Overview

The Ports of Long Beach (POLB) and Los Angeles (POLA) are the core of the largest trade complex in North America. More than 3 million jobs nationwide are supported by the two ports and nearly 230,000 jobs in the region. Direct, indirect, and induced effects from activities at the ports supported $2.78 billion in state and local taxes in 2022, plus an additional $4.73 billion in federal taxes. The ports are the base of the region’s overall Trade Cluster, which in 2022 generated more economic output than the State of Utah. Beyond this direct impact, the ports also provide additional payments to their respective cities and support various community reinvestment programs. This report quantifies the importance of the ports to the economy and the millions who rely on the ports for well-paying jobs.

The Ports of Long Beach and Los Angeles are indispensable assets that deliver extensive economic benefits, fostering job creation, income generation, and overall economic vitality. Their continued success is essential not just for the prosperity of Southern California but for maintaining the United States’ position in the global trade network. The ports’ activities bolster the wider Trade Cluster, enriching the economic fabric of the region by supporting a vast array of businesses and providing a steady stream of middle-class wage jobs, particularly for those with minimal formal education. This, in turn, has played a critical role in uplifting the socio-economic position of diverse communities within the region. Additionally, the ports’ commitment to community investment and environmental initiatives showcases a sustainable approach to economic development, aligning with broader goals of prosperity and well-being.

Table of Contents

- About This Report

- Key Jobs and Economic Findings

- The Ports Are an Economic Powerhouse

- Factors Affecting the Ports' Competitiveness

- Key Competitiveness Factors

- Closer Look: Energy Costs

- Closer Look: Cargo Theft

- Impacts of Reduced Market Share

- Closer Look: Lost Tax Revenue

- About the Center for Jobs

About This Report

This report is part of a continuing series by the Center looking at key components of the California economy and how they are being shaped—for good and bad—by state and local policies. As assessed in previous analyses by Los Angeles Economic Development corporation (LAEDC), Trade is the largest industry cluster in both Los Angeles County (LAEDC 2020) and Southern California (LAEDC 2017). The Ports of Long Beach and Los Angeles (Ports) are at the base of this cluster, but overall activity through this trade complex risks being affected under pending regulations from South Coast Air Quality Management District (SCAQMD) through its indirect source regulations for the ports (Ports ISR).

The report is being completed in two parts. Part 1 provides an overview of the economic contributions made by the Ports and the overall Trade cluster in Southern California, including a review of previous economic studies, details on the Trade workforce, and an updated assessment of the baseline economic and fiscal impacts using more current 2022 data. Part 2 will then assess the effects of the SCAQMD draft rule once it is released.

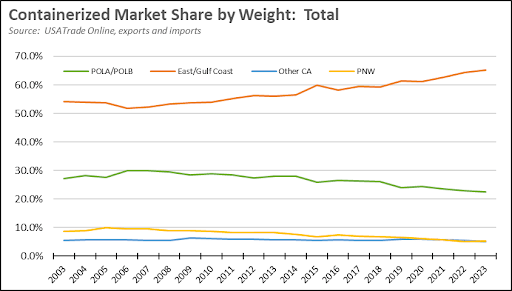

However, shifting markets, the impact of state and regional policy decisions (especially the rising cost of electricity), the ongoing threat of cargo theft, and other factors, have greatly affected traffic through the ports, leading to lost job and tax revenue to cities, other local agencies, the state, and nation. The ports’ market share for containerized cargo peaked in 2006-07 at 29.9 percent of total U.S. trade. As a result of the factors listed above, U.S. market share was down to 22.9 percent in 2022.

Key Jobs and Economic Findings

- One out of every 51 jobs nationwide is supported by the Ports of Long Beach and Los Angeles.

- The regional Trade Cluster supported 1.85 million jobs and accounted for 15.9 percent of all regional jobs.

- The Southern California Trade Cluster produced $47.81 billion in state and local tax revenue in 2022.

