The Center for Jobs and the Economy has released our full analysis of the April Employment Report from the California Employment Development Department. For additional information and data about the California economy visit www.centerforjobs.org/ca.

Highlights for policy makers:

- Nonfarm Jobs Up for the First Time in 2025

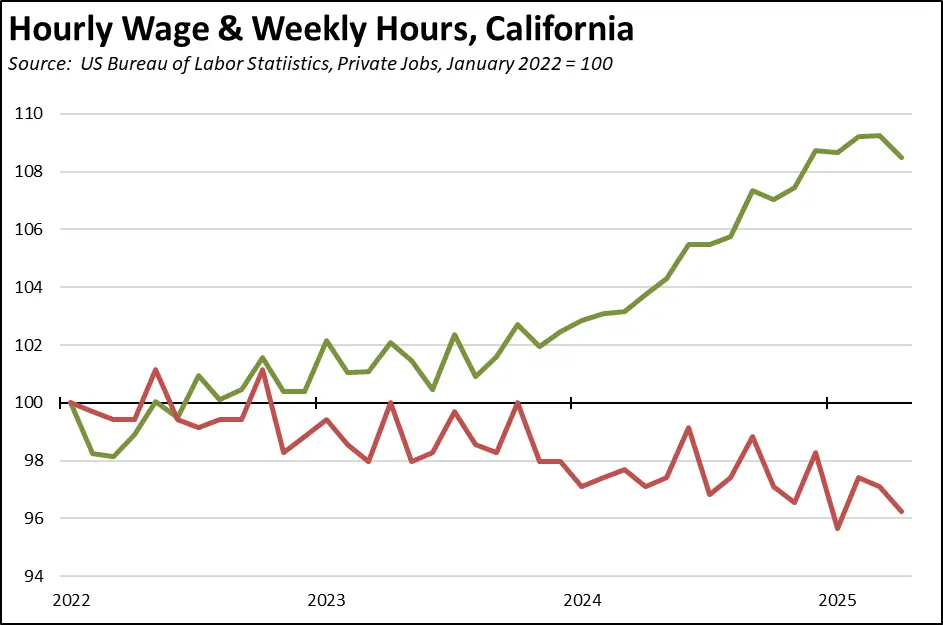

- Wages Up/Hours Down

- Jobs Prospects Largely Unchanged

- Business Employment Dynamics

- Unemployment Insurance Claims Continue to Track the 2024 Trend

- Unemployment Rate by Legislative District

Nonfarm Jobs Up for the First Time in 2025

After 3 months of losses and the 54,800 job downgrade in December, California posted a gain of 17,700 nonfarm jobs in the preliminary numbers for April. California’s gains were the 5th highest among the states, which were led by Texas (37,700), Ohio (22,200), Florida (21,300), and North Carolina (18,100).

Looking at the longer trend compared to the pre-pandemic jobs peak, California remained in 4th place having expanded by only 336,200 jobs, barely ahead of 5th place Georgia.

Wages Up/Hours Down

With the exception of Construction, private industries experienced growth in hourly wages over the year, with an overall average of 4.5% to $40.69 and ranging up to 12.0% to $65.57 for Information. These increases, however, were offset to some extent as employers pared back on weekly hours, dipping 0.9% to 33.3 hours in the overall average.

Looking at the longer trend, average hourly wage in all private industries saw rapid growth in 2024, but has since stagnated in the first 4 months of 2025. Adjusting to this rise and slowing economic conditions, average weekly hours have seen a gradual decline beginning in 2024.

