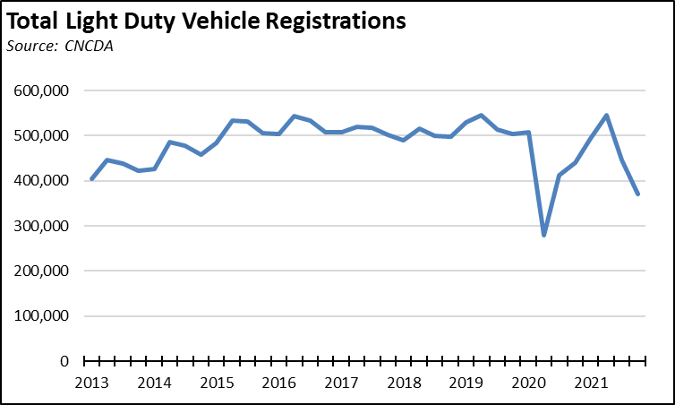

The latest report from California New Car Dealers Association (CNCDA) shows total new light vehicle registrations in 2021 came in just above expectations at 1.86 million vehicles but were still off 11.0% compared to pre-pandemic 2019. The report indicates that sales are expected to continue a gradual recovery, reaching 1.93 million in 2022. These numbers, however, remain subject to uncertainty stemming from the continuing supply chain disruptions and their effect on both imported vehicle deliveries and component shortages affecting domestic production. In part reflecting these continuing shortages, the new vehicle element in the Consumer Price Index rose 12.5% over the year in the latest data for March. As discussed in our previous reports, new vehicle sales are also a major component of sales and use tax that provides revenues for a range of state and local programs.

These factors are also present in the distribution of sales over the year. While pre-pandemic sales generally show only minor variation in 4th quarter sales, especially when compared to the 2nd and 3rd quarters, the 2021 sales saw a strong rise in the 2nd quarter as the state began to recover from the second round of state-ordered shutdowns and bolstered further from pent-up consumer demand, above-average levels of household savings, and continued low levels for household consumption of services. The 4th quarter in 2021, however, saw a sharp fall off of nearly a third from the 2nd quarter numbers in part as the result of supply constraints and rising prices.

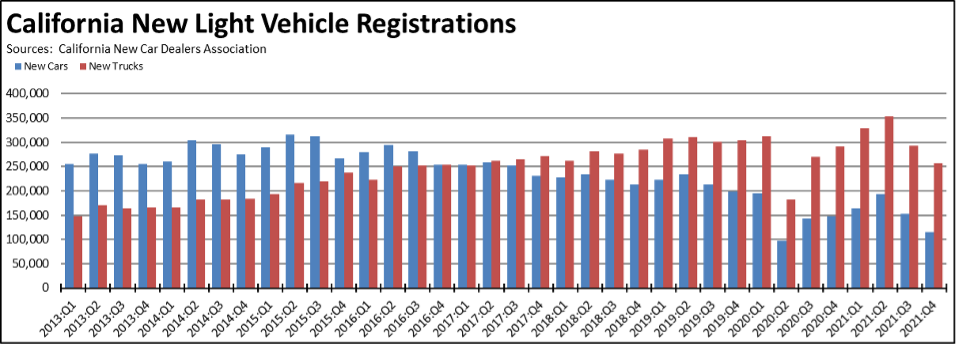

Light Trucks Continue to Dominate New Vehicle Sales

Consumer preferences continued to favor light truck purchases. In California, light trucks rose to 69.1% of total sales in Q4 2021 and 66.4% for the full year. The comparable numbers for the rest of the US were 79.2% for the quarter and 78.0% for the year.

The CNCDA report, however, notes that not all light trucks are created equal. A number of models in this classification are sub-compact and compact SUVs with a hatchback, higher center of gravity, and more ground clearance. Breaking sales into more defined categories, passenger cars were 34.1% of 2021 sales, smaller crossover SUVs at 28.4%, mid-size/large SUVs and small truck-based SUVs at 22.2%, and pickups and vans at 15.2%. The larger two components still show substantial growth, going from 29.7% in 2016 to 37.4% in 2021. The smaller crossover SUVs were somewhat stronger, going from 17.7% in 2016 to 28.4% in 2021.

Regardless of the definition, however, light truck sales continue to be important—as discussed in prior reports—due to their outsized contribution to producer operating margins. Elevated sales within this component will continue to be a source maintaining intra-company support for vehicles produced for regulatory compliance, especially to meet federal efficiency standards but also to continue supporting the transition to electric vehicles most producers are now following. The significance of this factor is even acknowledged in the recent Standardized Regulatory Impact Assessment issued by ARB on their proposed regulations to require 100% of light duty vehicle sales to be ZEVs by 2035. In order to posit a compliance cost schedule with the lowest costs for their economic analysis, this analysis assumes the transition costs will hit buyers of small and medium cars first. For example, the vehicle mix assumed in 2030 includes 75% of small cars produced as ZEVs, 61% of medium cars, but only 27% of pickups.

