Highlights for policy makers:

- Unemployment Rate Declines to 7.2%; Total Employment Climbs 70,700

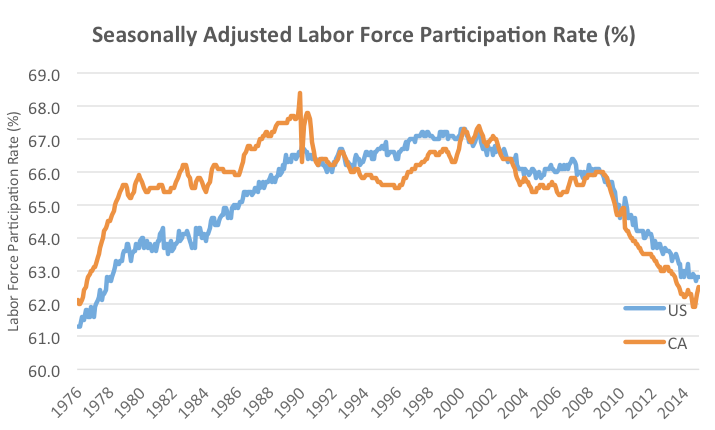

- Labor Force Participation Rate Remains at 1976 Levels

- 1/5 of Total Employed in Part Time Work

- Nonfarm Jobs Increase 90,100

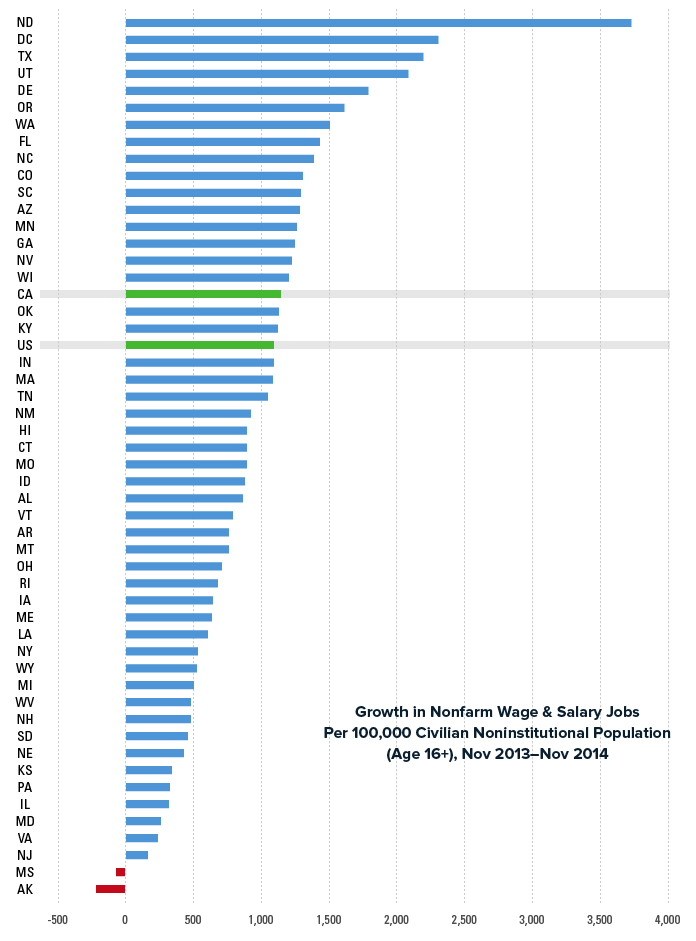

- Jobs Growth Adjusted for Population Near National Average

- 5 Industries Remain Below 2007 Pre-Recession Job Levels

- Second Largest Job Growth in Jobs Paying Average Annual Wage of $14.3k

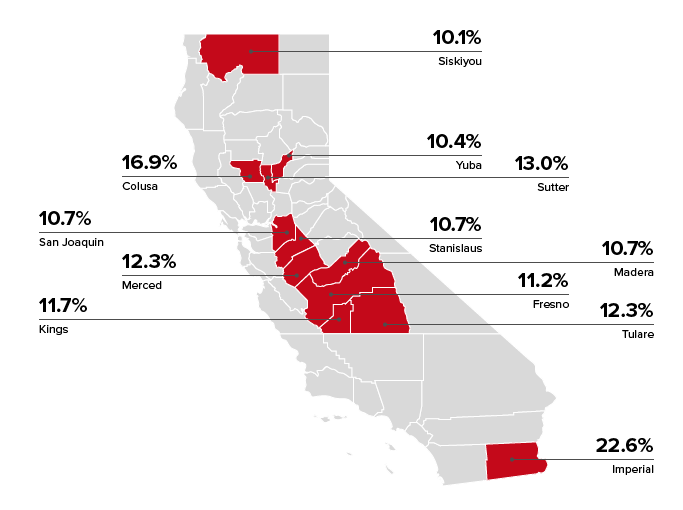

- 12 Counties Remain in Double-Digit Unemployment, Up from 8 in October

- Two-Tier Economy Persists

Unemployment Rate Declines to 7.2%; Total Employment Climbs 70,700

The Labor Force data for November 2014 (seasonally adjusted; California preliminary) is shown below, along with the change from the prior month:

The related not seasonally adjusted numbers (California preliminary), with the change from November 2013:

California Employment Development Department’s (EDD) latest release shows on a seasonally adjusted basis, total employment grew by 70,700, while the number of unemployed dropped by 6,000. California’s seasonally adjusted unemployment rate declined from 7.3% in October to 7.2% in November. The unadjusted rate increased from 7.0% in October 2014 to 7.1% in November 2014.

By comparison, total US employment remained essentially level (seasonally adjusted increase of 4,000), while the number of unemployed increased 1.3% (seasonally adjusted increase of 115,000).

California’s seasonally adjusted unemployment rate improved slightly to be 24% higher than the national rate. California had the 4th highest unemployment rate among the states, below DC, Mississippi, and Georgia.

Between November 2013 and November 2014, Bureau of Labor Statistics (BLS) data shows the total number of employed in California increased by 458,712 (not seasonally adjusted). This increase was the highest among the states, ahead of Texas (333,658) and Florida (277,268). Adjusted for population size, California had the 15th highest employment increase (15.2 additional employed per 1,000 Civilian Noninstitutional Population (Age 16+)), with North Dakota (27.1 per 1,000 population), Colorado (26.8 per 1,000 population), and DC (26.1 per 1,000 population) in the leading slots.