Jobs Prospects Largely Unchanged

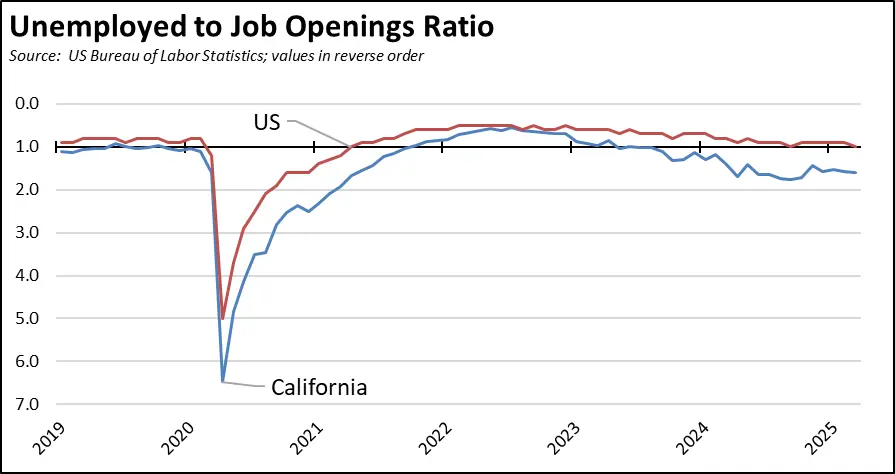

As measured by unfilled job openings, employer hiring plans have again begun to decline in the latest data, although at a lower rate than in recent years. The state’s job openings rate remains about 20% below the similarly softening US average.

The current number of unfilled jobs moreover remains well below levels needed to make serious dents in the state’s unemployment problem. California had 1.6 unemployed persons for every job opening at the end of March, substantially the highest among the states. The US rate also edged down to 1.0 for only the second time since the recovery upswing in April 2022.

Job openings by industry are only available in the national data. Healthcare & Social Assistance (18.6% of openings) and Professional & Business Services (18.3%) continue to experience the greatest labor shortages. Expected slowing in federal health and IHSS dollars, however, saw a substantial contraction in the number of unfilled job openings in Healthcare & Social Assistance over the year (-20.3%), while Federal Government openings contracted even more (-40.8%). On the other end, only two industries saw an increase in unfilled openings: Professional & Business Services at 2.6% and Other Services at 14.3%.