Sales of electric vehicles, in particular, current sales to generally higher income white collar and professional households consequently will continue to rely on sustained profit margins coming from the broader vehicle-buying base, both directly and through the sale of regulatory credits created by the state and federal agencies. Using data points from the state’s recent announcement of the one millionth ZEV sold in the state, direct state and federal subsidies have enabled only 3% of these ZEVs (broadly defined) to be purchased by low income households, while all households—low, medium, and high income—pay for those subsidies directly through higher costs of energy and other goods subject to the greenhouse gas credits, the cost of tax credits and other subsidies, and indirectly through higher vehicle prices (new and used) incorporating the cost of the state and federal regulatory credits.

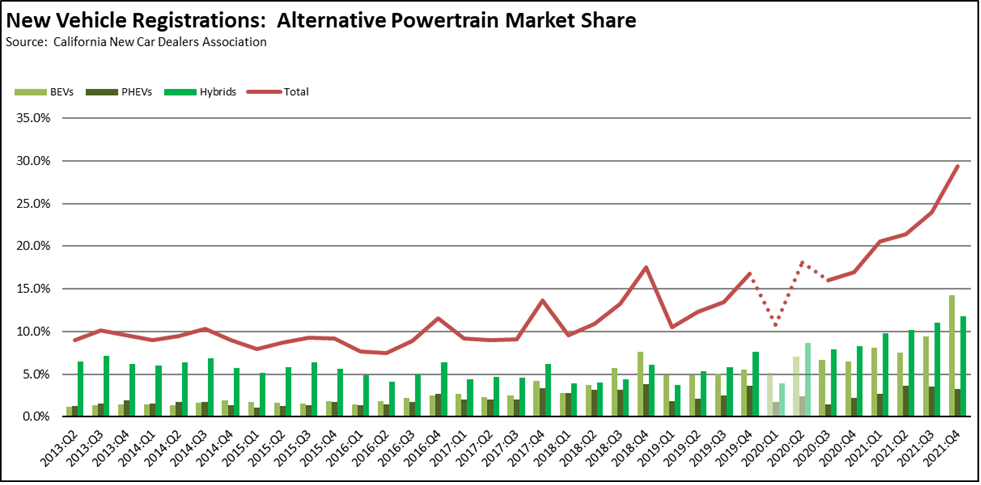

ZEV Sales Up 86.6% from 2020:Q4, 91.5% from 2019:Q4

New registrations of battery vehicles continued rising in the 4th quarter, although potential sales were likely affected by the pause in the production of GM’s models due to issues related to battery fire potential. Using the pre-pandemic numbers in 2019 as the comparison base, sales of true ZEVs (battery electric vehicles—BEVs) nearly doubled by growing 91.5%. The more volatile combustion engine component—plug-in hybrids (PHEV)—used to elevate the official numbers tracking ZEV adoption were off by nearly a third. Battery hybrids (HEVs) were up 14.0%, again likely reflecting consumer reactions to higher fuel prices particularly in California which continues to post the highest gasoline and diesel prices in the nation. From the separate Energy Commission sales data, hydrogen vehicles contributed a total of 3,205 in 2021.

Source: Derived from California New Car Dealers Association

Market shares for both BEVs and HEVs reached new highs in the 4th quarter. While these numbers improved, a focus on the market share results shown in the chart above overstates the acceleration in sales of these vehicles:

- As discussed above, total new registrations were down significantly in the 4th quarter, coming in at the second lowest level since at least 2013. The market share for battery vehicles is high in part because the overall base was much lower.

- The state-ordered shutdowns had and continue to have far less of an effect on higher wage households as their employers instead shifted operations to maintain a large portion of these jobs including through the use of telecommuting and other operational shifts. The high level of IPOs and venture capital deals concentrated in the Bay Area in 2021 added another element significantly skewing incomes in this period. On the demand side, the market consequently has been dominated more by the higher income consumers that continue to be the primary buyers of these higher priced vehicles, especially when taking into account the temporary withdrawal of the lower price GM models. As an indication, the Energy Commission sales data shows that the higher income Bay Area contained 18.1% of total light duty vehicle sales in 2021, but nearly a third of all ZEV (electric and hydrogen) sales in this period. The Los Angeles region was more proportional with 32.7% of all sales and 29.2% of ZEV sales. Lower income Inland Empire (12.5% and 7.6%, respectively) and the Central Valley (8.1% and 3.9%) show wider spreads. On the supply side, producers overall have adjusted to the ongoing parts supply shortage especially chips by cutting back on the production of lower price compacts and subcompacts while concentrating more on higher end and higher profit margin vehicles.

- The lower 4th quarter sales reflect constrained inventory as the result of production delays due to parts, components, and materials shortages. Battery market share in part was up because these were the vehicles available for sale. The significance of this factor, however, will not become better known until vehicle production and shipments overall return more to normal.

