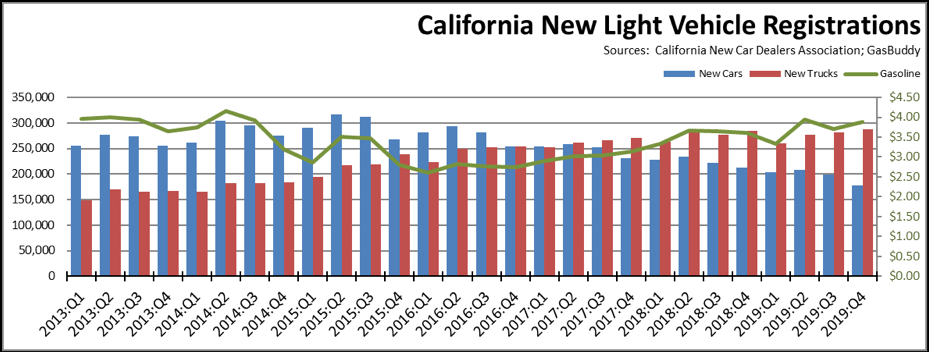

The latest new vehicle sales data from California New Car Dealers Association shows total 2019 sales at 1.89 million units for the year, slipping below the prior four years but still well above historical levels. While slowing, this indicator reflects the level of overall consumer confidence and continuing strength of the recovery. New vehicle sales are also a critical indicator of state and local revenues, with Motor Vehicle and Parts Dealers (NAICS 441) producing 12% of total taxable sales in the most recent data for the third quarter in 2019.

Light Trucks at 62% of Sales

- Californians continued their shift to light trucks, with the market share in the quarter rising to 61.8%, compared to 58.6% in the prior quarter and 57.2% a year ago in 2018:Q4. For all states other than California, light trucks continued rising to just over three-quarters of the market.

- Californians’ shift to light trucks since 2017 has continued even with generally rising gas prices in this period. The 2019:Q4 price per gallon for regular averaged $3.89 compared to $3.61 the year prior.

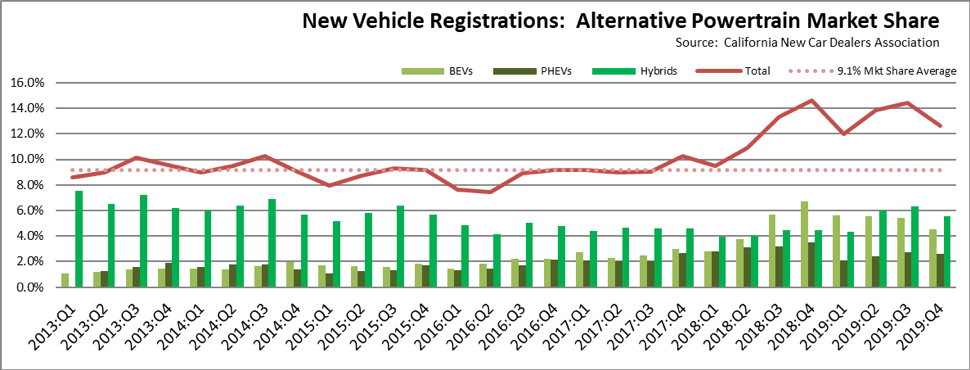

PEV Sales Drop in 4th Quarter

Source: Derived from California New Car Dealers Association

- Total market share for the primary alternative fuel vehicles remains elevated above the longer-term 9.1% share, but continues to reflect shifting trends among the three components. BEVs appear to be settling in the 4-5% range as sales no longer reflect the ramp-up in Model 3 backorder deliveries that began in the second half of 2018. In regard to the two combustion engine components, PHEV sales continue to show some volatility, while the overall share has again become dominated by the upsurge in HEVs rather than the plug-in vehicles the state’s policies attempt to promote. Again, these shifts illustrate that the overall market share for alternative vehicles remains largely fixed even if at a somewhat higher level, with consumers in this market component moving between HEVs and the other two components rather than the long expected breakthrough into more customers who now buy traditional vehicles. In addition, California New Car Dealers Association results for the first half of 2019 show additional movement came from a weakening as well for the other alternative powertrains—diesel, flex fuel, fuel cell, and other. Combined, these were down a point to a 5.7% market share.

