Download Report

Below are highlights from the recently released trade data from the US Census Bureau and US Bureau of Economic Analysis. To view additional data and analysis related to the California economy visit our website at www.centerforjobs.org/ca.

Compared to a year ago, the November trade numbers in general show improved activity through the state’s ports. Both origin exports and destination imports were up in nominal terms. Although down sharply from the prior month surge, total trade activity through the state’s ports was also up (6.3%) in nominal terms compared to the prior year, producing continued improvement (on a 12-month moving average) in both the share of US trade through the state’s ports and the state’s share of total US origin exports. This improvement comes as port activity recovers from the uncertainty facing shippers during the prolonged labor negotiations, and as global trade patterns face disruption from the Panama drought and threats to ships transiting through the Suez Canal.

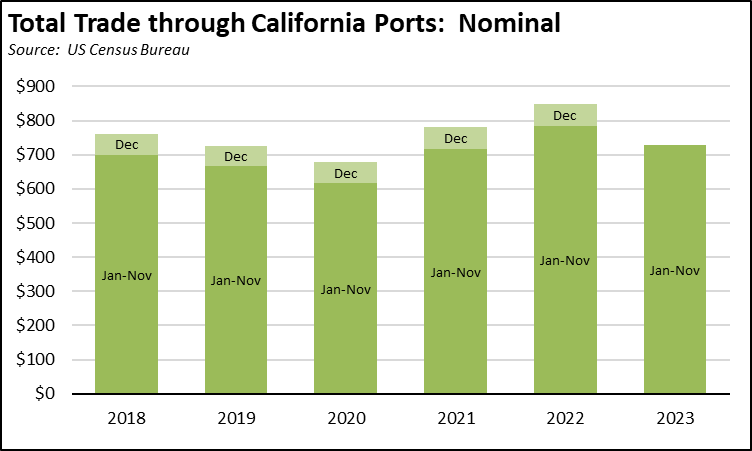

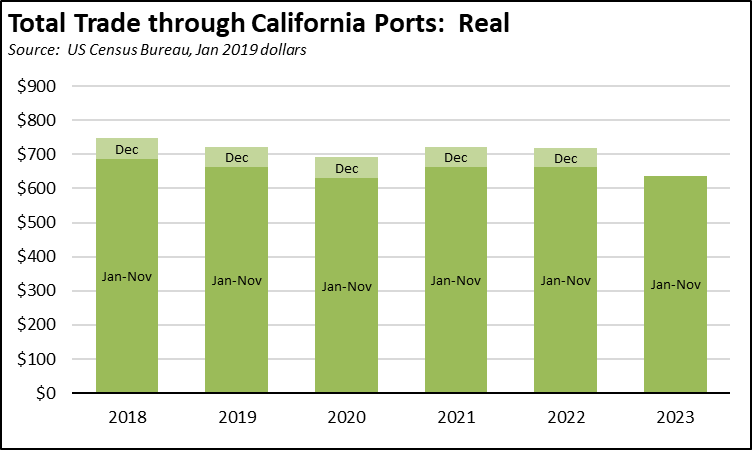

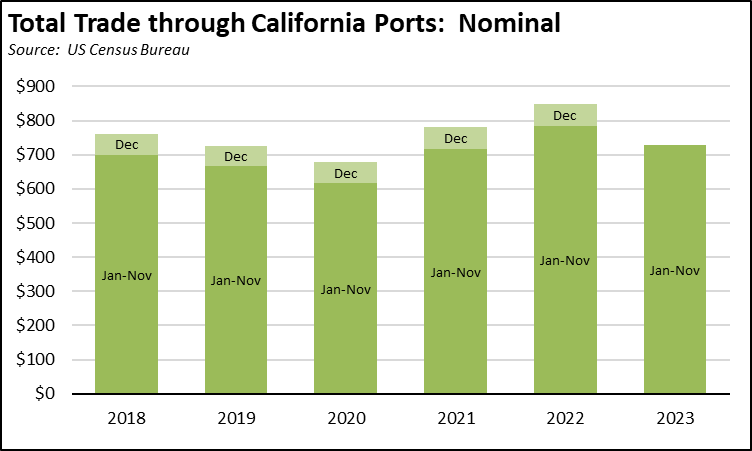

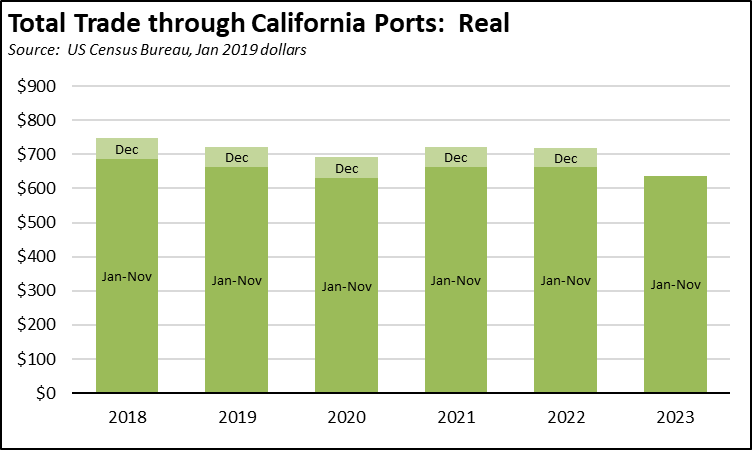

In nominal terms, total trade through the state’s ports year-to-date remained down from the 2022 highs, but also remained above the pre-pandemic levels in 2019.

In real terms, however, total trade through November fell 3.9% below the comparable level in 2019.

Share of Goods through US Ports

15.5%

CA Share of Total Trade

Through US Ports

The share of total US goods trade (exports and imports) through California ports edged up to 15.51% (12 month moving average; compared to 15.42% in October 2023 and 16.03% in November 2022).

California remained the #2 state, behind Texas with 20.06% (compared to 20.09% in October 2023 and 19.71% in November 2022). Trade through the Atlantic port states was at 30.02% (compared to 30.08% in October 2023 and 29.64% in November 2022). While down from previous years, this trade-related base forms one of California’s largest centers of middle-class, blue-collar jobs. Transportation & Warehousing alone provided 827,400 wage and salary jobs in the latest results for November.

