The Center for Jobs and the Economy has released our full analysis of the January Employment Report from the California Employment Development Department. For additional information and data about the California economy visit www.centerforjobs.org/ca.

Highlights for policy makers:

- Nonfarm Jobs Drop in February and January

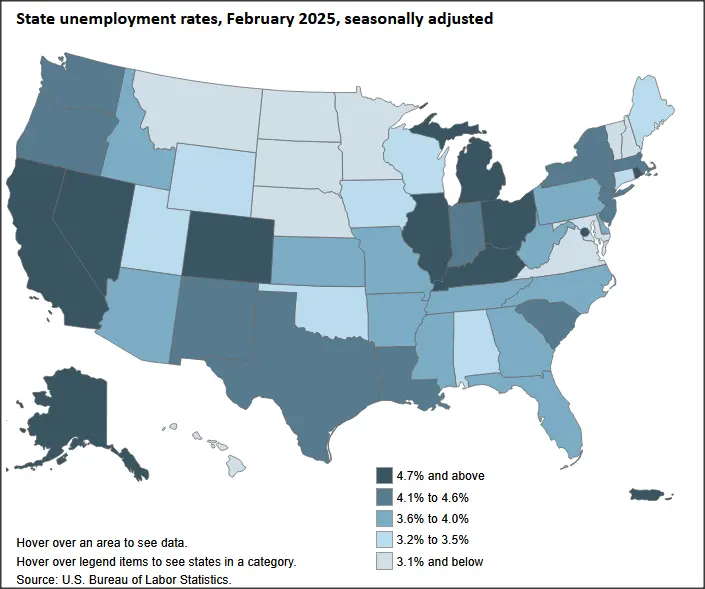

- California Unemployment Rate Unchanged at 5.4%

- 4th Quarter Real GDP Up 1.4%

- 4th Quarter Personal Income Up 5.1%

- Recovery Progress: CA Employment vs. Other States

- Nonfarm Jobs

- Wages & Hours

- Recovery Progress: CA Nonfarm Jobs vs. Other States

- Unemployment Rates by Region

- Counties with Double-Digit Unemployment

Nonfarm Jobs Drop in February and January

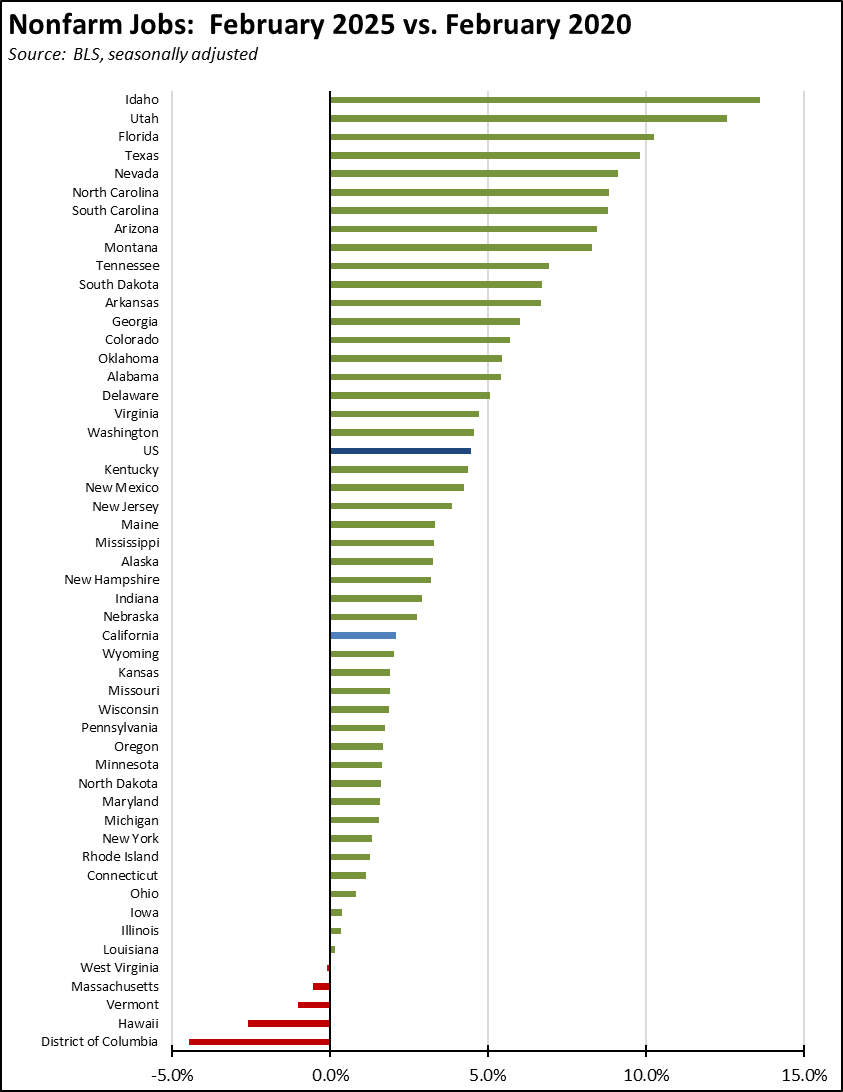

In the preliminary numbers, seasonally adjusted nonfarm jobs fell 7,500 in February. The January numbers were revised from a preliminary result of no change in jobs to a loss of 21,400. The February number was the 49th highest among the states, with jobs led by Ohio with a gain of 23,100 followed by Texas with 25,600 and New Jersey at 19,200.