- No longer affected by the Model 3 backorder deliveries, BEV sales were down substantially from both the prior quarter and prior year. The California market again consisted largely of sales from a single company, Tesla which accounted for 2/3 of BEV sales in the quarter. For the year as a whole, Tesla had 73% of all BEV sales, illustrating the extent to which the extensive system of direct and indirect subsidies (such as publicly-funded charging networks, sale of regulatory credits) the state now has in place—and continues to push for nationwide expansion through the continuing dispute with the federal government on vehicle standards—accrues to a single company.

- Results in the upcoming periods may change as producers introduce new models, especially the light trucks that the market is now buying. Several of the pending models, however, continue the Tesla model of appealing to higher income consumers through higher performance and technology characteristics. Broader market share instead likely will come from actions such as Ford’s shift of the Mach-E SUV production to Mexico to achieve significant labor cost savings enabling them to sell at a more competitive price point.

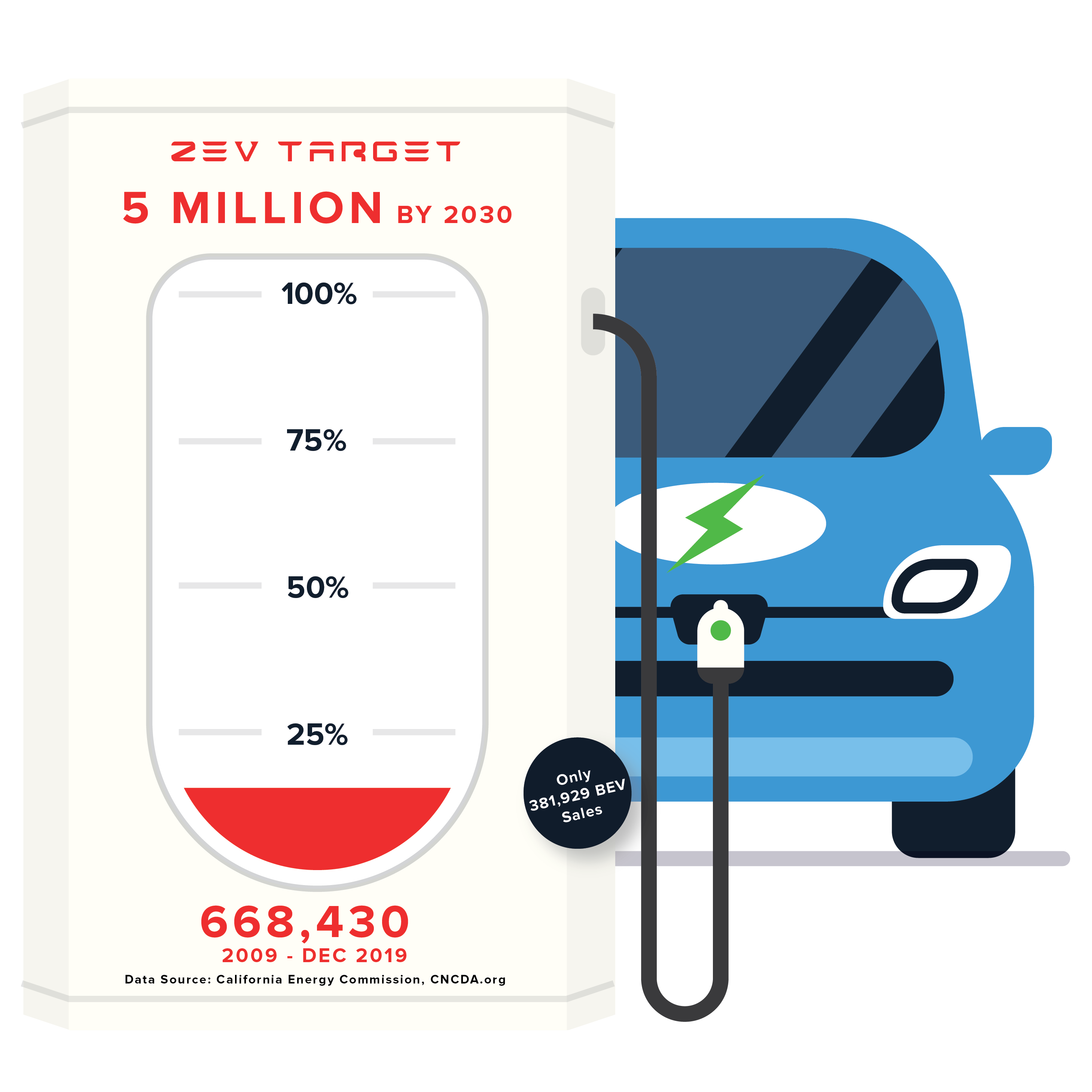

Cumulative PEV Sales at 13.4% of 2030 Goal—True ZEVs at 7.6%

As part of the AB 32 climate change program, Executive Order B-48-18 administratively created a goal of 5 million zero-emission vehicles (ZEVs) on California roads by 2030. This action expands on the prior Executive Order B-16-2012, which set a goal of 1.5 million by 2025. While these goals were set administratively, they are embodied in the state’s climate change strategies, and both public and utility ratepayer funds are being used in an attempt to reach this goal, including purchase subsidies, refueling infrastructure, regulatory credit sales that raise the price of traditional fuel vehicles, a continuing net subsidy from gasoline consumers for roads and road repairs, and other measures.

Rather than only true ZEVs, the numbers in the Executive Order and previous interpretations by the agencies indicate the goal is to be achieved by both BEVs that run only on electricity and combustion PHEVs that run on both electricity and gasoline. Consequently, only a portion of the vehicles being counted to meet the zero emission goal—roughly half based on current sales volumes—will in fact produce zero emissions when driven. Additionally, FCEVs (fuel cell electric vehicles) also would count towards the ZEV total, but CNCDA data show total market share for these vehicles to date at around 0.1%.

Using this more flexible interpretation that includes both true ZEVs and combustion PHEVs, total PEV sales since 2009 account for 13.4% of the 2030 goal. True ZEV sales, however, account for only 7.6%.

In addition to the distortion that comes from including combustion vehicles in the ZEV total, the Executive Orders also refer to ZEVs on California roads while the agency accountings rely on sales as the measure of progress. Using prior Energy Commission reviews to account for ZEVs no longer on the roads as a result of accidents, moves out of state, and other factors that over time remove vehicles from the active fleet, the actual progress rate consistent with the Executive Order language of “vehicles on California’s roads” would be 12.3% rather than the 13.4% shown in the chart. As discussed in the 2018:Q1 report, carpool lane sticker data, however, suggests a much higher turnover of PEVs “off California’s roads” than in prior estimates.

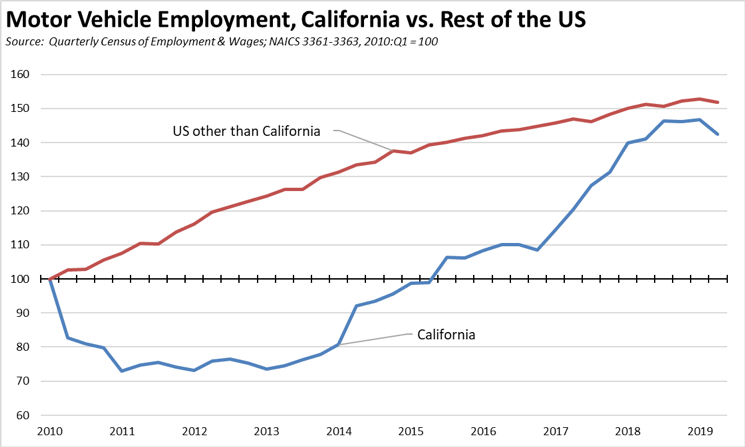

Manufacturing Job Provisions of Executive Order B-16-2012 Still Not Implemented

Executive Order B-16-2012 contains a number of provisions calling for actions to expand the ZEV and ZEV component manufacturing base in California:

