Download Report

Below are highlights from the recently released trade data from the US Census Bureau and US Bureau of Economic Analysis. To view additional data and analysis related to the California economy visit our website at www.centerforjobs.org/ca.

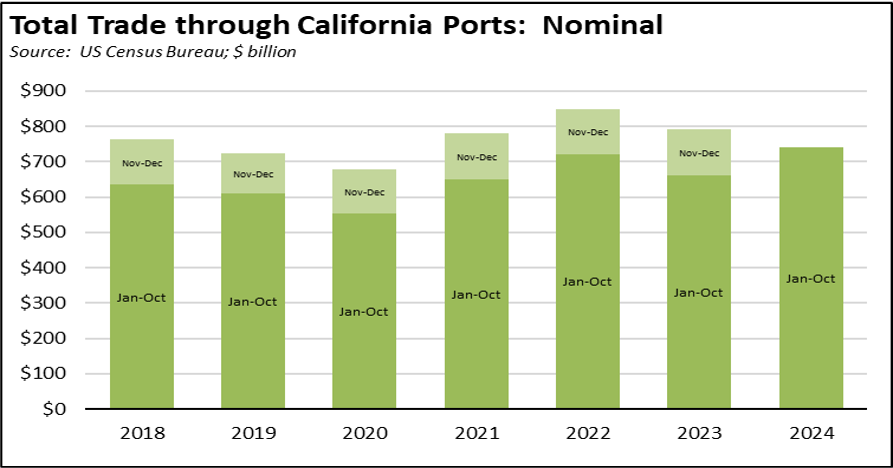

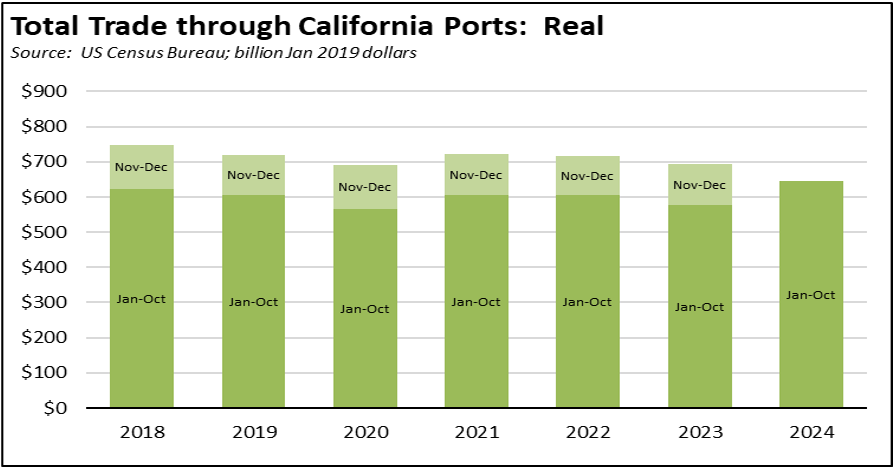

Trade Levels Continue Their Rise

In October, total trade through California’s ports reached its highest monthly level since at least 2003 in both nominal and real values as trade flows were diverted due to port disruptions in Canada and in the East and Gulf coast ports and as cargo owners sought to remain ahead of potential tariff increases in 2025. In nominal terms, total trade was up 33.1% compared to pre-pandemic October 2019, and up 17.6% compared to October 2023. Origin exports rose 5.4% compared to a year ago, while destination imports into the state were up 23.7%.

Overall, the surge in trade since March puts the state’s ports on track to set new records this year in both nominal and real values.

Share of Goods through US Ports

16.5%

CA Share of Total Trade

Through US Ports

The share of total US goods trade (exports and imports) through California ports edged up to 16.54% (12 month moving average; compared to 16.34% in September 2024 and 15.42% in October 2023).

California remained the #2 state, behind Texas which had a 20.02% share (compared to 20.06% in September 2024 and 20.09% in October 2023). Trade through the Atlantic port states was at 29.12% (compared to 29.32% in September 2024 and 30.07% in October 2023). These trade flows form the trade-related base for one of California’s largest centers of middle-class, blue-collar jobs. Transportation & Warehousing alone provided 771,100 jobs in October 2024, compared to 758,100 in October 2023.

California Goods Exports

$0.8

Billion Change

in Exports

Total California origin goods exports rose $0.8 billion compared to October 2023 (up 5.4%). California remained in 2nd place with 8.86% of all US goods exports (12 month moving total), behind Texas at 22.03%.

California Goods Imports

$3.2

Billion Change

in Imports

Total California destination goods imports grew $3.2 billion from October 2023 (up 7.7%).

Top 20 Exports, September 2024

Top 20 exports by value are shown below, along with the change from October 2023.

| NAICS Commodity | Oct 2024 Exports ($b.) | Change from October 2023 |

|---|

| Computer Equipment | $1.7 | 90.6% |

| Fruits & Tree Nuts | 1.2 | 11.7% |

| Semiconductors & Other Electronic Components | 1.1 | 9.4% |

| Aerospace Products & Parts | 1.0 | 6.1% |

| Navigational/measuring/medical/control Instrument | 0.9 | -4.5% |

| Communications Equipment | 0.6 | -11.4% |

| Pharmaceuticals & Medicines | 0.6 | -11.3% |

| Electrical Equipment & Components, Nesoi | 0.6 | -3.9% |

| Medical Equipment & Supplies | 0.5 | -3.9% |

| Petroleum & Coal Products | 0.5 | 2.3% |

| Commercial & Service Industry Machinery | 0.5 | 58.4% |

| Miscellaneous Manufactured Commodities | 0.5 | -7.6% |

| Waste & Scrap | 0.4 | 11.7% |

| Industrial Machinery | 0.4 | -17.1% |

| Used Or Second-hand Merchandise | 0.4 | 18.5% |

| Other General Purpose Machinery | 0.4 | 4.6% |

| Motor Vehicle Parts | 0.3 | -10.8% |

| Other Fabricated Metal Products | 0.3 | 16.5% |

| Foods, Nesoi | 0.3 | 12.1% |

| Electrical Equipment | 0.2 | -0.2% |

| | |

Top 10 Export Markets, September 2024

| Country | Oct 2024 Exports ($b.) | Change from October 2023 |

|---|

| Mexico | $3.2 | -4.1% |

| China | 1.5 | 0.6% |

| Canada | 1.3 | -19.5% |

| Japan | 0.9 | -1.2% |

| Korea, South | 0.7 | 4.9% |

| Netherlands | 0.7 | 55.5% |

| Taiwan | 0.7 | 2.0% |

| United Kingdom | 0.6 | 75.7% |

| Singapore | 0.6 | 45.9% |

| Hong Kong | 0.5 | -4.2% |

| | |