The US Bureau of Economic Analysis recent release of a new series tracking the economic contributions of R&D activities in each of the states provides a timely data base to evaluate proposals in the May Revise related to business tax credits.

The governor proposes to severely cut back on allowable use of a range of tax credits to no more than $5 million per business in 2025-27. The largest credit that would be affected by this tax increase is the R&D credit, which Department of Finance estimates at $3.15 billion in 2024-25 (Corporation and Personal Income Tax credits). As a public policy tool, the theory behind tax credits recognizes that the less something is taxed, the more it will be produced in the economy, and credits are consequently applied to those economic activities the state seeks to encourage including low income housing, retaining film production within the state, and at least until this proposal, expansion of California’s technological lead across many industries. Not as easy to grasp, apparently, is the opposite effect, that as taxes rise on an activity, there will be less of it moving forward.

California Now Leads the Nation in R&D

The new data provides details on R&D activity within each state, including value added (contribution to state GDP), jobs, and total compensation (wages, salaries, and benefits). Limited disaggregation by industry is also available, with the most detail provided for the value added data.

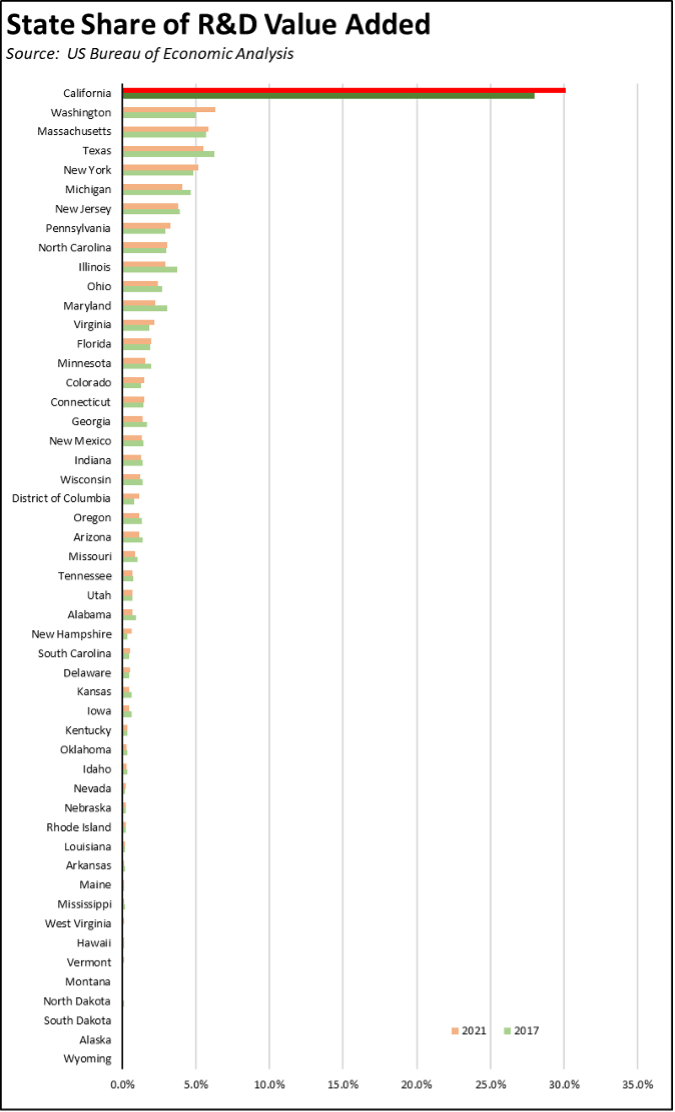

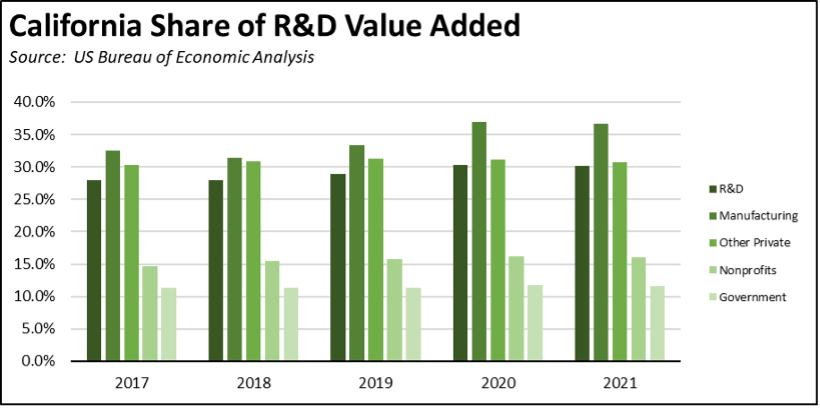

Measured by value added, California has been by far the leading center of R&D activity in the US, accounting for 28.0% of the US total in 2017 and increasing to 30.1% in the most recent data for 2021. Overall, R&D also tends to be highly concentrated among the states, with the top 10 accounting for 67.9% of the total in 2017 and increasing to 70.0% in 2021.

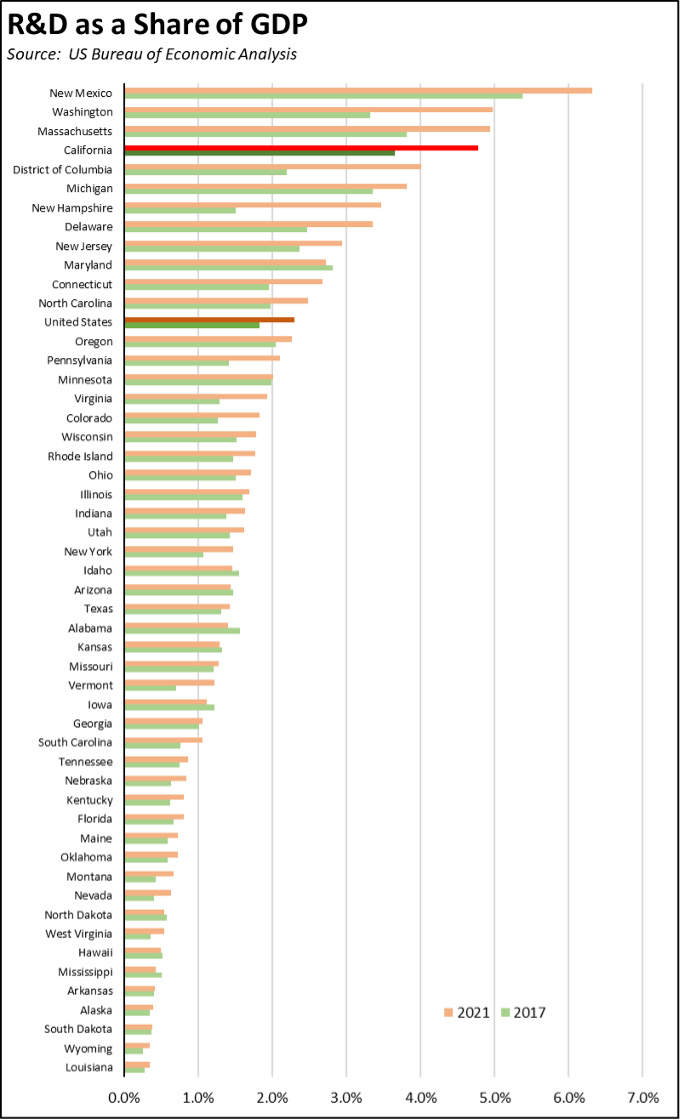

Measured by share of GDP, California ranked 4th in 2021, with R&D value added accounting for 4.8% of total state GDP.

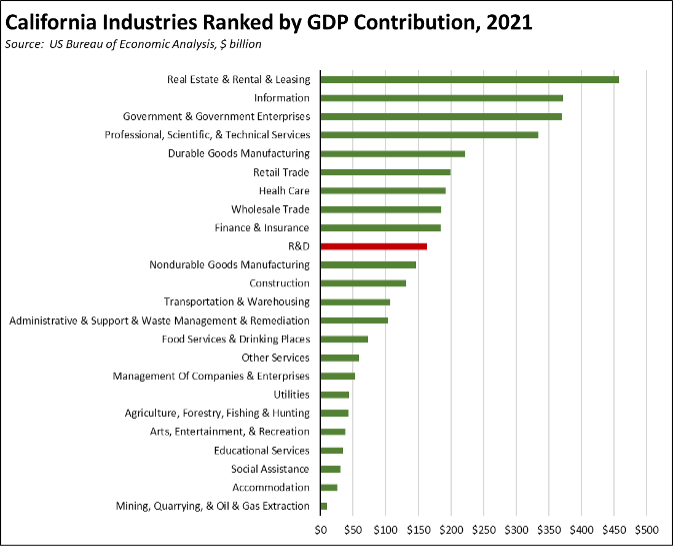

At this level and treating it as a separate industry, R&D would have ranked as California’s 10th largest industry in 2021.

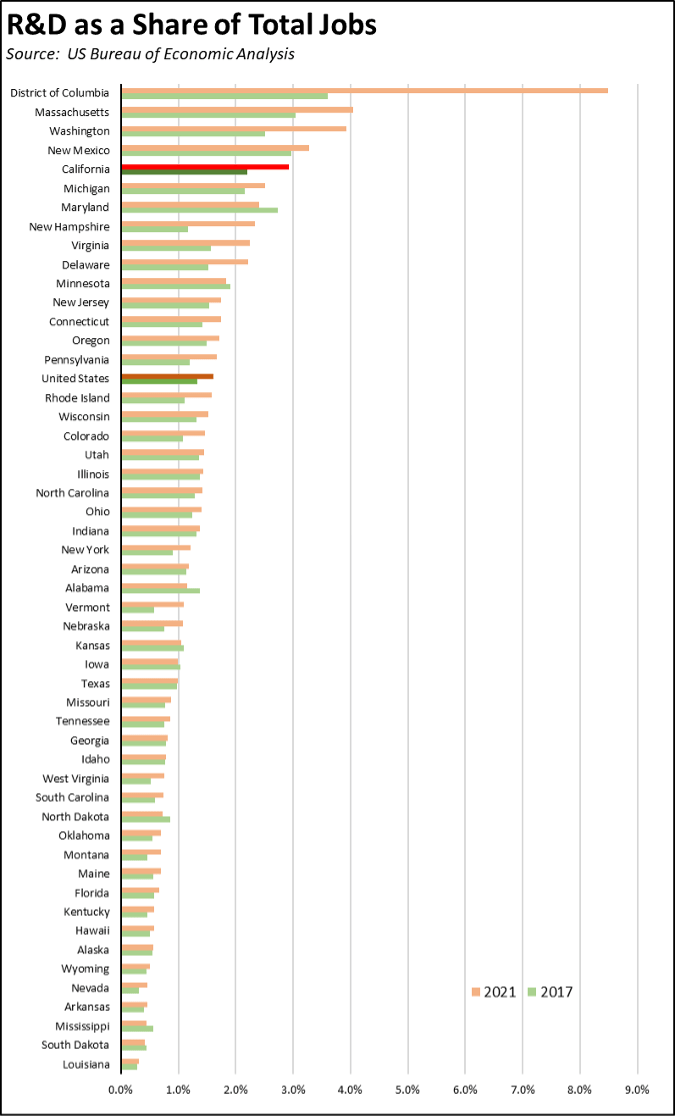

Ranked by share of state jobs coming from R&D, California was 5th in 2021, with R&D accounting for 2.9% of total state jobs, up from 2.2% in 2017.

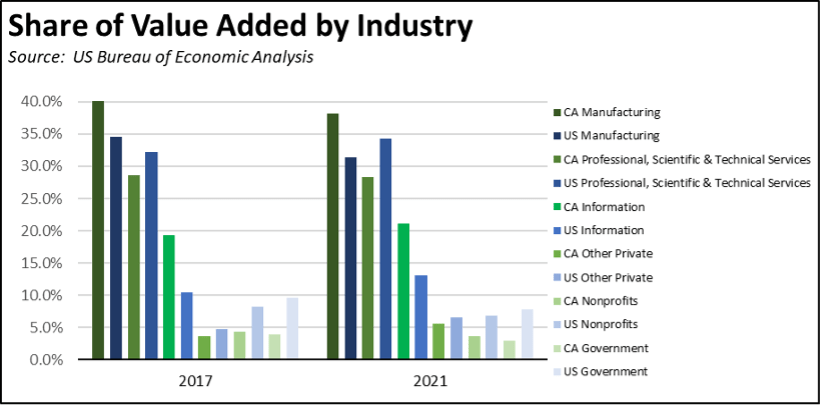

Manufacturing is the Leading Source of R&D Activity in California

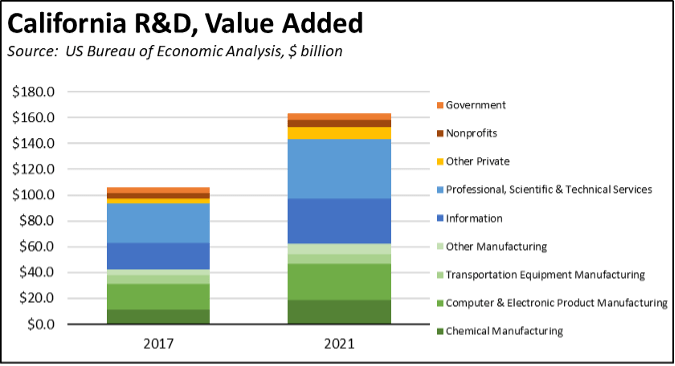

While California’s technological assets are generally associated with the High Tech industry, manufacturing is actually the largest source of R&D activity in the state. In contrast, Professional, Scientific & Technical Services is the leading source when looking at the US as a whole. In 2021, manufacturing accounted for 38.2% of R&D by value added in California. Professional, Scientific & Technical Services was 2nd at 28.3% and Information at 3rd with 21.2%. Although not shown separately in the following chart but included in the various categories, the state’s universities and colleges that are at the base of much of this activity combined only accounted for 4.6% of the California total. The vast majority—93.4%—instead comes from private industry investments.

Considered by share of total US R&D value added by industry, manufacturing also leads in the state. In 2021, 36.6% of all US manufacturing R&D by value added was in California. The relative shares coming from nonprofits (including private colleges and universities) and government were more in line with the state’s overall GDP share, while R&D in the other private businesses accounted for 30.7% of the US total.

The value added contributions coming from the different components of manufacturing vary. Computer & Electronic Product Manufacturing was the largest source at $27.9 billion in 2021, followed by the more traditional chemical manufacturing at $18.6 billion. In spite of the state’s focus on zero emission technology, Transportation Equipment Manufacturing accounted for only $7.5 billion, largely unchanged from 2017. This outcome reflects the situation under which the state’s policies gave lip service to the concept of promoting electric vehicle and battery manufacturing in the state as a strategy for jobs development, but in practice did little to act on it. As a result, California enacted the policies, but the jobs have been moving primarily to the southeastern states.

Overall, total R&D value added in California grew at an average annual rate of 11.5%, going from $105.8 billion in 2017 to $163.4 billion in 2021. In the same period, total US R&D value added grew at an average annual rate of 9.5%.

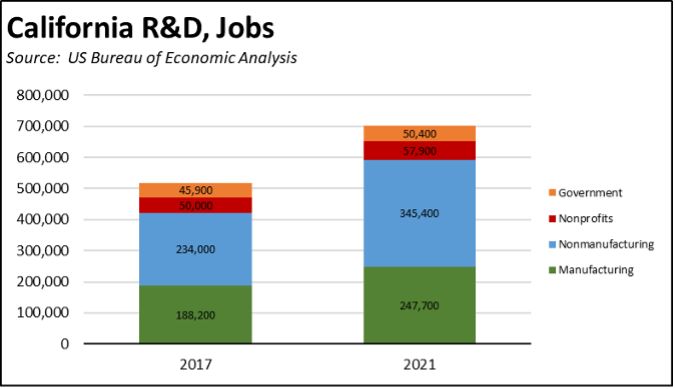

The associated jobs follow the same pattern, with the highest concentration of R&D jobs being in manufacturing as well.

Overall, R&D jobs have grown at an average annual rate of 7.9%, going from 518,100 in 2017 to 701,200 in 2021. Total US R&D jobs grew at an average annual rate of 5.7% in this period.

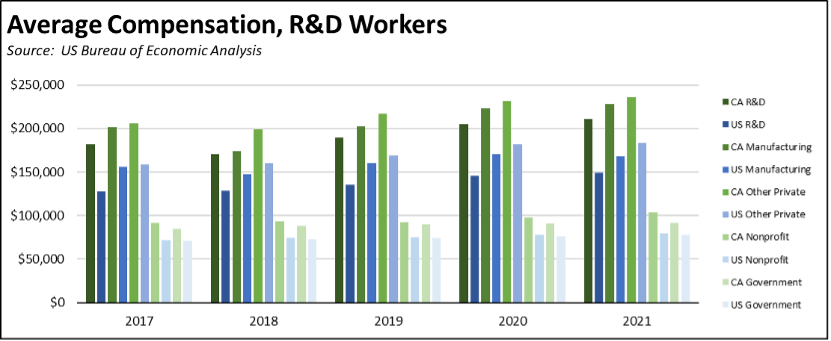

Pay for California R&D workers is substantially higher than the overall US averages. In 2021, average compensation for R&D workers in California was 41.8% higher at $211,400. Average compensation for manufacturing R&D workers was 35.5% higher at $228,300. The average for all other private R&D workers was somewhat higher at $235,900, 28.4% more than the US average. Nonprofit and government compensation was about 40% of these levels and showed smaller differences with the US averages.

California’s Manufacturing

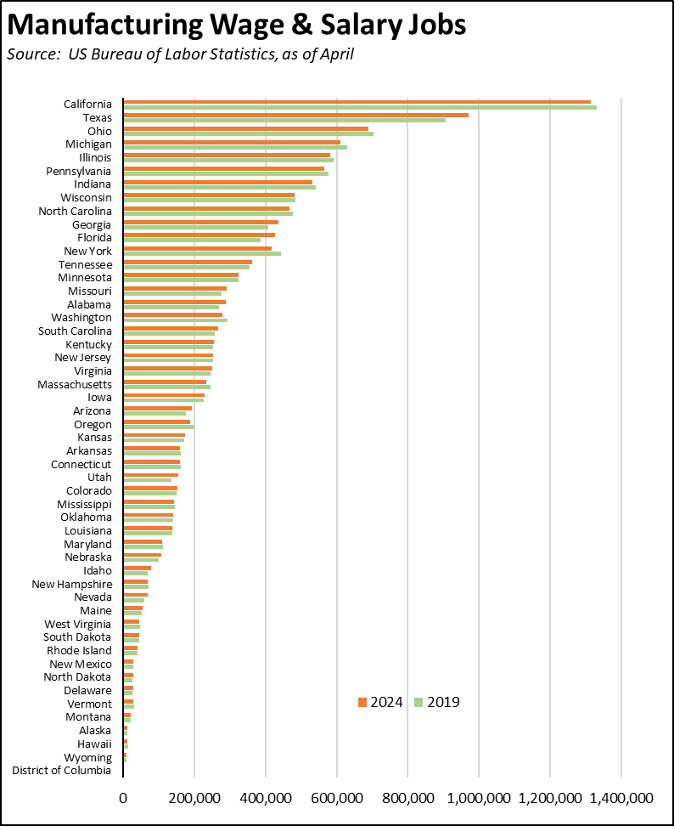

Even after losing 532,000 manufacturing wage and salary jobs since 2000, California retains the largest manufacturing base among the states, posting 35.5% more wage and salary jobs than second ranked Texas in the latest results from April. California’s ranking in the R&D data relies in large part on the size of this base. Conversely, retaining that base has relied in part on state policies that at least to date have promoted the R&D investments required to improve efficiency and products even in the face of rapidly escalating costs of doing business in the state.

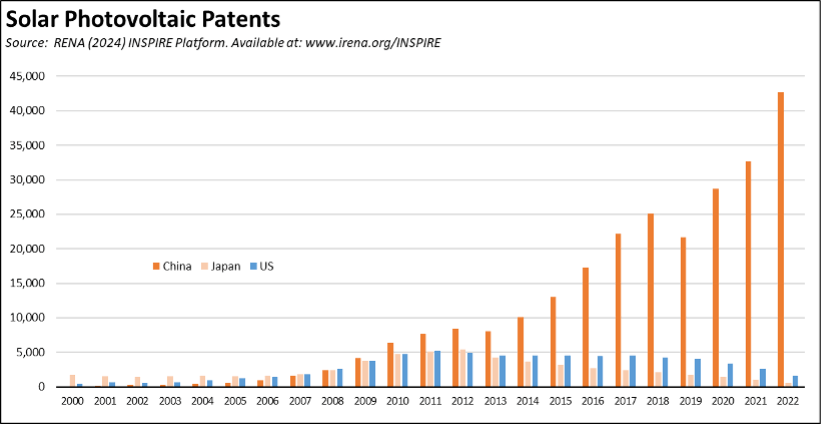

This relationship is illustrated by the trend in solar panel manufacturing. In 2009, US Energy Information Administration data shows the domestic solar panel industry hitting peak production and accounting for 63% of shipments in the US that year. In 2022, imports instead provided 85% of shipments, largely sourced from China.

Patent data compiled by International Renewable Energy Agency can be used as a proxy to illustrate the R&D side of this story. The foundation for current solar panel technology largely stems from a patent developed at Bell Laboratories in the US in the 1950s. In 2009, solar photovoltaic patents filed showed little difference between the US and China, and US patents had begun exceeding those filed in Japan as federal and state incentives sought to promote a domestic production base to offset what was then the primary competition coming from Japan. As the industry instead began to shift to China, so did R&D activities and related patent filings, dramatically so as the number of Chinese patents grew from 4,149 in 2009 to more than 10 times as many in 2022.

This pattern has had a number of effects. The upsurge in R&D has enabled China to cement its position both as the low-cost producer and as the technology leader. The availability of the production base in turn facilitates the expansion of this R&D by giving engineers ready access to production lines to test out new ideas and processes and develop incremental technology improvements, rather than the bench-tests and pilot projects many researchers in other countries must rely on. Finally, the broad array of state and federal incentives originally intended to promote a domestic panel base, instead produced the current pattern of both production and R&D activities centered in China.