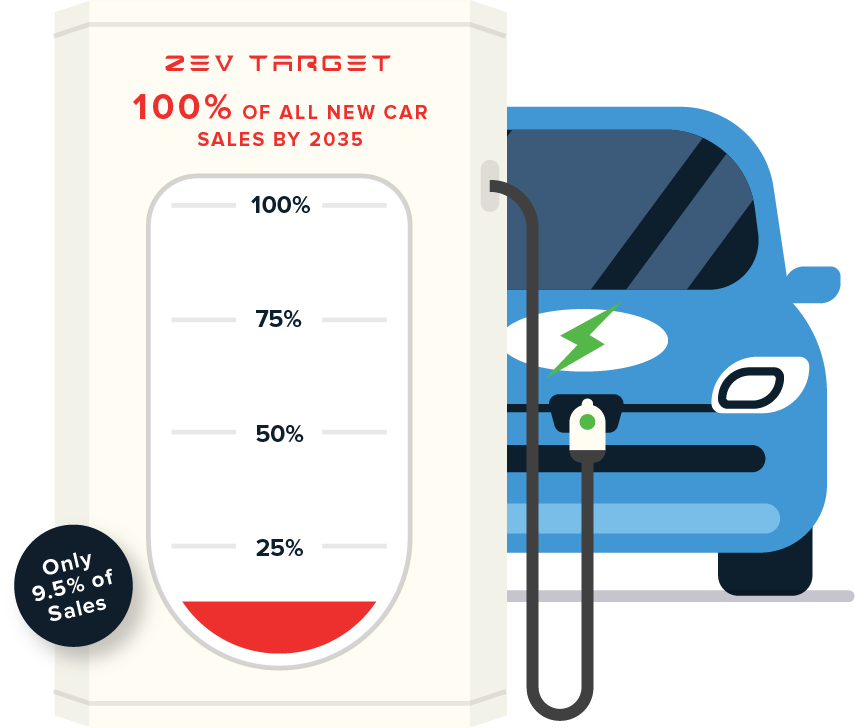

State Goal: 100% ZEVs by 2035

The state previously maintained a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030 pursuant to Executive Order B-48-18. Under Executive Order N-79-20, the governor changed this goal to require all new vehicles offered for sale in the state to be ZEVs by 2035 for light duty cars and trucks, and by 2045 for heavy and medium duty vehicles. In spite of the substantial but as-yet unknown costs and other effects of this action—including as discussed below the availability of the required battery and related materials—the state agencies are now moving ahead to implement this order administratively using the blanket authorities given to them by the legislature under the climate change program.

California’s sales mandates for ZEVs first began with the Air Board’s adoption of the LEV I regulations in 1990. After four decades, these mandates have resulted in ZEVs comprising 9.5% of new light vehicle registrations in 2021.

Promoting this overall goal, the state recently announced that the one millionth ZEV was recently sold in California. While an important milestone, this number must be viewed in context. First, this number includes both true zero emission vehicles (BEVs and hydrogen) in addition to the combustion engine PHEVs that rely on the continued supply of the fossil fuels that the state is now attempting to phase out of the economy. Looking only at the true ZEV component, the state is only two-thirds of the way to seeing the one-millionth sale.

Second, this number covers total sales over the past 11 years, and many of these vehicles are no longer in the state or even in operation. Based on the Energy Commission light vehicle registration data for 2020 combined with the 2021 sales, the number of true ZEVs now on California’s streets is only about half that amount. In fact, based on the 2020 registration data, Californians were three times as likely to own a flex-fuel vehicle and somewhat over three times as likely to own a battery hybrid (HEV) as opposed to a ZEV. Consumer openness to ZEVs is increasing, but they are still far more likely to consider less costly vehicles that give them at least some control over the state’s soaring fuel costs while still retaining the reliability from using these traditional fuels. ZEV sales are increasing, but they have not yet reached a point of sustainability, as indicated by the point that the one millionth sale celebrated in the state’s recent announcement was possible only through “several rebates and tax credits.” In other words, the one millionth sale was possible because the government paid somebody to buy it. Industry leaders such as Tesla—federal tax credits no longer apply, and most buyers have incomes that exceed the limits for California subsidies—are moving beyond this point because of the markets they target. Ability to reach the full breadth of consumers through a 100% mandate has yet to be demonstrated.

Producers are responding in kind. As discussed below, the primary vehicle producers have been announcing new production capacity for ZEVs, but to date, these are largely at new facilities that ensure they still have the operating capacity to produce to consumer demand regardless of the power train consumers are interested in buying. BMW has taken this one step further into agnostic production planning, retooling to produce a single platform capable of modification to whatever consumers want to buy—traditional fuel, HEV, PHEV, or BEV.

The ABC’s¹ of ZEV & ZEV Component Manufacturing

The state’s increasingly strict ZEV regulations have been promoted in part on the contention that because those regulations created the modern-day electric vehicle industry, the jobs as those vehicles and parts were produced would naturally grow here as well. The two executive orders preceding EO N-79-20 (EOs B-16-2012 and B-48-18) in fact directed the state agencies to pursue actions in order to ensure that the “zero-emission vehicle industry will be a strong and sustainable part of California’s economy.” These presumed ZEV-related jobs have underlain the core economic arguments for California’s broader energy policies, that as the transition occurs and many traditional jobs in the affected industries are eliminated in the state, new good paying jobs would be created in the process.

