The Center for Jobs and the Economy has released a special report that provides an analysis of the migration patterns of high earning Californians, with a focus on how this trend accelerated in 2021, as evidenced by the significant taxable income loss experienced by the state. For additional information and data about the California economy visit www.centerforjobs.org/ca.

High Earner Taxodus Accelerated in 2021

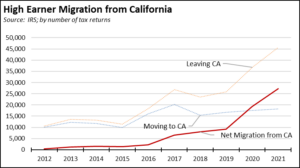

The migration of high earners to other states accelerated in 2021, according to the annual release of tax migration data from the Internal Revenue Service (IRS).

Net migration—the difference between households with a federal adjusted gross income (AGI) of $200,000 or more moving into California and those leaving—increased in 2021 to a loss of 27,340 comprising 69,350 persons. The number of high earners moving into the state essentially has shown little change since 2016. High earners leaving the state accelerated sharply during the first two pandemic years.

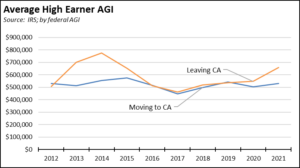

The income profile of high earner migration is changing as well. While there was little difference in average AGI in the period 2016-2019, those high earners leaving the state in the last two years have had higher incomes than those moving in, at a respective average AGI in 2021 of $660,700 vs. $530,400.

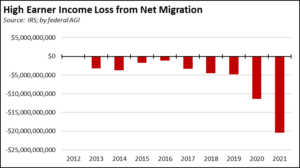

On balance, the net migration of high earners in 2021 had an average AGI of $747,600, representing a loss of $20.4 billion in taxable income (federal AGI) to the state. Using the tax year 2020 data from Franchise Tax Board (2021 is not yet available), this amount translates into an estimated $1.7 billion reduction in state personal income tax revenues, plus additional tax losses in property taxes, sales and use tax, fees and licenses, other revenues, and related business tax revenues that may have moved with these taxpayers. The estimated tax loss from all earners was $2.0 billion in 2021.

On a cumulative basis, the 2021 losses bring the 5-year high earner running total to an estimated $3.7 billion reduction in personal income tax.

Lower and Middle Income Earners Leaving as Well

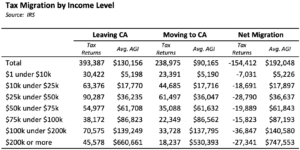

In 2021, California lost taxpayers and population in each income group. Including negative returns and foreign migration not shown in the following table, California had a net loss of 161,800 tax returns comprising 339,500 persons and total AGI of $29.1 billion.

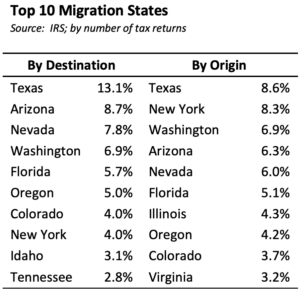

By state, the most popular destination states were Texas, Arizona, and Nevada. The most popular states for taxpayers moving to California were Texas, New York, and Washington.