- The Trade Cluster is the second-largest source of jobs for Latinos in the region, and a significant source of middle-class wage jobs for lower-skilled workers (2/3 of jobs in this cluster only require a high school diploma or less).

- 41.5 percent of Trade workers in 2022 were immigrants (naturalized and noncitizen), compared to an overall average of 34.6 percent in the region.

- Trade jobs have helped lead to an uptick in the share of middle-class households in the region, following decades of decline.

The Ports Are an Economic Powerhouse

Trade has become an increasingly important component of the US economy. In 2022 (World Trade Organization, 2023) excluding intra-EU trade, the US was the third largest exporter ranked by the value of merchandise trade ($2.065 trillion compared to China at $3.594 trillion and extra-EU exports at $2.704 trillion) and the largest importer ($3.395 trillion compared to extra-EU at $3.155 trillion and China at $2.714 trillion). On this basis, the US accounted for 10.1% of global merchandise exports and 15.8% of merchandise imports. Although the projections were prepared prior to the current weakness shown in the China and EU economies and challenges to Suez Canal trade routes, WTO expected global trade to grow 1.7% in 2023 and recover to 3.2% in 2024, compared to an overall average of 2.6% in the 12 years following the Great Recession.

The nation’s ports are critical infrastructure supporting this growing share of the economy. In 2021, waterborne vessels were the leading trade transport mode in the US, accounting for 41.1% of total trade by value (US Department of Transportation, 2023). The remainder was carried by air and by rail and truck from Canada and Mexico.

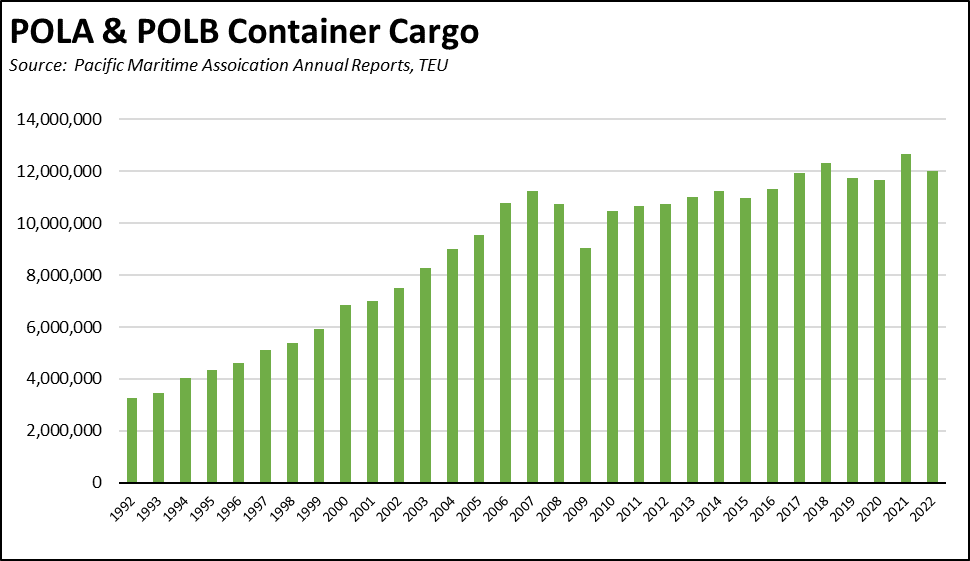

Ranked by total TEU throughput, combined activity at POLA and POLB placed them as the largest container port complex in North American and the 9th largest worldwide in 2022. Total traffic through the two ports was 19.045 million TEU in 2022 and 16.648 million TEU in 2023. Activity at the next 4 largest US ports in 2022: New York-New Jersey with 9.494 million TEU, Savannah with 5.892 million, Houston with 3.975 million, and Virginia at 3.718 million.

