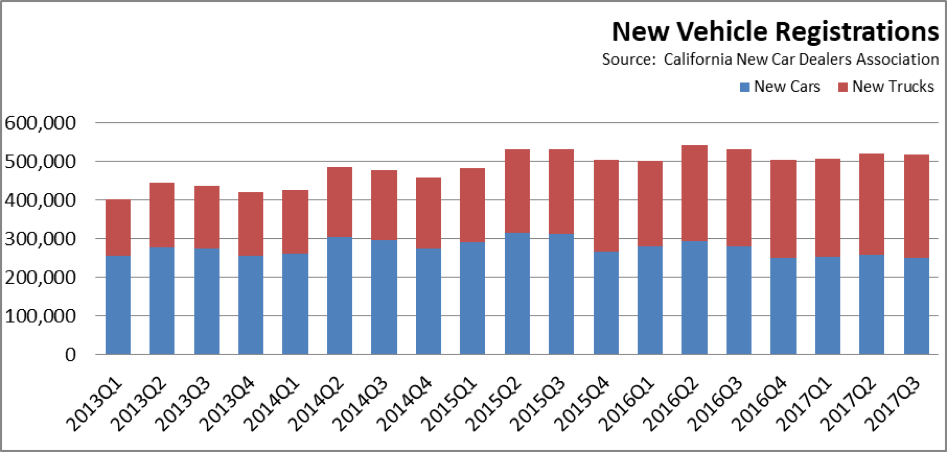

The latest new vehicle sales data from California New Car Dealers Association shows Californians remain on track to exceed 2 million new light vehicle purchases in 2017, although sales are beginning to ease from comparable levels a year ago. Key findings from the data:

Light Trucks Continue to Exceed Half of New Vehicle Sales

- Total light vehicle sales in 2017:Q3: 518,080. Down 2.8% from 2016:Q3.

- 2017:Q3 Market share, cars: 48.7%. Down from 52.8% in 2016:Q3.

- 2017:Q3 Market share, light trucks: 51.3%. Up from 47.2% in 2016:Q3.

- California average price per gallon regular gasoline, 2017:Q3: $3.05. Up from $2.77 in 2016:Q3.

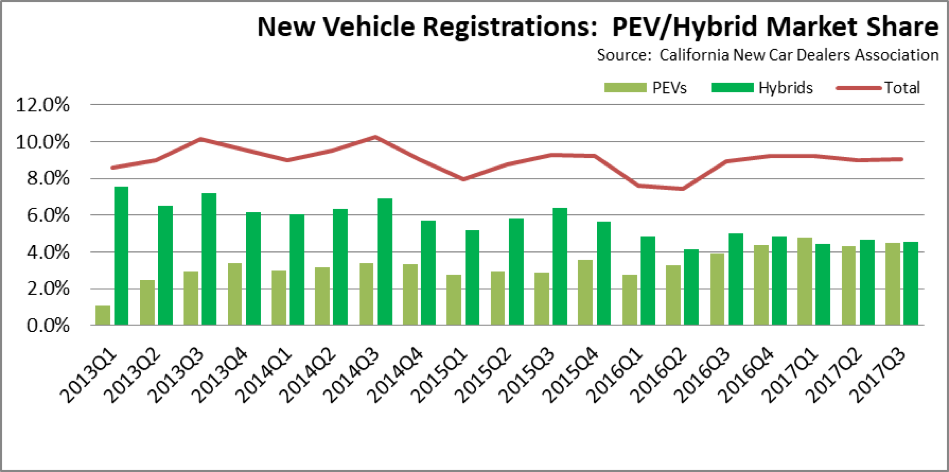

PEV Sales Up in Third Quarter

- 2017:Q3 PEV sales (plug-in hybrids and battery electric vehicles) at 23,336 vehicles, up 11.3% from 2016:Q3. Total market share for PEVs was 4.5%, up from 3.9% in 2016:Q3.

- True EV sales (battery electric vehicles) at 12,796 vehicles, up 7.8% in 2016:Q3, with market share going from 2.2% in 2016:Q3 to 2.5% in 2017:Q3.

- Hybrid sales (except for plug-in hybrids) at 23,611, down 11.5% from 2016:Q3. Total market share was 4.6%, down from 5.0% in 2016:Q3.

- Combined (PEVs and Hybrids) market share for alternative-fuel vehicles has essentially plateaued over the past 5 quarters at around 9.1%. While some consumers may be waiting for the introduction of new models such as from Tesla, purchases are being made as consumers switch from Hybrids to PEVs rather than expansion of this overall category.

