Highlights for policy makers:

- Unemployment Rate Level at 5.1%; Total Employment Gains 112,700

- Labor Force Participation Rate Matches Lowest Level from 1976

- State Employment Growth Rankings—California Rose to 3rd Place

- Nonfarm Jobs Up 52,200

- Six Industries below 2007 Pre-Recession Job Levels

- Job Gains by Wage Level

- Two-Tier Economy Persists—Central Valley Unemployment More than Twice as High as Bay Area

- Bay Area Provided 40% of Net Employment Growth Since Recession

- Eight California MSAs in the 10 Worst Unemployment Rates Nationally

Unemployment Rate Level at 5.1%; Total Employment Gains 112,700

The Labor Force data for September 2017 (seasonally adjusted; California preliminary) is shown below, along with the change from the prior month:

| Seasonally Adjusted | California | US | ||

|---|---|---|---|---|

| Sep 2017 | Change from Aug 2017 | Sep 2017 | Change from Aug 2017 | |

| Unemployment Rate | 5.1% | 0.0 | 4.2% | -0.2 |

| Labor Force | 19,295,227 | 0.7% | 161,146,000 | 0.4% |

| Participation Rate | 62.3% | 0.4 | 63.1% | 0.2 |

| Employment | 18,309,064 | 0.6% | 154,345,000 | 0.6% |

| Unemployment | 986,163 | 1.4% | 6,801,000 | -4.6% |

The related not seasonally adjusted numbers (California preliminary), with the change from September 2016:

| Not Seasonally Adjusted | California | US | ||

|---|---|---|---|---|

| Sep 2017 | Change from Sep 2016 | Sep 2017 | Change from Sep 2016 | |

| Unemployment Rate | 4.7% | -0.5 | 4.1% | -0.7 |

| Labor Force | 19,450,352 | 1.4% | 161,049,000 | 0.9% |

| Participation Rate | 62.8% | 0.4 | 63.0% | 0.2 |

| Employment | 18,533,056 | 1.9% | 154,494,000 | 1.7% |

| Unemployment | 917,296 | -8.7% | 6,556,000 | -14.4% |

California Employment Development Department’s (EDD) latest release shows on a seasonally adjusted basis, total employment was up 112,700 from August, while the number of unemployed rose by 13,200. The labor force rose by 125,900.

California’s seasonally adjusted unemployment rate remained level at 5.1%. California tied with Louisiana and West Virginia for the 7th highest unemployment rate among the states. The unadjusted rate dropped from 5.2% in September 2016 to 4.7%.

Total US employment saw a seasonally adjusted rise of 906,000 from August, while the number of unemployed dropped by 331,000. The national unemployment rate was down 0.2 point to 4.2%. The national labor force numbers grew by 575,000.

Labor Force Participation Rate Matches Lowest Level from 1976

California’s participation rate (seasonally adjusted) in September rose to 62.3%, while the US rate grew to 63.1%.

The seasonally adjusted California participation rate in September returned to the previous low seen in 1976.

State Employment Growth Rankings—California Rose to 3rd Place

| Rank | Number of Employed | Percentage Change | Population Adjusted (employment growth per 1,000 civilian noninstitutional population) |

