Highlights for policy makers:

- Unemployment Rate Rises to 5.1%; Total Employment Drops 14,100

- Labor Force Participation Rate Remains at Lowest Level Since 1976

- State Employment Growth Rankings—California Drops to 7th Place

- Nonfarm Jobs Down 8,200

- Six Industries below 2007 Pre-Recession Job Levels

- Job Gains by Wage Level

- Two-Tier Economy Persists—Central Valley Unemployment More than Twice as High as Bay Area

- Bay Area Provided 44% of Net Employment Growth Since Recession

- Eight California MSAs in the 10 Worst Unemployment Rates Nationally

Unemployment Rate Rises to 5.1%; Total Employment Drops 14,100

The Labor Force data for August 2017 (seasonally adjusted; California preliminary) is shown below, along with the change from the prior month:

| Seasonally Adjusted | California | US | ||

|---|---|---|---|---|

| Aug 2017 | Change from Jul 2017 | Aug 2017 | Change from Jul 2017 | |

| Unemployment Rate | 5.1% | 0.3 | 4.4% | 0.1 |

| Labor Force | 19,168,500 | 0.2% | 160,571,000 | 0.0% |

| Participation Rate | 61.9% | 0.0 | 62.9% | 0.0 |

| Employment | 18,196,800 | -0.1% | 153,439,000 | 0.0% |

| Unemployment | 971,800 | 4.9% | 7,132,000 | 2.2% |

The related not seasonally adjusted numbers (California preliminary), with the change from August 2016:

| Not Seasonally Adjusted | California | US | ||

|---|---|---|---|---|

| Aug 2017 | Change from Aug 2016 | Aug 2017 | Change from Aug 2016 | |

| Unemployment Rate | 5.9% | 0.3 | 4.5% | -0.5 |

| Labor Force | 19,423,600 | 1.3% | 160,863,000 | 0.7% |

| Participation Rate | 62.3% | -0.2 | 63.0% | 0.1 |

| Employment | 18,295,800 | 1.0% | 153,576,000 | 1.2% |

| Unemployment | 1,127,800 | 5.5% | 7,287,000 | -8.9% |

California Employment Development Department’s (EDD) latest release shows on a seasonally adjusted basis, total employment dropped 14,100 from July, while the number of unemployed rose by 45,700. The labor force rose by 31,600.

California’s seasonally adjusted unemployment rate rose from 4.8% to 5.1%. California had the 8th highest unemployment rate among the states. The unadjusted rate from 5.6% in August 2016 to 5.9%.

Total US employment saw a seasonally adjusted decrease of 74,000 from July, while the number of unemployed rose 151,000. The national unemployment rate was up 0.1 point to 4.4%. The national labor force numbers grew by 77,000.

Labor Force Participation Rate at Lowest Level Since 1976

California’s participation rate (seasonally adjusted) in August was unchanged at 61.9%, while the US rate also remained level at 62.9%.

The seasonally adjusted California participation rate in August remained at its lowest level since 1976.

State Employment Growth Rankings—California Drops to 7th Place

| Rank | Number of Employed | Percentage Change | Population Adjusted (employment growth per 1,000 civilian noninstitutional population) |

