CaliFormers: Billionaire Edition

The proposed Billionaire Wealth Tax has been criticized in many quarters, including by the governor, for its potential to encourage the targeted taxpayers and their companies to move to other states. Both personally (including through philantrophic activity) and through their companies, this group is part of the very limited portion of the taxpayer base supporting the state budget revenues and more importantly the critical factor in whether the budget is in deficit or surplus in any given year.

In the most recent FTB data for 2021, only 8,519 taxpayers (AGI of $10 million or more) paid nearly a quarter of all Personal Income Tax (PIT), equivalent to about a seventh of all general fund revenues. Most of these taxpayers are also key drivers in the health of the state’s tech industry, which, as discussed in our prior reports, is the next most important contributor of tax revenues and the dominant component of the state’s GDP growth.

Given the outsized importance these Califormers will have on the state economy, job growth, and tax revenue, the Center will continue to provide data insights on future movements by this cohort and the subsequent impact these relocations have on estimated tax revenue and corresponding impact on the state programs and services. As part of this effort, we are adding the Billionaire Edition to our CaliFormers series, tracking billionaires who have moved from the state

As with our regular series, information is developed from publicly available sources, including web and newspaper searches. Additional movers were identified by comparing the most recent Forbes 400 list with the same list from 2019. This approach consequently does not identify all billionaires who have moved as many of them likely have done so without fanfare, especially recently. The Forbes 400 list also only covers the 400 richest; by comparison, their Real-Time Billionaire list identifies more than twice as many at a total of 949 in the US. As indicated, less information is available for those identified through the Forbes data. All wealth information is from the Forbes Real-Time Billionaire list accessed in early January to approximate the tax base under the proposed tax.

The results are shown in the table below, indicating billionaires do in fact leave the state and given that the most recent ones along with their companies did so largely in December, are able to do so quickly and decisively. Note that Larry Ellison is included in this list although press reports from prior years suggest he may have moved his legal residence previously. However, Ellison is shown as living in California in the current Forbes 400 list, and while the sale of his San Francisco home is not conclusive proof he has changed his residency, most press reports reached this conclusion.

The list raises several points:

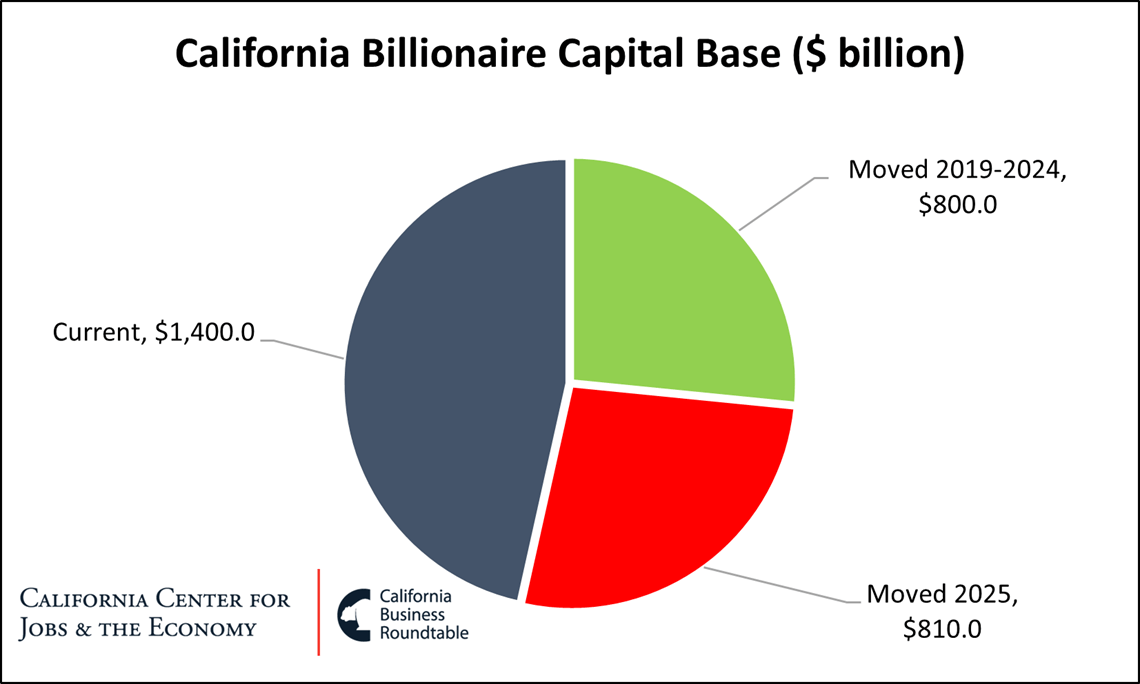

- Prior to December, billionaires with a net worth of at least $797 billion moved from the state since 2019.

- Prior to the end of 2025 and including Larry Ellison, billionaires with a net worth of at least an additional $813 billion left the state as well.

- This capital leakage is equivalent to about 40% of the taxable base identified by the supporters of the wealth tax.

- Using the proposed wealth tax rates, this capital leakage reduces the measure’s potential revenues by at least $41 billion, or about 40% of the potential tax windfall identified by the supporters of the wealth tax. As with the state’s overall revenue structure, the tax base targeted by the proposed wealth tax is highly stratified, with the potential revenues highly sensitive to the location decisions of a relatively few potential taxpayers.

Data sourced from Forbes.com

Sign up for our monthly data series to ensure you receive future reports on this issue.