Key Take Aways

- Job Gains: California added 14,700 nonfarm jobs in September, ranking fourth among states, but saw a previous loss in August in the revised numbers.

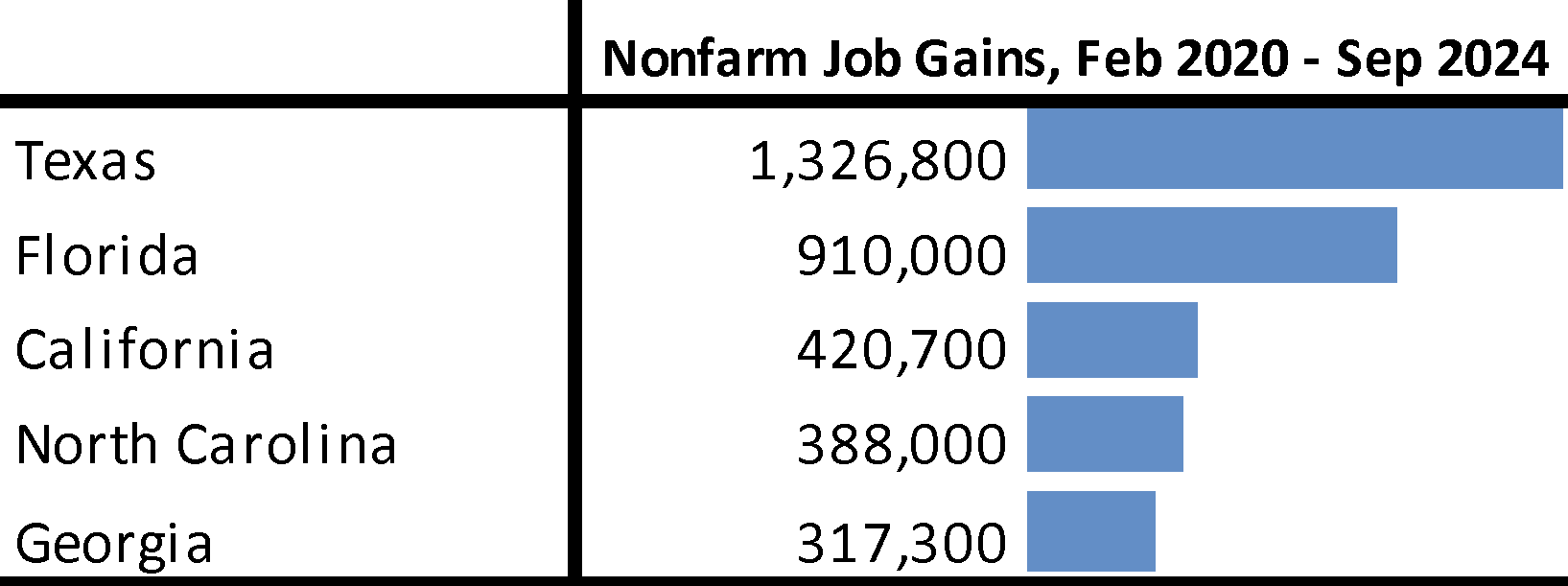

