2012, which set a goal of 1.5 million by 2025, with a sub-goal that their market share is expanding at that point.

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both ZEVs (battery electric vehicles (BEV)) that run only on electricity and plug-in hybrids (PHEV) which run on both electricity and motor fuels. Consequently, only a portion of the vehicles being counted to meet the zero emission goal—roughly half based on current sales volumes—will in fact produce zero emissions. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but CNCDA show total market share for these vehicles at only 0.1%.

Using this broader interpretation, total PEV sales since 2009 account for 7.8% of the 2030 goal. True ZEV sales (BEVs), however, account for only 4.0%.

The Executive Orders, however, also refer to ZEVs on California roads, while the agency accountings concentrate on sales. Using prior Energy Commission reviews to account for ZEVs no longer on the roads as a result of accidents, moves out of state, and other factors that over time remove vehicles from the active fleet, the actual progress rate consistent with the Executive Order language of “vehicles on California’s roads” would be 7.2% rather than the 7.8% shown in the chart below.

Accounting for normal fleet turnover rates and reductions from persons moving out of California, PEV sales would need to be 4.3 times higher to meet the 2030 goal. True ZEV sales would have to be 8.5 times higher.

Manufacturing Job Provisions of Executive Order B-16-2012 Still Not Implemented

Like its predecessor, Executive Order B-48-18 contains some language referencing the economic and jobs potential associated with expansion of the ZEV market in California. However, the primary language shows a shift in focus to developing temporary construction jobs through installation of charging infrastructure rather than the permanent manufacturing and associated jobs development originally envisioned in B-16-2012. However, because this earlier order was not repealed, its provisions would still remain in effect.

Executive Order B-16-2012 contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

- [By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

- [By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

- [By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the ZEV Action Plan instead calls primarily for data collection and conversations:

Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.

Since the last update, the following investments have been announced to locate ZEV-related manufacturing jobs outside of California:

- SF Motors leased a 135k sf facility in Milipitas in May, but primarily for R&D and low-volume manufacturing.

- Los Angeles based Thor Trucks has indicated it plans to partner with existing manufacturers to produce its electric trucks rather than build its own facility. Production, therefore, will be largely out of state.

- Los Angeles base Evolozcity announced major new funding, but plans to do its manufacturing through existing US and Chinese plants rather than building its own production facility.

- Along with the gradual shift of its conventional X3 SUV production from South Carolina to China, BMV now intends to produce the electric iX3 version in China as well.

- Rivian Automotive secured $200 million in financing as it continues to prepare a former automotive plant in Normal, IL to produce electric SUVs and pickups.

- In a direct price-challenge to Tesla models, NIO began selling its locally produced vehicles in China in December.

- Mercedes-Benz announced investments to manufacture compact electric cars at the Hambach plant in France.

- Tesla announced the company will build its Model Y in China.