Disney Cancels Move to New Florida Campus

The Walt Disney Company recently announced it was cancelling a $1 billion office project that would have seen 2,000 jobs move from California to Florida. This project was previously included under the Califormers when it was announced in 2021. Disney’s latest move was hailed as a “victory for California” over “authoritarian policies,” and as further evidence that “California’s economy continues to dominate the nation.”

Unpacking these statements, the issues are not necessarily so clear cut:

- The Califormer series has identified two Disney projects, the subject office project and much larger plans to invest $17 billion creating 13,000 jobs over the next 10 years. Disney’s statement specifically referenced its commitment to move forward with the 13,000 jobs in Florida while returning 2,000 to California.

- The office project change is only one in a series of cost-cutting moves recently announced by Disney. The latest is an announcement this week covering a third round of layoffs affecting another 2,500 jobs as part of a broader effort to cut company costs by $5 billion this year.

- California itself is no stranger to “authoritarian” actions, with some of the more recent including threats to impose punitive taxes on oil and gas companies rather than addressing state actions that have pushed fuel prices to elevated levels over a sustained period—later backing off with a more convoluted but additional layer of regulations that will likely lead to additional energy costs—as well as threats against companies attempting to comply with laws in other states—again later backing off after it was clear there was no legal basis for the threatened actions.

- The primary evidence cited in support of California’s economy dominating the nation was again a reference to an editorial speculating over the possibility that California would become the 4th largest economy in the world in 2022. In our recent analysis, California in fact remained in 5th position in 2022, and based on International Monetary Fund (IMF) projections is just as likely to sink to 6th place in the next few years as India’s economy continues to grow faster. More importantly, this analysis also considered the extent to which California’s high and growing costs of living have eroded the benefits of its current position. California sinks to 11th largest after adjustments using IMF’s Purchasing Power Parity GDP series which accounts for differences in the costs of living.

- A claim that “California has the most equitable tax system in the entire country” relies on a single 2018 study by the Institute on Taxation and Economic Policy. Rather than measuring the efficiency of the different state tax systems, this study uses selective tax data to assess the extent to which each state uses their tax codes to redistribute income. And while the specific data and methodologies used in the report are somewhat opaque, at least one review calls into question its currency, stating that the analysis “. . . is based on 2018 laws, 2015 population levels, and 1988 federal tax data.”

But regardless of whether the conclusion from this report is that California is better at using its tax policies for the social policy of redistributing income rather than developing a fair tax system that supports critical public services at minimal effect on long-term economic growth, the resulting tax system is one that distributes one of the highest tax and fee burdens in the country. In the most recent Tax Foundation analysis, California had the 5th highest total tax burden in 2022—the total amount of state and local taxes and fees paid by each state’s residents. In other words, taxes and fees contribute to the high costs of living in this state to a far greater degree than in 45 other states. The only ones doing worse are New York, Connecticut, Hawaii, and Vermont—all states that along with California have yet to see their employment numbers recover from the pandemic period.

- From the standpoint of “is this the right way to run a state,” California’s presumed most-equitable tax system is also one of the most volatile in the country because of these features. In the recently released May Revise, personal income tax accounts for 59.4% of total general fund revenues within the 3-year budget window. In some prior years, personal income tax has made up as much as 2/3 of the general fund. Yet, the amount paid under this tax—consequently largely determining whether the budget will be in surplus or deficit—relies on an extremely small share of the taxpayer base. In the latest data from Franchise Tax Board for tax year 2020:

- Tax returns showing $1 million or more AGI in 2020 were only 0.63% (115,096 tax returns) of total taxpayers, but paid nearly half (44.7%) of the total personal income tax.

- Of these, tax returns showing $5 million or more AGI in 2020 were only 0.07% (13,365 tax returns) of all taxpayers, but paid just over a quarter (25.8%) of all personal income tax.

- The overreliance on a few taxpayers is growing. The comparable numbers in 2017 were 0.42% of taxpayers with $1 million or more AGI paying 37.7% of the tax, and 0.05% of the taxpayers with $5 million or more paying 21.2% of the tax.

The flip side of an “equitable” tax system in this case is one that is also dependent on very narrow underpinnings. While there may have been incomes to redistribute in recent years, this system also ensures cuts get equitably distributed as well depending on the financial outcomes or residence decisions for only a relative handful from the taxpayer base.

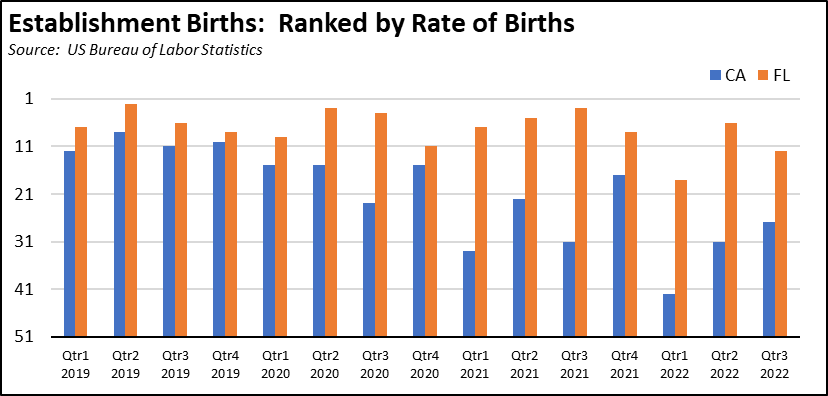

- The claim that California is number 1 for new business starts relies on the establishment birth data from the Business Employment Dynamics series from US Bureau of Labor Statistics. Measured in the absolute number of establishment births, this claim is correct. Using a sample period, California showed the highest number of births in the period 2019:Q1 through 2022:Q3 (as well as in earlier quarters). However, California also had the highest number of establishment deaths in this period as well (through 2022:Q1—the data lags).