The number of TEUs handled by the two Ports rose rapidly from 1992 through 2007, at an average annual rate of 8.6%, as trade with China expanded combined with the rapid shift to container mode. Using numbers from the Ports, total loaded TEUs at 10.8 million were down 9.4% in 2023—and total TEUs (loaded and unloaded) at 16.6 million in 2023 down 12.6%—outpacing the overall drop in global trade activity.

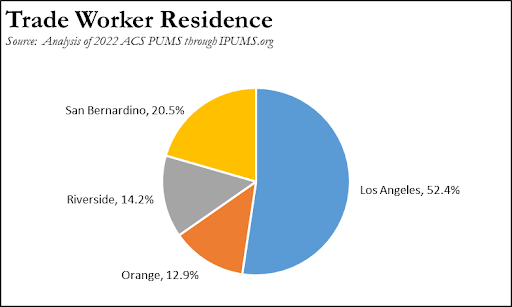

In 2022, just over half of workers with a primary job in Trade lived in Los Angeles County. San Bernardino County was the second highest with one-fifth of all Trade workers in the region.

By Ethnicity & Race, Trade is a relatively larger source of jobs for Latinos, at 46.7% of Trade jobs compared to 41.7% of all private jobs in Southern California in 2022. Non Latino Whites had a much lower share (28.7% of Trade jobs vs. 34.3% of total jobs), while the other categories show much smaller differences.

Factors Affecting the Ports' Competitiveness

The Ports became the dominant conduit for Pacific Rim trade as the result of leveraging their advantages as the first port of landing, under which cargo owners consider not only the time and cost of moving goods across oceans but also how quickly goods can be moved to/from land transportation nodes and their ultimate markets and production centers. Continued investments in the port facilities have kept them competitive as vessel sizes have grown larger. An extensive transportation, warehouse, and support industry network facilitates movement of goods to and from the Ports. Two Class 1 railroads provide competitive rail service to the interior US markets. The Clean Air Action Plan maps the investments required to maintain this economic activity while contributing to the region’s environmental goals and minimizing the shift—rather than a reduction—of the associated emissions to other ports and regions not having to face the same standards and costs of attaining them. As a result, under normal operating conditions, goods can be moved more quickly from East Asian originations to their final destinations using POLA and POLB rather than the East and Gulf Coast ports.

Interacting with these geographic and infrastructure advantages are a number of factors affecting market share and consequently jobs within the region related to the Ports. Many of these factors are reflected in the higher costs of shipping through POLA and POLB which in a rising number of instances have offset the time advantages they offer.

Key Competitiveness Factors

All ports are in competition for discretionary intermodal cargo moving beyond the coasts into the interior markets in US and Canada. This component makes up about 33% of all cargo handled by POLA and can be affected by factors such as capacity of rail routes and the competing water routes.

- Regulatory costs. According to a POLA analysis: “Paying for mandated air pollution reduction infrastructure, equipment and other measures may become a significant portion of the Port’s capital budget and operating budget.”

- Limited expansion options. The ability of POLA and POLB to compete for increased market share is constrained by relatively more limited space for expansion at the Ports, more costly and lengthy regulatory approvals, and increasing opposition to new warehouses in the region coming from the state and local sources.

- Canada. The Canadian Pacific Coast ports are also a source of competition due to the fact they are closer in sailing time to the Asian ports, have a shorter rail time to Chicago and other Midwest markets, have lower vessel and container charges due to the fact that they do not charge the Harbor Maintenance Tax applied in all US ports and avoid the Alameda Corridor Transportation Authority transit fee applied at POLA and POLB, and have invested in capacity expansion in recent years.

- Supply chain capacity. The Ports’ competitive edge comes from not only their ability to handle cargo efficiently at water’s edge but also through efficient movement of those goods to and from the point of final use and production. The congestion experienced through mid-2022 spotlighted capacity limits throughout the supply chain, including container storage yards, warehouses, and both truck and rail links.