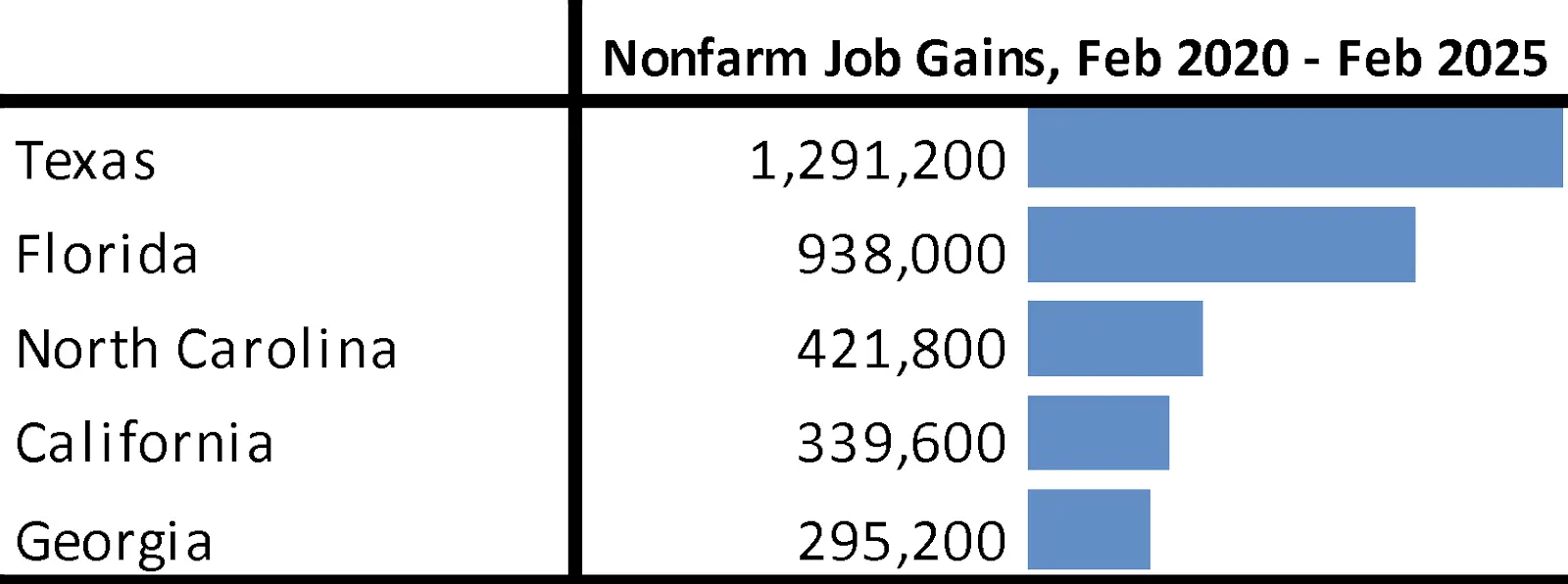

Looking at net total nonfarm job gains compared to pre-pandemic peaks, California remained in 4th place behind much smaller North Carolina but still ahead of Georgia.

By industry, both government and government-dependent Healthcare & Social Assistance again showed gains by 18.500 in February, but these were offset by a 26,000 drop in the other private industries. Still some gains were reported within this last category, including Private Educational Services (3,500), Information (2,600), and Wholesale Trade (1,800). These gains were more than offset by greater losses in industries led by Accommodation & Food Services (-8,200), tech-containing Professional, Scientific & Technical Services (-5,200), and Finance & Insurance (-5,000).

California Unemployment Rate Unchanged at 5.4%

California’s seasonally adjusted unemployment rate remained unchanged at 5.4%, but also remained the 2nd highest among the states, tied with Michigan and DC and behind Nevada. The US unemployment rate edged up 0.1 point to 4.1%. Total unemployed edged down by 8,200 but remained above the 1 million level for the 14th month in a row.

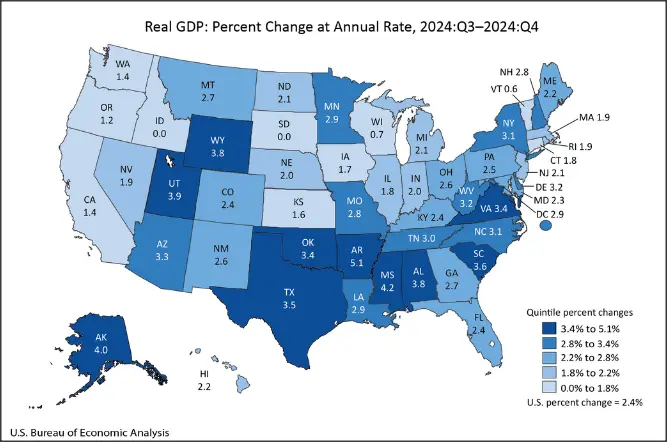

4th Quarter Real GDP Up 1.4%

On an annualized basis, California Real GDP grew at an anemic 1.4%, below the US average of 2.4% and coming in at 44th highest among the states. Leading contractions were in Information and Durable Manufacturing, while the strongest growth sectors were Healthcare & Social Services and Government.

For the year, the preliminary results are somewhat better. California Real GDP grew 3.6%, above the US average of 2.8% and 10th highest among the states. California’s growth rate was matched by both Texas and Florida.

Nominally, California’s 2024 current GDP of $4.103 trillion would place it marginally ahead of Japan to become the 4th largest economy based on the October 2024 data from the International Monetary Fund. However, the IMF data only contains an estimate for Japan in 2024, and that country’s performance in 2024 has experienced growth rather than the IMF’s projected contraction, which would keep it ahead of California’s level. A more accurate ranking will be reported after IMF updates its data next month.

The current IMF data does contain the 2024 results for India, and California remains ahead of that country. However, California would need to grow by more than 4.1% in 2025 and more than 14.8% in 2025 and 2026 combined to remain ahead in 5th place. At its current growth rate, California would still stay ahead in 2025, but fall behind India in 2026.

