Below are the monthly updates from the most current April 2024 fuel price data (GasBuddy.com) and March 2024 electricity and natural gas price data (US Energy Information Administration). To view additional data and analysis related to the California economy visit our website at www.centerforjobs.org/ca.

California Energy Costs Highest in the Nation

In March, California continued its energy cost trifecta with the highest residential, commercial, and industrial electricity prices among the contiguous states. These rankings join the highest cost postings for gasoline and diesel as well. Only natural gas price rankings showed marginal easing from the prior month.

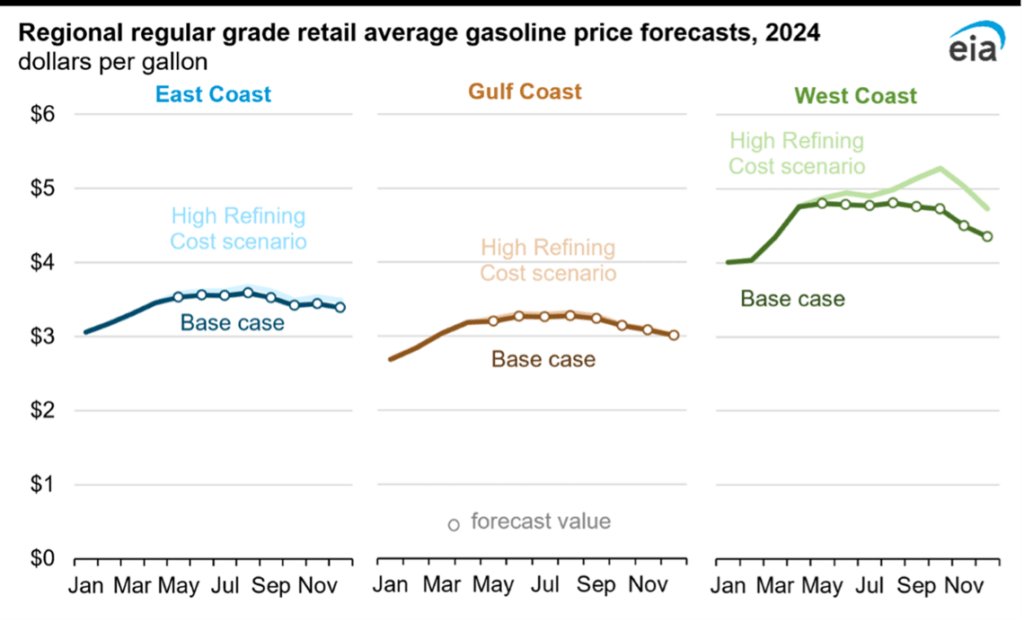

In their latest projections, US Energy Information Administration expects that the continued OPEC+ production cuts will keep oil near $90 a barrel the rest of the year, easing only to $85 in 2025. As a result, gasoline prices in most of the country are expected to stay near the levels from last year throughout the summer. In a separate perspective analyzing the current risk factors to these projections, however, an alternative “high refinery cost” scenario considers the current uncertainty in refinery costs. In the case of California, these specifically cover “Supply constraints [from closure of petroleum refining at two facilities] on the West Coast present a significant risk for heightened gasoline prices in the region that are further elevated by structural factors such as taxes, California’s unique CARB-gasoline formulation, and state Low Carbon Fuel Standards.” Assessing these factors, the upside risk on gasoline prices is currently high for the West Coast, potentially keeping prices above $5 a gallon through several months in the summer and fall, while minimal in the rest of the country.

The response from the state is, of course, to add even more regulations that will push these costs higher, as discussed below under California Gasoline Taxes & Fees.

The state’s response to continually rising electricity costs in contrast is to try to obfuscate the issue. With state policies now pushing electricity rates to the highest among the contiguous states, the California Public Utilities Commission recently adopted changes to restructure how customers of the state’s independently owned utilities (IOUs) will be billed. Under this approach beginning in 2025 for Southern California Edison and San Diego Gas & Electric and in 2026 for PG&E, electricity rates will be reduced by between 8% and 18%, and the costs instead recovered through a fixed fee of $24.15 for most customers and $6.00 and $12.08 for low-income households regardless of energy usage. Charges for the smaller IOUs will be $23.40 to $33.98. While the decision is intended to be revenue-neutral overall for the IOUs, monthly costs for some customers will increase to pay for the reductions to low-income households and the electrification incentives built into the order. Costs will also increase by $35.6 million to administer this new framework. While many utilities in other states charge a similar fixed fee, the $24.15 level adopted by the Commission is the second highest in the country and is subject to increases as utility costs continue to increase under state policy.

The overall change, however, raises a number of issues:

- Households don’t pay electricity rates; they pay electricity bills and the bottom number on aggregate under this new system will not change except for those households paying more to cover the social engineering built into the order. Trying to distract from the state’s soaring electricity costs by breaking up the charges does not change the bottom line.

