Below are the monthly updates from the most current April 2020 fuel price data (GasBuddy.com) and February 2020 electricity and natural gas price data (US Energy Information Agency). To view additional data and analysis related to the California economy visit our website at www.centerforjobs.org/ca.

Fuel prices in April softened substantially as oil prices reflected continuing competition within OPEC for market share coming at the same time as the collapse in world demand. Households and consuming businesses consequently saw some benefits from lower prices, but with the effects limited as businesses shut down and many workers and their families sheltered in place. For the producing regions along with related refining, transportation, and support centers—including those within California—the resulting reduction in higher wage jobs and incomes as producers have cut back their operations creates yet another challenge in the upcoming restart and recovery period.

And while fuel prices are lower, they are far lower in the rest of the country. California energy prices overall remain some of the highest in the nation as result of the state’s energy regulations. Gasoline prices were more than twice as high as the lowest cost state in April, while commercial electricity rates in February remained the 3rd highest, industrial rates the 5th highest, and residential rates the 7th highest. Industrial natural gas prices are 134% higher than the average for the rest of the country.

For employers, these regulation-driven prices mean fewer cash resources to bring back employees than in other parts of the country. For households, these prices mean paying more directly for the utilities component of housing costs, more directly for transportation, and more indirectly as business costs for fuel and utilities get driven into higher prices for goods and services. Even as wages and incomes recover, these higher costs mean many households will continue to lag behind those in other states in being able to stay ahead of the cost curve.

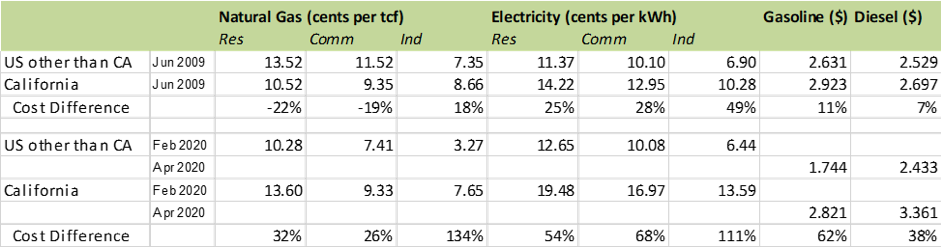

The degree of the regulation-created cost barriers in the pending recovery period is shown in the following table, which compares energy prices between California and the rest of the US (US average in 2009 for gasoline and diesel) at the beginning of recovery during the Great Recession and for the most recent data. As in the data below, natural gas and electricity prices are 12-month moving averages, and gasoline and diesel are monthly averages.

The regulation-created cost barriers for energy were far lower as California businesses began to recover during the Great Recession in 2009. Residential and commercial natural gas prices were even lower within the state. As energy regulations subsequently expanded with little attention paid to the compounding and cumulative costs, these regulatory differentials have spiked and now present a far greater competitive challenge to recovery by businesses, and a growing cost of living burden for households.

California vs. US Diesel Price

Above US Average

(CA Average)

The April average price per gallon of diesel in California eased 30 cents from March to $3.36. The California premium above the average for the US other than California ($2.43) eased to 92.8 cents, a 38.1% difference.

In April, California had the 2nd highest diesel price among the states and DC, behind only Hawaii.

Range Between Highest and Lowest Prices by Region

Above US Average

(Central Coast Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $0.88 in the Central Valley Region (average April price of $2.62), to $1.21 in Central Coast Region (average April price of $2.95).

Highest/Lowest Fuel Prices by Legislative District:

California Residential Electricity Price

Rest of US

California average Residential Price for the 12 months ended February 2020 was 19.48 cents/kWh, 54.0% higher than the US average of 12.65 cents/kWh for all states other than California. California’s residential prices remained the 7th highest in the nation.

California Residential Electric Bill

For the 12 months ended February 2020, the average annual Residential electricity bill in California was $1,226, or 23.3% higher ($232) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 1.6% ($22).

Residential bills, however, vary widely by region, with the estimated annual household usage in 2018 as much as 59% higher in the interior regions compared to the milder climate coastal areas.

US Average Price

For the 12 months ended February 2020, California’s higher electricity prices translated into Residential ratepayers paying $5.9 billion more than the average ratepayers elsewhere in the US using the same amount of energy.

California Commercial Electricity Price

Rest of US

California average Commercial Price for the 12 months ended February 2020 was 16.97 cents/kWh, 68.4% higher than the US average of 10.08 cents/kWh for all states other than California. California’s commercial prices remained the 3th highest in the nation.

California Industrial Electricity Price

Rest of US

California average Industrial Price for the 12 months ended February 2020 was 13.59 cents/kWh, 111.0% higher than the US average of 6.44 cents/kWh for all states other than California. California’s industrial prices remained the 5th highest in the nation.

US Average Price

For the 12 months ended February 2020, California’s higher electricity prices translated into Commercial & Industrial ratepayers paying $11.1 billion more than ratepayers elsewhere in the US using the same amount of energy.

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended February 2020 and changes from the previous 12-month period for each end user: