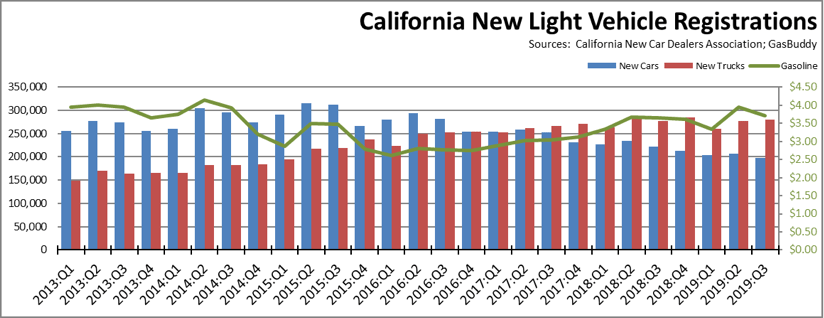

The latest new vehicle sales data from California New Car Dealers Association indicates that sales are still projected to be just over 1.9 million units for the year, slipping below sales in the prior four years but still well above historical levels. While slowing, this indicator reflects the level of overall consumer confidence and continuing strength of the recovery. New vehicle sales are also a critical indicator of state and local revenues, with Motor Vehicle and Parts Dealers (NAICS 441) producing 12% of total taxable sales in the most recent data for the second quarter in 2019.

Light Trucks at 59% of Sales

- Californians continued to shift to light trucks, with the market share in the quarter edging up to 58.6%, compared to 57.2% in the prior quarter and 55.5% a year ago in Q3 2018. For all states other than California, light trucks comprised nearly three-quarters of the market.

- The average California price for regular gas in Q3 2019 was $3.71 a gallon, down from $3.95 a year prior.

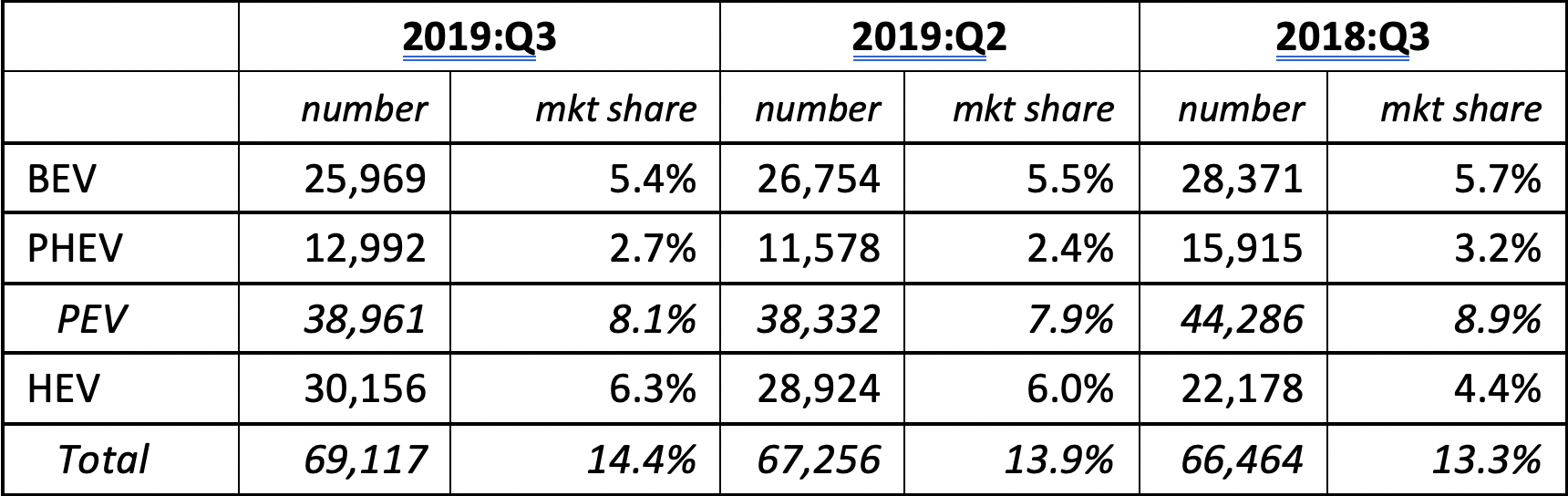

PEV Sales Mixed Results in 3rd Quarter

Source: Derived from California New Car Dealers Association

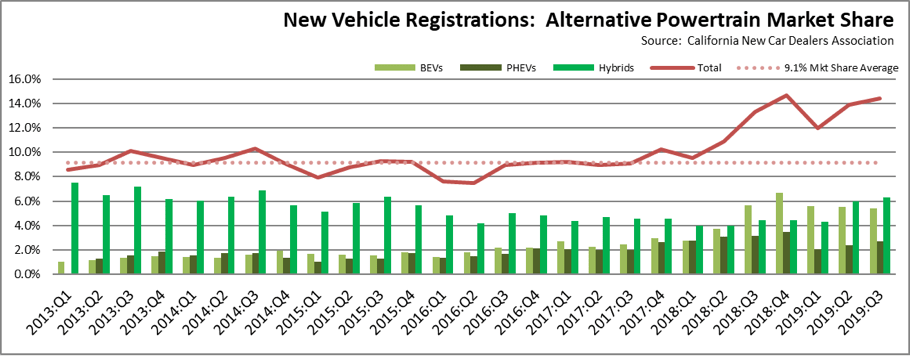

- Total market share for alternative fuel vehicles remains elevated above the longer-term 9.1% share, but continues to reflect shifting trends among the three components.

