The Center for Jobs and the Economy has released our initial analysis of the April Employment Report from the California Employment Development Department. Data for the other states will be addressed in our Full Jobs Report after it is released by Bureau of Labor Statistics next Tuesday. For additional information and data about the California economy visit www.centerforjobs.org/ca.

Highlights for policy makers:

- Nonfarm Jobs Rise 17,700

- California Labor Force

- Nonfarm Jobs

- Counties with Double-Digit Unemployment

Nonfarm Jobs Rise 17,700

After three months of losses and the 54,800 downgrade in December coming from the annual revision process, California posted a 17,700 nonfarm jobs gain in April. The 11,600 preliminary loss in March was revised to a loss of 6,800.

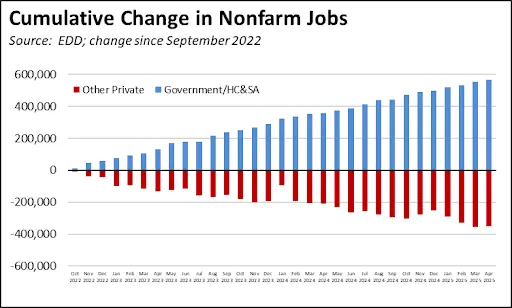

By industry, nonfarm jobs were again dominated by government and government-supported Healthcare & Social Assistance. The other private industries as a group posted a small positive result, primarily due to a seasonal uptick in activity in Construction and accelerated trade shipments in advance of the recent tariff actions. Jobs in the other private industries previously peaked in September 2022. Since then, nonfarm jobs growth has been solely in government and Healthcare & Social Assistance. Over the past 31 months, jobs largely dependent on public funding grew by 565,800, while jobs in the other private industries fell by 349,800. Even with jobs being propped up by the state’s continued deficit spending, the average monthly gain of only 7,000 coming from government-supported jobs in this period again emphasizes the extent to which the state’s economy was stagnant even before the recent actions by the federal government.

California Labor Force