|---|---|---|---|

| 1 | FL 340,000 | CO 4.5% | CO 29.0 |

| 2 | TX 186,600 | OR 3.9% | OR 23.3 |

| 3 | CA 182,700 | FL 3.6% | UT 22.3 |

| 4 | GA 164,300 | GA 3.5% | GA 20.8 |

| 5 | NY 156,300 | AR 3.4% | FL 20.4 |

| 6 | CO 125,700 | UT 3.4% | WA 20.0 |

| 7 | WA 114,800 | WA 3.3% | MD 18.8 |

| 8 | VA 103,500 | MD 2.9% | AR 18.8 |

| 9 | MD 88,900 | TN 2.8% | MN 17.6 |

| 10 | NC 88,600 | KY 2.6% | TN 16.3 |

| 11 | TN 85,200 | MN 2.6% | VA 15.8 |

| 12 | OR 76,900 | VA 2.5% | KY 14.6 |

| 13 | MN 76,100 | AZ 2.5% | AZ 14.1 |

| 14 | AZ 75,900 | WI 2.1% | WI 13.8 |

| 15 | WI 63,100 | NV 1.9% | NV 11.3 |

| 16 | MA 59,800 | NC 1.9% | DC 11.2 |

| 17 | KY 50,400 | ME 1.8% | NC 11.2 |

| 18 | UT 49,400 | SC 1.8% | ME 11.0 |

| 19 | AR 43,400 | MA 1.7% | MA 10.8 |

| 20 | OH 39,900 | NY 1.7% | ID 10.3 |

| 21 | MI 39,300 | DC 1.7% | SC 10.1 |

| 22 | SC 39,200 | ID 1.7% | RI 10.0 |

| 23 | IN 36,100 | RI 1.6% | NY 9.9 |

| 24 | CT 26,500 | CT 1.5% | CT 9.2 |

| 25 | NV 26,100 | TX 1.5% | TX 8.9 |

| 26 | AL 22,800 | IN 1.1% | IN 7.0 |

| 27 | NJ 20,600 | AL 1.1% | ND 6.4 |

| 28 | KS 13,800 | CA 1.0% | KS 6.2 |

| 29 | ID 13,200 | DE 1.0% | AL 6.0 |

| 30 | OK 12,600 | KS 1.0% | CA 5.9 |

| 31 | ME 12,000 | ND 0.9% | DE 5.9 |

| 32 | RI 8,600 | MI 0.9% | MI 5.0 |

| 33 | PA 8,200 | NM 0.8% | NM 4.4 |

| 34 | NM 7,100 | OH 0.7% | OH 4.4 |

| 35 | DC 6,300 | OK 0.7% | OK 4.2 |

| 36 | DE 4,500 | HI 0.6% | HI 3.4 |

| 37 | NE 4,500 | AK 0.5% | AK 3.3 |

| 38 | MS 3,900 | WV 0.5% | SD 3.2 |

| 39 | WV 3,800 | NJ 0.5% | NJ 2.9 |

| 40 | HI 3,700 | SD 0.5% | WV 2.6 |

| US 906,000 | US 0.6% | US 3.5 |

Between September 2016 and September 2017, Bureau of Labor Statistics (BLS) data shows the total number of employed in California increased by 182,700 (seasonally adjusted), or 20.2% of the total net employment gains in this period for the US. California rose to 3rd place behind Florida (which has a civilian working age population only 55% as large as California’s) at 340,000 and Texas (69% as large) at 186,600. Measured by percentage change in employment over the year, California improved to 28th highest. Adjusted for working age population, California rose to 30th.

Nonfarm Jobs Up 52,200

EDD reported that between August and September 2017, seasonally adjusted nonfarm wage and salary jobs grew 52,200. August’s losses were revised to 7,700 from the previous drop of 8,200. As usual, September’s numbers were heavily influenced by the return to schools. Looking at the underlying unadjusted numbers, State & Local Government Education and Educational Services combined saw an increase of 115,300, a typical but higher compared to years prior to 2016, seasonal effect related to the school year.