- After showing marked growth beginning in the second half of 2018 as Tesla ramped up deliveries on backorders for its Model 3, BEV sales continue to be above the prior levels, but dipped 3% from the prior quarter and 8% from the same quarter a year ago.

- The extensive system of direct subsidies enacted by the state along with the indirect subsidies that would be expanded nation-wide under the state’s regulations now subject to dispute with the federal government continue to accrue unevenly to a single producer. While additional models from other companies are scheduled for release in the coming year, Tesla accounted for 71% of total BEV sales in the 3rd quarter.

- PHEVs continue to show the strongest change from the prior trends. Although sales were up 12% from the prior quarter, the overall trend has shifted back to the 2017 levels after showing some growth in 2018.

- HEVs, however, have regained their role in exerting the strongest effect on total market share for alternative fuels. After a longer term decline through the end of 2018 in both sales and market share, the numbers rebounded strongly in the last two quarters.

- While total market share remains up compared to historical levels, the two combustion vehicle components—PHEVs and HEVs—continue to make up about 2/3 of the total. As expected as the Model 3 backorders were filled, BEV market share continued to ease in this quarter.

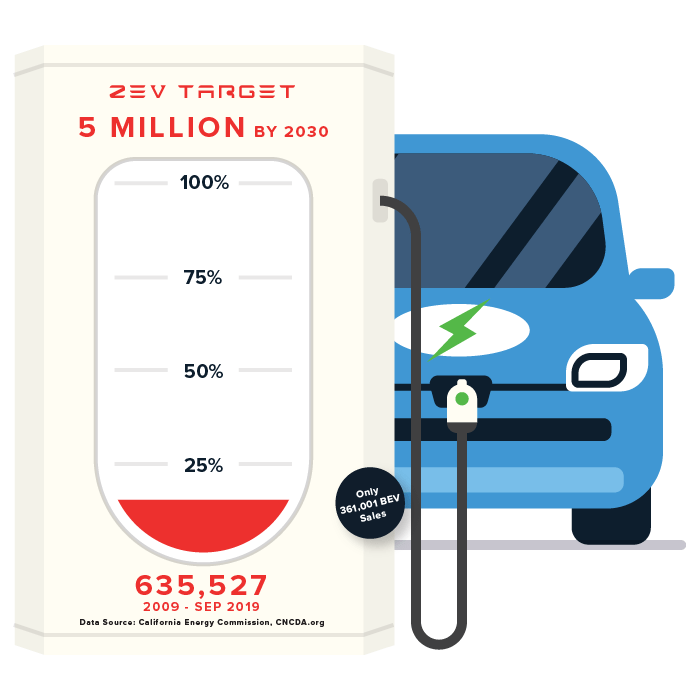

Cumulative PEV Sales at 12.7% of 2030 Goal—True ZEVs at 7.2%

As part of the AB 32 climate change program, Executive Order B-48-18 administratively created a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030. This action expands on the prior Executive Order B-16-2012, which set a goal of 1.5 million by 2025, with a sub-goal that their market share is expanding at that point. While these goals were set administratively, they are embodied in the state’s climate change strategies, and both public and utility ratepayer funds are being used to create the refueling infrastructure required for these motorists.

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both BEVs that run only on electricity and combustion PHEVs that run on both electricity and motor fuels. Consequently, only a portion of the vehicles being counted to meet the zero emission goal—roughly half based on current sales volumes—will in fact produce zero emissions when driven. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but CNCDA data show total market share for these vehicles to date at around 0.1%.

Using this more flexible interpretation that includes both true ZEVs and combustion PHEVs, total PEV sales since 2009 account for 12.7% of the 2030 goal. True ZEV sales, however, account for only 7.2%.

In addition to the distortion that comes from including combustion vehicles in the ZEV total, the Executive Orders also refer to ZEVs on California roads while the agency accountings rely on sales as the measure of progress. Using prior Energy Commission reviews to account for ZEVs no longer on the roads as a result of accidents, moves out of state, and other factors that over time remove vehicles from the active fleet, the actual progress rate consistent with the Executive Order language of “vehicles on California’s roads” would be 11.7% rather than the 12.7% shown in the chart below.

As discussed in the Q1 2018 report, carpool lane sticker data, however, suggests the differences may be even higher. While the “purple” decal numbers for cars bought beginning in 2019 track closely with the PEV sales since January, the “red” decal numbers for cars bought in prior years cover only 59% of PEVs sold in the applicable period. This discrepancy suggests a much higher turnover of PEVs “off California’s roads” than in prior estimates.