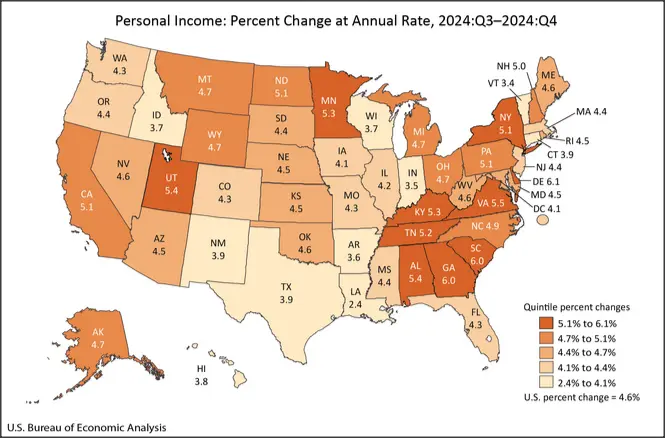

4th Quarter Personal Income Up 5.1%

On an annualized basis, Personal Income grew 5.1% in the 4th Quarter, above the US average of 4.6% and 13th highest among the states. Transfer payments were the strongest component, growing at an annualized rate of 9.4%, while Net Earnings grew by 5.1%. Earnings were driven heavily by Government (23% of the growth) and Healthcare & Social Assistance (18%).

For the year, the preliminary results show California Personal Income growing 6.5%, above the US average of 5.4% and 3rd highest among the states.

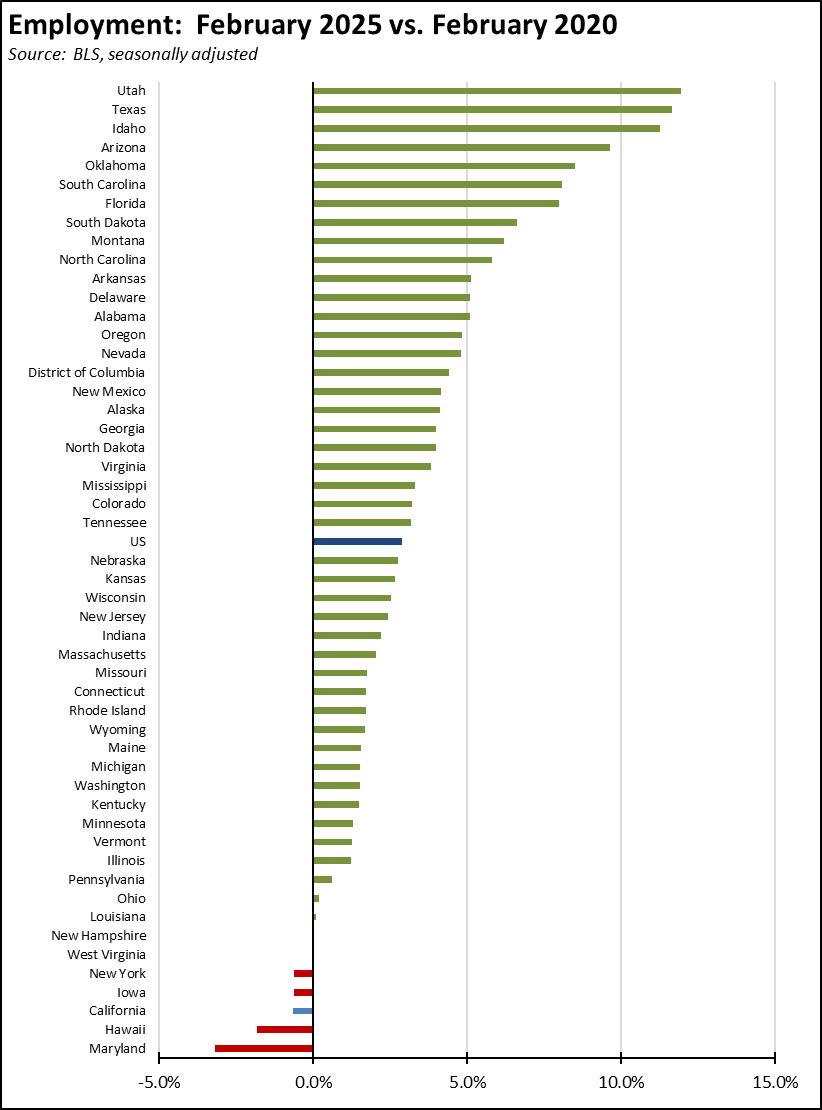

Recovery Progress: CA Employment vs. Other States

Compared to the pre-pandemic peak in February 2020, California’s relative ranking for employment recovery fell marginally to 3rd lowest among the states and DC. California is one of only 5 states still short of full recovery from the pandemic employment losses.