In the not seasonally adjusted nonfarm numbers overall, hiring saw increases in all but 5 industries over the year. The change in total payroll jobs from September 2016 saw the largest increases in Government (46,700), Construction (44,500), and Social Assistance (38,700). Declines were in Manufacturing (-6,200), Accommodation Services (-1,200), and Mining & Logging (-900).

| Not Seasonally Adjusted Payroll Jobs | Sep 2017 | Aug 2017 | Change Sep 2017 – Aug 2017 | Change Sep 2017 – Sep 2016 |

|---|---|---|---|---|

| Total Farm | 482,300 | 482,100 | 200 | 4,400 |

| Mining and Logging | 23,500 | 23,600 | -100 | -900 |

| Construction | 840,600 | 842,900 | -2,300 | 44,500 |

| Manufacturing | 1,312,600 | 1,318,800 | -6,200 | -6,200 |

| Wholesale Trade | 739,800 | 737,500 | 2,300 | 14,300 |

| Retail Trade | 1,675,100 | 1,677,400 | -2,300 | 5,900 |

| Utilities | 58,400 | 58,300 | 100 | -100 |

| Transportation & Warehousing | 542,500 | 536,900 | 5,600 | 5,400 |

| Information | 534,200 | 534,800 | -600 | 11,200 |

| Finance & Insurance | 549,400 | 550,900 | -1,500 | 4,100 |

| Real Estate & Rental & Leasing | 282,100 | 285,000 | -2,900 | 1,600 |

| Professional, Scientific & Technical Services | 1,223,600 | 1,228,800 | -5,200 | 1,000 |

| Management of Companies & Enterprises | 230,000 | 230,400 | -400 | 3,900 |

| Administrative & Support & Waste Services | 1,107,900 | 1,102,400 | 5,500 | -200 |

| Educational Services | 361,200 | 342,800 | 18,400 | 14,500 |

| Health Care | 1,487,400 | 1,486,400 | 1,000 | 17,400 |

| Social Assistance | 766,600 | 759,100 | 7,500 | 38,700 |

| Arts, Entertainment & Recreation | 308,300 | 319,100 | -10,800 | 5,100 |

| Accommodation | 223,300 | 229,900 | -6,600 | -1,200 |

| Food Services | 1,420,000 | 1,426,600 | -6,600 | 31,600 |

| Other Services | 582,600 | 577,700 | 4,900 | 20,600 |

| Government | 2,538,000 | 2,452,300 | 85,700 | 46,700 |

| Total Nonfarm | 16,807,100 | 16,721,600 | 85,500 | 257,900 |

| Total Wage and Salary | 17,289,400 | 17,203,700 | 85,700 | 262,300 |

At 52,200, California showed the highest increase in seasonally adjusted nonfarm jobs among the states from September 2016 to September 2017, as job levels at the national level in particular for states along the Gulf Coast were affected by severe weather. By percentage growth in jobs, California rose to 8th highest at 0.3%. By population adjusted jobs growth, California rose to 9th highest.

| Rank | Number of Jobs | Employment Growth (%) | Population Adjusted (job growth per 1,000 civilian noninstitutional population) |