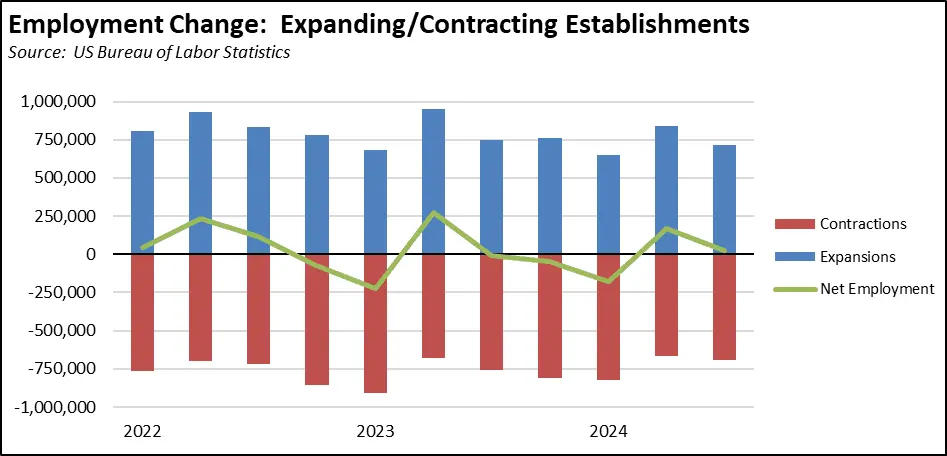

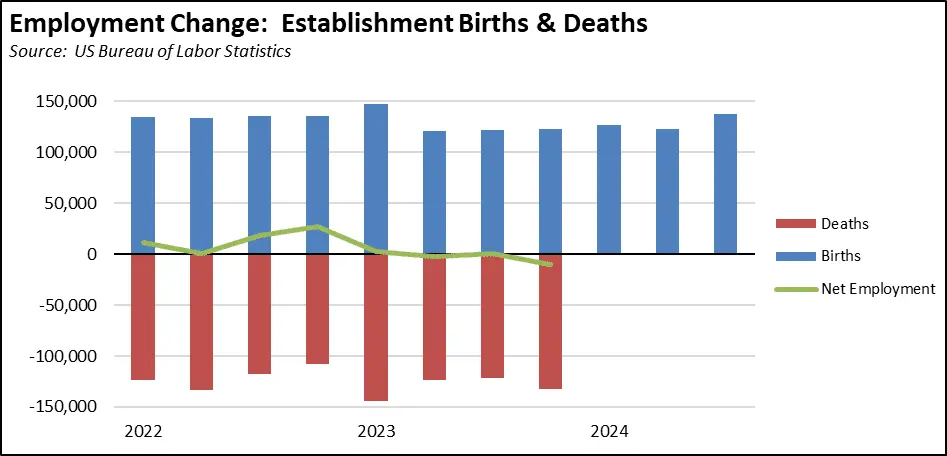

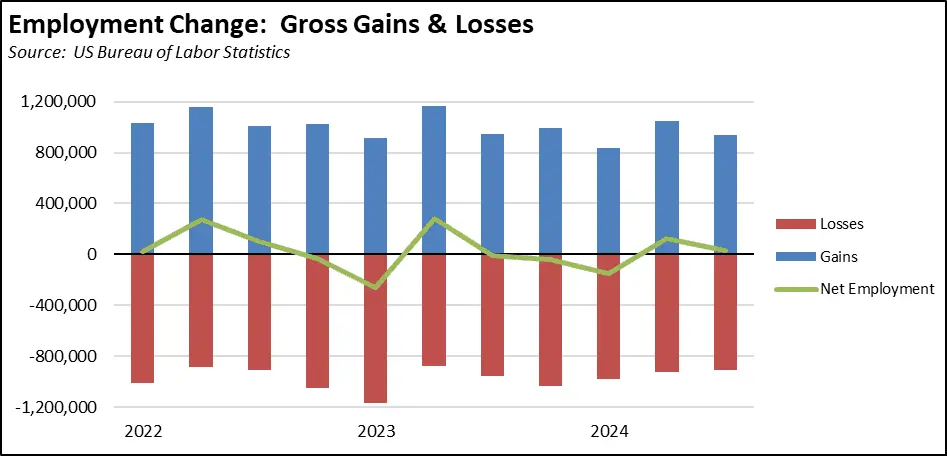

Business Employment Dynamics

The release of the 2025:Q3 BED statistics provides additional insights in the current stagnation of the state’s jobs picture. Covering only private establishments and employment, the BED data further illustrates the effects coming from the lack of growth on net in private industries other than government-supported growth in Healthcare & Social Assistance.

Looking at existing establishments, job losses from contracting establishments increasingly have offset the gains from expanding ones.

California’s entrepreneurial culture has continued to provide a source of growth, with the state still ranking first in the number of establishment births. The gains, however, have been offset by the state’s high costs of doing business—both the effects from higher business costs and higher costs of living affecting their supply of adequate skilled labor—with the state also first in the number of establishment deaths. Consequently, while births provide a source of jobs growth, the losses from closed business operations have turned this former economic advantage into more a Sisyphean effect. California may still be a great state to start a new business, but increasingly it is also a state where compounding costs force businesses to move or close. Note that due to the way establishment deaths are determined in the data, there is a 3-quarter lag.

Combining all sources of gains and losses, net job additions essentially peaked in 2022:Q2. Gains and losses since then have balanced out, first between quarters and in the last 5 quarters within each quarter.

