Download Data by Legislative District

Summary

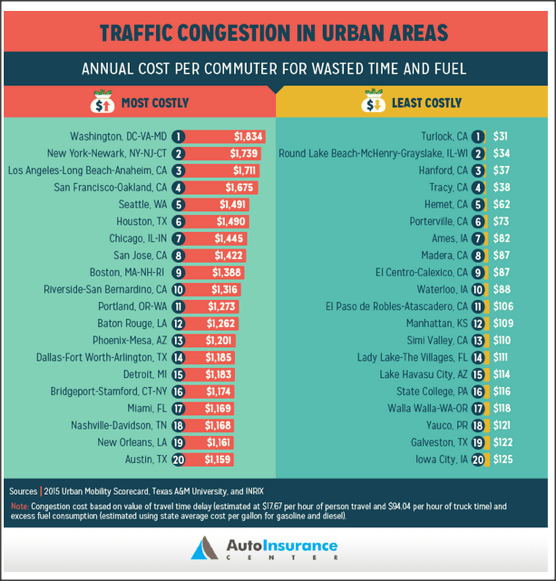

- This report analyzes the potential effects from recently adopted and currently proposed regulations having significant effects on the cost of new housing in California. Specifically, these regulations considered include proposals that would require all housing in California to be built while paying workers at prevailing wage levels along with Zero Net Energy requirements, increasing local requirements for affordable units, and offsets, VMT reduction, and other measures related to the state’s climate change policies. The analysis considers the effects on housing prices and rents, California employment and income, and related issues where increased housing prices will affect housing affordability, poverty, homelessness, overcrowding, and related issues in the state. The prevailing wage analysis is used to develop the core data and analytical base, while consideration of the other regulations draws from related studies.

- Drawing from a series of public, academic, and construction industry sources and based on 2016 data, requiring builders to pay government-determined prevailing wage rates would raise the median price of a new home by $42,900 to $79,000, the price of a unit in a new multi-family development by $47,000 to $86,500, and the monthly rent for those units by $250 to $460.

- In the mid-point estimate, new homes would increase $63,600 to a total of $553,500, units in multi-family developments $69,600 to $589,600, and monthly rents by $370. For comparison, US Census data shows the 2016 median new home price nationally (all units) was $315,500.

- To afford just this cost increase alone, a household would need another $15,700 in annual income to qualify for a single family home, $17,200 more for buying the median multi-family unit, and $15,800 more for renting the median multi-family unit.

- Over time, this factor alone would push housing prices up overall by about 13% primarily in inland regions, but much higher in coastal areas with significant historical building shortfalls.

- Increasing costs at this level are likely to bring currently approved developments to a halt due to project economics, reducing the level of new housing being built in California from its current level of about 100,000 units a year to only minimal residual construction of affordable units that are financed from public funds.

- Existing regulatory and cost barriers have kept new housing construction below levels required to keep up with population growth in all but 3 of the past 27 years. These additional steep cuts in building activity will add to the growing supply deficit that has raised housing costs for all Californians.

- Prevailing wage is not the only regulatory cost driver already approved or proposed within the same time frame: Zero Net Energy, local affordable housing set-aside mandates, VMT reduction and other measures under the CARB Scoping Plan and SB 375 Sustainable Communities Strategies, offsets and other climate change mitigation through CEQA, and other regulatory cost drivers on construction equipment, materials, and fuels.

- Combined with prevailing wage, these regulations would produce a price increase over the 2016 median price of new homes by well over $197,000 just for the first three components where cost estimates are available. This amount is larger than the 2016 average median home value in 29 states, according to Zillow Data, including Texas, Florida, Pennsylvania, Illinois, and Ohio. The required down payment on a median price new home incorporating these costs would be larger than the entire average median home value in 15 states.

- Combining both direct and indirect effects, the annual drop in home construction would produce a loss of $20.9 billion to total state incomes, 372,700 fewer jobs, and a $34.2 billion reduction in total California GDP.

- From the direct effects alone, the annual drop in home construction would result in a $15.5 billion loss to state and local revenues. The impact to state revenues would be $2.6 billion of this amount, but cuts in property taxes would produce further pressure on the General Fund by reducing the amount of locally available Prop. 98 funding for K-14 schools.

- Under the Supplemental Poverty Measure incorporating housing cost effects, California has the highest poverty level among the states, measured both by poverty rate and the number living in poverty. The estimated price increases would raise state poverty by another 481,000 persons.

- In 2015, California’s home-ownership rate was lower than every other state but New York. As housing affordability drops in response to prevailing wage effects on prices, even more California households will be unable to become homeowners. This effect will likely be more significant in the traditional regions of high ownership in the interior such as the Inland Empire and Central Valley, where sharply higher prevailing wage cost increases combined with generally lower income levels would produce some of the strongest impacts on overall affordability.

- California in 2015 had the second highest overcrowding rate among the states, at 8.4% of households compared to 3.4% for the national average. New cost measures such as prevailing wage would reduce new supply additions, and produce subsequent increases in the overcrowding rate as a growing population is limited by an essentially static supply.

- In 2015, 52.9% of all California renter households were cost-burdened, a level that would increase to an estimated 61.9% as a result of price increases from a prevailing wage requirement.

- California construction employment remains 17% below the peak levels in 2006, while Residential Building Construction employment is nearly a third below. Rather than raising mandated wage levels that would benefit only the few remaining workers on the residual amounts of publically-funded affordable housing, regulatory and other reforms that reduced the costs of and barriers to housing construction would have far wider income benefits. Just returning to the 2006 building levels, total annual wages paid to current Residential Building Construction workers would rise by an estimated $0.7 billion, and annual wages from increased jobs in this industry would add another $2.4 billion a year, for a total of $3.1 billion. Other building trades required for housing construction would see higher incomes and jobs as well.

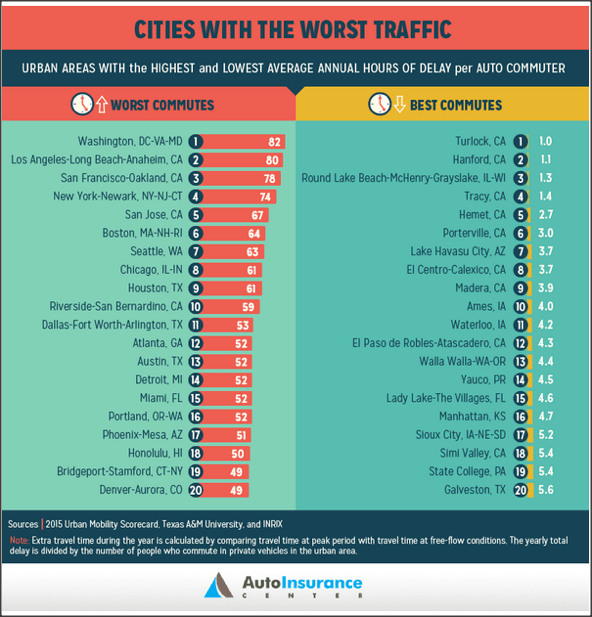

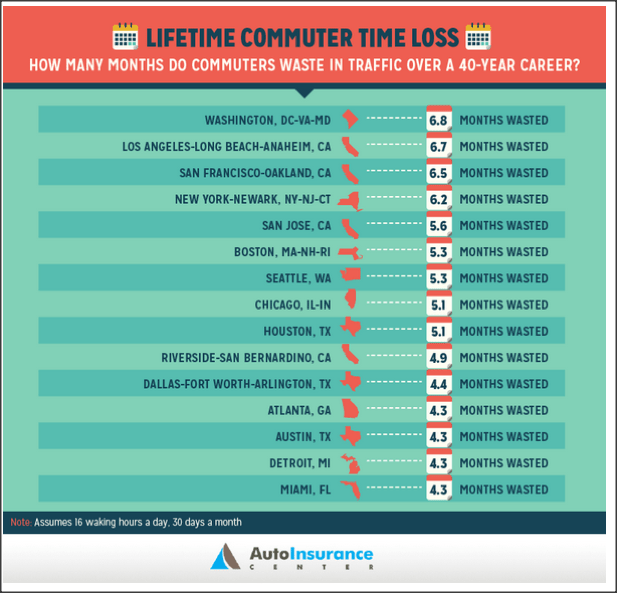

- California’s current high housing costs have resulted in longer commutes as Californians seek housing they can afford in outlying areas. Previous analyses by LAO found that a 10% increase in a metro area’s rental costs produced a 4.5% in commuting times.

- In 2015, 7.4 million Californians spent 30 minutes or more (one way) on their daily commutes, up from 6.1 million in 2005. Those spending an hour or more was 2.1 million in 2015, up from 1.6 million in 2005. As price increases from a prevailing wage requirement sharply slow new supply additions, the resulting price effect on existing housing costs will drive lower and moderate income households further away from job centers as they seek housing they can afford.

Introduction

In recent years, a number of studies (e.g., The White House, September 2016; Furman, November 2015; Shoag & Ganons, August 2016; Glaeser & Gyourko, January 2017) have identified the outcome of increasingly stringent land use regulation in limiting housing supply and thereby increasing housing costs particularly in coastal urban areas. Similarly, a number of studies have assessed the significance of these regulations specifically on California’s soaring housing costs (e.g., California Department of Housing & Community Development, January 2017; Legislative Analysts’ Office, March 2015 & March 2017; McKinsey Global Institute, October 2016; Next10, March 2016).

Although analyses have been conducted for specific rules, less work has been done looking at the expanding number of rules that affect the costs of construction directly. This report considers a number of both proposed and recently adopted rules that raise actual costs of construction or that attempt to ameliorate the effects of the state’s current regulatory structures by shifting additional costs such as for affordable housing on the remaining, generally middle class market-rate component.

The analysis first develops a core analytical structure around legislative proposals this session to require use of prevailing wage labor for all residential construction. The cost impacts are then expanded into more cumulative terms using previous work assessing the costs of Zero Net Energy requirements, increasing local requirements for affordable units, and offsets, VMT reduction, and other measures related to the state’s climate change policies. The impacts of these construction cost increases are then considered through their implications to employment, wages and incomes, fiscal effects, poverty, and various housing market measures including costs, supply, and crowding.

This report does not include all regulatory cost drivers in California. Land use regulations including the costs related to CEQA are treated as base conditions. Similarly, the AB 32 and related regulations adopted to date and other regulatory cost drivers—including the recently signed increase in fuel taxes—affecting construction equipment, materials, and fuels are also not explicitly considered. These additional regulatory cost components, whether already incorporated into California’s rising housing and rental prices or awaiting to become fully effective—further intensify the results of the analysis presented below.

Prevailing Wage Costs

Relatively Few Studies of Prevailing Wage Impacts on Housing Costs

There is extensive literature, independent studies, and advocacy reports evaluating the impacts of prevailing wage and comparable measures on construction costs. The vast majority, however, address infrastructure construction such as roads and public facilities due largely to the fact that proposals to expand these requirements to housing are a relatively new phenomenon. The conclusions in these documents are unique to public works projects and have little relevance to proposals related to housing. The methods they use, however, have been applied to analysis of housing as well.

These studies tend to take one of two forms: “modeling” and regression analysis. The modeling approach creates a representative construction budget, and then develops the impact estimates from total cost using market labor rates compared to using prevailing wage rates. The regression studies attempt to isolate other factors affecting construction costs such as geographic location, degree of regulatory costs, financing sources, and general regional price trends in order to estimate the effects of prevailing wage requirements alone.

The modeling-based studies tend to show a larger impact on total costs from prevailing wage (e.g., GAO, 1979). Proponents for prevailing wage tend to criticize these studies as assuming higher costs will occur regardless, and then using the wage differentials only to determine the size of this assumption. Instead, proponents argue (e.g., Mahalia, July 2008) the cost impact should be minor for a number of reasons, including: many public contractors already pay prevailing wage rates, model-based studies ignore improved productivity from higher skill/higher wage workers that can offset higher wages with lower hours worked, and labor costs for public works projects is a small share of overall public works construction budgets, which Mahalia estimates at roughly a quarter of the total cost. Regardless of whether these factors ameliorate the effect of prevailing wage on public infrastructure costs, these mitigating factors do not apply to the residential construction case.

On the other hand, it is also just as likely that many of these modeling studies underestimate the potential impacts. The data used to measure “market rate” wages comes from sources such as Bureau of Labor Statistics and Employment Development Department that rely on surveys that already incorporate a degree of union- and prevailing wage-level wages into the final averages. Far less data is available on wage rates actually paid to non-union vs. union workers that could be used to calculate the full differentials.

Most regression analyses of the issue done by prevailing wage proponents, however, show only minimal or no impact on total costs, although some studies such as Fraundorf (1984) show a more significant impact. For many of these analyses, however, it is unclear what extent the various control variables (e.g., region, regional cost indices, regional regulatory differences) also provide a proxy measure of areas with high incidence of prevailing wage construction, thereby reducing the measured impact of the wage variables.

In recent years, a number of studies have begun looking at housing construction specifically, with most of the work done on the cost effects to affordable housing. These are summarized briefly below along with the model-based study recently done by Beacon Economics on the potential impacts of Los Angeles’ Measure JJJ to extend these measures to market-rate housing construction as well.

Prevailing wage on all new residential construction could increase the project cost of new construction by as much as 37%, according to researchers at UC Berkeley Program on Housing and Urban Policy

In a study listed under the Working Papers from the UC Berkeley Program on Housing and Urban Policy, Dunn (2005) conducted a regression analysis of 205 affordable housing projects benefitting from the California Low Income Housing Tax Credit beginning in 1996. The preferred model identified in this research estimated that prevailing wage requirements increased construction costs by 9% to 37%, with an average point estimate of 25%.

Recent California legislation extends the application of prevailing wage regulations to subsidized low-income residential construction projects. Econometric evidence based on micro data covering 205 residential projects subsidized by the California Low Income Housing Tax Credit since 1996 and completed by mid-2002 demonstrates that construction costs increased substantially under prevailing wage requirements. Estimates of additional construction costs in the authors’ most extensive models range from 9% to 37%. The analysis controls for variations in cost by geographical location and for differences in project characteristics, financing, and developer attributes. The authors estimate the effect of uniform imposition of these regulations on the number of new dwellings for low-income households produced under the tax credit program in California. Under reasonable assumptions, the mid-range estimate of the prospective decrease exceeds 3,100 units per year. (Dunn 2005)

The range of 9% to 37% is for site and structure cost. The comparable range for total project cost is slightly different at 9% to 36%.

In addition to their preferred model that incorporated other policy variables, this paper also reported the raw results for their core regression results. This simpler model (OLS Estimation) showed a smaller range of 9% to 11%. As discussed below, similar ranges have been found in subsequent studies doing similar analyses to address the same issue, giving additional credence to the Dunn results and the more sophisticated preferred model resulting in the 9% to 37% cost premium result.

Criticisms of this paper include that the 37% upper range for project impacts is high given that the authors estimate that labor costs in total averaged 44% across the projects studied and that correction of some of the variables results in no significant impacts. However, as discussed below, similar ranges have been found in subsequent studies addressing the same issue, giving additional credence to the Dunn results and the more sophisticated preferred model resulting in the 9% to 37% cost premium result.

2004 study for California Coalition for Affordable Housing found potential project cost impact of 9% to 15%

Newman (2004) conducted a similar regression analysis of a larger number of 365 affordable housing projects in California and found the cost impacts to range between 6% to 15%, with an overall average of 11%.

Our regression analysis allowed us to directly compare costs for prevailing wage projects to costs for comparable projects built with market wages. We found that the prevailing wage requirements increased overall project costs by about 11 percent, even while controlling for other factors known to influence costs such as regional variations in construction costs and characteristics of the structures themselves. We further found that the impact from these expanded prevailing wage requirements varies across the state, with some areas expected to experience cost increases of as little as six percent while others will likely experience increases of more than 15 percent. (Newman 2004)

These results are comparable to the OLS Estimation model from the Dunn paper.

2008 study by Citizens Housing and Planning Council estimated that prevailing wage requirements would increase New York City’s already high project costs for affordable housing by another 25%

This study (Citizens 2008) reviewed a number of issues related to then-pending proposals to extend prevailing wage requirements to affordable housing construction in New York City.

The study did not do independent data analysis of cost differentials, but based on a review of existing model-based and regression-based study results, concluded that total development costs would increase by about 25%. Rents would increase by about $400 a month.

Imposing prevailing wages for affordable housing construction could increase the cost of labor, increasing total development costs by about 25%, resulting in the need for higher government subsidies or, in their absence the construction of fewer affordable units. In a typical apartment, rents might increase by about $400 per month, thereby increasing the amount of annual income a household would need to afford the rent by $16,000. Conversely, to keep the rent affordable to the same household, government subsidies would have to double or production of units would be cut in half. (Citizens 2008)

Based on a review of previous studies and OSHA data, the report also concluded there was no evidence to support improved quality and safety claims related to prevailing wage requirements.

There is no evidence that imposing prevailing wages would improve construction quality.

Construction fatality data in New York City does not indicate that imposing prevailing wages on affordable housing construction would result in fewer construction-related fatalities. (Citizens 2008)

New York City’s Independent Budget Office estimated that prevailing wage increased affordable housing construction costs by 13% and costs per affordable housing unit by $45,000

Addressing similar issues as the Citizens report above, this report conducted a regression analysis using construction cost budgets from 210 projects, provided by the City’s Department of Housing Preservation and Development. Net of land development costs, the analysis estimated a 13% increase in total construction costs from prevailing wage requirements.

Holding other variables constant, IBO estimates that the average total construction costs for a project requiring prevailing wages is 13 percent higher than a project where prevailing wages are not required. Total construction costs refers to all development costs other than costs associated with land acquisition—construction hard costs, soft costs, developer fees, and project reserves. (New York City 2016)

In Los Angeles, recent estimates are that prevailing wages would drive up total project costs for residential projects by 46%

One of the few studies on prevailing wage impacts on market rate housing was conducted as a review of the potential effects of the 2016 Measure JJJ in Los Angeles (Beacon Economics 2016). This measure requires residential projects of over 10 units that need changes to the General Plan or other zoning and construction rules, to pay prevailing wage rates. The measure also imposes local hiring conditions and requires projects to include 20% to 40% affordable units.

The Beacon analysis of the prevailing wage components was done using the modeling approach. Based on Census data and developer surveys, the study estimated the labor component at 48% of total construction cost for market rate residential, similar to the affordable housing labor share of 44% estimated by the Dunn (2005) study. Based on a comparison of market rates (from Employment Development Department occupational data) and the area’s prevailing rates, this study estimated a 46% increase in total project costs.

New residential development will be required to pay premium over-market wages for construction workers performing project work. Based on Beacon Economics’ estimations, we found that prevailing wages are almost double the market rate wages across job classifications and will drive up total project costs 46%. (Beacon Economics 2016)

While not quantified, the study also notes that additional cost increases are likely to result as well from the increased regulatory compliance costs associated with prevailing wage including extensive additional wage reporting, monitoring, and record keeping along with other components such as apprenticeship requirements.

Based on Existing Cost Impact Studies, Prevailing Wage Requirements would Increase Housing Project Costs from 25% to 46%

The three regression studies of affordable housing produced essentially similar results showing an 11% to 13% cost increase through their base regression models. The New York City result, however, does not include land costs, but is overlaid on already higher construction costs overall than the California average. The consistency in these results provides support for the Dunn (2005) estimate of a 25% cost impact (with a range of 9% to 37%) from their more complete model. The 25% factor is also the same one cited by Citizens Housing and Planning Council (2016) following their review of previous studies and developer survey responses.

The Beacon estimate is substantially higher but is also the only one that looked at market rate residential. A higher number is not unreasonable given the higher degree of amenities and finishings in market rate vs. affordable housing as well as the degree of product tailoring involved in buyer option installation.

The relatively higher share of labor costs identified in the few housing studies vs. the labor share identified in the bulk of the literature that analyzes public works projects is also reasonable. By their nature, public works projects will generally entail substantially higher cost and often specialized materials. Many of the trades used in public works construction will also tend to be more specialized trades with a higher degree of unionization.

Economic Impacts

Housing Construction Cost Model

The prior impact studies reviewed above all focus on the effects of prevailing wage requirements on construction cost. In order to evaluate potential effects on housing supply, housing affordability, and fiscal issues, a more complete picture of labor cost contributions to housing price is required.

Little information on this topic is available, however. The actual cost distributions will vary widely across the state depending on the type, size, location, and price point of the housing being constructed along with other factors such as cost of land, length and cost of the local permitting process and other regulatory hurdles, and the level of local permit and impact fees.

For the purposes of this document, a generalized model was developed from the following information sources:

- California-specific cost factors were first taken from the data developed from a detailed cost analysis of 400 multi-family affordable housing projects (California Department of Housing and Community Development, October 2014). This data provides details on the construction costs and generalized land costs but does not include other sales price components for market rate housing such as financing, sales expenses, and profit. The data also is focused on affordable housing and to multi-family housing, but covers a broad range of project sizes and has sufficient information to generalize the data to market-rate units.

- Additional sales price information was obtained through the National Association of Home Builders (NAHB) reports (NAHB, November 2015; 2016). This data provides the additional sales price components along with generally comparable cost categories for single family homes, but is based generally on national rather than California data.

- The two sets were then consolidated and rationalized, in particular incorporating the sales and profit components from NAHB and the significantly higher permit and impact fees from the California data.

- The two NAHB reports were used to adjust the national price factors to the cost structure for the Western states. Additional adjustments were then made to the single family home data for the higher development impact fees imposed in California, as discussed below.

- A component for Mello-Roos assessments was then added in to derive the effective sales price. Mello-Roos financing is another tool used by local governments to obtain financing for roads, street lighting, parks, libraries, schools, police, fire, and a range of offsite improvements. Unlike development impact fees which are incorporated directly into the sales price, Mello-Roos charges are instead recovered annually as a parcel tax to cover annual bond service costs and related charges associated with the covered improvements or ongoing local services. Using the same approach as LAO (LAO, September 2016), the 2016 average amount of Mello-Roos assessment per unit was derived from the Treasurer’s California Debt and Investment Advisory Commission data on total debt issued by Community Facilities Districts (CFD) in 2016. This amount, $18,800, was down from $29,300 in 2015. The bonds, however, cover only costs associated with term-limited fees. About 12.7% of Mello-Roos taxes are levied indefinitely to fund services such as fire, police, public transit, education, and others rather than to construct infrastructure facilities (California Tax Foundation, September 2014).

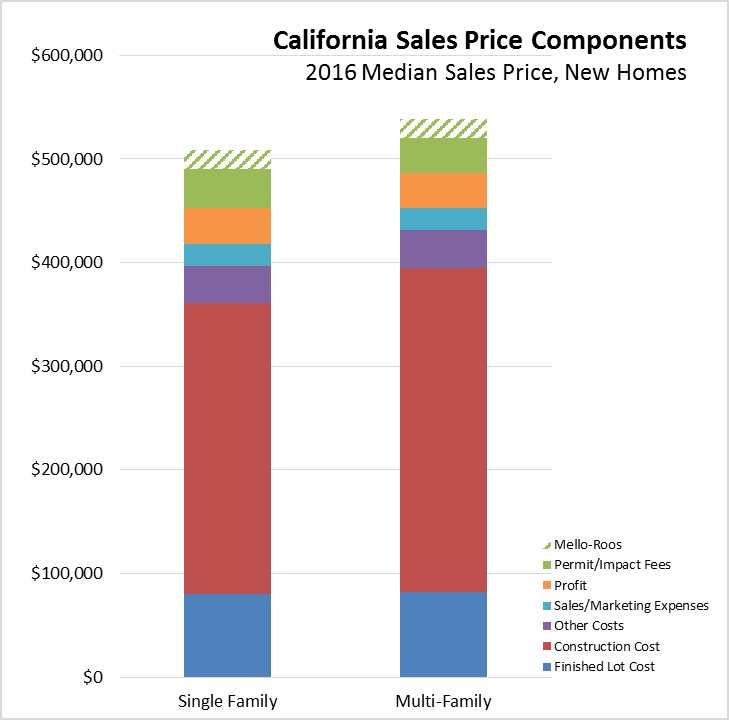

Using data from DQNews, the California median price for new single family homes in 2016 was $490,000. The comparable median price for new multi-family units was $520,000. As a point of comparison, the average median price of all (new and existing) single family home sales in 2016 was $502,100 (average of monthly median sales price from California Association of Realtors), while the average median price for all multi-family units was $389,900. The large differences in the multi-family numbers, when considered against affordable unit production, indicates that new home builders are already having to move to the upper end of the market to deal with the current high costs in the state’s urban areas for these developments.

Combining this information produces the general price structure for new single-family and multi-family units in 2016 shown in the following chart. Again, these are generalized factors based on the combined estimates from above.

Increasing Construction Labor Costs by 37% would Raise the Median Price of New Single Family Homes by $63,500 and the Median Rent for New Multi-Family Housing by $370 a Month

The results of the cost model were combined with the conclusions from the prior prevailing wage impact studies to estimate the effect on home prices:

- Using the factors from the Beacon (2016) and Dunn (2005) studies, labor costs were estimated at 48% of construction costs. Construction costs include both the construction cost element shown in the chart above along with the site preparation component of the finished lot cost element.

- The cost impact of a prevailing wage requirement on median housing prices was then estimated as a range using the results from the different studies: 25% as the point estimate from Dunn (2005), 37% as the upper range given in Dunn (2005), and 46% from Beacon (2016). As indicated previously, the Dunn results are also supported by the conclusions in Newman (2004), Citizens Housing & Planning Council (2008), and New York City (2016).

- These estimates were then validated by developing an alternative set of estimates using residential construction permit values for 2016 from the California Construction Industry Research Board. The permit valuations were adjusted to construction values based on US Census construction data, and the resulting construction and labor values adjusted to sales prices as previously. This alternative approach produced average values that were virtually the same as the median value results given in the table below for single family housing. The average values for multi-family housing were somewhat lower, but within the expected range for average vs. median values for this type of housing.

- The results, shown as estimated increases to the 2016 median price, are given in the table below for both single and multi-family housing. The potential monthly rent increase was estimated from the multi-family numbers by amortizing the increase over 30 years at 4.9%.[1]

Estimated Median Price and Rent Increases from Prevailing Wage Requirements for Residential Construction, Based on 2016 California New Home Median Sales Price

| Potential Labor Cost Increase | Single Family | Multi-Family | Multi-Family Rent |

| 25% | $42,900 | $47,000 | $250 |

| 37% | $63,500 | $69,600 | $370 |

| 46% | $79,000 | $86,500 | $460 |

Taking the mid-point impact estimate of a 37% increase in construction wages, the median price of new single family homes would increase by $63,500 to $553,500, the median price of a multi-family unit by $69,600 to $589,600, and the associated rent for new multi-family units by $370 a month.

For comparison, US Census data shows the median new home price nationally in 2016 (all units) was $315,500.

To afford just this cost increase alone (using the standard of 30% of income), a household would need another $15,700 in annual income to qualify for a single family home, $17,200 more to qualify for the median multi-family unit, and $15,800 more to qualify for renting the median multi-family unit.

Note that this approach only addresses cost increases from the increased wage requirements. It does not include lessened labor flexibility and increased compliance costs including monitoring, record keeping, and other regulatory costs associated with this type of measure. The estimates also are based solely on the potential price increases from a prevailing wage requirement and do not incorporate additional prices stemming from other current and proposed regulatory cost drivers, including but not limited to Zero Net Energy regulations, SB 32 and SB 743 VMT requirements, below market rate set-asides, and related GHG mitigation and offset requirements imposed under CEQA. These additional provisions are discussed in the section below.

Overall, the table above indicates that new housing prices—if they were built—would increase from 9% (25% scenario) to 17% (46% scenario) over the 2016 median price, with an average of 13%. Over time, this factor would push housing prices up overall by about the same amount—13%—primarily in inland regions, but likely much higher in coastal areas with significant historical building shortfalls. As described in a previous LAO report, building cost changes generally have determined housing costs within the inland regions, but housing costs in the coastal areas have accelerated faster due to supply shortage considerations being more dominant:

Higher building costs contribute to higher housing costs throughout the state. The relationship between building costs and prices and rents, however, differs across inland and coastal areas of the state. In places where housing is relatively abundant, such as much of inland California, building costs generally determine housing costs. This is because landlords and home sellers compete for tenants and homebuyers. This competition benefits renters and prospective homebuyers by depressing prices and rents, keeping them close to building costs. In these types of housing markets, building costs account for the vast majority of home prices. In two major inland metros—Riverside-San Bernardino and Sacramento—building costs account for over fourth-fifths of home prices. In contrast, in coastal California, the opposite is true. Renters and home buyers compete for a limited number of apartments and homes, bidding up prices far in excess of building costs. Building costs account for around one-third of home prices in California’s coastal metros. . . building costs explain only a small portion of growth in housing costs. Instead, increasing competition for limited housing is the primary driver of housing cost growth in coastal California. (LAO, March 2015)

As discussed in the next 3 sections, combined with the other adopted and pending regulatory cost drivers, the first year supply effects from prevailing wage requirements would produce an additional estimated 2.5% increase in housing prices on top of the actual 5.6% increase statewide in 2016 (as calculated from change in average median sales price from California Association of Realtors).

Increasing Construction Costs by 37% would Put an Effective Halt to New Market Rate Home Construction

The impact on overall housing construction activity in the earlier studies summarized above was more straightforward because they were limited to affordable housing. The studies estimated the increased cost per affordable unit, and then estimated how many fewer units could be built under available and projected agency budgets.

For market rate housing, the potential impacts to the levels of residential construction are more difficult to estimate given the range of possible market responses and the current relatively low level of new housing units already being built in the state. One possible long-term response is increased density that attempts to compensate higher construction costs with more intensive land use, but this type of project already faces significant regulatory costs and outright barriers related to permitting and CEQA delays. Simply making housing development proposals bigger and denser will likely increase the level of opposition they already face, and further slow the pace of new unit additions to the overall supply.

And even if housing proposals were changed to increase density, CEQA can work to counteract this attempt. As indicated by LAO from a review of CEQA documents from the state’s ten largest cities 2004 – 2013 (LAO, March 2015, p. 18), “The CEQA process also, in some cases, results in developers reducing the size and scope of a project in response to concerns discovered during the review process.”

In addition, the cost of materials and labor compared to a single family home increases as density increases, further amplifying the potential impacts from higher labor costs. A recent study summarizing construction cost differences in the Bay Area (Holland & Knight, August 2015) indicated that the per unit material/labor cost for a 5-story, 50 unit midrise development was 3.0 – 4.0 times the cost for a single family home, while the size of the finished unit was 60% smaller. For an 8 – 50 story highrise of 100 units and over, the material/labor cost was 5.5 – 7.5 times as high, again for a 60% smaller unit. Consequently, the impact of prevailing wage requirements would become more significant as density was increased, limiting design alternatives as a means to cope with the subsequent cost impacts. Equally important, this greater impact on densification would also limit the effectiveness of the housing strategies that state now wants to pursue as part of the climate change program.

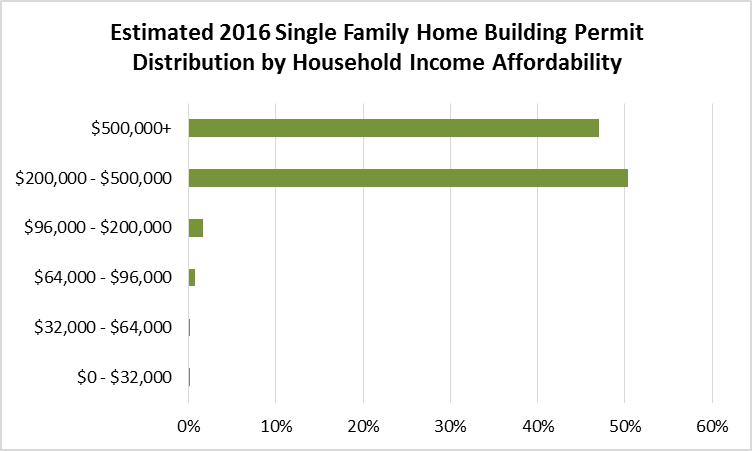

For current projects, however, increasing costs at this level are more likely to put developments back on the shelf due to project economics. Increasing costs combined with their effect on increasing home prices in the existing supply will continue to shift new housing further into the higher income segment of the market, and reduce significantly the amount of new supply that can be built economically for middle and lower income purchasers and renters. This effect is already seen as a result of the growing building costs to date that have been driven by existing regulatory cost drivers, as can be seen through estimating the market distribution of current housing construction in the state.

The estimates shown in the figure below were derived from the following steps: (1) average building permit value by city was derived from the monthly California Industry Research Board data for single family homes; (2) the adjustment to sales price was made by comparing median new home sales prices to median permit value; (3) annual costs were calculated from the California Association of Realtors methodology for mortgage, insurance, and taxes including a component for Mello-Roos payments; and (4) the target market income was derived using the standard that housing costs should not exceed 30% of household income. The resulting figure below shows the estimated distribution of single family construction in 2016 by household income affordability. The income bands are based on the 2015 median household income adjusted to 2016 by personal income growth. The lower bands are based on median income plus ($96,000) and minus ($32,000) 50% of median income to show a middle income range. As indicated, just over 1% of total single family home building permit activity was affordable to middle class incomes. The existing costs of construction—including regulatory cost drivers from CEQA and permits, development impact fees, Mello-Roos fees, affordable housing fee and other requirements, AB 32 and related regulations adopted to date, and other regulatory cost drivers on construction equipment, materials, and fuels—already put most of the 2016 supply increases at the higher income levels.

Increased labor costs, especially when combined with the other pending proposed housing regulation, would drive California’s housing construction cost structure further into the upper market segments. Any regulatory efforts to compensate for this evolving market by increasing the number of required below market rate units would simply continue the cost feedback loop, further increasing the cost of market rate units and continuing the current cost-push cycle sending housing out of the financial reach of an increasing share of Californians. For example, as discussed in the next section, a recent study (Capitol Matrix Consulting, April 2016) estimated based on 2015 data that a 15% affordable unit requirement would result in a $67,000 impact on the price of the remaining market-rate units. A simple calculation shows that increasing this level to 20% as in the low end of Los Angeles’ Measure JJJ would produce a price impact of $95,000 per market-rate unit.

A 25% to 46% Increase in Labor Costs Would Likely Make All Currently Proposed Private Developments Uneconomic, Resulting in a Halt to New Housing Supply

While the analysis in the next section calculates the supply effects by considering changes at the margin, the nature of the development process itself likely means that the immediate results of adopting a prevailing wage requirement would be a halt to all new private housing development.

The regulatory universe governing the residential process is really composed of two parts. The entitlement phase entails the series of planning, zoning, development, environmental review, and related approvals required for an overall residential project. In California, this is a lengthy, multi-year—multi-decade for an increasing number of projects—and costly procedure.

The end result is the creation of an “inventory” of buildable units that builders then proceed to construct over varying periods of time. Construction permits essentially cover units from the inventory that are built within the current year. But permits are pulled and housing units constructed only if market conditions remain conducive to a positive economic return.

While all development projects contain some element of flexibility within their financial plans to accommodate shifts in the market and costs, cost spikes such as a 25% to 46% increase in labor costs would likely cause currently approved developments—including units already under construction—to become uneconomic. As indicated in the previous sections, the scale of the increase is far more than what can be absorbed within existing profit margins, and attempts to cope through price increases would place these developments far beyond the price points in the markets for which they were designed. Potential home buyers, if faced with such substantial price increases on new houses, are instead far more likely to turn to a home from the existing but increasingly constrained supply, and be able to obtain a larger unit with more features at a lower price and potentially without additional annual costs such as Mello-Roos fees. These actions in turn would cause additional reactions throughout the market as existing home prices are bid up, supply expands primarily through very limited numbers of public-financed affordable units, and a greater share of households find themselves unable to obtain sufficient housing at a price they can afford.

These delays may extend into a multi-year to decades-long process as previously approved developments are shelved, and as the required adjustments become substantial enough to require amendments to or a restart of the entitlement process, including potential process and litigation delays from additional rounds of CEQA review.

This conclusion becomes even more apparent when considering that prevailing wage requirements are only one of several regulatory cost increases either recently adopted or currently proposed that would affect housing costs within the same period of time. These include but are not limited to the following:

- Costs to comply with the Energy Commission’s Zero Net Energy regulations were previously estimated at $58,000 a unit (Capitol Matrix Consulting, 2015), although more recent revisions from CBIA now place the number closer to $35,000 a unit.

- Increasing local requirements for affordable units and other measures such as the recently passed Measure JJJ in Los Angeles (20%-40% affordability requirement) have shifted the cost burden for the state’s housing supply crisis onto the market rate component and the associated prices paid by new home buyers. A recent analysis (Capitol Matrix Consulting, April 2016) of a potential 15% inclusionary zoning requirement applied to all new housing estimated would require an average subsidy of $162,000 per affordable unit, which spread over the remaining units in a development would require an average increase of $67,000 per market priced unit. These results are consistent with an earlier study (Reason Foundation, June 2004) which analyzed the effects of affordable units built under existing inclusionary zoning requirements through 2003 in Los Angeles and Orange Counties, and estimated the resulting new home price effect at $33,000 to $66,000 in a median city, and up to $100,000 in high market-rate cities.

- Offsets and other climate change mitigations are now imposed through CEQA reviews as a result of court decisions (e.g., Center for Biological Diversity v. California Department of Fish & Wildlife, 2015) and pending CEQA regulations from the Office of Planning & Research.

- VMT (vehicle miles traveled) reduction and other nonpoint source measures are now being developed pursuant to the most recent CARB Scoping Plan and through the SB 375 Sustainable Communities Strategies.

While few estimates exist for the additional regulatory costs for these last two components, the potential scale can be shown through the $5,000 to $25,000 a unit VMT fee used as the basis for planning staff analyses in the Bay Area (Bay Area BIA, 2017).

Cumulatively, these costs—all of which are being proposed to become effective within the same period—have the potential to drive costs and the resulting home prices up far higher than prevailing wage alone.

The Estimated Supply & Demand Effects Also Show New Building Permits Would Decline to Zero

The calculated effects on housing supply and demand were estimated using state-wide price elasticities for housing. While some studies have calculated supply elasticities for several California areas, the results differ widely and far fewer of these studies appear to have done the same for demand elasticities. One analysis (Egan, 2014) estimated both demand and supply elasticities for San Francisco using data for all California cities. This analysis arrived at a blended (owner-occupied and rentals) price elasticity of demand of (negative) 0.74, meaning that for every 1% increase in price, the demand for housing units would decrease by 0.74%. The comparable blended price elasticity of supply was estimated at 0.09.

While San Francisco may not represent the housing market for California as a whole, these results are similar to a much earlier study done for Pittsburg and Phoenix (Hanushek and Quigley, 1980). In this case, the simple model in the paper that compares to the San Francisco analysis found demand elasticities of (negative) 0.33 to 0.95 for Pittsburg, and (negative) 0.20 to 0.71 for Phoenix.

These results are also consistent with a more recent estimate of California metro supply elasticities (Trulia, July 2016). Nationally, the long-term housing supply elasticity was estimated at 0.20, with a 1999 peak of 0.29 and a 2016:Q1 estimate of 0.17. For California, the long-term supply elasticities ranged from 0.21 to 0.26 in the inland region metropolitan areas, and 0.04 (San Francisco and Los Angeles) to 0.11 in the Bay Area and coastal areas.

The Trulia study also found that delays in permit processing were far more significant than restrictive zoning in how inelastic regional housing markets were, accounting for over half of the variation in supply elasticities between markets. The results indicate that each month of approval delay was correlated with a 0.03 decrease in housing supply elasticity. California, with its substantially more lengthy permit processing times, reflects this outcome.

To calculate the impacts for California, the 2015 short term elasticities were calculated as follows. Due to the nature of the data used, blended elasticities were estimated directly:

- Price elasticity of demand was estimated using a standard demand function of the form:

Qd = a * Pdξd * Yb

Where Qd is the number of units demanded, Pd is the price, ξd is the price elasticity of demand, and Y is income. As in Egan, both sides of the equation are multiplied by P to yield the following equation.

Pd * Qd = a * Pd(1+ξd) * Yb

P * Q is the same as household housing expense, for which data is available through the American Community Survey (ACS). The demand elasticity was then estimated by regression using data for the 128 California cities (cities over 65,000 population) for which the 2015, 1-year data is available. P * Q is the annual household housing expense from the ACS. Data for P is the 2015 home value (all units) from Zillow Data. Data for Y is the median household income from the 2015 ACS.

The regression produced a significant price elasticity of demand of (negative) 0.88. This result indicates that demand is slightly inelastic, meaning that as prices increase, California households will demand relatively fewer units and likely have to respond instead through trends already seen in the market such as increased overcrowding and homelessness.

- Estimates of price elasticity of supply were attempted using standard supply functions from the literature, but no significant results were produced from the data used. Instead, a significant estimate resulted from calculating the following formula directly:

ΔQs% = ξs * ΔPs%

The supply elasticity was then estimated by regression again using data for the 128 cities. The supply quantity (Qs) used the 2015 number of housing units (occupied and vacant) in each city, with the change in Q determined from the 2016 housing permits in each city. While the number of building permits does not necessarily equate to the number of new housing units built in any given year, it is the best available proxy at this level of detail for California. By comparison, Census data for the West Region states shows building permits in 2016 were only 4% higher than the number of new housing starts.

The percentage change in price (P) was then calculated from the change in average home value (all units) from Zillow data.

This regression produced a significant estimate for price elasticity of 0.08, meaning a 1% price increase produces a supply increase of only 0.08%. As expected, this result indicates housing supply is highly price inelastic, a result consistent with the fact that additions to builders’ “inventories” is a long and expensive process in California. Few additions to supply can occur in the short term, and the costs and risks (market and regulatory) associated with long term changes currently limits the degree of elasticity as well.

Applying the elasticities separately, the effect on supply (number of new building permits annually) was estimated by combining the estimated costs from above with the projected cost of $35,000 per unit for Net Zero Energy requirements, $67,000 for inclusionary zoning, and the mid-point of $15,000 from the VMT proposal range above to represent a low estimate for anticipated SB 32 cost increases. Due to the lack of a data reference point, no cost estimate is included for GHG measures imposed through CEQA reviews.

These cost factors (at 25%, 37%, and 46% labor cost increase scenarios) were then applied to the 2015 average home value from Zillow data for California, moving the supply curve to the left by an average of 2.5% of the 2015 housing supply as measured by the ACS data. Combining both elasticities, total new units demanded would have declined by 271,000 units (25% scenario) to 308,000 units (46% scenario), or an average of 290,000 units. Compared to actual 2016 production as measured by building permits, this result is equivalent to 2.9 years of production that would be precluded by the proposed cost increase. Using the calculations for just the cost increases associated with the prevailing wage component, an average of 1.1 years of production would be precluded.

These results are consistent with the more general discussion above that concluded that most housing construction would come to a halt as a result of the interactions with the regulatory framework governing housing development in California. Some residual construction of affordable units may proceed to the extent they are financed from public funds and are already subject to prevailing wage requirements. However, estimates for all affordable unit construction are low, accounting for only about 7,000 units a year (LAO, 2016). Furthermore, financing for most of these units is dependent instead on developer agreements that are predicated on production of the associated market-rate housing. Much of this work in turn is dependent on the Low Income Housing Tax Credit, but the associated funding has already become restricted recently in anticipation of federal tax reform that would reduce the value of these credits (Wall Street Journal, March 2017). Prevailing wage requirements on top of these current trends would eliminate most affordable housing funding sources in the state.

Total First Year Direct Impacts: $33.3 Billion Loss in Construction Expenditures

Direct impacts from the first year following the effective date of a prevailing wage requirement are based on an impact that would preclude the 2016 building permit levels, as determined from the previous cost analysis applied to the 2016 median value new home prices. These calculations assume a residual public agency construction of 1,000 affordable units. The table below shows the construction costs that would not be expended, calculated as the total price for the indicated housing unit less profit, sales/marketing expenses, other costs, and land costs. With the exception of the land costs, the absence of these other price factors would have additional effects on the California economy, but these are addressed in the indirect impact analysis that follows.

Estimated First Year Reduction in Annual Housing Units and Construction Expenditures from Prevailing Wage Requirements, Based on 2016 California New Home Median Sales Price

|

| Single Family | Multi-Family | Total |

| Reduced # of Units | -48,000 | -51,000 | -99,000 |

| Reduced Construction Cost Expenditures ($ billion) | -$15.4 | -$18.1 | -$33.5 |

Total Direct & Indirect Impacts from First Year Reductions: $20.9 Billion Loss in Incomes; 372,700 Loss in Employment

Economic impacts from the reduced construction were estimated using the RIMS II input-output multipliers obtained from the US Bureau of Economic Analysis. The analysis calculated the direct and indirect impacts (Type I multiplier) using California specific multipliers from the 2015 revision. The calculations were performed netting out the land costs associated with the estimated reductions in units by unit type.

The results are summarized in the following table. As estimated above, at least 99,000 units would be precluded under each of the three labor costs scenarios. Consequently, the table below provides a single set of estimates that apply to each scenario. The effects of the reduced level of construction in one year would be a loss of $20.9 billion to total state incomes, 372,700 fewer jobs,[2] and a $34.2 billion reduction in total California GDP.

Through the 3rd quarter of 2016, US Bureau of Economic Analysis shows that California’s real GDP grew at an annual rate of 2.6%. A reduction in GDP of this size occurring in the same period would have cut the rate to only 1.1%.

In 2016, Employment Development Department data shows that California total wage and salary jobs grew by 425,900, or 2.6%. A reduction in jobs of this size occurring in the same period would have cut the rate to only 0.3%.

Estimated Direct & Indirect Economic Impacts from First Year Impacts of Prevailing Wage Requirements, Based on 2016 California New Home Median Sales Price ($ in billions)

| Income | Employment | GDP |

| -$20.9 | -372,700 | -$34.2 |

These numbers measure only the reduced level of construction activity, and do not include any assumptions related to consumer shifts in spending as housing costs rise, alternative uses for the land, or responses by the affected firms and employees such as seeking work or housing investment opportunities in other states. While the numbers in the table show the impacts associated with one year’s worth of reduced construction, the nature of input-output analysis makes it impossible to estimate how long it will take for the indirect effects to work through the state’s economy. Similar impacts, however, would occur as construction activity is constrained in subsequent years as well.

Annual Permit and Impact Fees Reduced by $3.5 Billion

Residential construction is subject to a wide range of permit and regulatory fees along with development impact fees and other revenue sources such as Mello-Roos districts levied on new construction to support schools, roads, parks, libraries, police, fire, and a range of other local services. These fees are a critical resource financing local infrastructure and in some cases, annual operating costs as well.

Using the construction cost model above, the total for all permit and impact fees is estimated at $36,900 for the median price single family unit and $33,300 for the median price multi-family unit.

By comparison, studies of state and local impact fees (Duncan Associates, 2015) estimated average non-utility impact fees alone for single family homes in California at $23,455 in 2015 ($31,787 for total fees), and $15,555 ($19,558 total) for multi-family units. The Duncan surveys also indicate these averages apply only to the communities surveyed rather than the states as a whole, but cover communities that rely on these fees for infrastructure funds.

A recent LAO report (LAO, September 2016) gives a lower estimate of about $12,000 (all units) for the 2014-15 median impact fee, but the data appears to have been derived from the generalized categories of the Controller’s annual local government financial reports. The LAO number does not provide the detail given in the Duncan surveys on data coverage or which fee purposes are covered in this number. The LAO report also concludes that in communities where impact fees are low, costs are instead recovered through wider use of voter approved parcel fees (as opposed to CFD-specific Mello-Roos fees):

As seen in the figure, the median impact fees were roughly $5,000 per permit in cities that passed a parcel tax between 2000 and 2014. In comparison, those cities that did not propose a parcel tax or failed to pass a parcel tax had median impact fees of over $12,000. Looking at the difference in the fees, cities that could not pass a parcel tax likely relied on higher impact fees to pay for the costs associated with new development. (LAO, September 2016, p. 39)

Consequently, the more detailed average numbers from the Duncan surveys were used as the basis for these estimates, as they better reflect the average amount of infrastructure costs recovered by local governments per unit, regardless of whether through impact fees or parcel taxes. The permit and impact fee estimates are based on the Duncan estimates for non-utility impact fees. The utility fees and permitting costs associated with the entitlement phase of the development process are treated as incorporated into the finished land cost. For projects already underway in the year a prevailing wage requirement would take effect, these fees would be a sunk cost already paid to local governments. In years out, these fees would also decline as new proposals are pulled back.

Applied to the market reduction estimates in the previous section, estimates of lost fee revenue to all agencies are summarized in the following table, applicable to all three wage cost scenarios. State and local agencies would lose about $3.5 billion annually in permit and impact fees at the 2016 level of construction. Mello-Roos revenues would also be affected, but the exact effect is more difficult to estimate given that many developments that are in the midst of build-out would have already created the obligations. Some of these would risk bankruptcy as the result of a construction halt. Using the factors derived earlier, the total amount of Mello-Roos revenues associated with the annual construction reductions is $100 million a year, or a present value of $1.8 billion for each year’s worth of reductions.

Estimated Reduction in Permit and Impact Fee Revenues from Prevailing Wage First Year Impacts, Based on 2016 California New Home Median Sales Price ($ billion)

| Single Family Units | Multi-Family Units | Total |

| -$1.8 | -$1.7 | -$3.5 |

$16.2 Billion Total Annual Fiscal Impacts to State and Local Governments

In addition to lost fees, the California and local governments would see reduced revenues from taxes as well. These annual impacts are summarized in the table below and apply to all three wage impact scenarios. These are only the direct effects related to the reduced level of construction, assume higher wages would be paid only for the remaining minimal level of affordable housing construction due to the absence of market-rate activity, and do not incorporate additional revenue losses related to the indirect income and employment impacts estimated above. As indicated, total revenues would be reduced by about $16.2 billion from annual construction reductions. Of this amount, the impact to state taxes would be a loss of $2.6 billion, although the effect on property taxes would produce further pressure on the General Fund by reducing the amount of locally available Prop. 98 funding for K-14 schools.

Estimated Reduction in Annual State & Local Revenues from Prevailing Wage First Year Impacts,

Based on 2016 California Median Sales Price ($ billion)

|

|

|

| Property Tax | -9.21 |

| Permit & Impact Fees | -3.47 |

| Sales Tax | -1.48 |

| Income Tax | -1.30 |

| Unemployment Insurance Tax | -0.05 |

| Total | -$15.50 |

Income Tax is derived from estimated wages paid to workers plus foregone profit on the reduced number of units constructed. Taxes on profits assume all business entities are taxed on a pass-through basis. Taxes on wages are based on an assumed 50-50 split between joint and single filing rates, and include both decreased personal income tax revenues as fewer workers are used to build fewer housing units and increased revenues from the higher wage increment paid to the remaining workers on the assumed 1,000 unit level of affordable housing.

Unemployment Insurance Tax is calculated from the estimated number of employees.

Sales Tax is based on the average state and local rate of 8.48% applied to the estimated materials component of construction cost.

Permit & Impact Fees are taken from the previous section. Additional fees such as real estate transfer and recording charges are not included.

Property Tax is applied only to the improvements portion of the estimated unit reductions, while assuming taxation of the land component will be unchanged (although landowners may seek reductions in assessed valuations on which property tax rates apply, due to sharp declines in residual land values resulting from the adoption of prevailing wage requirements). Tax is estimated from the average 1.1% rate. Property Tax revenues are the only component in the table that comes from an ongoing revenue stream associated with changes in units in any given year, while the other fiscal components are all one-time effects stemming from the reduced number of units in each year. To allow the comparison on an annual basis, the stream of reduced revenues associated with unit reductions in one year are translated into present value using the maximum 2% annual growth rate in valuation and a 4.9% discount rate[3] over 30 years.

[1] Projected average 30-Year Mortgage Rate, 2017 – 2020, Department of Finance, Economic Forecasts.

[2] The employment loss applies to all jobs, and does not distinguish between full-time and part-time positions.

[3] Projected average 30-Year Mortgage Rate, 2017 – 2020, Department of Finance, Economic Forecasts.

Poverty Impacts

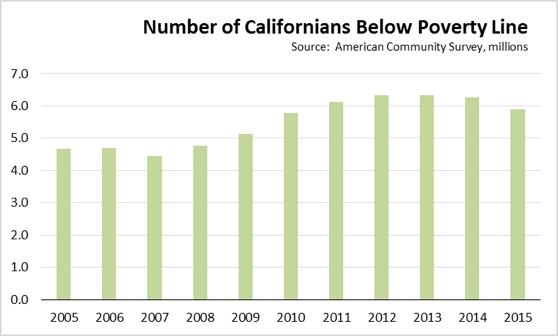

1.5 Million More Californians Live in Poverty than Before the Recession

From the most recent American Community Survey data (ACS, 1-year estimates), 5.9 million Californians had incomes below the official federal poverty level in 2015, still 1.5 million higher than the 4.4 million living in poverty prior to the recession in 2007.

The poverty rate in 2015 varied widely across demographic groups: Latino 21.0%, White (non-Latino) 10.0%, Asian 11.6%, and Black 22.5%. For California as a whole, the ACS 1-year estimate was 15.3% (which differs slightly from the 3-year estimate in the next section).

Estimated Rise in Housing Costs from Prevailing Wage Requirement would Increase the Number Living in Poverty by 481,000

In 2013-2015, US Census reports there were 5.8 million Californians (15.0%) living below the official federal poverty level. The alternative Supplemental Poverty Measure provides a more complete measure by incorporating income received from assistance programs and adjusting for differences in housing costs. For 2013-2015, the Supplemental Measure placed the number of individuals living in poverty much higher: 8.0 million Californians (20.6%). Both in number of persons and size of the poverty rate, California was the highest in the nation.

Using American Community Survey data, the previous construction cost model factors, and the Supplemental Poverty Measure equations (Renwick, March 2014), the change in poverty numbers was estimated based on California rent in 2015. The increase in median rent calculated from the previous impact numbers would result in an additional 481,000 persons living in poverty as defined by the Supplemental Poverty Measure. This effect would occur over time as the lack of new home production drives up the cost of housing.

Housing Supply

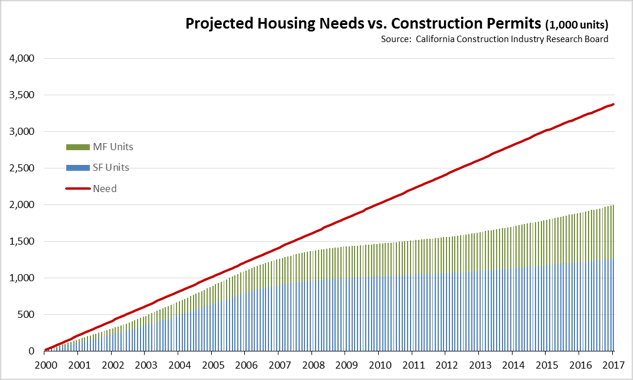

Current Construction Levels are Already Low—2016 Produced Just 56% of the New Homes Needed Annually to Meet Future Population Growth

The State’s current draft Housing Plan (California Department of Housing and Community Development, January 2017) projects the state will need 180,000 new homes constructed annually to meet population and household growth. The prior Housing Plan was based on a need for 220,000 units annually, although later outside reviews suggested the number should be closer to 200,000.

The chart above shows the growing gap between the state’s housing needs and the cumulative amount of new residential construction each year. The theoretical need line is constructed from an annual need of 200,000 units from 2000-2014, and 180,000 annually beginning in 2015. As discussed previously, construction permits are not fully synonymous with the number of units constructed, but the availability of the data and its close relationship with housing starts makes this data a useful proxy.

Since 1990, the number of new units under permit exceeded the 180,000 target in only three years: 2003 (197,000), 2004 (212,000), and 2005 (210,000). In recent years, the number of annual units reached as low as 37,000 in 2009. By comparison, the lowest level reached during a comparable recessionary period during the 1990s was only 85,000—a figure that is much closer to the state’s average over the past 4 years.

In the most recent full year report, total number of units was just over 100,000 in 2016, only 56% of the annual target level of 180,000.

The figure above shows that from January 2000 through January 2017, the state has had a cumulative shortfall of 1.4 million units of housing. Cost increases at the level of a prevailing wage requirement that would halt market-rate housing development would add to this supply deficit at an annual rate of nearly 180,000 more, with only minimal levels of affordable unit construction financed by public funds remaining.

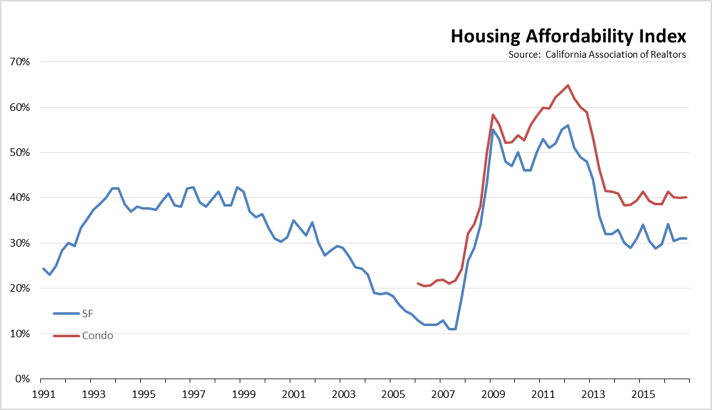

Housing Prices are Already High—Only 31% of Californians Can Afford a Median Price Home

California Association of Realtors (CAR) tracks the affordability of California through their Housing Affordability Index. The Index compares monthly costs for mortgage payments, taxes, and insurance against typical qualifying income levels.

The latest data for 2016:Q4 shows only 31% of California households have sufficient income to afford the median priced single family home. Only 40% can afford the median priced condo.

While these numbers are low, the CAR data shows that housing affordability has been a consistent problem as the state has long failed to generate sufficient residential supply to keep pace with population growth. Converting the earlier CAR data into quarterly averages, the only significant affordability improvements in the past quarter century came as housing prices crashed during the recent recession. The current barriers to construction in the state have long meant prices have remained high as additions to supply have failed to keep pace with continual increases in demand. Adding even more barriers such as prevailing wage cost increases would push prices even higher, worsening the conditions that now make housing affordable to less than a third of the state.

Home Ownership Dropped to 53.6% of California Households in 2015

ACS (1-year estimate) data shows that as prices have risen and affordability dropped, owner-occupied housing has declined 5 percentage points since 2005, to 53.6% of California households in 2015.

Home ownership also varies widely by demographic group, ranging from 42.1% for Latinos in 2015, to 62.5% for non-Latino Whites. In 2015, the home-ownership rate was lower than every other state other than New York.

Percent Owner-Occupied Housing

| 2005 | 2015 | |

| California | 58.4% | 53.6% |

| Latino | 43.0% | 42.1% |

| White, non-Latino | 61.1% | 62.5% |

| Asian | 52.7% | 57.2% |

| Black | 37.1% | 33.5% |

Source: American Community Survey, 1-year estimates

As housing affordability drops in response to prevailing wage upward effects on prices, a decreasing share of California households would be able to become homeowners. Sharp drops in construction would cut off opportunities to purchase new homes, and as discussed previously, the subsequent effect of higher income households turning instead to existing homes would bid up the existing stock beyond the reach of more Californians as well. This effect is likely to be more significant in the traditional remaining regions of high ownership in the interior such as the Inland Empire and Central Valley, where sharply higher prevailing wage cost increases combined with generally lower income levels would produce some of the strongest impacts on overall affordability.

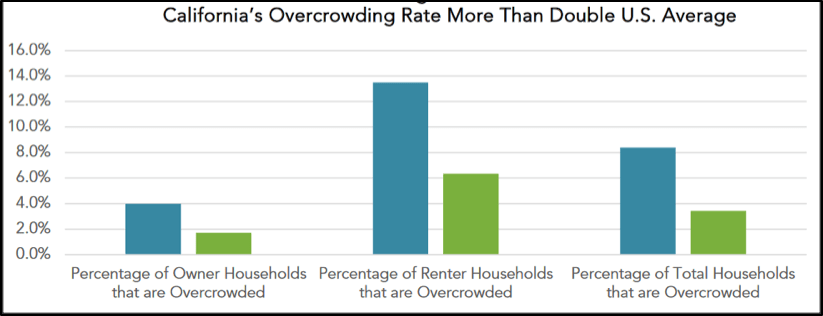

California’s Overcrowding is More than Twice the National Average

As housing has remained unaffordable, many Californians have coped by moving more persons into the existing supply. According to the Department of Housing and Community Development (January 2017), California in 2015 had the second highest overcrowding rate among the states, at 8.4% of households compared to 3.4% for the national average. The renter overcrowding rate was 13.5%, more than three times as large as the owner-occupied overcrowding rate of 4%. Overcrowding is defined as more than one resident per room, with every room except bathrooms counted in the equation.

Source: California Department of Housing and Community Development, January 2017

Overcrowding also remains a persistent condition in the state, with the rates relatively unchanged over the last 10 years. The rates, however, vary substantially by demographic group, with one-fifth of Latinos living in overcrowded conditions.

Percent Overcrowding

| 2005 | 2015 | |

| California | 8.0% | 8.4% |

| Latino | 21.6% | 19.7% |

| White, non-Latino | 1.7% | 2.2% |

| Asian | 8.7% | 8.9% |

| Black | 5.1% | 4.8% |

Source: American Community Survey, 1-year estimates

While the overcrowding rates have been relatively unchanged over the past 10 years, this outcome is the primarily the result of two factors. First, population growth has slowed as the birth rate has declined and as the state has gone from net immigration to net out-migration. Second, the housing supply benefited from the only period, 2003 – 2005, in the last 27 years when new housing construction reached levels sufficient to keep up with population. And while construction declined dramatically thereafter, it was at least some level of new homes being built. New cost measures such as prevailing wage would shut off this supply, and produce subsequent increases in the overcrowding rate as a growing population is limited by an essentially static supply.

California has 21.5% of the Nation’s Homeless Population

Based on the US Department of Housing & Urban Development (November 2016) Point-in-Time estimates, California in 2016 had 118,142 total homeless, or 21.5% of the national total. New York was 2nd with 15.7%.

The California 2016 number was down from 138,986 in 2007, but this data is developed through a count on a single night each January. The actual number can vary widely over the course of a year.

Inability to Afford Rent Increasingly Cited by the Homeless as the Reason Why They are Still Living on the Streets

While the Point-in Time surveys are conducted in most areas through standard census and demographic questions, some areas have also used these efforts to obtain more data related to the causes and reasons for duration of homelessness.

In 2015, nearly half of the homeless population surveyed in San Francisco responded they were still homeless because they could not afford rent.

Respondents were also asked what prevented them from obtaining housing. The greatest percentage (48%) reported they could not afford rent. Twenty-eight percent (28%) reported a lack of job or income. Most other respondents reported a mixture of other income or access related issues, such as the lack of available housing (17%), difficulty with the housing process (13%), or an eviction record (6%). Twelve percent (12%) of respondents reported that a criminal record prevented them from obtaining housing, and 8% reported a medical illness. Eight percent (8%) of respondents reported they did not want housing. (San Francisco, 2015)

Following a 50% increase in the median rent between 2011 and 2015, Oregon saw a 9% increase in the number of homeless students in the state’s schools in 2015 alone.

Rising rent costs and inadequate affordable housing have likely caused the number of homeless students in Oregon to spike, especially in the Portland area, officials say.

Statewide about 20,524 Oregon youth were homeless last year, making up about 4 percent of students, according to data released by the Oregon Department of Education October 1. That figure is a 9 percent increase from the prior year and marks the highest number of homeless students since the 2010-2011 school year.

. . . A city of Portland map from February 2014 showed not a single spot where a four-person household with an annual income of $20,800 spending 30 percent of that on housing could afford to rent or buy. For renters, rates climbed 8.6 percent year-over-year and hit an average of $1,614 a month, according to a Zillow analysis released in May. (Rising rents, lack of affordable housing causes jump in homeless students statewide, The Oregonian, October 8, 2015)

After achieving a 44% reduction in the homeless population through their 10-Year Plan to End Homelessness, Washington County, OR began to see an upward spike again in 2015.

Of the 424 households (591 persons) experiencing homelessness, 26% (109 households) report “couldn’t afford rent” as the primary cause of homelessness. The cause of homelessness is reflective of a rental housing market with less than 2 percent vacant units and a shortage of affordable housing for extremely low-income and low-income households. The need for affordable housing is a topic being addressed by local leaders, as well as communities across our nation. (Washington County, OR, Higher Cost of Housing Increases Homelessness, press release, May 7, 2015)

Continued upward pressures on housing prices, both rent and purchase, caused by increasing construction costs due to prevailing wage requirements would reduce the number of units affordable to low- and middle-income ranges, thereby continuing to increase the significance of affordability in the growth of homelessness in California. This factor could become particularly significant by eliminating the number of new affordable units associated with market-rate developments, the primary source of new affordable housing since the elimination of California’s redevelopment agencies.

Over Half of California’s Renter Households are Cost Burdened; A Quarter are a Step Away from Homelessness

The cumulative shortages in new home construction over the past 27 years have produced upward pressures on home prices and rents, with only a pause primarily during the housing collapse in 2008. Combined with growth since the recession that has pushed the economy from middle-class wage to low-wage jobs, just over half of renter households in California now pay more than 30% of their income for rent.

American Community Survey (1-year estimates) data shows that in 2015, 25.6% of renter households were moderately cost burdened (paying 30% to 49.9% of income for rent). The same data shows that 27.3% of households were severely cost-burdened (paying 50% or more of income for rent), for a total of 52.9% of all renter households cost burdened.

Seniors aged 65 and older—many of whom live on fixed incomes—comprised 16% of all cost burdened households.

As an estimate using the ACS 2015 income bands, the 13% housing cost increase from prevailing wage requirements would raise the share of rental households who are cost-burdened from 52.9% to 61.9%, placing an additional 540,000 household at greater risk of becoming homeless.

Construction Employment

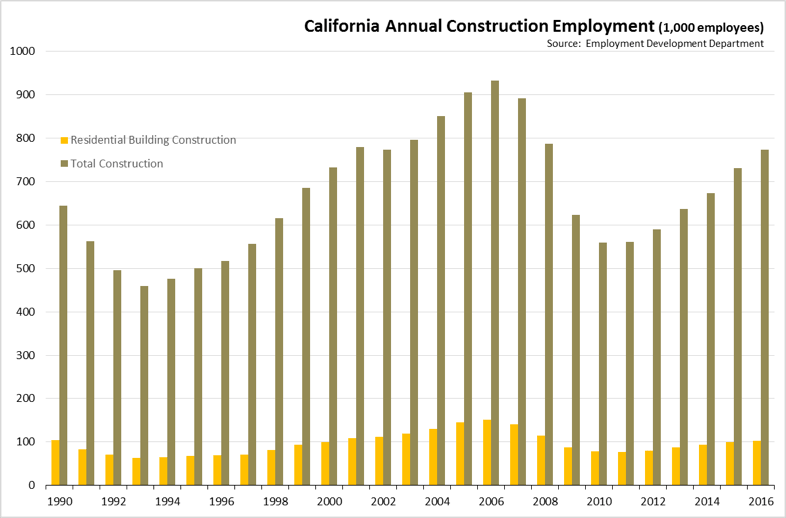

California Construction Employment is Still 17% Below Its 2006 Peak Level

Construction employment in California reached a peak level of 934,000 wage and salary workers in 2006, and began declining even before the housing crash in 2008. Based on the 2016 annual average, Employment Development Department data (Current Employment Statistics) shows the industry is still off by 159,600 employees, or 17.1% below the 2006 peak.

California Residential Building Construction Remains Nearly a Third Below Its 2006 Peak

Recovery within the Residential Building Construction industry (NAICS 2361) is even further away from its peak. At a 2016 annual level of 103,000, employment remains 31.7% below the 2006 high of 150,900.

Peak employment in this industry in the years 2003-2006 followed from the comparable peak in residential construction permits in 2003-2005, the only period during the last 27 years when permits exceeded 180,000 a year (California Department of Finance).

Residential Building Construction employment is not the only source of workers engaged in new home construction. Various other trades provide specialized labor such as for electrical, utilities, and other components of the final product. However, due to the current low levels of housing construction, Residential Building Construction employment has averaged only 13% to 14% of total Construction employment over the last few years, similar to the levels seen in prior years with low housing construction such as the 1990s.

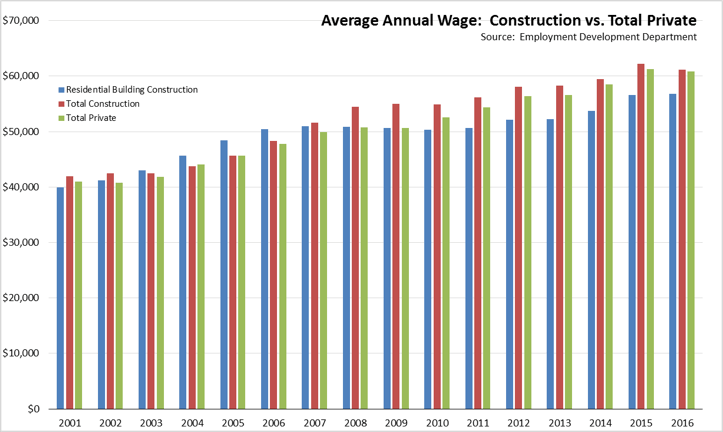

Rather than Mandating Wages, a Policy Alternative that Looked at Increasing Worker Incomes through Reforms to Increase the Level of Housing Construction could Raise Residential Building Construction Incomes by $3.1 Billion Annually