Labor Force Participation Rate Improves but Remains at 1976 Levels

The state’s seasonally adjusted labor force participation rate of 62.5% ticked upward for the 3rd month in a row, but still remains at levels last seen in 1976.

1/5 of Total Employed in Part Time Work

The percentage of part time workers remained constant at 20.2% of total employment, with a slight decline to 7.0% working part time for economic reasons (primarily the lack of full time jobs).

Nonfarm Jobs Increase 90,100

EDD reported that between October and November 2014, seasonally adjusted nonfarm payroll jobs increased by 90,100. Not seasonally adjusted, nonfarm payroll jobs grew by 115,500.

Looking at the not seasonally adjusted numbers, the change in nonfarm payroll jobs from October 2014 saw the largest increases in Retail Trade (66,000) as the holiday shopping season kicked into gear, Government (23,300), Health Care & Social Assistance (8,800), Professional, Scientific & Technical Services (6,900), and Accommodation & Food Services (3,800). Biggest declines were in Manufacturing (-5,400) and Arts, Entertainment & Recreation (-2,800).

Jobs Growth Adjusted for Population Near National Average

From November 2013 to November 2014, California had the second highest increase in seasonally adjusted Nonfarm jobs, at 344,100 or 12.6% of the US total. Texas had the highest, with 441,200 Nonfarm jobs or 16.1% of the US total.

Adjusted for population, however, California’s private job creation rate is just slightly above the US average. A significant factor in California’s recent job growth is its sheer size. As the largest state (45% larger than the second largest state, Texas), California will normally be near the top in terms of total jobs created during any national recovery period. Adjusting for the labor force population base gives a better view of the state’s overall performance relative to the nation and other states.