Manufacturing Job Provisions of Executive Order B-16-2012 Still Not Implemented

Executive Order B-16-2012 contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

[By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

[By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

[By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The state’s current energy costs, additional labor law restrictions and litigation risks, and lengthy permitting processes continue to limit the ZEV related manufacturers choosing to locate within California. Rather than tackle these well-documented barriers to new manufacturing jobs, the most recent version of the ZEV Action Plan instead calls primarily for data collection and conversations:

Moving forward, state government will play a central role connecting regions to share best practices, gathering economic data to measure ZEV market growth and ensuring our workforce is trained to meet future needs.

Like many other statements concerning job creation associated with the state’s environmental and energy policies, these provisions related to ZEVs primarily consist of promises with little in the way of concrete action to shift the other state policies and regulations standing in the way of creating these types of permanent jobs within the state. California does have a significant ZEV production presence from Tesla, but Tesla located here primarily because of the availability of a vacant vehicle production facility that was fully permitted and constructed. California previously had several such facilities, but instead of being repurposed to create new manufacturing jobs, they were instead mined to produce air quality emission credits.

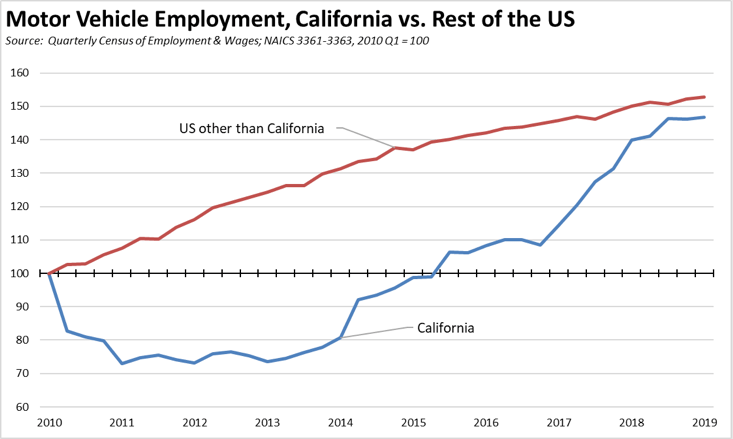

The availability of a fully permitted and quick-to-operational facility in Fremont has at least made it possible for California to come close to catching back up with the rest of the country in vehicle-related employment. As shown in the chart below, California employment in the related industries (NAICS 3362 Motor Vehicle Manufacturing, 3362 Motor Vehicle Body & Trailer Manufacturing, and 3363 Motor Vehicle Parts Manufacturing) in the most recent 2019 Q1 data was 47% above the level in 2010 Q1, somewhat below the equivalent figure for the other states which came in 53% higher. Rather than making California an electric vehicle manufacturing center, this relative performance reflects the fact that other states are doing as well or better in securing these jobs.

California’s gains much like the overall progress to date on the ZEV goals relied heavily on a single producer, Tesla, and to a great extent a single model, the Model 3, as shown in the employment upsurge beginning in 2017 but that has leveled off in the past 3 quarters.

California essentially gave birth to the modern electric vehicle industry through regulations issued in 1990. The state’s failures to enact the required reforms necessary for a stronger manufacturing presence has instead seen this industry the state created increasingly concentrated in China. And as China continues to expand its near monopolistic control over the battery production needed to fuel these vehicles, this concentration is only slated to grow more intense in the years to come.

Past issues of this report have tracked the shift of the electric vehicle industry to other states and to China. Some events over the past quarter have included:

- While many analysts previously anticipated battery critical shortages in the near term as a result of projected electric vehicle demand (see the Center’s California’s Cobalt Economy report), a slowdown in actual sales below those projections has seen recent sharp drops in prices for materials such as cobalt, lithium, graphite, and battery-grade nickel. Glencore announced in August the idling of its Mutanda Mine in Democratic Republic of the Congo, removing about 20% of global production from the market.

- In November, Ford revealed its Mustang Mach-E SUV which will be built in Mexico. The company chose a location “. . . where labor costs are low, and with a price starting at $43,895, the automaker says it will avoid the losses automakers typically suffer selling high-cost EVs.” Ford was also reportedly considering producing the model in China as well.

- As part of its recent contract negotiations, GM offered to replace jobs at the closing Lordstown, OH plant—which recently employed 3,000 workers, down from its prior peak of 15,000—with a new facility producing batteries for electric vehicles but with only 300 workers. Wages at the battery facility are slated for $15 to $17 an hour, replacing the $30 an hour wages worker earned at the closing plant.

- Electric-truck start-up Lordstown Motors subsequently announced it had acquired GM’s Lordstown plant, where it planned to produce vehicles under a license from Workhorse Group and employ 400 workers.

- Volvo’s Polestar opened its factory in Chengdu, China to produce hybrid electric vehicles for export and sale to the US.