|---|---|---|---|

| 1 | CA 52,200 | NE 0.5% | NE 3.7 |

| 2 | WA 13,800 | HI 0.5% | HI 2.8 |

| 3 | IN 11,400 | WA 0.4% | WA 2.4 |

| 4 | AZ 10,900 | AZ 0.4% | KS 2.3 |

| 5 | OH 10,500 | IN 0.4% | IN 2.2 |

| 6 | PA 10,300 | KS 0.4% | VT 2.1 |

| 7 | MI 9,900 | VT 0.3% | AZ 2.0 |

| 8 | MA 9,300 | CA 0.3% | WI 1.9 |

| 9 | WI 8,600 | WI 0.3% | CA 1.7 |

| 10 | MN 6,400 | MA 0.3% | MA 1.7 |

| 11 | NE 5,400 | SD 0.3% | SD 1.7 |

| 12 | KS 5,000 | UT 0.2% | UT 1.5 |

| 13 | CO 4,000 | MI 0.2% | MN 1.5 |

| 14 | AL 3,800 | MN 0.2% | MI 1.3 |

| 15 | UT 3,400 | AL 0.2% | OH 1.1 |

| 16 | HI 3,100 | OH 0.2% | PA 1.0 |

| 17 | KY 3,100 | PA 0.2% | AL 1.0 |

| 18 | NC 2,500 | KY 0.2% | CO 0.9 |

| 19 | MD 2,400 | CO 0.2% | KY 0.9 |

| 20 | MS 1,400 | MS 0.1% | MS 0.6 |

| 21 | VT 1,100 | WV 0.1% | WV 0.6 |

| 22 | SD 1,100 | AR 0.1% | MD 0.5 |

| 23 | AR 1,100 | MD 0.1% | AR 0.5 |

| 24 | WV 900 | ID 0.1% | ID 0.5 |

| 25 | TN 800 | NC 0.1% | NC 0.3 |

| 26 | ID 600 | TN 0.0% | TN 0.2 |

| 27 | NV 200 | DE 0.0% | DE 0.1 |

| 28 | DE 100 | NV 0.0% | NV 0.1 |

| 29 | MT -100 | GA 0.0% | GA -0.1 |

| 30 | GA -500 | MT 0.0% | MT -0.1 |

| 31 | ME -700 | TX -0.1% | TX -0.3 |

| 32 | ND -900 | ME -0.1% | ME -0.6 |

| 33 | NM -1,100 | CT -0.1% | NM -0.7 |

| US -33,000 | US 0.0% | US -0.1 |

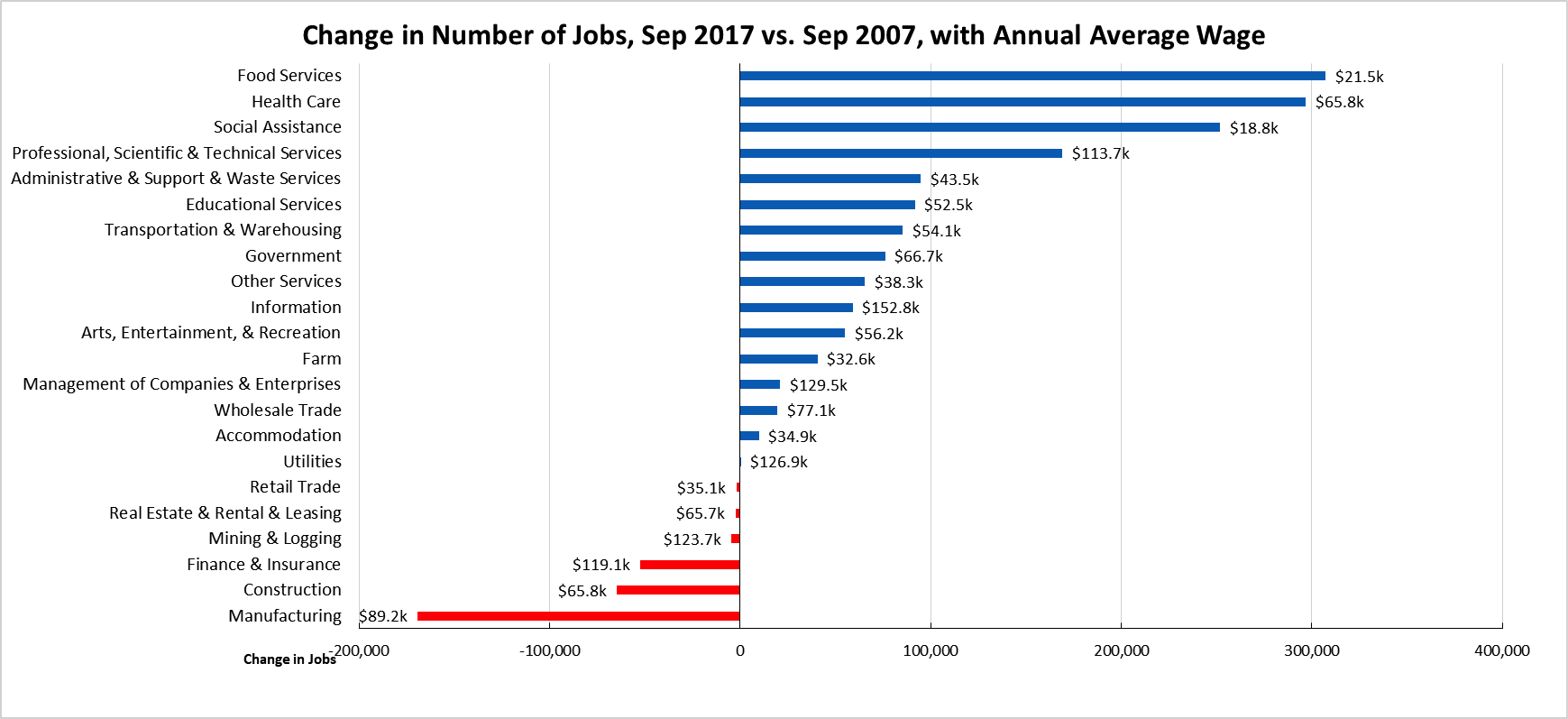