The state, however, has done little to effectuate these directives beyond proposals for data collection and consultation. And while private companies are now pursuing plans to invest hundreds of billions in new facilities in states and countries other than California, the latest offering here is a $60 million grant program—coming after most of the major facility location decisions have already been made—for manufacturing ZEVs, components and batteries, and charging or refueling equipment. No assessment has been made of why most facilities have bypassed California. No analysis has been done on the policies and regulations that should be reformed in order for the state to become more competitive for these jobs.

California does have the original Tesla plant, but Tesla chose that location because the closure of NUMMI spun off a vacant automotive plant capable of quick retrofitting, thereby avoiding the state’s long and litigious approval processes that otherwise could have delayed the company for years. As the company has expanded, greenfield facilities instead have gone to Nevada, China, Germany, and Texas. Faraday Future continues activities related to opening production at another former automotive parts plant in Hanford, but the company has been proposing capacity in California or Nevada since at least 2014 and continues to encounter both financial issues and turnover in its key management. The company instead now appears to be pursuing high volume production through a subcontractor in South Korea. Karma Automotive continues to produce luxury electric vehicles in California, but its overall volume is small compared to other producers and even former Karma executives seeking to launch their own company by resurrecting the DeLorean as a ZEV have chosen to build in Texas instead.

Other California-based companies while maintaining their headquarters here for now, have placed the production side of their operations and its far more numerous jobs and larger tax base elsewhere, including Lucid (Arizona), Mullen (Tennessee), Rivian (Illinois and Georgia), VinFast (Kentucky), Battle Motors (Ohio), Xos (Tennessee), and Fisker (Austria and India) as are suppliers such as CellLink (Texas) and Simwon America (Texas) as they expand to be near the new electric vehicle production centers in the Southeastern and Southwestern states. Others have moved their full operations, including Canoo (Texas and Oklahoma), Noodoe EV (Houston), REE Automotive (Austin), and Envirotech (Arkansas). Still other manufacturers are bypassing California altogether, including Ford (Tennessee and Mexico), GM (Michigan), Hyundai (Alabama), Honda (Ontario, Canada), and Arrival Automotive (North Carolina), along with related facilities such as the Tritium DCFC Ltd. charging station factory (Tennessee) recently showcased by the White House and ZEV parts manufacturers TEKLAS (Georgia) and GEDIA Automotive Group (Georgia). Even electric tugboats intended to comply with the electrification mandates on the state’s ports are now being produced in Alabama.

[1] Almost-Anywhere But California.

The anywhere-but-California trend extends as well to the batteries that constitute a third or more of the total ZEV cost base. Other than Tesla’s Gigafactory in Nevada, current battery pack production is heavily concentrated in China, while battery cell production is heavily concentrated in Japan and South Korea along with China. In 2021, the top three producers—CATL (China), LG Energy Solution (South Korea), and Panasonic (Japan)—accounted for 68.7% of global electric vehicle battery production, while all producers within these three countries produced 93.9%.

This situation is about to change as a number of new battery plants are now being completed (Tesla in Texas) or have been recently announced in the North American market. In addition, Mullen just announced it will begin battery pack assembly at its California facility in Monrovia to fulfill its own needs, but its most recent 10-K filing also states that it intends to eventually consolidate all manufacturing at its Tennessee facility after that expansion is complete.

Current Proposed ZEV Battery Production

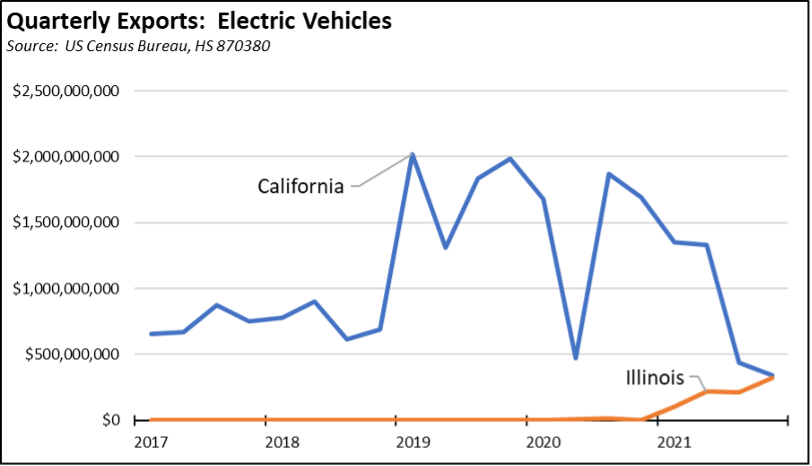

The initial rise followed by a rapid fall in California’s role in the ZEV industry is also illustrated in the export numbers. In 2019, California essentially dominated this industry, accounting for 91% of all US exports that year of Motor Vehicles with Only Electric Motor (HS 870380). As the industry has moved rapidly to other states, California’s share in the first two months of 2022 plunged to 60% and is currently on track to be surpassed by Illinois, which has four major ZEV manufacturers to California’s one.

California’s exports are likely to sink faster, as Tesla has already completed facilities in China and the EU to serve those markets directly, and has recently announced further expansion of its China plant in order to serve as its lower production cost export hub. The far broader industry will be exporting from other states as the announced plants are completed and move into full production.