California Goods Exports

$0.2

Billion Change in Exports

Total California goods exports were up $0.2 billion from November 2022 (up 1.3%). California remained in 2nd place with 8.87% of all US goods exports (12 month moving total), behind Texas at 21.98%.

California Goods Imports

$1.1

Billion Change in Imports

Total California destination goods imports rose $1.1 billion from November 2022 (up 2.9%).

Top 20 Exports, November 2023

Top 20 exports by value are shown below, along with the change from Nov 2022.

| NAICS Commodity |

Nov 2023 Exports ($b.) |

Change from Nov 2022 |

| Fruits & Tree Nuts |

$1.2 |

45.7% |

| Aerospace Products & Parts |

1.0 |

45.8% |

| Navigational/measuring/medical/control Instrument |

0.9 |

27.6% |

| Computer Equipment |

0.9 |

11.6% |

| Semiconductors & Other Electronic Components |

0.8 |

-4.0% |

| Communications Equipment |

0.6 |

-15.6% |

| Pharmaceuticals & Medicines |

0.6 |

-12.7% |

| Medical Equipment & Supplies |

0.5 |

-2.3% |

| Petroleum & Coal Products |

0.5 |

-20.8% |

| Miscellaneous Manufactured Commodities |

0.5 |

-13.2% |

| Industrial Machinery |

0.4 |

-37.2% |

| Electrical Equipment & Components, Nesoi |

0.4 |

4.3% |

| Waste & Scrap |

0.4 |

15.1% |

| Motor Vehicles |

0.3 |

4.0% |

| Other General Purpose Machinery |

0.3 |

17.8% |

| Commercial & Service Industry Machinery |

0.3 |

0.2% |

| Other Fabricated Metal Products |

0.3 |

7.7% |

| Foods, Nesoi |

0.3 |

-1.1% |

| Basic Chemicals |

0.3 |

-6.2% |

| Plastics Products |

0.2 |

-9.6% |

|

|

|

Top 10 Export Markets, November 2023

| Country |

Nov 2023 Exports ($b.) |

Change from Nov 2022 |

| Mexico |

$2.6 |

0.3% |

| China |

1.7 |

14.1% |

| Canada |

1.6 |

-2.5% |

| Japan |

0.9 |

1.2% |

| Taiwan |

0.7 |

7.7% |

| Korea, South |

0.7 |

-11.2% |

| Netherlands |

0.5 |

-8.0% |

| Hong Kong |

0.4 |

13.2% |

| Germany |

0.4 |

-8.3% |

| Malaysia |

0.4 |

69.4% |

|

|

|