Six Industries Below 2007 Pre-Recession Job Levels

Comparing the number of jobs by industry in September 2017 (not seasonally adjusted), 6 industries had employment below the 2007 pre-recession levels. The highest gain industries were led by lower wage Food Services, Health Care (with a relatively higher mix of lower and higher wage occupations), lower wage Social Assistance, and higher wage Professional, Scientific & Technical Services. Of the lagging industries, three—Manufacturing, Mining & Logging, and Construction—are blue collar middle class wage industries, while the higher wage Finance & Insurance also continued to lose ground.

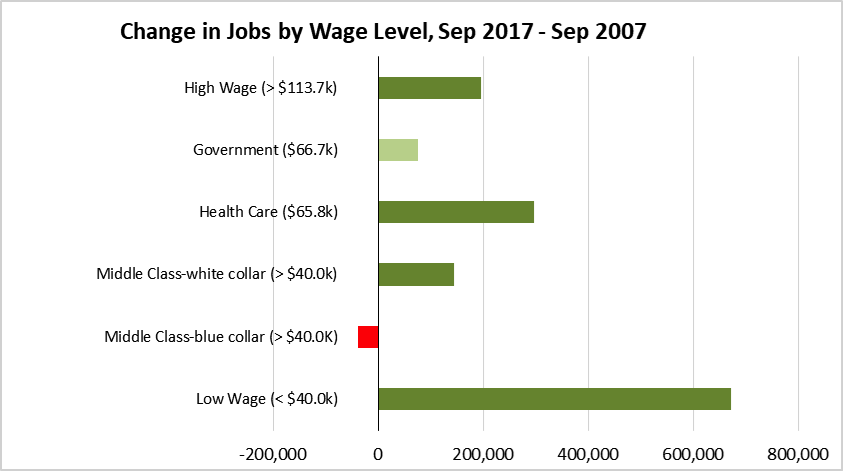

Job Gains by Wage Level

In the May Budget Revision, the Governor again pointed to the increasing share of lower wage jobs as one of the prime causes of slowing state revenues growth: The level of wages has been revised downward, and cash receipts have been significantly below forecast. The following chart illustrates this trend for total wage and salary jobs, according to the industry wage classification used previously in other Center analyses of this issue. As indicated, half of net jobs growth since the recession has been in the low wage industries. Middle Class-blue collar jobs continue to show a decline.