Nonfarm Jobs

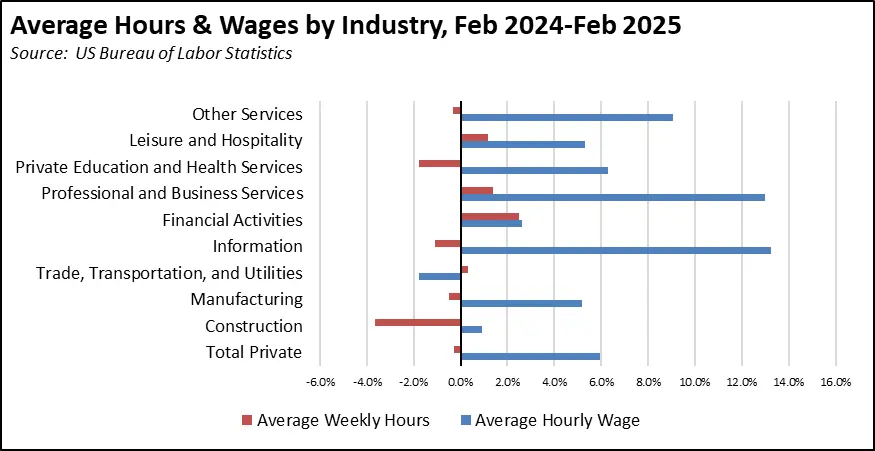

Wages & Hours

Recovery Progress: CA Nonfarm Jobs vs. Other States

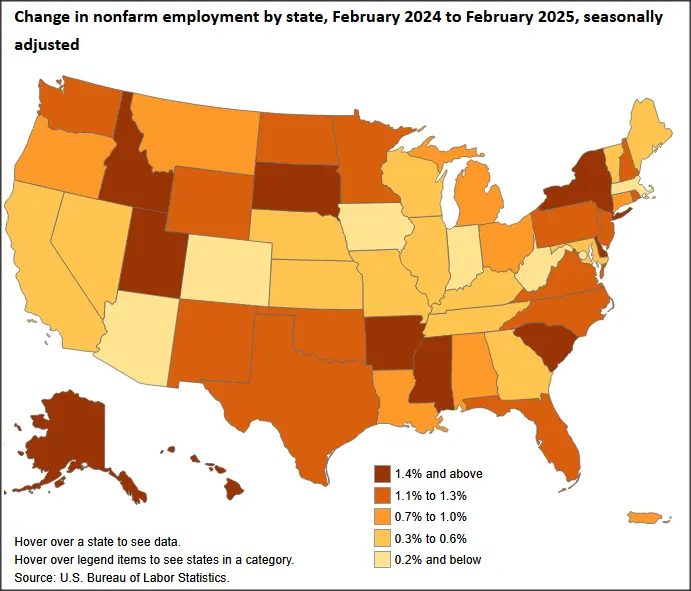

Interactive Original

https://www.bls.gov/charts/state-employment-and-unemployment/change-in-nonfarm-employment-by-state-map.htm

California’s monthly job performance in February was the 49th highest among the states and DC. Adjusted for size, California’s recovery level compared to the pre-pandemic peaks notched up to 29th highest, while only 4 states and DC have yet to show positive recovery.

Unemployment Rates by Region

Unemployment rates (not seasonally adjusted) were higher in all regions compared to pre-pandemic February 2020 levels.

Counties with Double-Digit Unemployment

Unemployment Rate by Legislative District

The estimated unemployment rates are shown below for the highest and lowest districts. The full data and methodology are available on the Center’s website.