Consistent with its overall jobs trends in the past decade, California has been competitive for some of the higher wage knowledge-based jobs associated with this new industry. The state in fact has been one of the centers for the design and technology elements of the automotive industry since at least the 1990s. This economic asset provided a base to expand these jobs. They have grown because the nature of these operations makes them more responsive to the current agglomeration economies than to the high and growing costs of operating in the state. Even for this component, however, the state will face headwinds in the near future as the economic center of the ZEV industry consolidates further in the Southeastern and Southwestern states.

For the far more numerous middle-class wages, blue collar and white collar jobs associated with the production side, the state agencies continue to promise these as an offsetting benefit justifying the cost of increasing regulation on fuels, overall energy, and the types of vehicles Californians will be allowed to buy. But this part of the industry largely has not built it here, the jobs are not coming, and the state has done little to reverse this situation by taking on the necessary reforms to improve its competitiveness for these kinds of jobs. Of more concern, California through its policies and regulations continues to eliminate many traditional, middle class wage jobs while making it more costly for those remaining to continue operating in the state. Instead, other states, including even high-tax Illinois, are the ones taking steps to reform the barriers to securing the replacement, good paying jobs being created by California’s policies and regulations.

The state has been through this cycle before. California gave birth to the tech industry. In its earlier incarnation, California became the center for the knowledge-based jobs of this industry along with a high share of the ancillary manufacturing such as semiconductors and electronics components and support jobs both within the Bay Area and, as the industry expanded, other regions as well in particular the Central Valley. As taxes, fees, and regulations continued to rise, those ancillary middle class wage jobs began to shift out of the state over the past two decades, and new entrants such as Apple and others bypassed California entirely by placing those operations in lower cost operating environments in other states and other nations.

In the current incarnation of the tech industry, California has experienced phenomenal growth in the knowledge-based jobs largely by leaving them alone. The current tech industry leaders are little affected by state’s high regulations because of the nature of their operations or because they have located the potentially affected components out of the state’s reach. Still others such as Uber, Lyft, Airbnb, Zillow, Amazon, cryptocurrencies, and others prospered specifically by bypassing and in some cases ignoring the regulations, fees, and taxes that placed a dead hand on their competitors in traditional businesses. In the current reshoring cycle for tech manufacturing especially for chips, California isn’t even a consideration, with major investments and jobs going instead to new production centers in Arizona (TMSC, Intel, and others) and Ohio (Intel).

California’s performance in the years prior to the pandemic was cited in some quarters as proof that the state’s high-regulation/high-tax model is compatible with strong economic and jobs growth. Yet, this performance was due to the outsized contributions coming from the tech-industry based Bay Area, which with 19.6% of the population in pre-pandemic 2019 produced 23.6% of nonfarm jobs, 32.9% of GDP, and 42.8% of the personal income tax revenues that provide about two-thirds of the state general fund. And these outsized contributions have continued to increase due to the fact that tech employees were far less affected by the state-ordered shutdowns during the pandemic period. California’s high-regulation/high-tax model has not been responsible for this growth. That growth came in spite of it because the model impinges more heavily on the lower- and middle-class wage jobs.

California was never in a position to capture the bulk of the ZEV related jobs in this emerging industry, but in the past, the state—even though it was removed from the core automotive supply chains in the Midwest—supported eight major automotive assembly plants along with a number of smaller, often more transitory producers. Today after three decades of promoting—through words but not actions—the development of a ZEV industry, the state essentially contains one. The failure of current state policy is not that so many producers have chosen to locate elsewhere. The failure comes from policy declaring ZEV jobs as a priority, but then doing little to make sure more are developed here to help rebuild the middle class wage jobs base under siege from state regulations, taxes, and fees. Californians consequently are faced with the growing costs of the regulations, while the job benefits instead go elsewhere.

The Mineralities of Living in a Materials World

A more fundamental challenge to the contention that ZEVs represent offsetting job benefits to the cost of these policies comes from the fact that production of ZEVs (BEVs) is very much different from the current jobs structure for traditional, internal combustion engine (ICE) vehicles. As indicated in a recent analysis by Economic Policy Institute:

- BEVs require 30% less labor than ICEs to produce, meaning employment in the overall industry will decline as regulations require a greater share of vehicles offered for sale to meet this requirement.

- About 75% of ICE powertrain components are produced in the US compared to just under 45% for BEV powertrain components, meaning that under current sourcing a greater share of existing jobs will be shifted outside the US as the regulations become stricter.

Related jobs will be affected as well. As it shifts Cadillac to a fully electric offering, GM is closing over a third of its dealerships as part of its efforts to reduce costs and bring ZEVs closer to being a profitable product. Other producers are attempting to mimic Tesla’s model of bypassing dealerships entirely and selling direct to the public. Many earlier analyses also have assumed there will be fewer maintenance and repair jobs due to fewer moving parts in BEVs, but more recent tracking comparisons suggest these costs are higher at least in the initial ownership period. The final outcome on this factor remains to be seen as the existing fleet shifts more to ZEVs.