[By 2015] The State’s manufacturing sector will be expanding zero-emission vehicle and component manufacturing;

[By 2020] The private sector’s role in the supply chain for zero-emission vehicle component development and manufacturing State will be expanding.

[By 2025] The zero-emission vehicle industry will be a strong and sustainable part of California’s economy;

The specific steps to address these provisions in the most recent ZEV Action Plan, however, call primarily for data collection and conversations rather than specific policy changes that would have created real jobs. California consequently has seen the modern-day electric vehicle industry—which the state in essence created under CARB’s LEV I regulations in 1990—go to other states if not increasingly concentrated offshore in China.

California does have a significant ZEV production presence from Tesla, but Tesla located here primarily because of the availability of a vacant vehicle production facility that was fully permitted and constructed. California previously had several such facilities including in both the Bay Area and Southern California, but instead of being repurposed to create new manufacturing jobs, they were instead mined to produce air quality emission credits. When it came time to expand with new facilities, Tesla instead chose Nevada, other states, and China where the regulatory processes and cost factors allow facilities to be constructed and staffed according to schedules reflecting the rapidly changing needs of this industry. And as China continues to expand its near monopolistic control over the battery production needed to fuel these vehicles, this concentration is only slated to grow more intense in the years to come. While California has promises for these “green jobs,” other states and China are seeing them being created, earning wages, and generating public revenues for schools and other public services.

The availability of a fully permitted and quick-to-operational facility in Fremont has made it possible for California to have at least one component of this industry. As shown in the chart below, California employment in the related industries (NAICS 3362 Motor Vehicle Manufacturing, 3362 Motor Vehicle Body & Trailer Manufacturing, and 3363 Motor Vehicle Parts Manufacturing) in the most recent 2019:Q2 data was 42% above the level in 2010:Q1, below growth in the other states which came in 52% higher. Rather than making California an electric vehicle manufacturing center, this relative performance reflects the fact that other states are doing as well or better in securing these jobs. In terms of total jobs, California also lags behind with only 3.7% of total national employment in these three industries, down from 3.9% in 2010:Q1.

Past issues of this report have tracked the shift of the electric vehicle industry to other states and to China. Some events over the past quarter have included:

- Rather than expanding manufacturing jobs, several recent events have illustrated the potential of the electric vehicle policies to reduce both jobs and wages. The previous quarter’s report cited the pending drops in jobs and wages associated with the proposed repurposing of GM’s Lordstown, OH plant along with Ford’s shift of production to Mexico enabling the labor cost savings needed to sell these vehicles at a competitive price point. United Auto Workers previously issued a report citing concerns that an electric vehicle requires about 30% fewer production labor hours than the often unionized labor for a comparable combustion engine vehicle. Daimler recently announced plans to layoff 10,000 workers as it shifts to electric vehicle production, following on prior announcements from Audi to cut jobs by 9,500, BMW’s agreement to reduce bonuses and other pay perks to finance its shift to electric vehicles, and German auto parts makers Continental and Osram plan to cut jobs and pursue other cost-cutting measures for the same purpose.

- In December, GM and LG announced a $2.3 billion battery plant to be built in Ohio employing up to 1,100 workers. Planned capacity is for 30 GWh compared to Tesla’s current production output of about 24 GWh at its Nevada facility.

- GM announced it will produce the Origin, an autonomous electric vehicle developed by GM’s San Francisco-based subsidiary Cruise, at the Detroit-Hamtramck assembly plant.