- Shifts in manufacturing. As discussed in this report, even at reduced levels Southern California retains a significant manufacturing base that relies on the Ports both for access to export markets and as a conduit for required parts, components, and materials. Nationally, however, this trade is shifting to the East and Gulf coasts. Between the low in 2010 and 2022, US Bureau of Labor Statistics data shows that 38% of manufacturing jobs expansion in the US was in 7 Southeastern states, and this trend will accelerate as the electric vehicle and battery plants now under construction move to full operation and as their supply and support networks relocate to this region. Parts, component, and material freight routes will also follow this shift.

- Regulatory uncertainty. Intermodal supply chain components are capital-intensive operations involving long-term investments and leases. Uncertainty in the regulatory environment throughout the supply chain has effects on the costs of operation and has the potential to dampen overall investments in Southern California across all supply chain sectors, ironically reducing investments in the infrastructure necessary to facilitate environmental improvements and higher deployment levels of zero emission equipment. The net result is to shift these investments away from Southern California and to more certain investment environments in other states, moving capital spending more to other regions and affecting the overall competitiveness that leads shippers to consider other port options.

Closer Look: Energy Costs

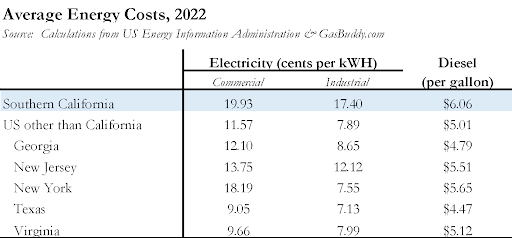

State and local energy policies have produced the highest or near the highest energy prices among the states. The Average estimated commercial electricity rate in the region in 2022 was 72% higher than the average for all states other than California. The estimated average industrial rate in the region was 121% higher. The table below shows energy costs in the region compared to the state with the other top 5 ports.

Closer Look: Cargo Theft

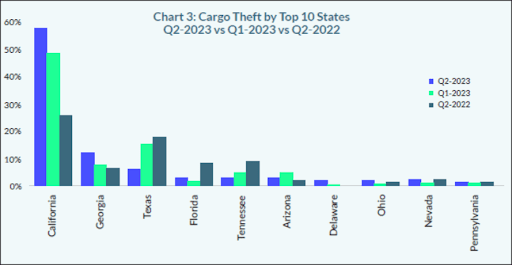

Cargo theft has become an increasing risk. Nationally, the number of reported incidents nearly doubled between 2019 and 2023. In one accounting, California experienced 58% of the nation’s cargo theft volume in the second quarter of 2023, compared to 49% during the same period in 2022. The primary California targets were electronics (44% of total), clothing and shoes (10%), and home and garden (10%).

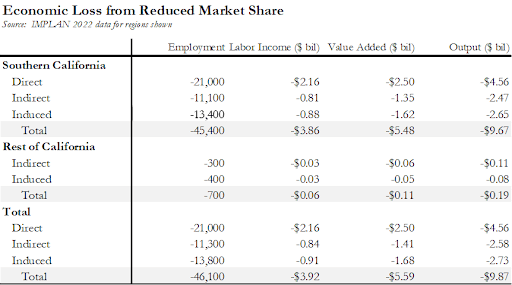

Closer Look: Lost Tax Revenue

The associated state and local tax loss is $560.9 million to the state and local governments in Southern California. Cumulative losses to state and local governments since 2006 are an estimated $4.5 billion. The associated federal tax revenue loss is $935 million in 2022, or an estimated cumulative loss of $7.5 billion since 2006.

About the Center for Jobs

The Center for Jobs provides an objective and definitive source of information pertaining to job creation and economic trends in the United States. The Center is a 501(c)(3) public benefit corporation with governance consisting of a board of directors, board of governors and a research advisory council. Learn more at www.centerforjobs.org.