A more significant difference, however, centers on energy delivery and materials. Current traditional and emerging ICE vehicles support a large number of domestic jobs related to the production and distribution of fuels, both petroleum based and alternatives. Following the oil shocks beginning in the 1970s, this jobs base increasingly has been centered in an industry making the country largely energy independent, with imports primarily limited to those states such as California lacking pipeline connections to the broader national market. The shift to ZEVs, however, eliminates these domestic jobs base while substantially increasing dependence on minerals mostly produced in other countries, not only those needed for ZEV batteries but as well for expansion of generation, transmission, and charging capacity to keep them running. As recently acknowledged by President Biden, “China controls most of the global market of these minerals, and the fact is that we can’t build a future that’s made in America if we ourselves are dependent on China for the materials, the power, the products.”

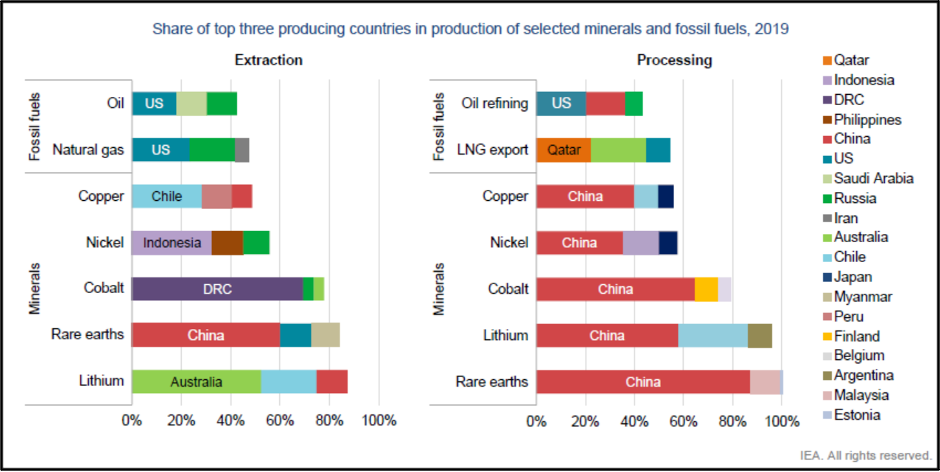

The extent of this dependence is illustrated in the following chart from International Energy Agency (IEA) covering some but not all of the relevant minerals. China by itself produces few of these energy-critical minerals other than rare earths and graphite, but mining production currently is concentrated within a few countries to the point that, with the primary exception of nickel, it has been possible for Chinese companies to centralize access to a large portion of current global exported supplies. More critically, processing of those ores consequently is even more concentrated within China. Comparable capacity within the US has been significantly reduced over the past several decades, and proposals to rebuild it face numerous regulatory and permitting challenges due to environmental factors, ore access, and operating cost differences.

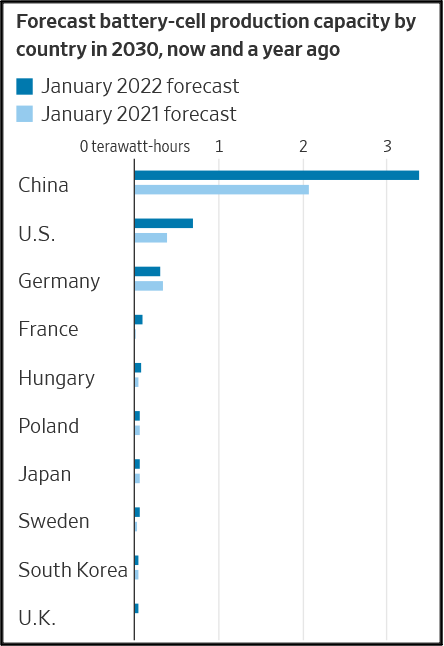

As a result of this concentration, China has now an almost insurmountable lead in battery cell—as opposed to battery pack assembly that will occur in many of the currently announced US battery facilities—manufacturing. Based on currently announced projects and not counting Chinese-owned production such as slated for the EU, China is still expected to account for 70% of battery cell capacity in 2030. Battery packs for the vehicles needed to comply with the 2035 mandate likely will be assembled in plants elsewhere in the US. Most will still be dependent on China for battery cells and cell components.

Source: Benchmark Mineral Intelligence, in Wall Street Journal

This high degree of concentration for materials also carries its own economic risk. Even under the currently unsettled market conditions, oil prices have risen but crude supplies have continued to flow because both production and processing is more globally diverse. The US in particular has been far less affected because what it uses is with few exceptions produced and processed domestically. The key minerals are far more concentrated and consequently carry an elevated risk stemming from future trade disruptions, problems arising at the centralized mining and processing locations, and supply chain interruptions such as the current war in Ukraine. As an example, the collapse of a single cobalt mine (Kobato mine in Democratic Republic of the Congo (DRC)) in 1990 as the result of corruption caused prices to nearly double, moderated only by recession in that period. Cobalt prices again nearly doubled in 1992 as riots and looting affected a larger cobalt mining region in the DRC. The risk from centralized commodities is both that prices can rise and that supplies will not flow.