|---|---|---|---|

| 1 | FL 322,800 | CO 4.2% | CO 27.3 |

| 2 | TX 153,700 | OR 4.2% | OR 24.9 |

| 3 | GA 141,600 | UT 3.5% | UT 23.3 |

| 4 | NY 126,800 | FL 3.4% | FL 19.4 |

| 5 | CO 118,200 | AR 3.2% | AR 18.0 |

| 6 | WA 96,400 | GA 3.0% | GA 17.9 |

| 7 | CA 94,900 | WA 2.8% | WA 16.8 |

| 8 | VA 89,300 | MD 2.6% | MD 16.5 |

| 9 | OR 81,800 | KY 2.5% | DC 14.4 |

| 10 | MD 78,100 | DC 2.2% | WI 13.8 |

| 11 | NC 69,700 | VA 2.2% | VA 13.6 |

| 12 | WI 63,300 | WI 2.1% | KY 13.5 |

| 13 | MA 62,600 | AZ 2.0% | MN 13.4 |

| 14 | AZ 62,100 | MN 2.0% | AZ 11.5 |

| 15 | MN 57,700 | RI 1.9% | CT 11.4 |

| 16 | UT 51,500 | NV 1.8% | MA 11.3 |

| 17 | TN 50,600 | CT 1.8% | RI 11.3 |

| 18 | MI 47,400 | MA 1.8% | ME 10.9 |

| 19 | KY 46,600 | ME 1.8% | NV 10.7 |

| 20 | AR 41,700 | TN 1.7% | TN 9.7 |

| 21 | IN 40,400 | SC 1.6% | SC 9.0 |

| 22 | SC 34,900 | NC 1.5% | NC 8.8 |

| 23 | CT 32,800 | NY 1.4% | ID 8.4 |

| 24 | NJ 25,500 | ID 1.4% | NY 8.0 |

| 25 | NV 24,700 | IN 1.3% | ND 7.9 |

| 26 | OH 22,700 | TX 1.2% | IN 7.8 |

| 27 | PA 18,100 | ND 1.1% | TX 7.4 |

| 28 | AL 12,900 | MI 1.0% | MI 6.0 |

| 29 | ME 11,900 | AK 0.9% | AK 5.5 |

| 30 | ID 10,700 | HI 0.9% | HI 5.4 |

| 31 | RI 9,700 | NM 0.8% | NM 4.2 |

| 32 | KS 8,900 | MS 0.7% | KS 4.0 |

| 33 | MS 8,600 | DE 0.7% | DE 4.0 |

| 34 | DC 8,100 | AL 0.6% | MS 3.8 |

| 35 | NM 6,800 | KS 0.6% | SD 3.7 |

| 36 | HI 5,900 | NJ 0.6% | NJ 3.6 |

| 37 | OK 5,900 | SD 0.5% | AL 3.4 |

| 38 | ND 4,600 | CA 0.5% | NH 3.2 |

| 39 | NH 3,500 | NH 0.5% | CA 3.1 |

| 40 | WV 3,300 | WV 0.4% | OH 2.5 |

| US 1,784,000 | US 1.2% | US 7.0 |

Between August 2016 and August 2017, Bureau of Labor Statistics (BLS) data shows the total number of employed in California increased by 94,900 (seasonally adjusted), or 5.3% of the total net employment gains in this period for the US. California dropped to 7th place behind Florida (which has a civilian working age population only 55% as large as California’s) at 322,800, Texas (68% as large) at 153,700, Georgia, New York, Colorado, and Washington. Measured by percentage change in employment over the year, California dipped to 38th highest. Adjusted for working age population, California fell to 39th.

Nonfarm Jobs Down 8,200

EDD reported that between July and August 2017, seasonally adjusted nonfarm wage and salary jobs fell 8,200. July’s gains were revised to 84,500 from the previously reported 82,400. Looking at the not seasonally adjusted nonfarm numbers, hiring saw increases in all but 3 industries over the year. The change in total payroll jobs from August 2016 saw the largest increases in Construction (47,600), Government (56,800), and Social Assistance (37,900). Declines were in Professional, Scientific & Technical Services (-4,800), Manufacturing (-4,600), and Mining & Logging (-1,000).

| Not Seasonally Adjusted Payroll Jobs | Aug 2017 | Jul 2017 | Change Aug 2017 – Jul 2017 | Change Aug 2017 – Aug 2016 |

|---|---|---|---|---|

| Total Farm | 482,100 | 485,100 | -3,000 | 2,900 |

| Mining and Logging | 23,600 | 23,700 | -100 | -1,000 |

| Construction | 845,500 | 838,600 | 6,900 | 47,600 |

| Manufacturing | 1,319,300 | 1,308,000 | 11,300 | -4,600 |

| Wholesale Trade | 738,200 | 737,200 | 1,000 | 11,800 |

| Retail Trade | 1,676,400 | 1,670,500 | 5,900 | 200 |

| Utilities | 58,400 | 58,300 | 100 | -400 |

| Transportation & Warehousing | 536,500 | 535,100 | 1,400 | 1,400 |

| Information | 533,100 | 528,100 | 5,000 | 6,100 |

| Finance & Insurance | 550,600 | 549,800 | 800 | 2,700 |

| Real Estate & Rental & Leasing | 285,400 | 285,600 | -200 | 4,100 |

| Professional, Scientific & Technical Services | 1,226,200 | 1,232,300 | -6,100 | -4,800 |

| Management of Companies & Enterprises | 230,200 | 231,300 | -1,100 | 3,400 |

| Administrative & Support & Waste Services | 1,103,800 | 1,099,600 | 4,200 | 10,800 |

