The Center for Jobs and the Economy tracks closely California’s Trade sector and its importance in creating well-paying, resilient jobs for millions of residents. California’s Trade sector is a national economic powerhouse, with more than 1 in 51 jobs nationwide supported by the sector. To further quantify the impacts of this sector, the Center released a detailed economic study, “Special Report: Economic Importance of Trade & the Ports to Southern California,” which quantified the importance of this sector.

Using that report as a foundation, the Center has completed a brief analysis of language likely to be amended into Assembly Bill 98, which would add further regulations and restrictions to the state’s warehousing sector. This analysis includes the number of Trade and Warehousing jobs by Assembly District as well as by County to show the geographical breakdown of the sector.

Key Findings

- Warehouse shortages contributed to the supply chain bottleneck during the Pandemic that led to empty shelves and increased costs for families

- The California Trade Cluster supports 3.2 million jobs—or 17.6% of all jobs in the state

- The California Trade Cluster accounted for 14.3% of the state GDP in 2023

- The California Trade Cluster supports an estimated $96.5 billion in state and local tax revenue

- Trade jobs, with an average annual wage of $87,800, are the foundation for Latinos, those with a high school education or less, and immigrants

- States like Texas, Georgia, and South Carolina are making significant investments in warehousing capacity. Similar investments in the past have reduced California’s overall market share of trade activity

What is At Stake With AB 98—California’s Trade Cluster of 1.3 Million Jobs

Warehousing is a critical component of California’s economically key Trade Cluster. Warehouse shortages along with other trade channel bottlenecks led to vessels backing up at the state’s ports during the recent Pandemic period. These bottlenecks led to shortages and consequently rising prices for both consumer goods and critical parts and materials for production throughout the US.

In 2023, California’s Trade Cluster supported an average of 1,254,700 jobs in the state, or 7% of the California total. The average annual wage of $87,800 was nearly the same as the overall average for all jobs in the state. The Trade Cluster industry grouping used in these estimates is the one developed by the Los Angeles County Economic Development Corporation and used in our recent report on the economic effects of the Ports of Los Angeles and Long Beach.

Combined, the direct, indirect, and induced effects support 3.2 million jobs (17.6% of California total), $277.6 billion labor income, $502.0 billion value added (equivalent to 14.3% of California GDP in 2023), and $851.9 billion in output (sales). The full economic importance of these jobs to the state is assessed using the IMPLAN input-output model for California using 2022 data and reporting the results in 2024 dollars.

This economic activity also supports a substantial share of state and local revenues. Combining direct, indirect, and induced effects, the Trade Cluster supports an estimated $52.2 billion in state revenues and $44.3 billion in local revenues.

Anti-Competitive Regulations Have Already Reduced Jobs and Economic Output

California’s regulatory environment continues to impact businesses’ decisions on whether to site or expand operations in the state, especially the Southern California region. Since 2006, the Southern California ports complex and associated supply chain network have lost 23% of their market share to competing states. This reduction in market share had led to fewer well-paying jobs and reduced local and state tax revenue. This includes:

- 45,400 jobs annually in Southern California

- $3.86 billion in reduced labor income

- $43.8 billion in cumulative losses to the regional economy

- $590.9 million in lost local and state tax revenue to governments in Southern California

- Cumulative revenue losses to state and local governments of $4.5 billion

Where will Warehouse Jobs Go?

Curtailing new warehouse space in the state through higher regulatory compliance costs means these Trade Cluster jobs will be at risk of moving to other states. For example, the recent closure of Save Mart’s distribution center cost 300 lost jobs in Roseville. Georgia Ports Authority is expanding new warehouse demand through expansion of a third container terminal and a new rail terminal to expand inland intermodal capacity. South Carolina Ports has invested more than $2 billion in expansion projects in recent years. Dick’s Sporting Goods recently announced an 800,000 square foot distribution center in Texas.

What Workers Would be Affected?

By ethnicity and race, the state’s Trade Cluster shows a relatively higher incidence of Latino workers. Average annual wages in 2023 were higher for Latinos, African-Americans, and Other Races in Trade compared to the overall state economy.

Trade also provides a relatively higher share of job opportunities for workers with a high school education or less, paying annual wages higher than the statewide average.

Trade also serves as an important gateway job for immigrants. Using the American Community Survey (ACS) microdata, nearly 40% of Trade workers in 2022 were foreign-born naturalized citizens or non-citizens.

Where Do They Live?

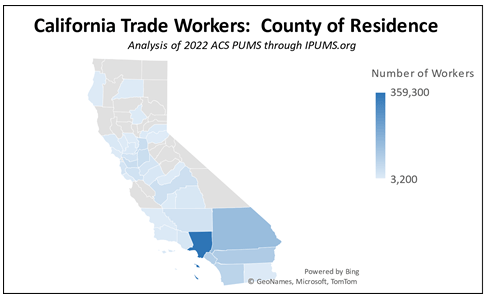

Los Angeles County and the rest of Southern California have the highest concentration of Trade Cluster workers, but this industry is spread throughout the state. Including Ventura and San Diego Counties, Southern California accounts for 62% of the state’s Trade Cluster workers.

Note that data is only available for the counties shown on the map. Another 31,500 Trade Cluster workers live in the grey counties. Also note that the map shows where these workers live. They may commute to work to another location.

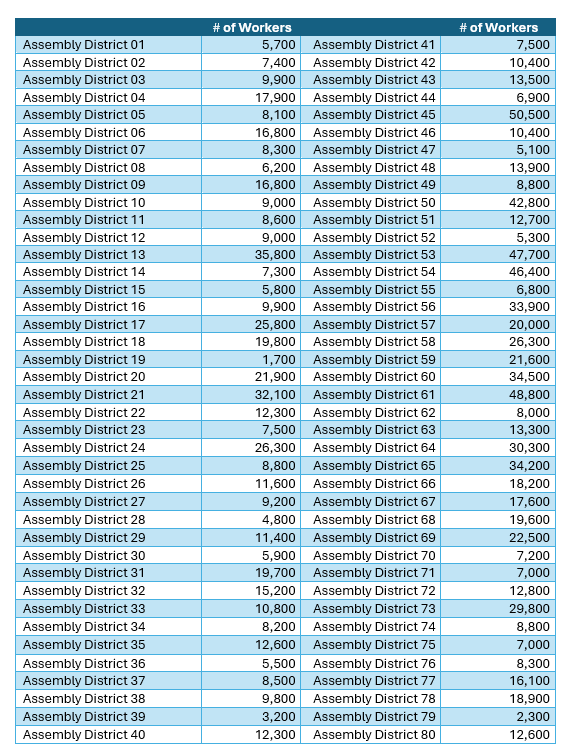

The number of workers is not available by legislative district in the 1-year ACS data. However, an approximation can be obtained using the QCEW data the Center maintains through special runs by EDD. This data, however, is only available by 2-digit level NAICS, and consequently overstates the Trade Cluster component by about 17% due to some additional industries included under Transportation & Warehousing (NAICS 48-49) such as Couriers & Messengers but not included under the Trade Cluster definition used in this report. The numbers in the table below have been adjusted to address this factor. While the previous numbers detailed the residence of Trade Cluster workers, the numbers in this table are by place of work. They estimate the number of workers employed by Trade Cluster businesses within each district.

![]()