In CARB’s current rulemaking to implement EO N-79-20, the standardized regulatory impact assessment (SRIA) does not address the potential economic risks of this shift to supply dependence in its economic impact analysis. The associated draft environmental impact statement (DEIR) acknowledges the potential for environmental but not socioeconomic impacts related to a narrow list of minerals but then dismisses them as “less than significant” by limiting the analysis to only changes related to increased California ZEV sales, limiting the analysis to only the ZEVs themselves and not any of the related generation, transmission, and recharging facilities to keep them running, and by assuming that this additional demand as narrowly defined will be met by activities within existing mining and processing footprints. Left unsaid, however, is that those existing footprints assumed to receive the impacts from California’s policies are not in the state and in almost all cases are not even in this country.

But California’s actions are not occurring in isolation, and several other states and countries are pursuing or considering similar mandates within the same timeframe. Other non-energy demand for these materials will also increase as the global economy returns to growth. The existing footprints are nowhere near sufficient to meet California’s anticipated demand at the same time overall global demand is growing to this extent.

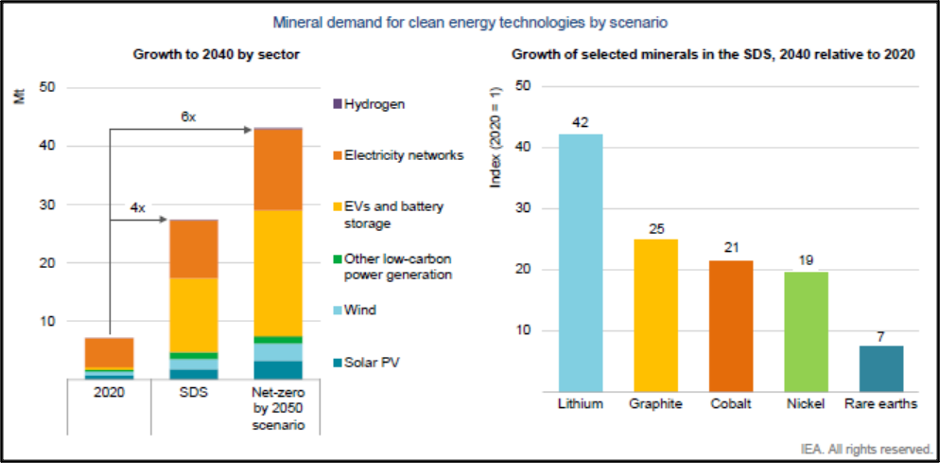

In order to attain the policy goals in the Executive Order and do it in a way that does not add even more to the attendant costs, California consequently will rely on a substantial increase in global supplies of the affected minerals. In their recent analysis, IEA expects global demand for minerals required for clean energy technologies alone to increase substantially, ranging from four times 2020 demand to meet climate change actions in accordance with the Paris Agreement (SDS), to six times if full Net Zero is broadly adopted. The analysis does not cover other related materials including steel, aluminum, or concrete.

The IEA analysis anticipates demand just from their lower range projections consequently will exceed production from both current mining operations and those now under construction by 2028 for lithium and cobalt, and by 2026 for copper. Other assessments expect nickel demand to exceed supply in 2026 as well. Another recent analysis from BloombergNEF expects cumulative demand to exceed known reserves for lithium, cobalt, and nickel by 2045 under their Net Zero scenario.

Shifts in battery chemistries may extend the economic life of current reserves for some materials but as well possibly shortening others such as class 1 nickel, but battery recycling will be essential to meet expected demand—the current known reserves are not sufficient to keep up with demand let alone keep materials prices down to levels that will bring ZEVs more competitive to ICEs. Battery recycling, however, also is not necessarily a source of future domestic jobs given the cost advantages of conducting these operations in lower cost locations. The high level of regulation on recycling operations will also play a role. A recent study concluded that a strengthening of regulations for lead-acid battery recycling caused a major portion of this industry—along with its emissions—to shift from the US to Mexico after 2009.