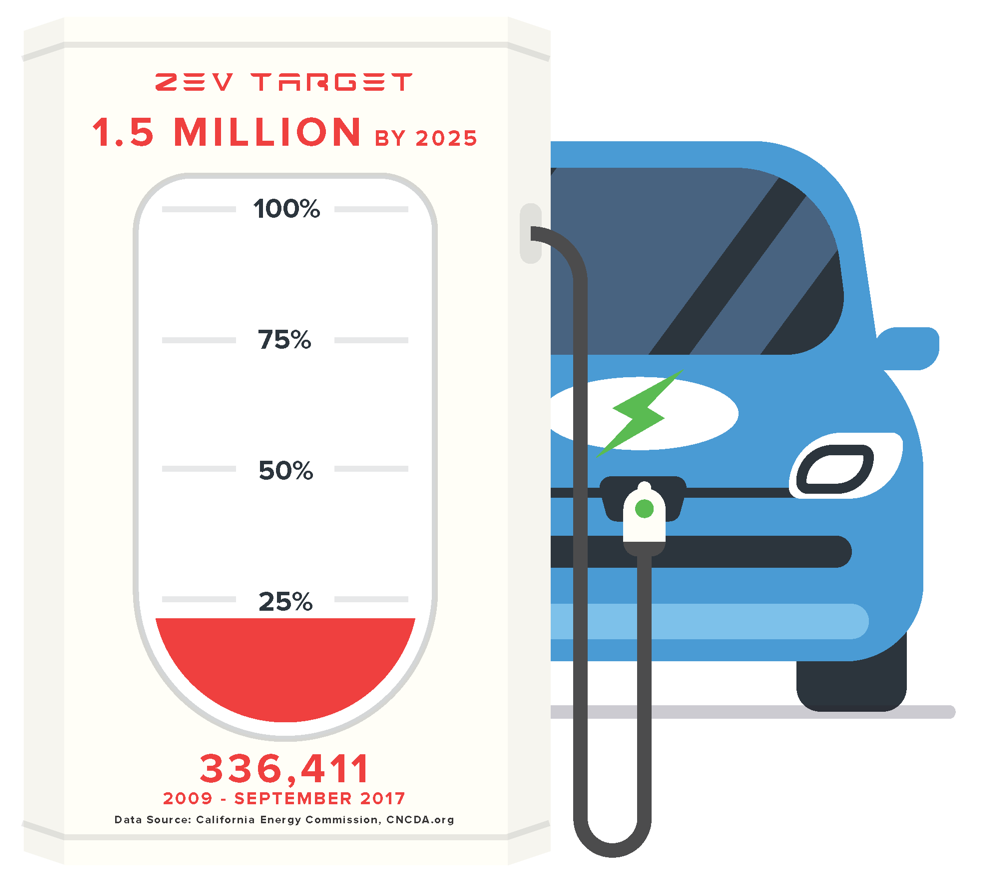

Cumulative PEV Sales at 22.4% of 2025 Goal

As part of the AB 32 climate change program, Executive Order B-16-2012 administratively created a goal of 1.5 million zero-emission vehicles (ZEVs) on California roads by 2025, with a sub-goal that their market share is expanding at that point. The order also established interim mileposts primarily related to infrastructure support for recharging along with more qualitative targets for manufacturing capacity and commercial viability of these vehicles.

Rather than only true ZEVs, implementation of this goal has been interpreted by the agencies as being met by both BEVs that run only on electricity and PHEVs which run on both electricity and motor fuels. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but to date, just over 300 have been registered in the state.

Under the current agency interpretations, total PEV sales since 2009 account for 22.4% of the 2025 goal. However, applying the Executive Order standards to true zero-emission vehicle sales (BEVs), the state instead has achieved only 11.5% of the 2025 goal.

Previous Center updates were based on the most current Energy Commission estimates for ZEVs currently registered and actually operating on California’s roads, updated with the CNCDA quarterly sales data. The most recent Energy Commission update, however, has shifted from tracking progress based on registrations to reporting of cumulative ZEV sales based on estimates from an outside organization. The numbers, therefore, overestimate the number of ZEVs actually operating in the state by not taking into account ZEVs that have been moved out of state, traded in, involved in accidents, or otherwise removed from operation on the state’s roads. The tracking graphic below has been revised to conform to the Energy Commission’s current approach.

As an indication of the significance of this change, the previous Energy Commission estimate of registrations showed an 8% drop-off from the then-current cumulative sales number, a factor consistent with fleet-turnover rates for vehicles of this type. Applying this factor to the latest sales total, the actual progress rate consistent with the Executive Order language would be 20.6% rather than the 22.4% shown in the chart below.

Accounting for normal fleet turnover rates and reductions from persons moving out of California, PEV sales even under the revised Energy Commission approach would need to be 2.0 times as large in order to meet the 2025 goal. Considered from true zero emission vehicles, sales of BEVs would have to be 4.1 times as large.

Manufacturing Provisions of the Executive Order Still Not Implemented

Executive Order B-16-2012 also contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

- [By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

- [By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

- [By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the expansion of the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the ZEV Action Plan instead calls primarily for data collection and conversations:

Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.

Since the last update, the following investments have been announced to locate ZEV-related manufacturing jobs outside of California:

- In September, Daimler announced a $1 billion investment to ramp up electric vehicle production at its Tuscaloosa, AL plant.

- In October, Tesla announced it will build a manufacturing plant in China. While California essentially created the modern-day electric vehicle industry through its clean air regulations, Tesla joins most other manufacturers in locating facilities in China rather than in California as envisioned in the Executive Order.

- In November, Tesla announced the purchase of a second automation company, Perbix in Minnesota, to facilitate improved automation at its manufacturing facilities.

- In November, Mahindra opened its North American headquarters in Detroit and announced it was assessing when to begin sale of electric vehicles in the US.

- In November, Volkswagen announced $12 billion in manufacturing investment over 7 years with its China partner, JAC.

- In November, Chinese manufacturer GAC Motor announced it will begin exporting its Trumpchi line of electric vehicles to the US by 2019.