| Educational Services | 339,700 | 346,400 | -6,700 | 13,200 |

| Health Care | 1,486,500 | 1,485,900 | 600 | 20,600 |

| Social Assistance | 758,800 | 752,200 | 6,600 | 37,900 |

| Arts, Entertainment & Recreation | 319,800 | 324,000 | -4,200 | 6,500 |

| Accommodation | 230,500 | 230,500 | 0 | 1,900 |

| Food Services | 1,424,800 | 1,431,400 | -6,600 | 34,900 |

| Other Services | 584,000 | 580,700 | 3,300 | 24,200 |

| Government | 2,449,900 | 2,422,400 | 27,500 | 42,300 |

| Total Nonfarm | 16,721,200 | 16,671,600 | 49,600 | 258,800 |

| Total Wage and Salary | 17,203,300 | 17,156,700 | 46,600 | 261,700 |

By total number of new jobs, California continued to show the second highest increase in seasonally adjusted nonfarm jobs among the states from August 2016 to August 2017, at 265,100 or 12.6% of the US net increase. Texas led jobs growth with 298,600 jobs, and Florida was third with 221,400. By percentage growth in jobs, California dropped to 21st highest at 1.6%, above the US average of 1.4%. By population adjusted jobs growth, California dropped to 26th highest, slightly above the US average.

| Rank | Number of Jobs | Employment Growth (%) | Population Adjusted (job growth per 1,000 civilian noninstitutional population) |