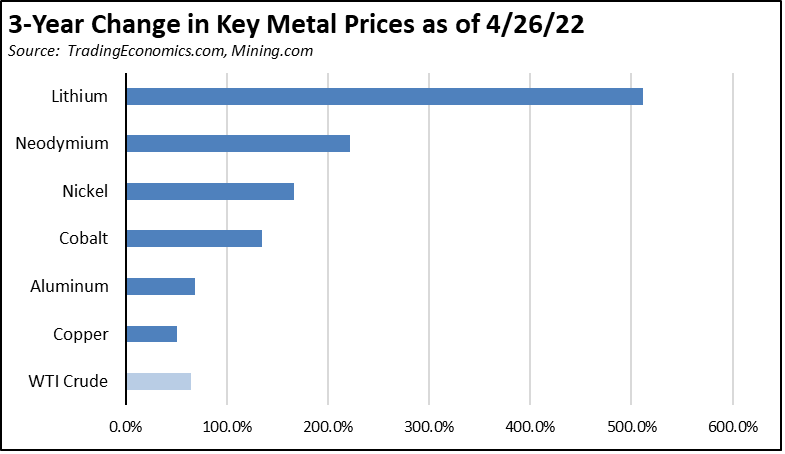

The current strained supply conditions from clean energy shifts exacerbated by supply disruptions stemming from pandemic shutdowns in China and from Russian sanctions due to its war on Ukraine have already sent prices soaring for the affected materials. These price spikes in turn have already caused Tesla, other ZEV producers, and vehicle producers overall to add to inflationary pressures through higher prices. The more narrowly traded but battery critical graphite alone has risen more than a third so far this year. And while recent rises in gasoline prices have renewed concerns over national energy policies, the inflation potential from materials prices—which have ranged up to 10 times higher for lithium than for crude oil—has so far been moderated only by the low national and global market share to date for ZEVs and related vehicles.

Ignoring these challenges, EO N-79-20 and the current CARB rulemaking are now in the process of mandating specific technologies for all vehicles to be sold in the state even before there are reasonable assurances that the required materials for those technologies will be in place. Rivian’s CEO recently warned that battery shortages currently are a greater supply chain threat to expanded ZEV production that what the industry has so far experienced from computer chip shortages. Current global cell production is well under 10% of what will be needed to meet projected demand over the next 10 years, and while new capacity is being proposed as above, the necessary materials supply is still not assured. As he stated, “. . . 90% to 95% of the supply chain does not exist.” As the result of these supply chain issues, Rivian has cut its 2022 production estimates in half.

13 Years to 2035 Goal + Shortages by 2026-28 – 16 Years for Major New Mines = Challenge of Setting a Mandate without Addressing Supply Chain Needs

EO N-79-20 directs the agencies to require all light vehicle and drayage truck sales to be zero emission by 2035, meaning that in the absence of another major recession, global materials supplies as projected by IEA and others will fall short before reaching the halfway mark to this goal. New mining proposals are possible and even likely in this period given soaring metals prices, but the typical development period for these operations is lengthy. IEA analysis of the development history for major mines globally indicates that it takes an average of 16 years from discovery to first production to bring larger-scale new resources online. Additional supplies are possible, but these long lead times more than suggest they will not be on the timeline now being advanced by the agencies. And even if expedited development is possible, such an outcome will rely on the willingness of the host, often developing countries to accept rapid depletion of their minerals base to fulfill the timelines of California and the other developed economies.

One of the more constrained materials—lithium—generally has a somewhat shorter development period and is one of the few under active consideration for production in California. Proposals for lithium mining in Imperial County, however, have been around for many years without yet producing any product beyond the demonstration phase. Currently, however, there are three active projects in play. Controlled Thermal Resources Hell’s Kitchen project first began in 2013, and currently expects reaching its Stage 1 production levels in 2024—a development period of at least 11 years. EnergySource Minerals ATLiS project began with a demonstration grant in 2017, and secured its final approvals in late 2021. The Final EIR projects completion of construction in late 2025, or a development period of more than 9 years to reach full production. BHE Renewables received a similar demonstration grant in 2020, and by locating at existing geothermal plants currently expects, if the demonstration is successful, to begin construction in 2024, or roughly a development period of at least 6 years to production. Greenfield projects such as those in Nevada are on a longer time frame.

President Biden recently invoked the Defense Production Act to expand domestic capacity for the critical metals. Earlier indications were that this process will concentrate on processing rather than mining. The order’s requirement that all federal and state permitting requirements and environmental health and safety laws will continue to be followed with no provisions to expedite these reviews and decisions is another indication that the mountains of red tape that have ensnared mining projects in the past will continue to apply. California’s mandate and similar efforts elsewhere in the nation consequently are likely to continue a reliance on development of the required mining production in other nations.

Climate change has been declared in some quarters as an existential threat, yet the full range of measures needed to match action to promises has often fallen to other political and policy priorities. In its more absurd form, the Biden Administration treats Tesla, the industry leader, as the company that shall not be named. The lack of permitting, cost, and regulatory reforms that could have promoted a more vibrant California ZEV industry is a more relevant instance where the state by not acting on its initial competitive advantages failed to reap economic benefits promoting both its climate change and equity goals. The promise of increased domestic materials capacity but only under business-as-usual regulatory practices threatens a repeat of the California experience but at the national level with more lasting implications to both energy and economic security.

The record to date in fact shows that climate change priorities have lost when going from policy to project decisions. The Biden Administration chose recently to cancel leases for the Twin Metals copper-nickel mine in Minnesota (copper, cobalt, platinum group metals, and nickel), and has moved to halt the Pebble Mine in Alaska (copper, cobalt, platinum group metals, and nickel). Local controversies continue to delay two lithium projects ready to move to construction and production in Nevada.

Without getting into the merits of these four mining projects, the practical effect is that ZEV mandates continue to move forward both directly and indirectly on both the state and national levels. These mandates will require new mining capacity somewhere, if not in the US, then in other nations not necessarily applying the same permitting requirements and environmental health and safety laws. The functional result is that mining development and jobs will still occur but in other nations. Instead of increasing energy security, the state and the country will remain dependent on an increasingly centralized source of imports.