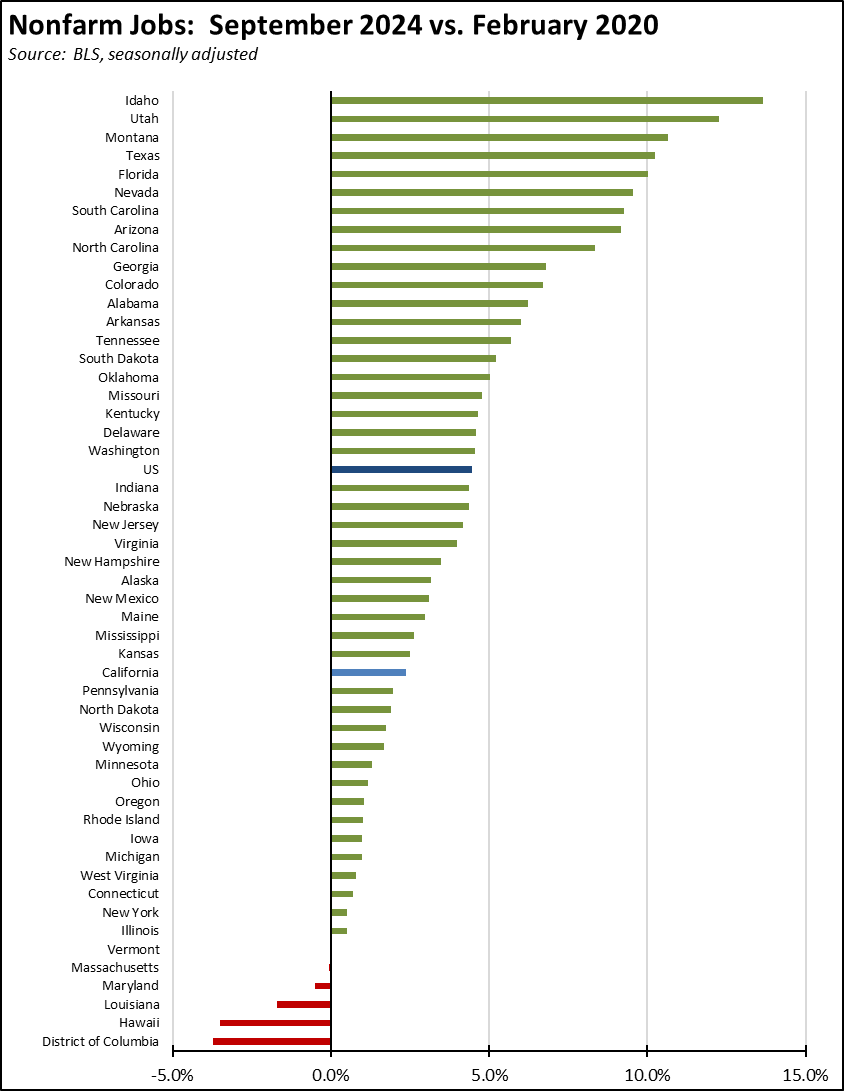

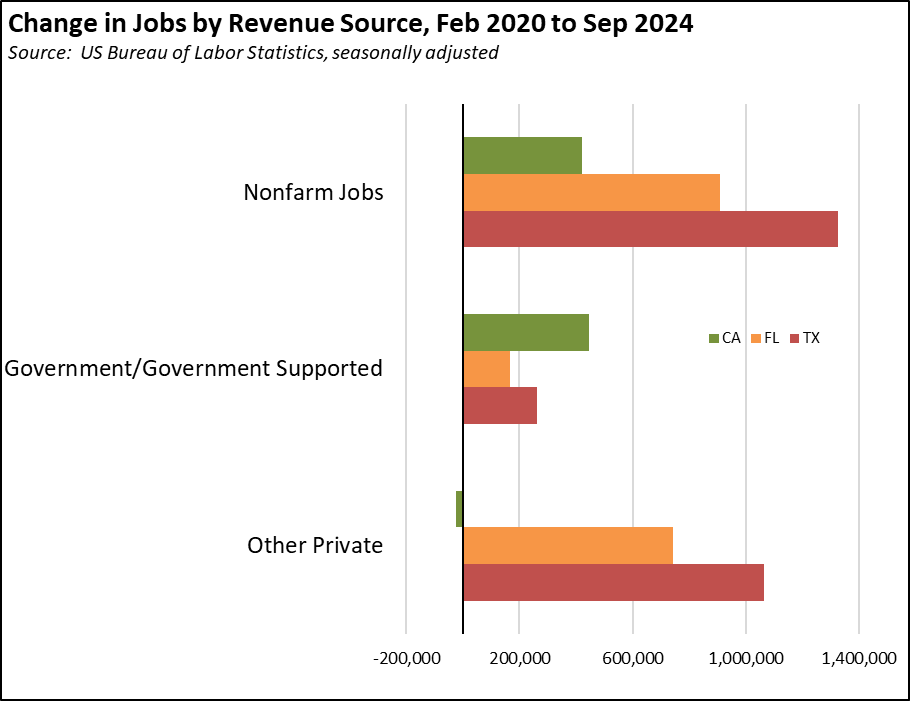

- Long-term Trends: Since February 2020, California has gained 420,700 jobs, the third highest among states, but ranks 31st when adjusted for population size.

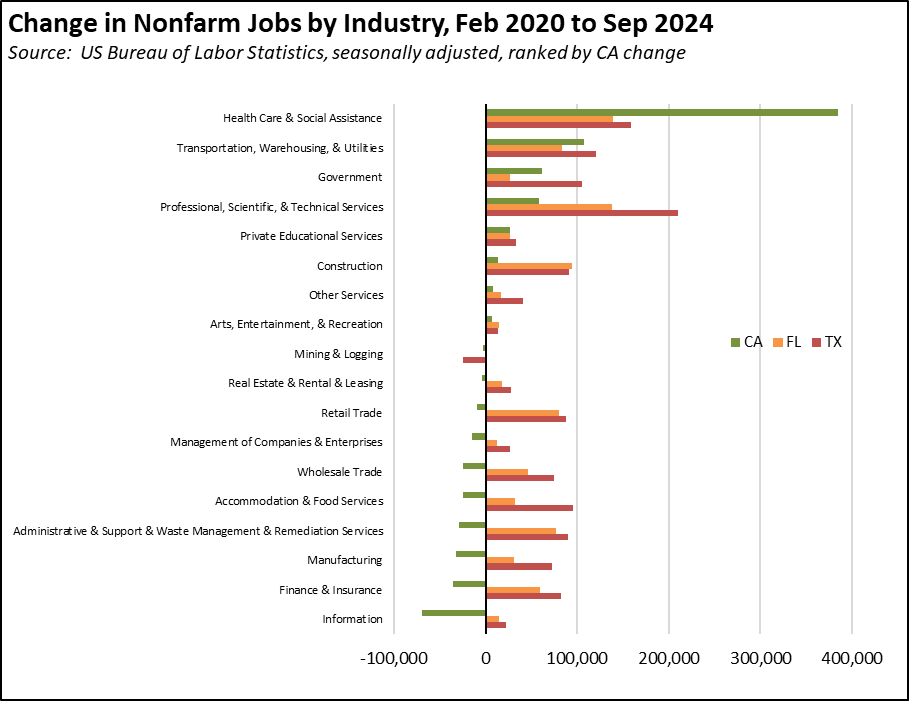

- Sector Dependence: Job growth is concentrated in government and government-supported industries, especially Health Care, while private sector growth has lagged, with many key industries showing positive or stronger growth in other states.

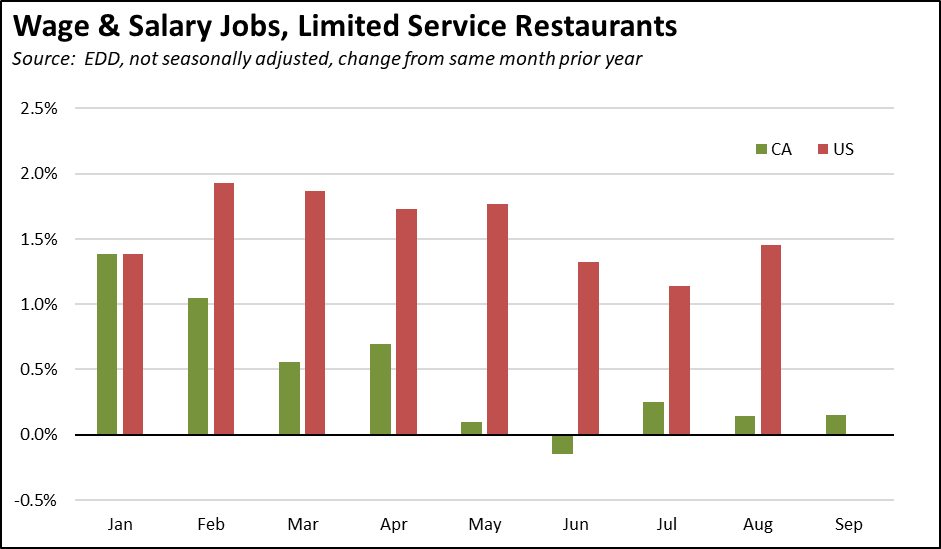

- Challenges in Fast Food: The fast food sector is struggling with job growth due to recent minimum wage increases, leading to frozen to negative job impacts—depending on which data series is used—and higher prices for consumers.

- High Unemployment Rates: California’s unemployment rate remained tied for 2nd highest among the states at 5.3%, with a broader U-6 rate of 9.6%, the highest in the nation.

