The Los Angeles Times recently published an editorial allegedly to correct the record on information being disseminated by groups such as FactsPerGallon.com on the reasons why gasoline prices are so much higher in California. In what purports to be a fact check piece, the editorial is astonishingly fact-free in its arguments. This special report from the Center for Jobs and the Economy provides the facts that are missing. For additional information and data about the California economy visit www.centerforjobs.org/ca.

Table of Contents

- Editorial Claim: There’s a new watchdog division at the state Energy Commission that’s starting to look over petroleum companies’ shoulders to sniff out potential market manipulation.

- Editorial Claim: It is true that a portion of what Californians pay at the pump goes to state and local taxes and fees . . . But an even greater percentage of the per-gallon cost goes to the oil industry for refining, distribution and marketing and as profit . . .

- Editorial Claim: We don’t know exactly what all that money being sucked up by oil refiners, distributors and retailers is paying for because those details have long been shrouded in mystery. While some of it goes toward operating expenses, a good portion is pure profit . . .

- Editorial Claim: It’s also unclear why Californians pay so much more for gas.

- Editorial Claim: In February, California’s prices were $1.35 per gallon higher than the rest of the country, and between 30 to 40 cents of that is what UC Berkeley economist Severin Borenstein calls a “mystery gasoline surcharge” that cannot be explained by higher taxes, fees or environmental standards.

Editorial Claim: There’s a new watchdog division at the state Energy Commission that’s starting to look over petroleum companies’ shoulders to sniff out potential market manipulation.

The Facts: The state has had a “watchdog” with these responsibilities since its founding, the Attorney General and, within their jurisdictions, the county District Attorneys. These watchdog functions have done more than just “look over the shoulders,” and along with other agencies such as the Energy Commission have engaged in full-on investigations into gasoline pricing in the state.

In response to rising fuel prices in 1999, the Attorney General convened a broad-based panel to investigate potential market manipulation and determine the causes of those price increases. In a preliminary November 1999 report and a May 2000 Final Report, the Attorney General instead cited four core reasons why California gasoline prices were 48.4 cents higher than the national average: (1) little spare capacity in California refineries that have limited options when one or more are affected by accidents or other unscheduled down periods, (2) relatively lower fuel inventory levels in the state, (3) few alternative sources of supply because the state fuel regulations limit what can be sold, and (4) the cost of the state’s higher fuel taxes, although these were not considered as significant as the higher cost of producing fuels complying with the state’s regulations. California’s regulations have increased the cost of producing compliant gasoline and diesel. Those same regulations severely limit access to potential relief supplies during periods when the state’s decreasing refinery capacity experiences unexpected shutdowns.

The Attorney General released an updated report in March 2004 assessing why California gasoline prices had risen to up to 50 cents higher than the national average, but again cited the reasons stated in the 2000 report rather than market manipulation.

Because neither the agencies nor the legislature adopted any corrective actions in response to these reports, California continued to experience rising fuel costs due to additional regulations and fees, and periodic price spikes during refinery disruptions, especially during the mandated biannual changeover between the winter and summer formulations. In response to each of these events, additional investigations were announced, but with no apparent actions taken as public furor diminished once prices eased.

The Attorney General did file at least one major recent case alleging price manipulation (People of California v. Vitol, Inc. et al., (Cal. Super. Ct. (San Francisco Cty.)), but with energy traders Vitol, Inc., SK Energies America, Inc., and SK Trading International Co., Ltd. and not against any of the state’s oil and gas companies. The lawsuit was announced with considerable publicity in 2020. It was apparently settled with no public release late last year.

The Energy Commission also has been tasked periodically with investigating the same issues. In a May 2019 report exploring why California gasoline prices had soared to as much as $1.11 a gallon higher than the US average, six core reasons were given: (1) higher cost of producing compliant gasoline (19.6% of the difference), (2) higher fuel taxes (27.5%), (3) Cap & Trade costs (15.8%), (4) Low Carbon Fuel Standard (LCFS) costs (14.8%), (5) factors due to the refinery outages and California’s regulation-defined status as a fuel island (10.3%), and (6) other unspecified factors (11.9%) that the editorial refers to as a “mystery surcharge.”