- As part of the negotiations for its new union contract, Ford agreed to retool a Dearborn, MI factory to produce electrified versions of its F-150 pickup along with a battery-assembly operation employing 300 workers.

- Electric charger manufacturer EVBox chose to move its headquarters to Libertyville, IL after assessing 33 locations around the country.

- Electrical goods and energy company Grupo IUSA announced 4 electric vehicle models to be produced in Mexico.

- Germany and France announced plans along with Total’s Saft Groupe to open a new battery plant in Kaiserlautern, Germany.

- Irvine-based Karma Automotive most recent job cuts brought their total layoffs to 260 over the past three months.

- After China cut purchase subsidies by 65%, new electric vehicle purchases saw a sharp 28% drop in the 3rd quarter. Sales continued to drop, plunging 54% in January from a year earlier.

California’s Policy Dependence on Democratic Republic of the Congo (DRC) Continues

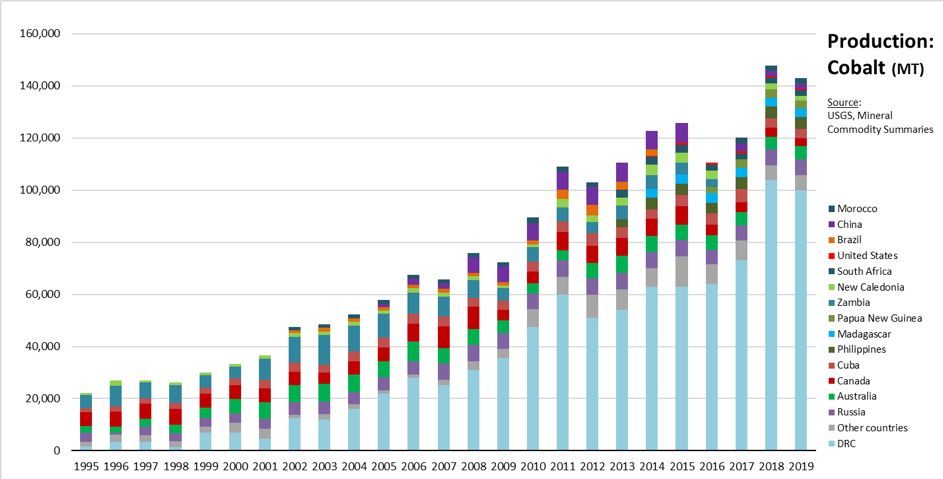

As recently reported by US Geological Survey, the dependence of the state’s electric vehicle policies on the politically unstable DRC continued. In 2019, DRC produced 71% of the cobalt that has been essential for the production of electric vehicle batteries compared to 70% in the revised 2018 numbers and 61% in 2017. Production of other battery critical materials including lithium and battery-grade nickel supplies is also highly concentrated within a few countries.

As detailed in the Center’s A Closer Look at California’s Cobalt Economy, DRC has been marked by ongoing civil and international wars, internal conflicts from militias and the nation’s own security forces, and continuing high levels of corruption and sporadic government control of many areas. Internal strife in 2019 continued to force hundreds of thousands to flee their homes. Instability of this type has affected that nation’s mining output in the past with immediate effects on world prices and supplies, as recently illustrated by Glencore’s recent decision to idle its Mutanda Mine, an action that reduced worldwide cobalt output so far by 5% in 2019 in a move to boost prices. DRC in turn has moved to increase future production by removing 10,000 families from areas targeted for new mines.

DRC cobalt mining is also heavily dependent on artisanal mining, estimated to comprise 20% of that nation’s output or about 14% of the world’s supply. Previous reports on artisanal mining in that country citied unsafe working conditions and an estimated 40,000 child laborers, slave labor, and worker and human rights abuses. In December 2019, Washington, DC based International Rights Advocates filed a lawsuit against Apple, Alphabet, Dell, Microsoft, and Tesla on behalf of 14 families whose children were killed or maimed while mining cobalt. Details of the allegations are contained in the filed complaint.