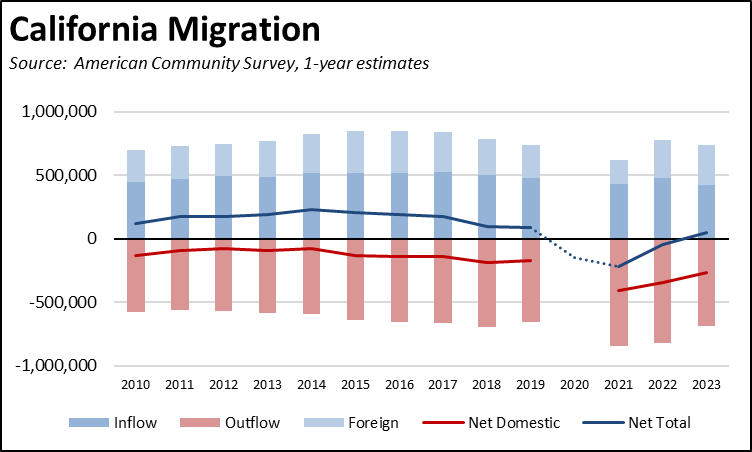

California Continues to Lose Population to Other States

The Census Bureau’s recent state migration numbers from the American Community Survey, 1-year estimates again show more people moved (690,127) from California than came here (422,075) from other states in 2023. The domestic inflow was the lowest in the data series (since 2010), while the outflow was comparable to the level in 2018.

The net domestic outflow was counterbalanced for the first time in 4 years by an uptick in the level of foreign in-migration. In total, net migration for the state was positive due to this factor, but low at only 45,508. The data, however, is not able to track the number of persons moving from California to other nations. Note that in the chart, the ACS data for 2020 is not statistically significant for this indicator. The point shown for Net Total Migration is taken from the Department of Finance estimates.

California Gains 14,700 Nonfarm Jobs—4th Highest Among the States

California gained 14,700 nonfarm jobs in September, the 4th highest gain among the states. Nationally, jobs growth was led by Texas (29,200), New Jersey (19,200), and Florida (17,000).

The previously reported job gains in August were revised to a 1,200 nonfarm jobs loss, putting California into the 42nd highest position among the states.

Looking at the longer term trend, California continued to show the 3rd highest net gain with 420,700 nonfarm jobs since the pre-pandemic peak in February 2020, behind Texas with more than triple the gains (1.3 million) and Florida (910,000) and just ahead of much smaller North Carolina (388,000).

Adjusting for population size, California’s overall job performance since February 2020 notched down to 31st highest among the states.

The Type of Jobs Growth Still Matters

The seasonally adjusted series shows September gains in 12 industries led by Health Care & Social Assistance (8,900), Government (3,800), and Retail Trade (1,200). Losses were in the other 6 industries, led by Arts, Entertainment & Recreation (-3,700), Information (-2,400), and Other Services (-800).

This dominance by government and government supported (Health Care & Social Assistance) jobs has been the case since the pandemic. California has experienced job growth primarily as the result of buying it using state, local, and federal tax dollars. The two job leaders—Texas and Florida—in contrast have experienced jobs growth as their private sectors have expanded.

Within California, elements of the private sector have grown, notably Transportation, Warehousing & Utilities, but this growth is now at risk of being choked off due to expanding state and local regulations. These gains also have been outweighed by net losses in other industries. Instead, growth in such key California strengths as Manufacturing, Construction, Accommodation & Food Services, Information, Finance & Insurance, and Professional, Scientific, & Technical Services has shifted to other states. Texas and Florida have grown the private sector needed to support their additional government and government-supported jobs. California instead now has a jobs model dependent on continued access to public dollars. Putting Health Care & Social Assistance to one side, the number of other private sector jobs in California is now lower than before the pandemic.

Fast Food Restaurants

A case in point is the continuing disputes over the effect of the recent fast food minimum wage hike. In the latest data using the not seasonally adjusted data and comparing the same months in 2023 and 2024, the number of jobs in Limited Service Restaurants grew by only 1,100 in both August and September. In contrast, the US numbers show a gain of 69,000 in August (September not yet available), indicating the extent to which the increased California labor costs have affected growth in this industry.

Using the seasonally adjusted series from the St. Louis Federal Reserve that accounts for the highly seasonal nature of this industry, jobs were down by 4,400 since their recent high in January. This data series indicates jobs in this industry have shown virtually no change since May.

The monthly estimates consequently show an effect on Limited Service jobs but one that depends on which series is used, ranging from a loss of jobs (seasonally adjusted) to essentially freezing additional jobs growth (not seasonally adjusted). Both outcomes counter the narrative being conveyed by supporters of the labor cost increase, and is likely the reason why recent analyses by various union-oriented research groups have ignored the official data and instead have turned to other data sources in an attempt to prove their case.