Two-Tier Economy Persists—Central Valley Unemployment More than Twice as High as Bay Area

While unemployment rates have improved in the interior counties as a result of seasonal employment, the level of unemployment rates (all data is not seasonally adjusted) continues to vary widely across the state, ranging from 3.4% in the Bay Area to more than twice as large at 7.6% in the Central Valley.

| Not Seasonally Adjusted | Unemployment Rate (%) September 2017 |

|---|---|

| California | 4.7 |

| Bay Area | 3.4 |

| Orange County | 3.6 |

| Central Coast | 4.5 |

| Sacramento Region | 4.5 |

| Central Sierra | 4.6 |

| Los Angeles | 4.8 |

| San Diego/Imperial | 4.9 |

| Inland Empire | 5.4 |

| Upstate California | 5.4 |

| Central Valley | 7.6 |

By Legislative District:

| Lowest 10 Unemployment Rates | |||||

|---|---|---|---|---|---|

| CD18 (Eshoo-D) | 2.6 | SD13 (Hill-D) | 2.6 | AD16 (Baker-R) | 2.4 |

| CD12 (Pelosi-D) | 2.8 | SD11 (Wiener-D) | 3.0 | AD22 (Mullin-D) | 2.5 |

| CD52 (Peters-D) | 2.9 | SD39 (Atkins-D) | 3.2 | AD24 (Berman-D) | 2.7 |

| CD45 (Walters-R) | 3.0 | SD37 (Moorlach-R) | 3.2 | AD28 (Low-D) | 2.7 |

| CD14 (Speier-D) | 3.0 | SD36 (Bates-R) | 3.3 | AD77 (Maienschein-R) | 2.9 |

| CD17 (Khanna-D) | 3.1 | SD07 (Glazer-D) | 3.5 | AD17 (Chiu-D) | 2.9 |

| CD49 (Issa-R) | 3.3 | SD15 (Beall-D) | 3.5 | AD19 (Ting-D) | 3.0 |

| CD15 (Swalwell-D) | 3.3 | SD10 (Wieckowski-D) | 3.5 | AD78 (Gloria-D) | 3.1 |

| CD02 (Huffman-D) | 3.3 | SD02 (McGuire-D) | 3.5 | AD73 (Brough-R) | 3.1 |

| CD33 (Lieu-D) | 3.5 | SD26 (Allen-D) | 3.6 | AD25 (Chu-D) | 3.1 |

| Highest 10 Unemployment Rates | |||||

|---|---|---|---|---|---|

| CD36 (Ruiz-D) | 6.1 | SD24 (de León-D) | 5.6 | AD36 (Lackey-R) | 6.4 |

| CD41 (Takano-D) | 6.1 | SD21 (Wilk-R) | 5.6 | AD34 (Fong-R) | 6.4 |

| CD09 (McNerney-D) | 6.2 | SD30 (Mitchell-D) | 5.7 | AD23 (Patterson-R) | 6.6 |

| CD10 (Denham-R) | 6.2 | SD35 (Bradford-D) | 5.9 | AD64 (Gipson-D) | 6.9 |

| CD44 (Barragán-D) | 6.7 | SD08 (Berryhill-R) | 6.2 | AD13 (Eggman-D) | 7.1 |

| CD23 (McCarthy-R) | 7.1 | SD05 (Galgiani-D) | 6.4 | AD21 (Gray-D) | 7.8 |

| CD22 (Nunes-R) | 7.4 | SD12 (Cannella-R) | 6.6 | AD31 (Arambula-D) | 8.7 |

| CD16 (Costa-D) | 8.1 | SD16 (Fuller-R) | 6.9 | AD26 (Mathis-R) | 9.3 |