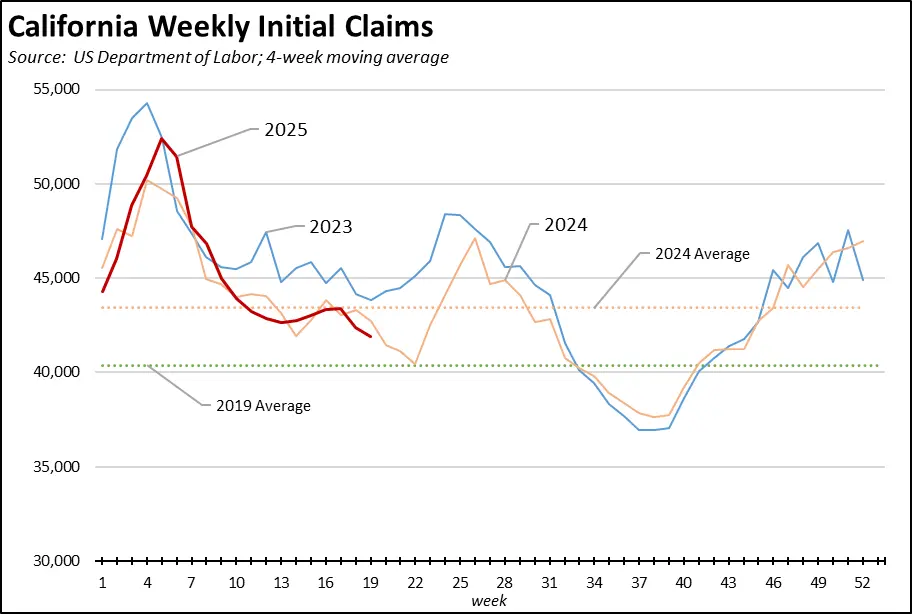

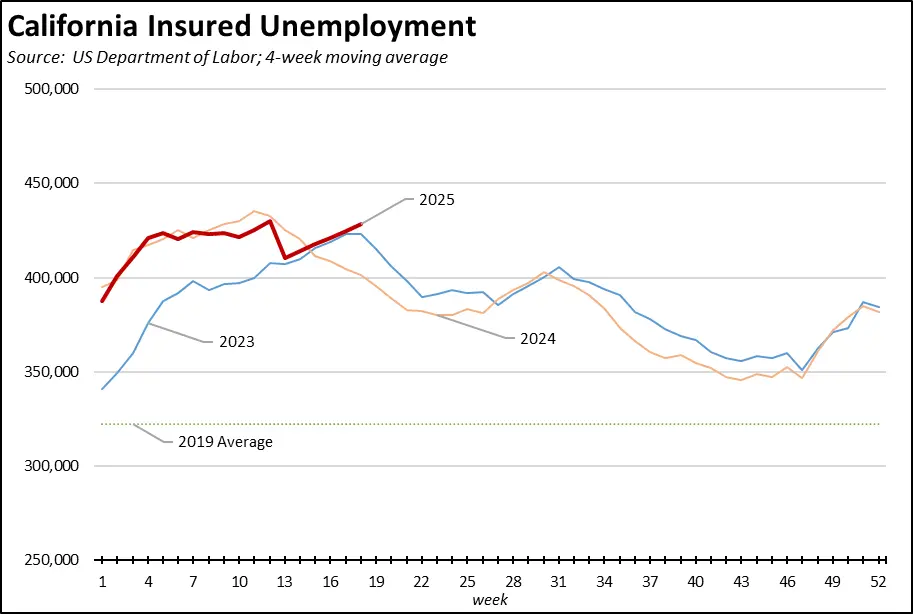

Unemployment Insurance Claims Continue to Track the 2024 Trend

The most recent initial unemployment insurance claims data (4-week moving average) continues to closely follow the 2024 trend, an indication that little has changed to affect the state’s high unemployment levels.

Insured unemployment (a proxy for continuing claims) runs close to the previous trends in 2023, which in the second half of that year showed little difference with conditions in 2024. The stagnant economic conditions over these two prior years continue into the current period.

Compared to the state’s 11.6% share of population, the most recent data shows California workers relying on the unemployment insurance program at almost double this rate, with 19.8% of total initial claims and 23.6% of continuing claims.