Both series, however, are based on surveys and modeling and are subject to adjustment in the annual data updates at the beginning of next year. In contrast, the Quarterly Census of Employment & Wages (QCEW) provides a full accounting of these jobs. The next update is scheduled for early December. In our previous comparison of the numbers, the most recent QCEW data for January-March suggested the monthly estimates are about 10,000 higher than the actual number of jobs. The next release for April-June will provide additional insight on this issue as well as the actual results coming immediately after imposition of the higher labor costs.

California Fast Food Prices Highest in Nation

While a time series is not yet available, a snapshot of fast food prices after the mandated rise in labor costs is provided through the Fast Food Index. The data is obtained by accessing each chain’s mobile ordering app at each location in a state. The resulting database covers from 936 to 18,850 separate locations for 8 different chains. All data is from the beginning of October.

As shown in the summary results, California ranks among the top 5 most costly states for each of the items being tracked, with an overall average ranking of 3.0 putting it as the most costly state. The results translate into Californians paying 7% to 23% more per item than the US average, with an overall average cost premium of 15% or $9.25 if buying one of each item.

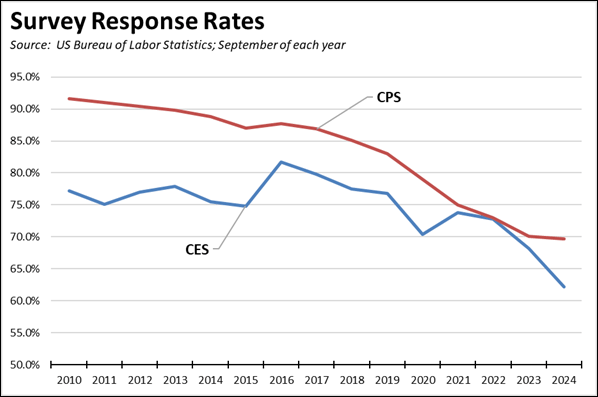

Economic Survey Response Levels Decline

An additional issue with the current surveys used to produce the monthly estimates is that fewer businesses and people are responding. The monthly estimates come from two surveys. The establishment survey (CES) is used to develop the monthly wage and salary job estimates. The household survey (CPS) is used to craft the labor force estimates. Both saw a sharp drop in response rates during the pandemic, but both also have experienced a longer trend eroding their overall response rates. Looking at the September results over the years, the most recent CES survey response rate of 62.2% (first preliminary release) was the lowest since 2002. The CPS response rate of 69.7% was the lowest since at least 1994. Both response rates, however, still produce statistically significant results, but results that may face higher revisions during the annual adjustments especially at the sub-industry level. The annual revisions that bring the monthly estimates in line with the actual job counts from the QCEW data consequently have become more important.

Bay Area Leads in Jobs Growth—Los Angeles Shows a Loss

The Bay Area counties led nonfarm jobs growth in September, with a combined total of 6,700 (seasonally adjusted), while the Los Angeles region counties lost 1,600. The Bay Area, Los Angeles, and Central Coast continued to perform below pre-pandemic levels.

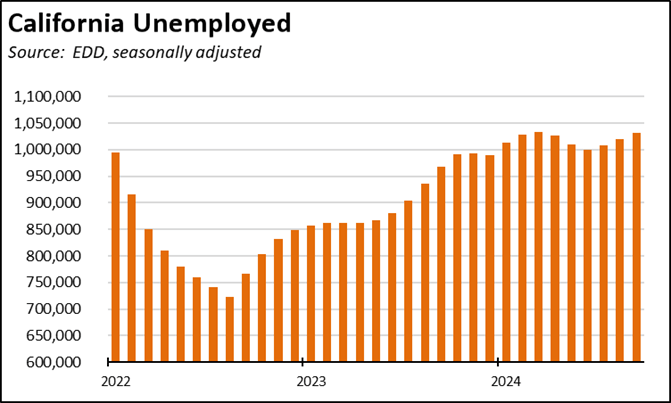

Unemployment Remains Above 1 Million

California’s unemployment rate in September was unchanged at 5.3%, but again tied with Illinois for the 2nd highest among the states. Nevada led with 5.6%, while DC came in higher than the states at 5.7%. California unemployment has been above the 1 million mark every month so far in 2024, nearing levels previously seen in December 2021. Overall, the number of unemployed in September was 22.6% higher than in December 2018. In that same period of time, employment dipped 1.9% even though the potential labor pool represented by Civilian Population (civilian populations age 16 and over) grew by 6.5%.

