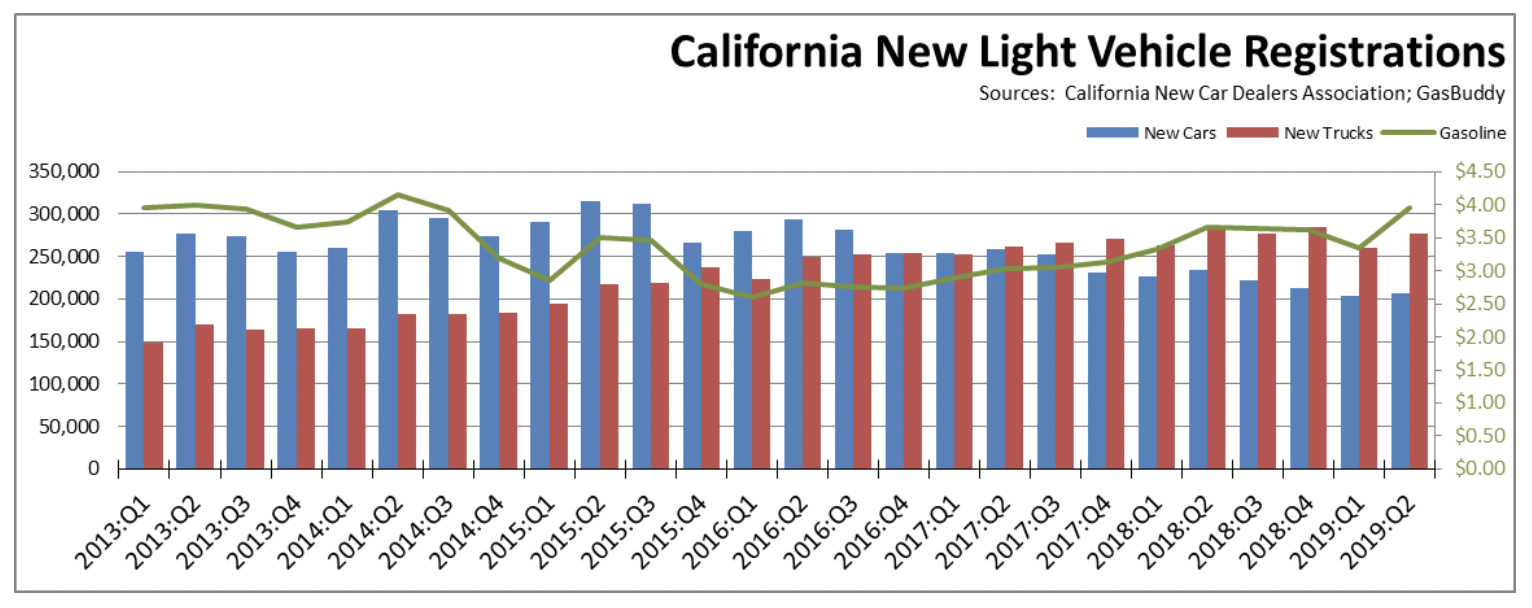

The latest new vehicle sales data from California New Car Dealers Association indicates that sales are still projected to be under 2 million units for the year, slipping below sales in the prior four years but still well above historical levels. While slowing, this indicator reflects the level of overall consumer confidence and continuing strength of the recovery. New vehicle sales are also a critical indicator of state and local revenues, with Motor Vehicle and Parts Dealers (NAICS 441) producing 13% of total taxable sales in the most recent data for the first quarter in 2018.

Light Trucks at 57% of Sales

- Light truck market share in the quarter notched up to 57.2%, compared to 56.1% in the prior Q1 2019 and 54.6% a year ago in Q2 2018.

- Consumer shifts to light trucks for the US outside California similarly showed only a small change, easing to 66.3% of new light vehicle sales. The potential for California’s ZEV policies to be replicated beyond its borders remains low as the market segment targeted by most Plug-in Electric Vehicle (PEV) models—cars—continues to remain low as a result of consumer preferences. In addition, the costs of the state’s policies—monetized under the emissions credit components of the ZEV regulations—continue to be shifted to generally lower income consumers in California and other states as a result of these trends.

- The average California price for regular gas in Q2 2019 was $3.99 a gallon, up from $3.66 a year prior.

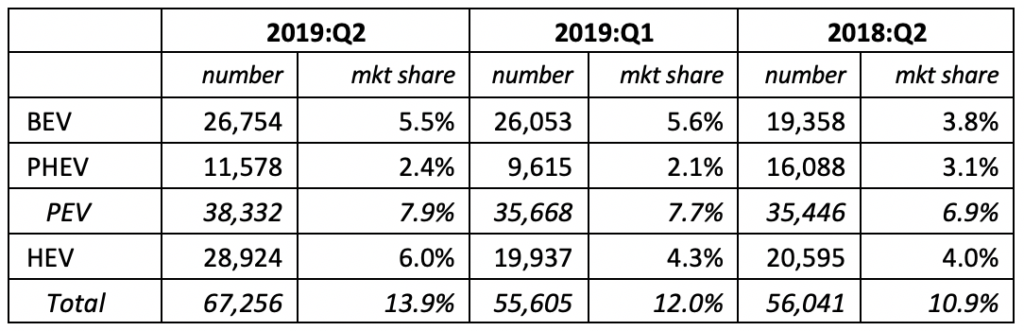

PEV Sales Mixed Results in 1st Quarter

Source: Derived from California New Car Dealers Association

- PEV sales were up 8.1% from the same quarter a year ago, and up 7.5% from the prior quarter as PHEV sales regained some of their lost ground.