The real mystery in this string of events, however, is that the fundamental drivers of California’s now substantially higher gasoline costs—$1.52 a gallon higher in the Center’s most recent analysis of energy prices—have been clearly laid out in investigative reports starting nearly a quarter century ago. Yet, nothing has changed other than to make price volatility worse through additional rounds of regulation, increases in fuel taxes and fees, restrictions on in-state production in favor of imported oil and its attendant risks due to global factors, and policy pressures on refineries that will see the state’s already constrained capacity reduced further in the upcoming years. Simply creating yet another bureaucracy to investigate the same issues and come up with the same conclusions will not change prices. Acting on the well-established causes for the state’s high prices will.

Editorial Claim: It is true that a portion of what Californians pay at the pump goes to state and local taxes and fees . . . But an even greater percentage of the per-gallon cost goes to the oil industry for refining, distribution and marketing and as profit . . .

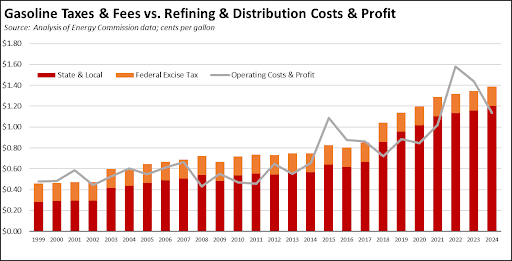

The Facts: Putting aside the fact that this statement appears to be saying that the oil industry should be singled out and not allowed to recover their costs in pricing their products, this claim can only be supported by cherry-picking through the data. A more complete look shows this statement does not hold up. Using average annual results from Energy Commission data, the total amount of taxes and fees Californians must pay at the pump—state, local, and federal—generally exceeds the actual costs of refining and distributing that fuel. Since the tax and fee bite began soaring in 2018, the amount charged by state and local governments alone has exceeded those costs in 5 of the last 7 years (2024 is the year-to-date results as of March).

To put these results in perspective:

-

- Fuel taxes and fees are not just a “portion” of what Californians pay. These charges basically double the cost of refining and delivering gasoline in this state. No other product, especially one so critical to the cost of living faced by Californians every day, is penalized with this level of taxation.

-

- Using the Energy Commission data to date for 2024, the effective tax rate paid by Californians—regardless of income level—when buying gasoline is 45.0%. State and local charges alone are 39.0%. And these only cover the taxes and fees tacked onto the final selling price, and do not include the range of other taxes and fees levied against the refining, distribution, and retail operations and which consequently are incorporated into the final prices Californians must pay.

-

- Using the most current Energy Commission data for March 18, US Energy Information Administration data shows the spread between the average California and average US per gallon price for gasoline was $1.06. Total state and local taxes and fees were $1.25 per gallon. Except for the high cost of these state and local taxes and fees, Californians in fact would be paying less per gallon than the cost in the other states.

-

- The California rates are not just high, they are the highest. As of July 2023, Tax Foundation reports that the state taxes and fees alone are the highest at 77.9 cents per gallon, compared to an average of only 31.6 cents in the other states and DC and 17.47 cents in Missouri, the lowest among the contiguous states.

Editorial Claim: We don’t know exactly what all that money being sucked up by oil refiners, distributors and retailers is paying for because those details have long been shrouded in mystery. While some of it goes toward operating expenses, a good portion is pure profit . . .