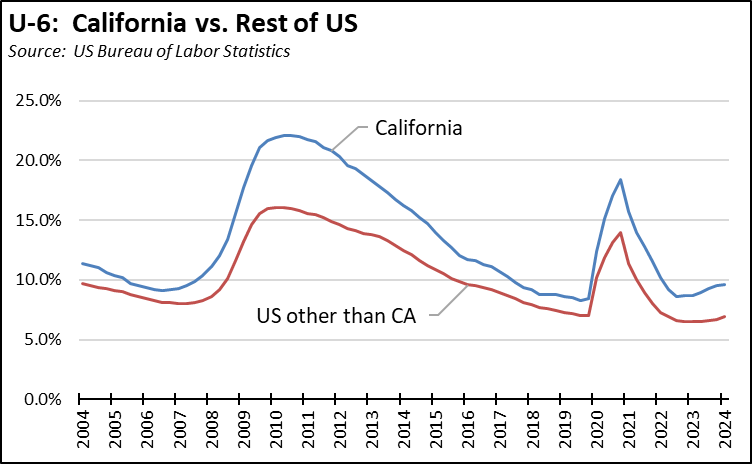

The monthly unemployment number, however, is calculated based only on persons working or actively looking for work. The broader U-6 unemployment covers this universe but also includes persons who are marginally attached to the labor force and persons working part time for economic reasons (e.g., full time work is not available). Under this broader measure, California’s unemployment rate was 9.6% in the 2nd Quarter, the highest of any state and 36% higher than the 6.9% rate for all the other states and DC. California’s U-6 rate remains above the pre-pandemic levels in 2019 and has been rising faster than the rate for the rest of the country.

Unemployment Rate by Legislative District

Estimated unemployment rate for the 10 highest and 10 lowest legislative districts:

CaliFormer Businesses

Additional CaliFormer companies identified since our last report are shown below. The listed companies include those that have announced: (1) moving their headquarters or full operations out of state, (2) moving business units out of state (generally back office operations where the employees do not have to be in a more costly California location to do their jobs), (3) California companies that expanding out of state rather than locate those facilities here, and (4) companies turning to permanent telework options, leaving it to their employees to decide where to work and live. The list is not exhaustive but is drawn from a monthly search of sources in key cities.

