March 29, 2016

The proposed minimum wage expansion (SB 3) contains two triggers under which a governor may—but is not required to—delay a programmed minimum wage increase by one year. These provisions are intended to mitigate state budget costs in the event of a future recession, which Governor Brown repeatedly and most recently in the January Proposed Budget has warned as being “an event not too far off given the historic pattern of the ten recessions that have occurred since 1945.”

The triggers in SB3 are defined by two factors:

-

The economic trigger must meet both of two conditions. First, there has been a decline in seasonally adjusted nonfarm employment for either the 3-month period ending in June of the subject year or the 6-month period ending in June. Second, there has been a decline in the state-portion of sales and use tax receipts as measured by the 12-month period ending in June of the current year compared to the prior 12-month period.

-

The budget trigger is based on the multi-year general fund revenue forecasts now required from Department of Finance as part of the enacted budget. This trigger comes into effect if Finance projects a deficit in the then-current fiscal year or in either of the following two fiscal years. A deficit is defined as a negative balance in the Special Fund for Economic Uncertainties (SFEU) that exceeds 1% of total general fund revenues and transfers.

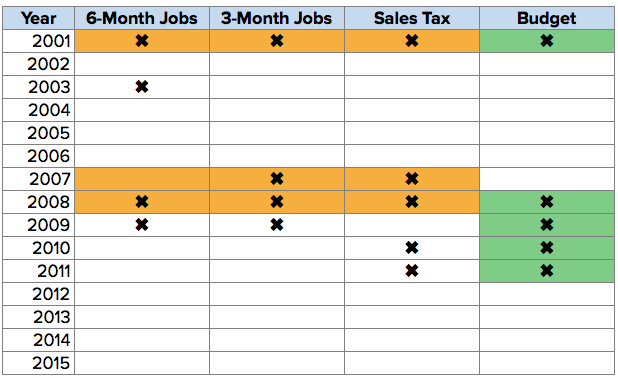

A programmed and subsequent minimum wage increase may be delayed by one year using either trigger. The economic trigger may be used at any time, but the proposal limits the budget trigger to a maximum of two uses. The following chart illustrates the potential of these triggers using data over the past two recession periods:

Note: The colored bars show the year in which the trigger conditions are met, making a 1-year delay possible in the following year.

As indicated by the gold bars in the table, the economic trigger could have been used 3 times during this period, while the green bars show the budget trigger could have been used an additional 2 out of 3 times.

More critically, however, the triggers are designed to delay programmed increases by only one year. This situation means that should the inevitable next recession occur during the phase-in period of this legislation, both the budget and hiring will gain a temporary respite after the state has entered an economic downturn. However, the state will then resume raising its wage level above other states just as the recovery begins—a time when competitive factors will be particularly crucial to how quickly the state can restores its economy.

The previous two recessions illustrate two cases. In the first case, most of the country went through a relatively short 2001 recession, but in California it was extended due to Silicon Valley being the epi-center of the dot.com bust and spiking energy prices as a result of the state’s regulatory and other energy policy decisions. While the triggers would have provided a one-year delay in 2002, the minimum wage would have continued its annual increase as unemployment continued to rapidly rise from an average of 5.4% in 2001 to a peak of 7.3% in 2003.

The second case is the most recent recession which illustrates the effects on a more-prolonged recovery period. The table shows the economic trigger could have been applied for two years in the fall of 2007 at the start of the impending downturn. The budget trigger—if not previously used at the start of the downturn—then could have been applied for an additional two years during that time. The minimum wage increases would have resumed in 2012 when unemployment still averaged 10.4% or even earlier in 2011 when unemployment averaged 11.7%. Most importantly, the minimum wage increases would have kicked back in during the critically important 5 year recovery period where California slowly struggled to regain the two million jobs lost throughout the state.

The data in the chart above is derived from the following sources:

-

Nonfarm employment is measured by seasonally adjusted nonfarm wage and salary job data maintained by Employment Development Department (EDD). The analysis assumes this is the intent of the bill rather than “employment” which is a broader term that includes wage and salary jobs along with proprietors, unpaid family workers, and certain self-employed.

-

The sales and use tax receipt data specified in the proposed bill is currently not readily available. Instead, the table is based on the total tax receipts as reported by Finance in their budget tables and schedules.

-

The budget trigger data is taken from Finance Chart A. Rather than projected data, however, the actual SFEU is compared to 1% of general fund revenues and transfers in each year. The analysis is based on the history that significant deficits began being projected only with the 2008 budget. This comparison also does not include an additional factor for higher salaries as would be the case in the future if SB 3 is enacted.