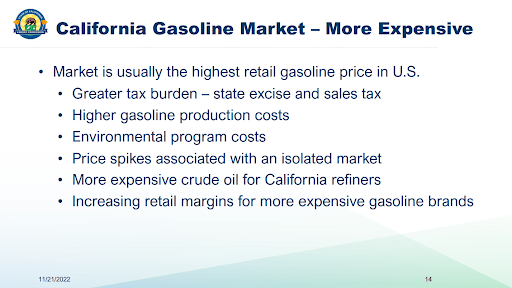

The Facts: The Energy Commission has long maintained a web site that details the specific factors that have led to California’s higher fuel prices. As summarized:

-

- Higher taxes. As discussed above, California has the highest state gasoline taxes and fees among the states and DC.

-

- Higher gasoline production costs, currently at 15 cents a gallon, due to California’s unique formulation regulation. These costs, however, are going higher. The Air Resources Board continues to promulgate additional regulations affecting the formulation and consequently the cost of fuels allowed to be sold in the state. The Board’s recent Standardized Regulatory Impact Assessment estimates that the current changes being considered to the LCFS requirements will raise the price of gasoline by 12 cents a gallon beginning in 2024, increasing to $1.83 a gallon by 2041. These numbers are based on constant dollar (2021) estimates. The actual price that will be paid by Californians will be higher once inflationary factors are incorporated as well.

-

- Higher environmental program costs. California’s stricter requirements for issues such as air quality, climate change, and other environmental programs significantly increase the compliance component of operating costs.

-

- Shorter winter season. California’s regulations require an annual changeover between the winter blend and summer blend regulations. As recognized by the governor in issuing orders twice to the Air Resources Board for an early shift to winter blend to deal with fuel price spikes, production costs are substantially higher for the summer blend.

- Isolated fuels market. California’s unique formulation regulations mean compliant fuels and blending components are primarily produced in the state for use in the state. There are no pipelines connecting to the broader national market, and what few alternative supplies that do exist must be transported by tanker in a three-to-four-week voyage. As a result, “. . . unplanned refinery outages requiring maintenance can significantly impact the state’s gasoline supply, usually resulting in temporary price spikes.”

If the editorial writers don’t “know exactly” where the money goes, it is because they haven’t bothered to read the information that has long been available through the state and federal agencies, research organizations, other sources that have long tracked the reasons behind California’s higher prices, and nearly a quarter century’s worth of state investigations into this issue.

Editorial Claim: It’s also unclear why Californians pay so much more for gas.

The Facts: In addition to the previous sources that lay out the reasons in great detail why Californians pay so much more, a recent Energy Commission presentation provided yet another summary:

That presentation also noted that California refinery capacity—essentially the only source for gasoline sold in the state—declined by 9.8% between 2019 and 2022. Under executive orders and SB X1-2 (2023), the state is also now on a course to reduce that capacity even further. As fuels production becomes even more constrained, the issues that have led to price volatility in the past are likely to become magnified in the future.

The reason that Californians pay so much more for gasoline is not because the source of this price differential is unknown. There are volumes on this issue. The reason is that the state agencies have chosen to ignore this information, and continue down the path of increasing rather than mitigating the factors that have led to these conditions. The definition of insanity is doing the same thing over and over again and expecting a different result. The definition of energy policy in this state is not only doing the same thing but doubling and tripling down on those actions and then acting surprised when energy prices keep going up.

Editorial Claim: In February, California’s prices were $1.35 per gallon higher than the rest of the country, and between 30 to 40 cents of that is what UC Berkeley economist Severin Borenstein calls a “mystery gasoline surcharge” that cannot be explained by higher taxes, fees or environmental standards.

The Facts: Following the May 2019 report cited above, the Energy Commission then delved into the “mystery surcharge” further with a subsequent report in October 2019. The report concluded that this additional charge was occurring at the retail rather than the refiner level, and that the “. . . CEC does not have any evidence that gasoline retailers fixed prices or engaged in false advertising.” However, this report only considers the additional cost through a margin analysis and contains no analysis of the differences between retail gasoline operations in California and those in other states, including the much higher cost of operating these businesses in California. There is no mystery to the fact that because California regulations, taxes, and fees make it more costly to operate a business in this state, employers often have to charge higher prices to cover those costs.