| CD21 (Valadao-R) | 9.3 | SD40 (Hueso-D) | 8.8 | AD32 (Salas-D) | 9.7 |

| CD51 (Vargas-D) | 10.4 | SD14 (Vidak-R) | 10.2 | AD56 (Garcia-D) | 12.3 |

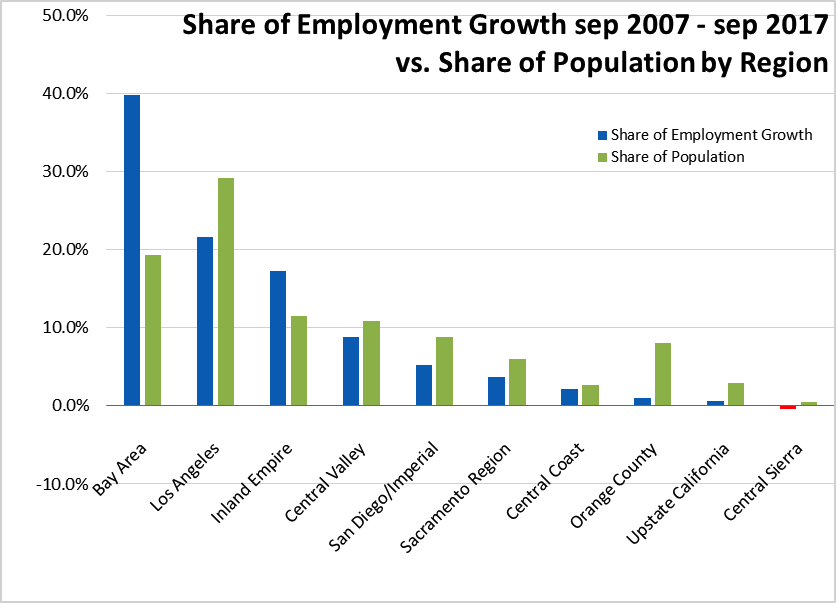

Bay Area Provided 40% of Net Employment Growth Since Recession

Containing just under 20% of the state’s population, the Bay Area was responsible for 39.8% of the net growth in employment since the pre-recession peaks in 2007. Los Angeles Region provided the next largest share at 21.7%, but spread over 29.2% of the population. Inland Empire is the only other region continuing to show employment gains above their population share.

Eight California MSAs in the 10 Worst Unemployment Rates Nationally

According to BLS data, of the 10 Metropolitan Statistical Areas (MSAs) with the worst unemployment rates nationally, 8 are in California. Of the 20 worst, 10 are in California.

| US Rank | MSA | August 2017 Unemployment Rate |

|---|---|---|

| 369 | Weirton-Steubenville, WV-OH Metropolitan Statistical Area | 6.7 |

| 370 | Cleveland-Elyria, OH Metropolitan Statistical Area | 6.8 |

| 370 | Las Cruces, NM Metropolitan Statistical Area | 6.8 |

| 372 | Danville, IL Metropolitan Statistical Area | 6.9 |

| 373 | Vineland-Bridgeton, NJ Metropolitan Statistical Area | 7.1 |

| 374 | Beaumont-Port Arthur, TX Metropolitan Statistical Area | 7.2 |

| 375 | Brownsville-Harlingen, TX Metropolitan Statistical Area | 7.3 |

| 376 | Modesto, CA Metropolitan Statistical Area | 7.5 |

| 376 | Stockton-Lodi, CA Metropolitan Statistical Area | 7.5 |

| 378 | Farmington, NM Metropolitan Statistical Area | 7.7 |

| 378 | Yuba City, CA Metropolitan Statistical Area | 7.7 |

| 380 | Madera, CA Metropolitan Statistical Area | 7.8 |

| 381 | McAllen-Edinburg-Mission, TX Metropolitan Statistical Area | 8.0 |

| 382 | Hanford-Corcoran, CA Metropolitan Statistical Area | 8.5 |

| 383 | Fresno, CA Metropolitan Statistical Area | 8.6 |

| 384 | Merced, CA Metropolitan Statistical Area | 9.1 |

| 385 | Bakersfield, CA Metropolitan Statistical Area | 9.4 |

| 386 | Visalia-Porterville, CA Metropolitan Statistical Area | 10.6 |

| 387 | Yuma, AZ Metropolitan Statistical Area | 23.7 |

| 388 | El Centro, CA Metropolitan Statistical Area | 24.9 |

Note: All data sources, methodologies, and historical data series available at CenterforJobs.org.