|---|---|---|---|

| 1 | TX 298,600 | NV 3.0% | DC 23.4 |

| 2 | CA 265,100 | GA 2.7% | UT 16.9 |

| 3 | FL 221,400 | FL 2.6% | NV 16.8 |

| 4 | NY 128,600 | UT 2.6% | GA 14.7 |

| 5 | GA 116,500 | TX 2.5% | TX 14.3 |

| 6 | NC 70,500 | MD 2.3% | MD 13.4 |

| 7 | WA 67,300 | OR 2.3% | FL 13.3 |

| 8 | MD 63,600 | ID 2.2% | NH 13.1 |

| 9 | MI 60,300 | NH 2.1% | OR 12.6 |

| 10 | PA 59,400 | WA 2.1% | ID 11.9 |

| 11 | VA 58,700 | AR 1.9% | WA 11.7 |

| 12 | MA 57,400 | RI 1.9% | MO 11.0 |

| 13 | OH 57,100 | MO 1.8% | RI 10.8 |

| 14 | MO 52,300 | CO 1.8% | CO 10.6 |

| 15 | TN 52,200 | TN 1.8% | MA 10.4 |

| 16 | CO 45,800 | SC 1.7% | MN 10.2 |

| 17 | MN 44,000 | DC 1.7% | AR 10.1 |

| 18 | OR 41,600 | MT 1.6% | TN 10.0 |

| 19 | NV 38,800 | NC 1.6% | ND 9.8 |

| 20 | NJ 38,100 | MA 1.6% | NE 9.3 |

| 21 | UT 37,300 | CA 1.6% | MT 9.2 |

| 22 | SC 35,600 | KY 1.6% | SC 9.1 |

| 23 | AZ 34,700 | MN 1.5% | VA 9.0 |

| 24 | IN 31,600 | VA 1.5% | NC 8.9 |

| 25 | KY 30,500 | MI 1.4% | KY 8.8 |

| 26 | AL 26,900 | NY 1.4% | CA 8.6 |

| 27 | LA 24,200 | AL 1.4% | NY 8.1 |

| 28 | IL 23,600 | NE 1.3% | MI 7.6 |

| 29 | AR 23,400 | ND 1.3% | AL 7.0 |

| 30 | OK 19,900 | AZ 1.3% | IA 7.0 |

| 31 | WI 19,000 | LA 1.2% | LA 6.7 |

| 32 | IA 17,200 | OK 1.2% | OK 6.7 |

| 33 | ID 15,200 | IA 1.1% | AZ 6.4 |

| US 2,097,000 | US 1.4% | US 8.3 |

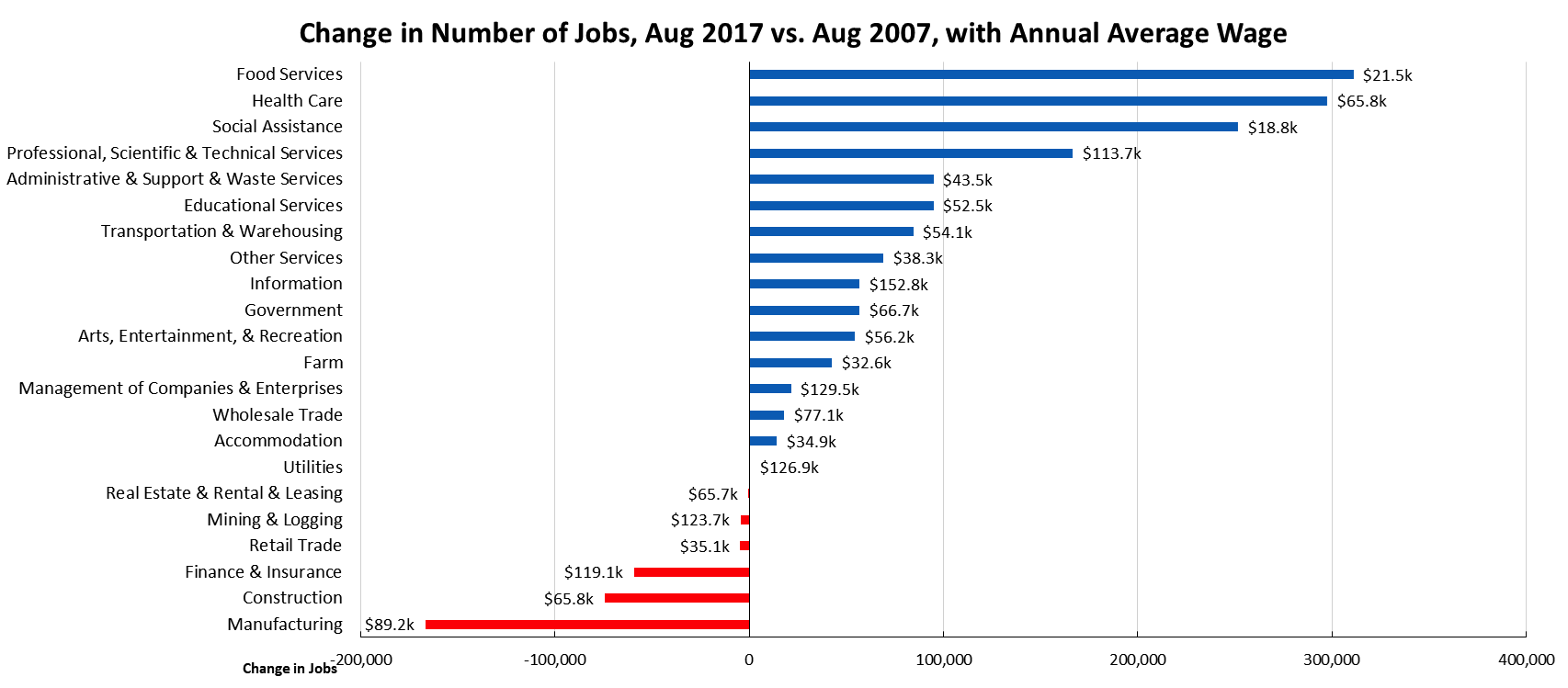

Six Industries Below 2007 Pre-Recession Job Levels

Comparing the number of jobs by industry in August 2017 (not seasonally adjusted), 6 industries had employment below the 2007 pre-recession levels. The highest gain industries were led lower wage Food Services, Health Care (with a relatively higher mix of lower and higher wage occupations), lower wage Social Assistance, and higher wage Professional, Scientific & Technical Services. Of the lagging industries, three—Manufacturing, Mining & Logging, and Construction—are blue collar middle class wage industries, while the higher wage Finance & Insurance also continued to lose ground.