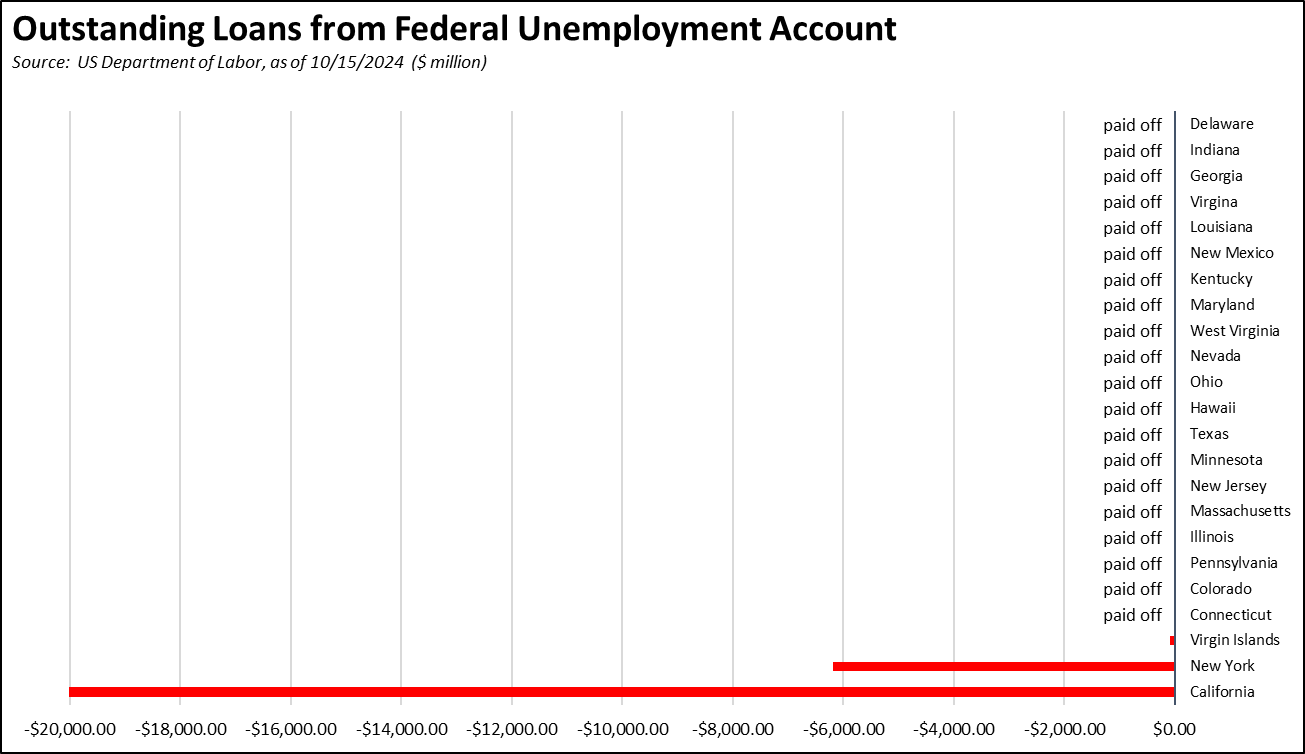

State UI Fund Debt Remains Above $20 Billion

The state’s continuing failure to address its burgeoning Unemployment Insurance debt saw the level growing to $20.4 billion in mid-October. All other states other than New York have paid off their pandemic period debt, in large part using the federal funds provided for that purpose. California instead chose to use those funds on other expenditures.

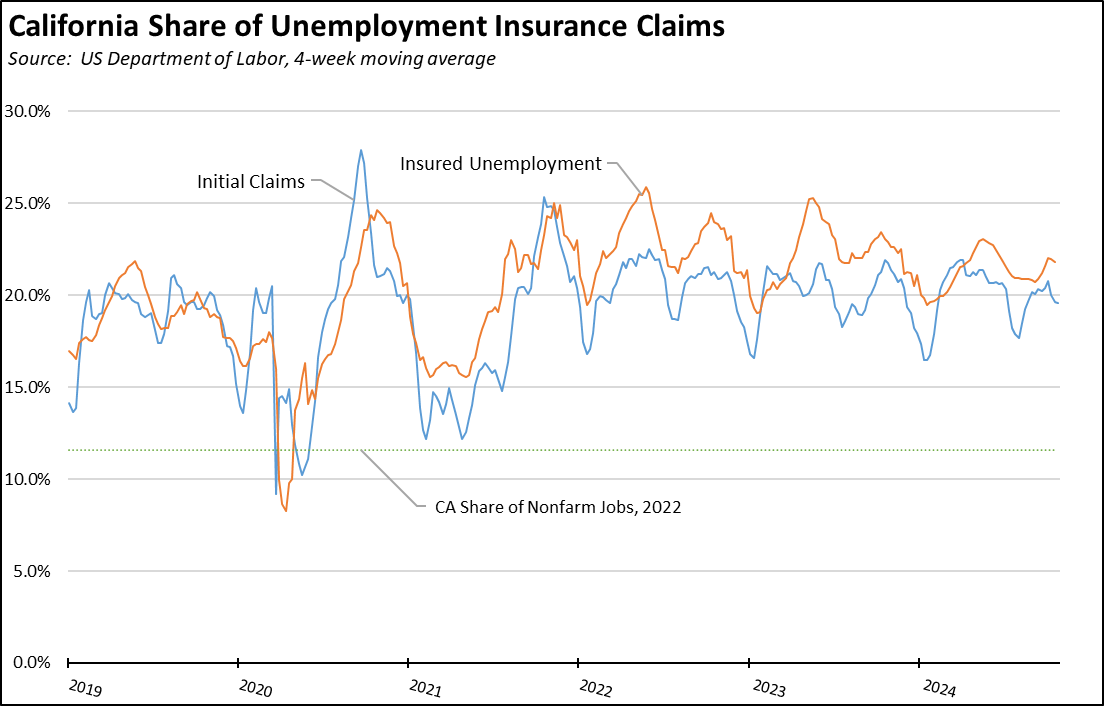

The growing size of this debt is not just due to the state’s fiscal management practices. California also remains one of the most generous programs in the country, accounting for an average to date in 2024 of 19.9% of all state unemployment insurance payments while containing only 11.4% of nonfarm jobs. The state’s persistent unemployment level above 1 million reflects policies that continue to lean towards benefit payments rather than expansion of earned income opportunities.