- Battery Electric Vehicles (BEVs) sales were largely stable from the prior quarter (from 5.6% to 5.5% share of total sales), primarily as Tesla eliminated its $35,000 price point for the Model 3 base model (now $38,990) and continued its shift for sales growth to China and Europe. Tesla sales volume in this quarter for California dipped to 19,594 (17,200 of which were Model 3), or 73% of all BEVs sold in the state, illustrating the extent to which fulfillment of the state’s policies remain heavily dependent on the sales performance of a single company if not a single car model. Chevy Bolt, generally in the same price range as Model 3, shows only 2,197 units for the quarter.

Comparing the performance of the Model 3 and Bolt continues to suggest that pricing alone is not the dominant factor in consumer decisions for these vehicles to date. Model 3 in the near luxury market segment continues to appeal to higher income households, while Bolt in the subcompact segment has yet to gain traction in the broader moderate income levels. Prior experience showed that sales of these vehicles were highly sensitive to the availability of government subsidies—with dramatic changes in sales when areas such as the state of Georgia, Denmark, and Netherlands pulled back on subsidies or as others such as Norway greatly expanded them—but the current sales drivers are shifting away from this tool. California has already eliminated its credits to the primary BEV consumers through enactment of income limits. Both Tesla and GM have since passed the 200,000 sales threshold after which the federal credits are phased out, and Nissan and Ford are on track albeit more slowly to reach these levels as well. China, currently the primary market for ZEV sales, recently announced a phase-out of its direct subsidies by 2021.

Subsidies for these vehicles instead are shifting to emissions credit systems.

California’s regulations are structured to shift the cost of the ZEV policies from the generally higher income ZEV buyers to the more moderate and lower income consumers of traditional combustion vehicles, through the sale of emission credits from ZEV producers such as Tesla to the mass market vehicle manufacturers. Tesla’s recent pricing moves, however, suggest that these administratively-imposed costs on the average vehicle consumer will have to go much higher in order to result in the consumer changes envisioned in the state’s policies.

- After plunging 31% in the prior quarter, Plug-in Hybrid Vehicles (PHEVs) regained some of their lost ground, up 20.4% from the prior quarter but still down 28.0% from a year ago. Sales of this combustion component of “zero emission” vehicles helped offset the relative decline of BEVs, producing a marginal increase in PEV market share to 7.9%.

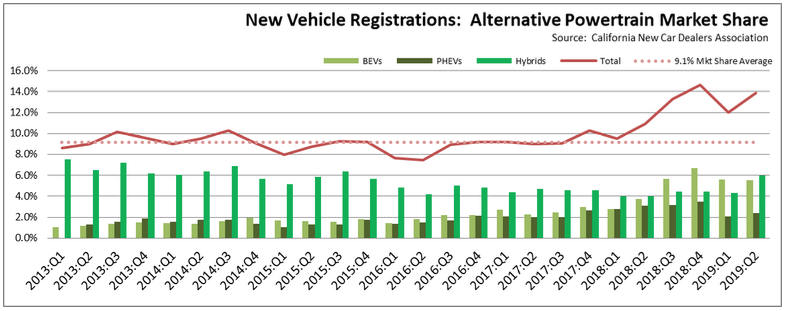

Alternative Market Share Still Above Long-term Trend

- Until recent data was taken over by Tesla’s backlog deliveries on the Model 3, the longer term trend line for sales of alternative fuel vehicles deviated little from an average market share of 9.1%. The sales mix instead changed as consumers open to these vehicles shifted from battery Hybrid Vehicles (HEVs) to PEVs as more models became available in that class. Driven by the Model 3 deliveries, total market share for alternative vehicles peaked at 14.6% in Q4 2018.

- After dropping sharply in the prior quarter, total market share again rose in the second quarter to 13.9%, but as the result of sales increases in the combustion based hybrid vehicles. After stabilizing since 2017 at an average of 4.4%, sales of battery hybrids (HEV) rose sharply in Q2, likely influenced by the state’s high gasoline prices in this period as consumers bought based on fuel efficiency rather than fuel type. PHEVs also regained some ground.

- The longer-term trend continues to be influenced more by outside factors rather than consumer appeal of ZEVs themselves. While the trend is likely to reset somewhat above the previous 9.1% level, the exact point is yet to be revealed in the data.