Given that the state contains 15.1% of all private establishments, it should be creating more of them in absolute terms, but in relative terms, other states are growing much faster. On a relative basis using the rate of establishment births, California ranks much lower, generally deviating little from the overall US average. In this period, California ranked from 8th to only 42nd highest. Florida in this same period ranged from 2nd to 18th highest and performed better than California in each quarter.

- While the claim that California leads the nation in access to venture capital relies on a report showing 2020 data, most other recent sources show this situation to still be the case although the value of deals in some states had been growing faster prior to the current slowdown. However, California’s overreliance on such deals at the IPO or other exit stage for state revenue generation has been a major factor in the wide swings in the budget numbers in recent years. This situation represents a problem that is good to have in the up years, but the state policy focus on these tech industries while pursuing other policies that negatively affect the much larger share of middle class job industries provides less of a fallback revenue base in the down years.

- Using the source cited for the claim that California leads in tourism spending, the preliminary number for 2022 does show California with the highest level of travel spending at $140.5 billion. However, this source also shows that number is down 12% from 2019. In contrast, travel spending is growing in Florida, up by 9% to $122.9 billion and closing in on the California number even after Hurricanes Ian and Nicole in 2022. Tourism in fact was one of the industries hardest hit by California’s series of pandemic period closures and shifting regulations. Overall, Leisure & Hospitality employment (seasonally adjusted) in the latest data for April is still 23,000 jobs lower than in pre-pandemic February 2020, but is up 33,200 in Florida.

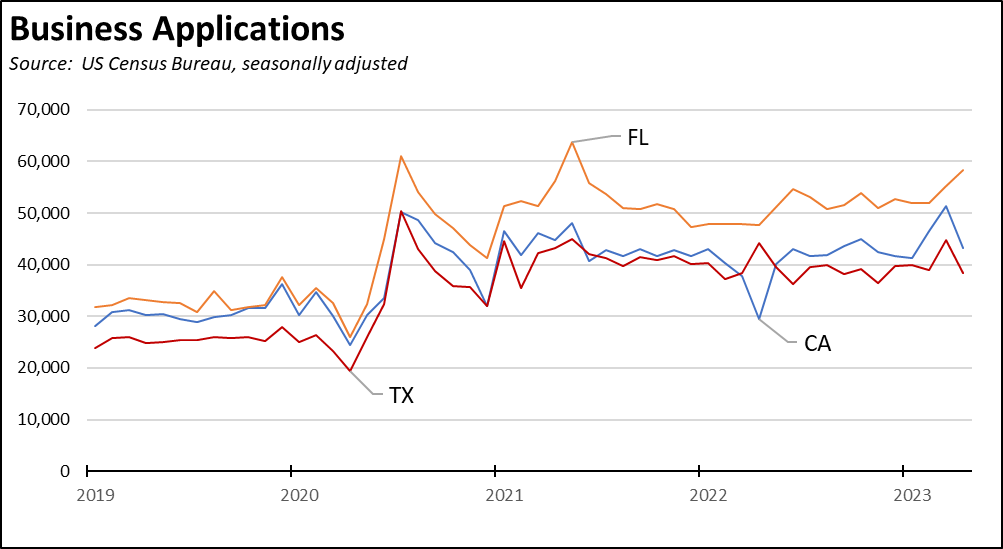

- As claimed, business license applications in April were up 46.6% since April 2022, but only because the comparison month of April 2022 posted the lowest level since April 2020 at the depths of the pandemic downturn. Using a more meaningful comparison, applications in the 12 months ending April 2023 were up 5.8% from the same period ending April 2022, still positive but avoiding the distortion coming from selective choice of the monthly data. More telling, the number of business applications in California has consistently lagged those in Florida since at least 2019, and has closely tracked those in Texas even though that state is only three-quarters as large.

The lesson from the Disney announcement is not that suddenly everything is right with the business climate in California and wrong in Florida, but that capital is mobile. Government attitudes towards business can have an effect on where that capital will be allocated, especially during times such as at Disney when major expenditures are under review. And for every Disney announcement, California has seen counter moves at a much larger scale by companies such as Cacique Foods, Dole Food, Hewlett Packard, McKesson, Oracle, Tesla, and the other employers tracked in our Califormer series who have moved their headquarters and/or operations to other states.

California has substantial competitive advantages, but the general attitude of government has been that businesses leaving is not a problem because there has always been others to take their place. That attitude reflects the historic pattern of development in this state, serving as the birthplace for innovation in today’s industries beginning with mining and agriculture in the 19th century and continuing on with entertainment, aerospace, electronics, trade, and now tech and biochemistry in the 20th and 21st. But California served as the incubator and subsequent center for these and other industries not only because of its advantages in natural, financial, and knowledge-based resources, but because it also provided the conditions where the required workforce wanted to live and a place where that workforce could afford to live.

Those conditions have now changed. California is still able to support the higher end of many industries where wages make it possible for those workers to cope with the high costs of living. As in the case of the tech industry, however, the ancillary jobs—both higher wage blue collar jobs in manufacturing and white collar jobs in support and back office operations—now go to lower cost locations instead of spreading to other regions in the state and supporting the middle class base.

In spite of its advantages, California still faces challenges—many of its own making—in growing the jobs that support its workers and the business activity supporting its budget needs.