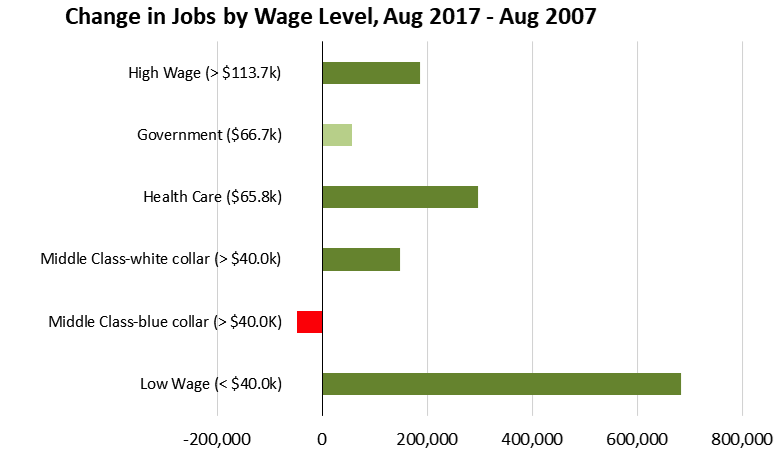

Job Gains by Wage Level

In the recent May Budget Revision, the Governor again pointed to the increasing share of lower wage jobs as one of the prime causes of slowing state revenues growth: The level of wages has been revised downward, and cash receipts have been significantly below forecast. The following chart illustrates this trend for total wage and salary jobs, according to the industry wage classification used previously in other Center analyses of this issue. As indicated, over half of net jobs growth since the recession has been in the low wage industries. Middle Class-blue collar jobs show a decline.

Two-Tier Economy Persists—Central Valley Unemployment More than Twice as High as Bay Area

Unemployment rates (all data is not seasonally adjusted) continue to vary widely across the state, ranging from 4.0% in the Bay Area to more than twice as large at 8.6% in the Central Valley.

| Not Seasonally Adjusted | Unemployment Rate (%) August 2017 |

|---|---|

| California | 5.9 |

| Bay Area | 4.0 |

| Orange County | 4.2 |

| Sacramento Region | 5.1 |

| Central Coast | 5.2 |

| Central Sierra | 5.3 |

| Los Angeles | 5.3 |

| San Diego/Imperial | 5.6 |

| Inland Empire | 6.2 |

| Upstate California | 6.3 |

| Central Valley | 8.6 |

By Legislative District:

| Lowest 10 Unemployment Rates | |||||

|---|---|---|---|---|---|

| CD18 (Eshoo-D) | 3.0 | SD13 (Hill-D) | 3.0 | AD16 (Baker-R) | 2.8 |

| CD12 (Pelosi-D) | 3.3 | SD11 (Wiener-D) | 3.5 | AD22 (Mullin-D) | 2.9 |

| CD52 (Peters-D) | 3.4 | SD39 (Atkins-D) | 3.7 | AD24 (Berman-D) | 3.1 |

| CD45 (Walters-R) | 3.5 | SD37 (Moorlach-R) | 3.8 | AD28 (Low-D) | 3.2 |

| CD14 (Speier-D) | 3.5 | SD36 (Bates-R) | 3.8 | AD77 (Maienschein-R) | 3.4 |

| CD17 (Khanna-D) | 3.6 | SD26 (Allen-D) | 4.0 | AD17 (Chiu-D) | 3.5 |

| CD49 (Issa-R) | 3.9 | SD07 (Glazer-D) | 4.0 | AD78 (Gloria-D) | 3.5 |

| CD15 (Swalwell-D) | 3.9 | SD15 (Beall-D) | 4.0 | AD19 (Ting-D) | 3.5 |

| CD33 (Lieu-D) | 3.9 | SD10 (Wieckowski-D) | 4.1 | AD73 (Brough-R) | 3.6 |

| CD02 (Huffman-D) | 4.0 | SD02 (McGuire-D) | 4.2 | AD25 (Chu-D) | 3.6 |

| Highest 10 Unemployment Rates | |||||

|---|---|---|---|---|---|

| CD36 (Ruiz-D) | 7.0 | SD30 (Mitchell-D) | 6.3 | AD80 (Gonzalez-D) | 7.2 |

| CD41 (Takano-D) | 7.0 | SD31 (Roth-D) | 6.3 | AD34 (Fong-R) | 7.4 |

| CD09 (McNerney-D) | 7.0 | SD21 (Wilk-R) | 6.4 | AD23 (Patterson-R) | 7.5 |

| CD10 (Denham-R) | 7.2 | SD35 (Bradford-D) | 6.5 | AD64 (Gipson-D) | 7.7 |

| CD44 (Barragán-D) | 7.5 | SD08 (Berryhill-R) | 7.1 | AD13 (Eggman-D) | 8.0 |

| CD23 (McCarthy-R) | 8.1 | SD05 (Galgiani-D) | 7.2 | AD21 (Gray-D) | 9.2 |

| CD22 (Nunes-R) | 8.3 | SD12 (Cannella-R) | 7.7 | AD31 (Arambula-D) | 9.9 |

| CD16 (Costa-D) | 9.5 | SD16 (Fuller-R) | 8.0 | AD26 (Mathis-R) | 10.3 |

| CD21 (Valadao-R) | 10.6 | SD40 (Hueso-D) | 9.9 | AD32 (Salas-D) | 11.1 |

| CD51 (Vargas-D) | 11.7 | SD14 (Vidak-R) | 11.6 | AD56 (Garcia-D) | 13.8 |

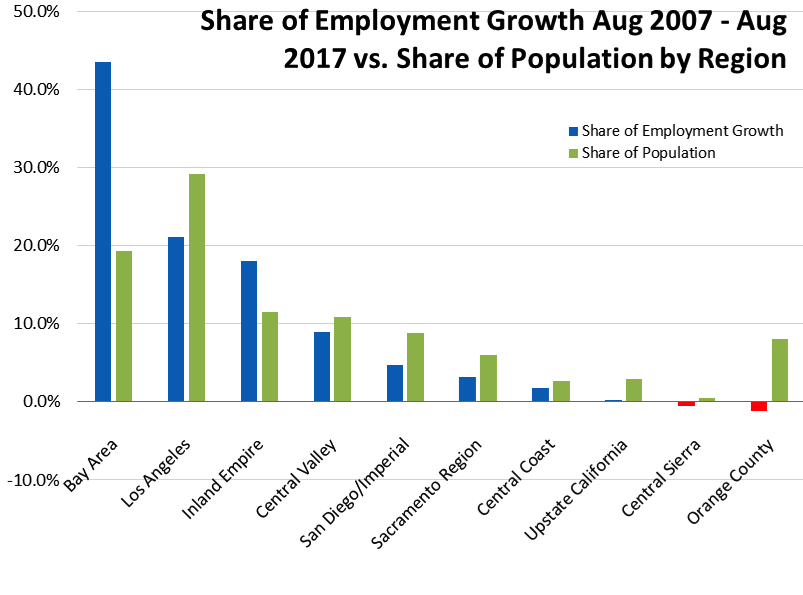

Bay Area Provided 44% of Net Employment Growth Since Recession

Containing just under 20% of the state’s population, the Bay Area was responsible for 43.6% of the net growth in employment since the pre-recession peaks in 2007. Los Angeles Region provided the next largest share at 21.1%, but spread over 29.2% of the population. Inland Empire is the only other region continuing to show employment gains above their population share.

Eight California MSAs in the 10 Worst Unemployment Rates Nationally

According to BLS data, of the 10 Metropolitan Statistical Areas (MSAs) with the worst unemployment rates nationally, 8 are in California. Of the 20 worst, 10 are in California.

| US Rank | MSA | July 2017 Unemployment Rate |

|---|---|---|

| 369 | Beaumont-Port Arthur, TX Metropolitan Statistical Area | 6.8 |

| 369 | Weirton-Steubenville, WV-OH Metropolitan Statistical Area | 6.8 |

| 371 | Vineland-Bridgeton, NJ Metropolitan Statistical Area | 6.9 |

| 372 | Brownsville-Harlingen, TX Metropolitan Statistical Area | 7.0 |

| 373 | Danville, IL Metropolitan Statistical Area | 7.1 |

| 374 | Las Cruces, NM Metropolitan Statistical Area | 7.7 |

| 374 | McAllen-Edinburg-Mission, TX Metropolitan Statistical Area | 7.7 |

| 374 | Stockton-Lodi, CA Metropolitan Statistical Area | 7.7 |

| 377 | Youngstown-Warren-Boardman, OH-PA Metropolitan Statistical Area | 7.9 |

| 378 | Modesto, CA Metropolitan Statistical Area | 8.0 |

| 379 | Yuba City, CA Metropolitan Statistical Area | 8.1 |

| 380 | Farmington, NM Metropolitan Statistical Area | 8.2 |

| 381 | Madera, CA Metropolitan Statistical Area | 8.4 |

| 382 | Fresno, CA Metropolitan Statistical Area | 8.7 |

| 383 | Hanford-Corcoran, CA Metropolitan Statistical Area | 8.9 |

| 384 | Bakersfield, CA Metropolitan Statistical Area | 9.7 |

| 384 | Merced, CA Metropolitan Statistical Area | 9.7 |

| 386 | Visalia-Porterville, CA Metropolitan Statistical Area | 10.8 |

| 387 | Yuma, AZ Metropolitan Statistical Area | 23.8 |

| 388 | El Centro, CA Metropolitan Statistical Area | 24.2 |

Note: All data sources, methodologies, and historical data series available at CenterforJobs.org.