The following chart shows Nonfarm jobs created per 100,000 Civilian Noninstitutional Population age 16 and over (the available labor force population base). Accounting for population size, California’s Nonfarm job performance for the 12 months was the 17th highest.

California has regained its total pre-recession job levels, but its continued performance near the national average job creation rate means the state has yet to match job creation with the population growth (about 5% according to Department of Finance data) that has occurred since the recession.

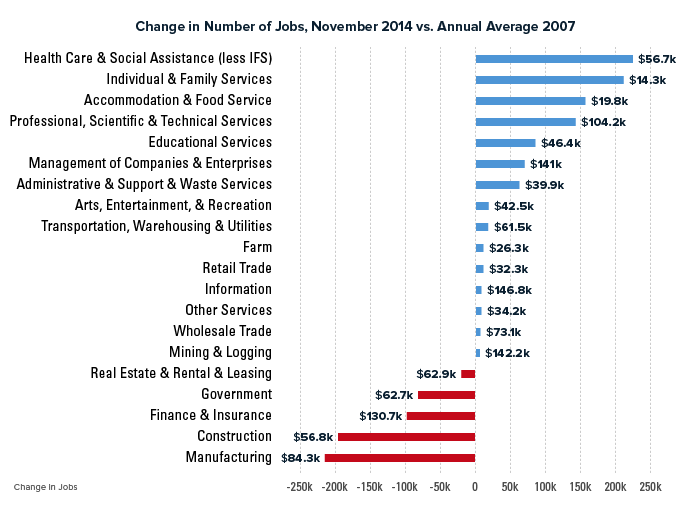

5 Industries Remain Below 2007 Pre-Recession Job Levels

Comparing the number of jobs by industry in November 2014 (not seasonally adjusted), 5 industries remain below the 2007 pre-recession levels and the remaining are above. Looking at seasonally adjusted numbers, 6 industries (Retail Trade is added to this category) remain below the 2007 pre-recession levels.

As indicated in the figure above, growth has been primarily in the lower wage and higher wage industries. Significant job growth in industries paying above $1,000 a week average wage has been limited to Professional, Scientific & Technical Services, Health Care Services, and Management of Companies & Enterprises. All other industries in this wage category remain near or significantly below the 2007 average employment levels.

The chart above differs from previous versions provided in this monthly report in that the numbers are based on the not seasonally adjusted job numbers. Previous reports were based on seasonally adjusted numbers. This change allows Individual & Family Services to be broken out separately from Health Care & Social Assistance. Individual & Family Services (IFS) is dominated by In Home Supportive Services (IHSS) workers, which are Medicaid-supported positions which were first added to the job numbers by EDD beginning this year (with retroactive revisions to previous years).

Breaking the data out this way still shows Health Care & Social Assistance Services (less IFS) is still the leading job creator, driven primarily by expansion under the federal Affordable Care Act. Individual & Family Services, however, holds second place—largely a government-supported industry paying an average of only $14,300 a year.

Second Largest Job Growth in Jobs Paying Average Annual Wage of $14.3k

The chart above differs from previous versions provided in this monthly report in that the numbers are based on the not seasonally adjusted job numbers. Previous reports were based on seasonally adjusted numbers. This change allows Individual & Family Services to be broken out separately from Health Care & Social Assistance. Individual & Family Services (IFS) is dominated by In Home Supportive Services (IHSS) workers, which are Medicaid-supported positions which were first added to the job numbers by EDD beginning this year (with retroactive revisions to previous years).

Breaking the data out this way still shows Health Care & Social Assistance Services (less IFS) is still the leading job creator, driven primarily by expansion under the federal Affordable Care Act. Individual & Family Services, however, holds second place—largely a government-supported industry paying an average of only $14,300 a year.

12 Counties Remain in Double-Digit Unemployment, Up from 8 in October

Two-Tier Economy Persists

Unemployment rates and employment (all data is not seasonally adjusted) continue to vary widely across the state, with the spread between regions increasing to 2.18.

By County:

Ratio of Highest to Lowest Rate: 5.79

By Legislative District:

Ratio of Highest to Lowest Rate: Senate 3.30

Ratio of Highest to Lowest Rate: Assembly 3.82