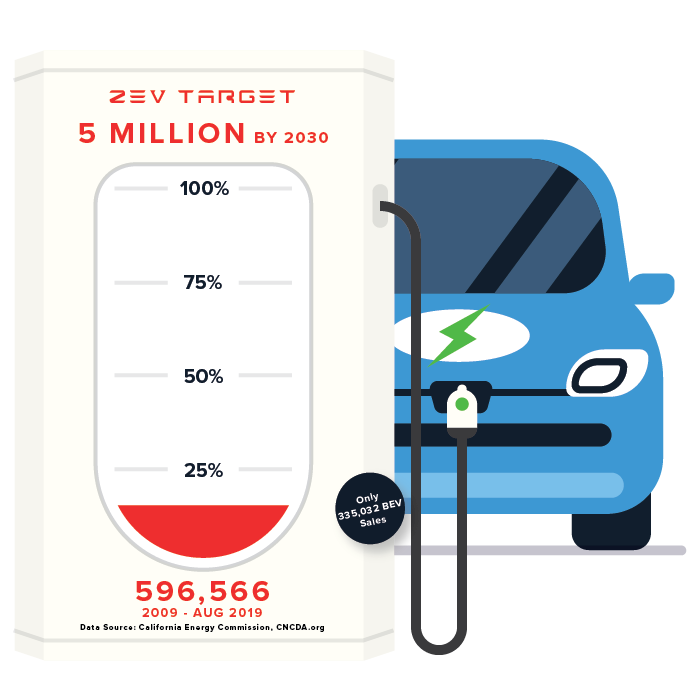

Cumulative PEV Sales at 11.9% of 2030 Goal—True ZEVs at 6.7%

As part of the AB 32 climate change program, Executive Order B-48-18 administratively created a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030. This action expands on the prior Executive Order B-16-2012, which set a goal of 1.5 million by 2025, with a sub-goal that their market share is expanding at that point. While these goals were set administratively, they are embodied in the state’s climate change strategies, and both public and utility ratepayer funds are being used to create the refueling infrastructure required for these motorists.

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both BEVs that run only on electricity and combustion PHEVs that run on both electricity and motor fuels. Consequently, only a portion of the vehicles being counted to meet the zero emission goal—roughly half based on current sales volumes—will in fact produce zero emissions when driven. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but CNCDA data show total market share for these vehicles to date at around 0.1%.

Using this more flexible interpretation that includes both true ZEVs and combustion PHEVs, total PEV sales since 2009 account for 11.9% of the 2030 goal. True ZEV sales, however, account for only 6.7%.

In addition to the distortion that comes from including combustion vehicles in the ZEV total, the Executive Orders also refer to ZEVs on California roads while the agency accountings rely on sales as the measure of progress. Using prior Energy Commission reviews to account for ZEVs no longer on the roads as a result of accidents, moves out of state, and other factors that over time remove vehicles from the active fleet, the actual progress rate consistent with the Executive Order language of “vehicles on California’s roads” would be 11.0% rather than the 11.9% shown in the chart below.

As discussed in the Q1 2018 report, carpool lane sticker data, however, suggests the differences may be even higher. While the “purple” decal numbers for cars bought beginning in 2019 track closely with the PEV sales since January, the “red” decal numbers for cars bought in prior years cover only 59% of PEVs sold in the applicable period. This discrepancy suggests a much higher turnover of PEVs “off California’s roads” than in prior estimates.

Manufacturing Job Provisions of Executive Order B-16-2012 Still Not Implemented

Executive Order B-16-2012 contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

[By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

[By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

[By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the ZEV Action Plan instead calls primarily for data collection and conversations:

Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.

Like many other statements concerning job creation associated with the state’s environmental and energy policies, these provisions related to ZEVs primarily consist of promises with little in the way of concrete action to shift the other state policies and regulations standing in the way of creating these types of permanent jobs within the state. California does have a significant ZEV production presence from Tesla, but Tesla located here primarily because of the availability of a vacant vehicle production facility that was fully permitted and constructed. California previously had several such facilities, but instead of being repurposed to create new manufacturing jobs, they were instead mined to produce air quality emission credits.

ZEV and ZEV component producers requiring new facilities have instead gone to other states and countries providing the timing certainty on development decisions required by such a rapidly changing industry. Tesla chose Nevada for its Gigafactory 1 for this reason. Announcements from other companies since the last quarter include:

- BloombergNEF’s most recent Electric Vehicle Outlook 2019 identifies over $140 billion in currently planned vehicle production capacity investments by nine companies, none of which is located in California.

- For the year ending June 30, China accounted for 54% of the global sales of BEVs and PHEVs. The share for the entire US was 16%.

- Aiways became the first Chinese manufacturer to launch electric vehicle sales in Europe.

- Ford announced it would produce its first all-electric SUV in Mexico.

- Reinforcing the conclusions in the Center’s prior analysis of battery-critical raw materials, Mackenzie’s most recent Global Battery Raw Materials Long-Term Outlook warned that supply chain constraints especially for cobalt, lithium, and nickel could limit the electric vehicle production capacity needed to meet California’s and other state and nation policies beginning in the mid-2020s. In May, Tesla also warned of imminent shortages in copper, nickel, and lithium that would constrain electric vehicle production.