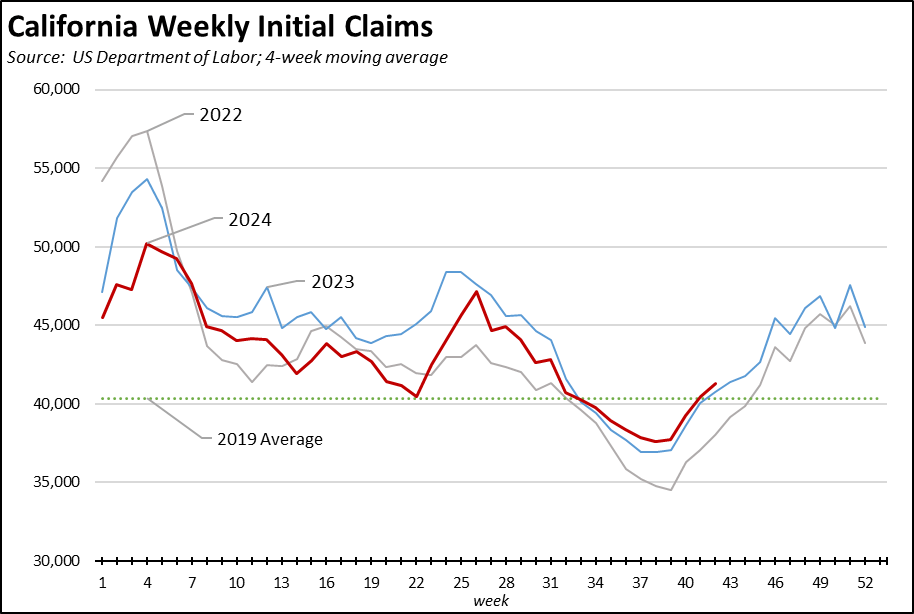

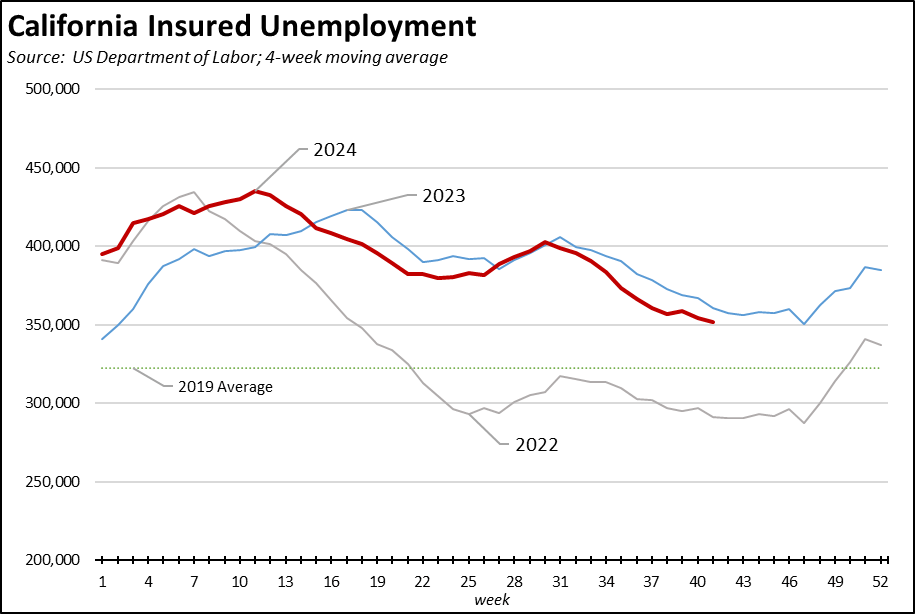

Measured on a 4-week moving average basis for the week ended October 19, the number of initial claims continues to moderate from the sharp rise that began at the beginning of June. The overall trend continues to track just marginally above the results from 2023 during the same period.

The number of workers receiving unemployment—as measured by insured unemployed (a proxy for continuing claims)—is now tracking somewhat below the 2023 trend, but remains substantially elevated above the levels in 2022.

Reflecting California’s outsized share of total benefit payments, insured unemployment was 21.3% of the national total (4-week moving average), while initial claims were 19.5% of the total.