- In this respect, the order is a 180 degree turn from previous official statements maintaining that higher rates coming from each new climate change bill don’t really matter because California’s mild climate means electricity bills overall will be lower than the national average. This line of reasoning was used by former Senator Kevin de Leon to promote SB 100 (2018) moving California to 100% renewables. It continues to be used by other state officials. With rates soaring to record highs—pushing the average electricity bill to the 14th highest in the nation—they now apparently do matter enough to change how they are defined.

- The new system also continues the state’s typical response of doing everything in response to a growing problem but going back to change the policies that caused the problems in the first place. Subsidies, more process and bureaucracies, moving the furniture around, and trying to distract from the bottom line does not change the fact that energy costs are soaring in California. Trying to redefine the problems doesn’t fix them. Going back to the foundational policies and fixing them does.

- The new system also represents a moment of inconsistency for state policy. Under SB 478 (2023) beginning in July, businesses can no longer itemize various costs—such as compliance with various government mandated regulations—separately on a bill or as a surcharge but instead must incorporate them into the price of the service or good. As stated by the Attorney General: “The law is simple: the price you see is the price you pay.” Not so, apparently, in the case of the electricity rates where the price you see is only the portion of the price the state wants you to see. SB 478 was adopted in keeping with current policy trend of combating “hidden fees.” But as with similar policy movements fails to deal with largest single serial offender on such fees, namely government.

Inflation Up

March 2023

For the 12 months ending March, the California CPI rose 3.8%, up from 3.3% in February. In the same period, the US CPI rose to 3.5% from 3.2% in February.

Using the same formula Department of Finance uses to calculate the California CPI, the California Food Away from Home (restaurants and take out) component rose 5.0% in March, compared to only 1.2% in the overall US numbers

California Gasoline Taxes & Fees

Fees per Gallon

Of Gasoline

In May, California Energy Commission data indicates that $1.43 (28.6%) of the price of a gallon of regular gasoline was paid to cover state, local, and federal taxes and fees.

The state tax portion is scheduled to rise another 2 cents beginning July 1. Diesel taxes will rise 1.3 cents. In addition, pending Air Resources Board regulations would raise these costs much higher. While Board staff has since tried to downplay the published numbers, the Board’s economic impact statement on pending changes to the Low Carbon Fuel Standard forecasts an additional pass-through cost of 47 cents a gallon for gasoline in 2025, rising to a peak of $1.83 by 2041. Expected diesel cost pass-throughs are 59 cents in 2025 and $2.40 in 2041. Jet fuel is at 44 cents in 2025 and $1.90 in 2041.

Proposed amendments to Cap-and-Trade are expected to raise these costs as well. On an annualized basis, the additional costs to individuals are estimated at $90 a year per person across all energy platforms, or $360 for a family of four.

California vs. Rest of US Diesel Price

Above Other States

(CA Average)

The May average price per gallon of diesel in California eased 15 cents from April to $5.27. The California regulatory and tax premium above the average for the US other than California ($3.80) eased to $1.47, a 38.8% difference.

price

In May, California had the highest diesel price among the contiguous states and DC.

Range Between Highest and Lowest Prices by Region

above Other States

(Central Sierra Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.58 in the Orange County Region (average May price of $5.05), to $1.95 in Central Sierra Region (average May price of $5.42).

Highest/Lowest Fuel Prices by Legislative District:

California Residential Electricity Price

Rest of US

California average Residential Price for the 12 months ended March 2024 was 29.85 cents/kWh, 96.1% higher than the US average of 15.22 cents/kWh for all states other than California. California’s residential prices were the highest among the contiguous states and DC.

California Residential Electric Bill

For the 12 months ended March 2024, the average annual Residential electricity bill in California was $1,743, or 75.4% higher ($749) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 20.9% ($285).

In 2010, California had the 9th lowest residential electricity bill among the contiguous states and DC. In the latest data, it rose to the 14th highest.

Residential bills, however, vary widely by region. Transforming the 2022 data from the Energy Commission, estimated annual household usage is as much as 82% higher in the interior regions compared to the milder climate coastal areas, and substantially higher when comparing across counties.

Average Price in

Other States

For the 12 months ended March 2024, California’s higher electricity prices translated into Residential ratepayers paying $12.0 billion more than the average ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest cost state, California households paid $15.4 billion more.

California Commercial Electricity Price

Rest of US

California average Commercial Price for the 12 months ended March 2024 was 24.39 cents/kWh, 107.4% higher than the US average of 11.76 cents/kWh for all states other than California. California’s commercial prices were the highest among the contiguous states and DC.

California Industrial Electricity Price

Rest of US

California average Industrial Price for the 12 months ended March 2024 was 19.29 cents/kWh, 154.2% higher than the US average of 7.59 cents/kWh for all states other than California. California’s industrial prices were the highest among the contiguous states and DC.

Average Price in

Other States

For the 12 months ended March 2024, California’s higher electricity prices translated into Commercial & Industrial ratepayers paying $19.0 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, Commercial & Industrial ratepayers paid $24.4 billion more.

California Natural Gas Prices

Average prices ($ per thousand cubic feet; 12-month moving average) for the 12 months ended March 2024 and changes from the previous 12-month period for each end user: