The Center for Jobs and the Economy has released the first in a new series: Recession Watch. These reports will provide important information on employment trends and other key indicators and their impact on the state budget and economic outlook. For additional information and data about the California economy visit www.centerforjobs.org/ca.

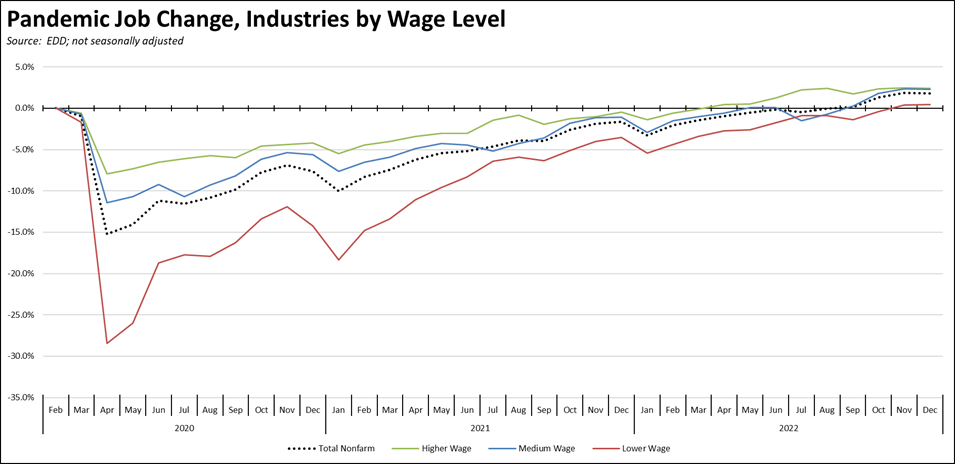

Recovery Progress

The December numbers continued the trend from recent months. Nonfarm job gains at 16,200 were positive but slowing, coming in at the second lowest for 2022 and representing only 7% of the total national gains of 223,000. Employment declined 20,000, posting the fifth month in a row with a loss in the number of employed. Compared to the February 2020 pre-pandemic peaks, California was 0.3% above that recovery measure for nonfarm jobs, but continued slipping to 1.6% below for employment.

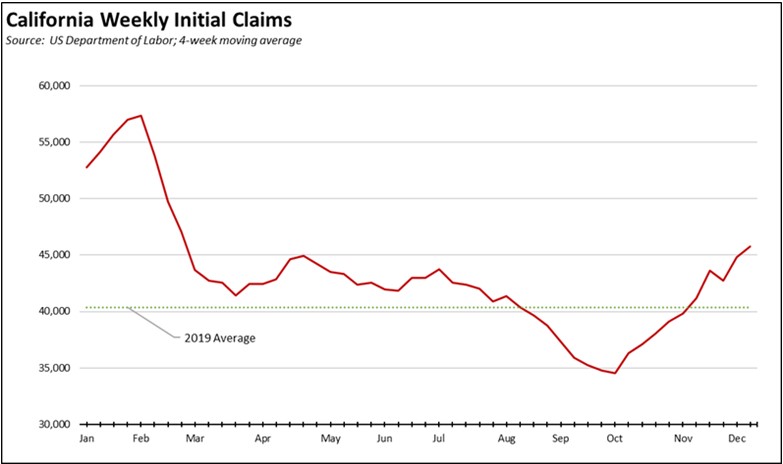

Unemployment Insurance Claims Rising

While at least a portion is due to seasonal factors, the number of initial claims (4-week moving average, not seasonally adjusted) continued rising in California along with the rest of the US, with the state numbers remaining above the 2019 average. For the past 4 weeks ending with the week of January 14, California initial claims at 22% of the national total were well above its share of total employment, and insured unemployment (a proxy for continuing claims) in the 4 weeks through the week of January 7 were 20% of the total.

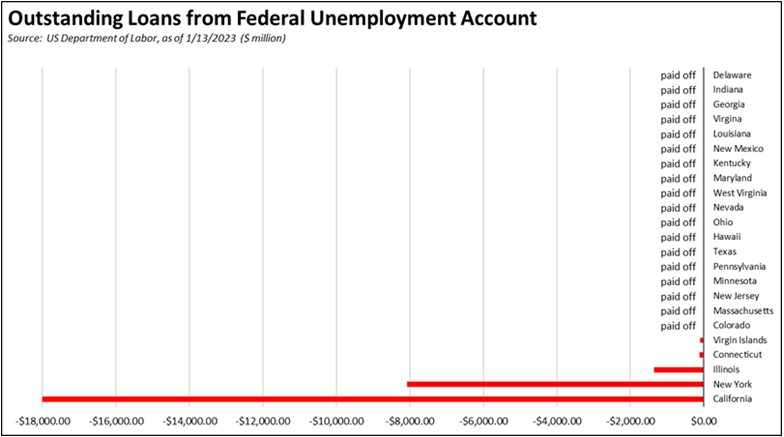

Federal Trust Fund Debt Now Down to California & New York

Even with the prospects of another economic downturn rising, California’s primary fund to assist unemployed workers remains fully unprepared. With Illinois previously announcing it will pay off its debt, California and, in a distant second, New York remain the primary states still relying on federal borrowing to sustain their unemployment funds both now and during what increasingly appears to be a looming recession in the upcoming year. In the current numbers, California is responsible for 66% of the total current federal debt. While 18 other states to date have paid off their debts—and in some cases restored their state fund balances to the levels prior to the pandemic—using the federal funds intended for this purpose, California has yet to make any similar progress. Even the limited $1 billion in payments proposed in the current Budget Act would be rescinded in the governor’s current budget proposals.