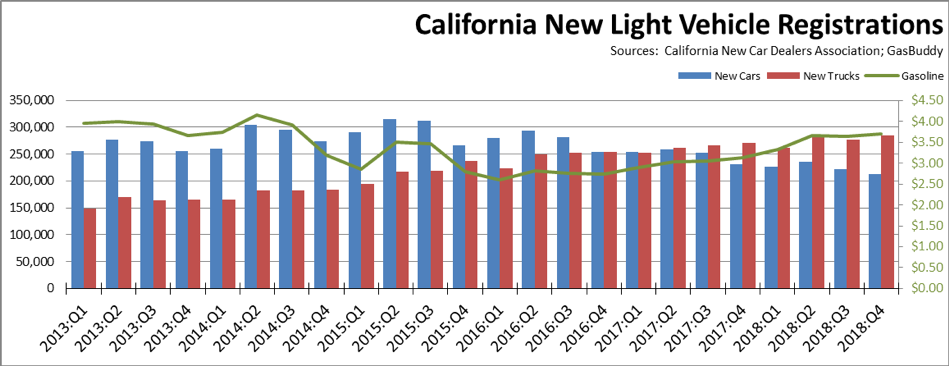

The latest new vehicle sales data from California New Car Dealers Association indicates that sales once again exceeded 2 million units for the year. Although slowing 2.2% from the prior year, this indicator reflects the level of overall consumer confidence and continuing strength of the recovery. New vehicle sales are also a critical indicator of state and local revenues, with Motor Vehicle and Parts Dealers (NAICS 441) producing 13.1% of total sales and use tax in the most recent data for the first three quarters of 2017.

Q4 deliveries for battery electric plug-ins (BEVs) continued to rise as Tesla promoted sales based on the pending phase out of federal subsidies along with some compensating shifts in vehicle prices. Other key findings from the data:

Light Trucks at 57% of Sales

-

- Light truck market share in the quarter was 57.3%, up from 54.0% in Q4 2017, as consumers continue to show a growing preference for this type of vehicle.

- Consumer shifts to light trucks for the US outside California continued to be more pronounced, accounting for 70.6% of new light vehicle sales in this quarter and 68.8% for the year overall. The potential for California’s ZEV policies to be replicated beyond its borders remains low as the market segment targeted by most PEV models—cars—continues to contract as a result of consumer preferences.

- The trend towards light trucks continues in spite of higher fuel prices. The average California price for regular gas in Q4 2018 was $3.70 a gallon, 19.5% higher than the prior year’s $3.13.

PEV Sales Up in 4th Quarter

| 2018:Q4 | 2017:Q4 | |||

|---|---|---|---|---|

| number | mkt share | number | mkt share | |

| BEV | 33,427 | 6.7% | 15,072 | 3.0% |

| PHEV | 17,309 | 3.5% | 13,435 | 2.7% |

| PEV | 50,736 | 10.2% | 28,507 | 5.7% |

| HEV | 20,163 | 4.1% | 22,991 | 4.6% |

| Total | 70,899 | 14.2% | 51,498 | 10.2% |

Source: Derived from California New Car Dealers Association

- BEV sales saw a substantial increase (from 3.0% to 6.0% share of total sales), but primarily as a result of Tesla’s continued delivery of vehicles from prior orders. Tesla sales volume in this quarter was 25,969 (all models), or 78% of all BEVs sold in the state. While the BEV component is likely to continue rising in the next few quarters as Tesla continues to ramp up production, the longer term market penetration of BEVs will not become clear until several current extraneous factors work themselves out.

First, Tesla stopped taking reservations in July 2018 and has since moved to a direct order system, a change that will bring the data closer to its actual trend in the coming quarters as backlogged order deliveries catch up. Second, both Tesla and GM are now entering the phase-out period for federal subsidies, and the true market potential will become more apparent as this price distortion is removed.

Finally, Tesla’s pricing continues to place its vehicles in the Near Luxury and above market segments. With BEV sales consequently being driven by higher income buyers engaged at this level, longer term sustainability of market share still is dependent on models at price levels for middle income buyers including Tesla’s goal of $35,000. Even at this level though, state and local taxes and fees will tack on additional charges in the $3,000 to $4,000 range depending on location, leaving out-of-pocket costs still close to the $40,000 level even before considering any optional packages.

- PHEV sales continued to rise at a lower level, offset partially by a dip in HEVs compared to the year prior.

Alternative Market Share Above Long-term Trend

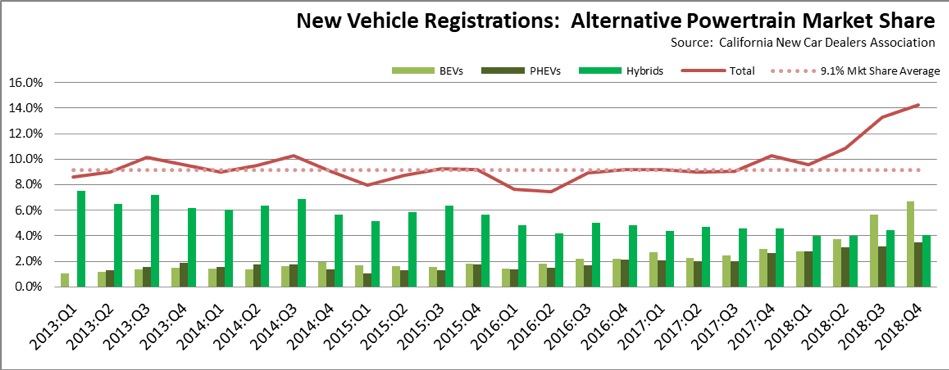

- Over the longer term, sales of alternative fuel vehicles previously deviated little from an average market share of 9.1%. The sales mix instead changed as consumers open to these vehicles shifted from HEVs to PEVs as more models became available.

- The 2018 results finally show a departure from this long term share, with alternative vehicles reaching a 14.2% market share in the last quarter and 12.0% for the year overall. The sustainability of this higher penetration level, however, remains dependent on the factors discussed above along with diversification into lower price levels in a state market now dominated by Tesla’s current higher price models.

- Stability of the market share will also be dependent on the extent to which the combustion vehicle component of the mix—PHEVs and HEVs—turn out to be transitional technologies as many analysts expect or due to pricing, remain the primary offering from the state’s regulations available to middle and lower income buyers. This factor in particular has important distributional implications to current policy considerations concerning vehicle fuels, including proposals to further shrink an already isolated and volatile state fuels market.

- Additional pricing uncertainty and consequent long term market share also is subject to the continuing dispute between California and the federal government over the state’s ZEV waiver and proposed amendments to the CAFE regulations. With federal credits expiring as producers reach their sales ceilings, the subsidies made possible through the expansion of credits created under the prior ZEV/CAFÉ structure become more significant in vehicle pricing. While shifting the cost burden from public coffers to an unadvertised charge on consumers buying traditional cars and trucks, these credits were previously set to take on an increasing role in subsidizing future sales of these vehicles, in particular BEV models currently targeted to the higher income segments of the market.

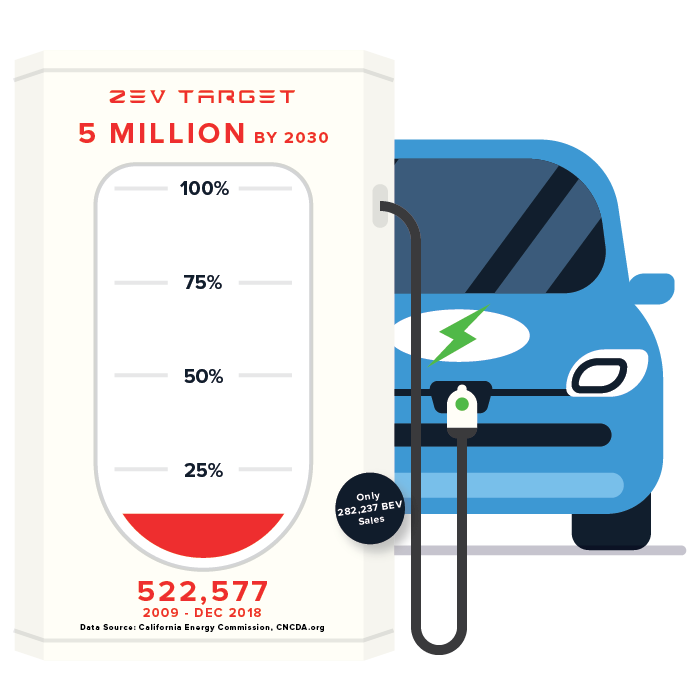

Cumulative PEV Sales at 10.5% of 2030 Goal—True ZEVs at 5.6%

As part of the AB 32 climate change program, Executive Order B-48-18 administratively created a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030. This action expands on the prior Executive Order B-16-2012, which set a goal of 1.5 million by 2025, with a sub-goal that their market share is expanding at that point. While these goals were set administratively, they are reflected in the state’s climate change strategies, and both public and utility ratepayer funds are being used to create the refueling infrastructure required for these motorists.

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both BEVs that run only on electricity and plug-in hybrids (PHEV) which are combustion vehicles that run on both electricity and motor fuels. Consequently, only a portion of the vehicles being counted to meet the zero emission goal—roughly half based on current sales volumes—will in fact produce zero emissions when driven. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but CNCDA data show total market share for these vehicles to date at only 0.1%.

Using this more flexible interpretation that includes both true ZEVs and combustion PHEVs, total PEV sales since 2009 account for 10.5% of the 2030 goal. True ZEV sales, however, account for only 5.6%.

The Executive Orders, however, also refer to ZEVs on California roads, while the agency accountings concentrate on sales. Using prior Energy Commission reviews to account for ZEVs no longer on the roads as a results of accidents, moves out of state, and other factors that over time remove vehicles from the active fleet, the actual progress rate consistent with the Executive Order language of “vehicles on California’s roads” would be 9.6% rather than the 10.5% shown in the chart below.

Accounting for normal fleet turnover rates and reductions from persons moving out of California, PEV sales would need to be 2.9 times higher to meet the 2030 goal. True ZEV sales would have to be 5.0 times higher. These numbers assume, however, that the current market share will remain elevated above the long-term average.

Manufacturing Job Provisions of Executive Order B-16-2012 Still Not Implemented

Like its predecessor, Executive Order B-48-18 contains some language referencing the economic and jobs potential associated with expansion of the ZEV market in California. However, the primary language shows a shift in focus to developing temporary construction jobs through installation of charging infrastructure rather than the permanent manufacturing and associated jobs development originally envisioned in B-16-2012. However, because this earlier order was not repealed, its provisions would still remain in effect.

Executive Order B-16-2012 contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

- [By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

- [By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

- [By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the ZEV Action Plan instead calls primarily for data collection and conversations:

Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.

Since the last update, Tesla’s Fremont facility continues to be the primary ZEV producing presence in California, with the battery components—which typically comprise half the value chain of an electric vehicle—produced in the Nevada Gigafactory. Other related announcements since the last quarter include:

- Boeing successfully tested its electric vertical take-off and landing (eVTOL) air taxi. The vehicle was developed by its Aurora Flight Sciences subsidiary, which is headquartered in Virginia with manufacturing in West Virginia and Mississippi.

- As it continued to improve production efficiencies and its cost structure, Tesla announced it was laying off another 3,000 workers—more than 1,000 in California—on top of the 9,000 announced earlier in 2018.

- Volkswagen announced an $800 million EV assembly line addition to its Chattanooga, TN plant.

- Toyota announced a partnership with Panasonic to produce EV batteries, with Panasonic shifting 5 of its production facilities in Japan and China to the new venture.

- Waymo and Magna announced they will build a factory in Michigan to produce self-driving cars, based on Chrysler’s Pacifica Hybrid minivan and Jaguar’s I-PACE.

- Download Report

[1]“Tesla Removes Affordable Model 3 Variant from Website,” GM Authority, July 17, 2018.