Below are highlights from the recently released trade data from the US Census Bureau and US Bureau of Economic Analysis. To view additional data and analysis related to the California economy visit our website at www.centerforjobs.org/ca.

Trade Growth Driven by Imports

The July trade data showed strong results for California and its ports as shippers produced an early surge in activity in order to stay ahead of pending tariffs and potential labor actions. Origin exports rose 7.3% in nominal terms compared to a year ago. Total trade activity through the state ports accelerated by 22.7%, with the strongest increases coming from a steep rise in imports.

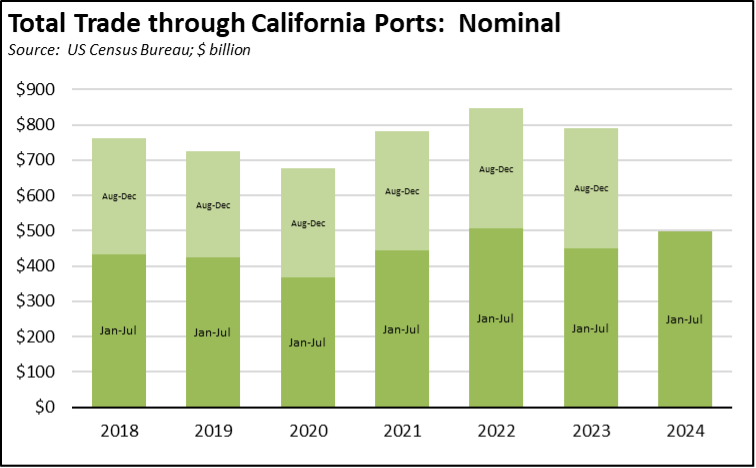

The July numbers put the state on track to match or exceed the previous peak in 2022 in both nominal terms:

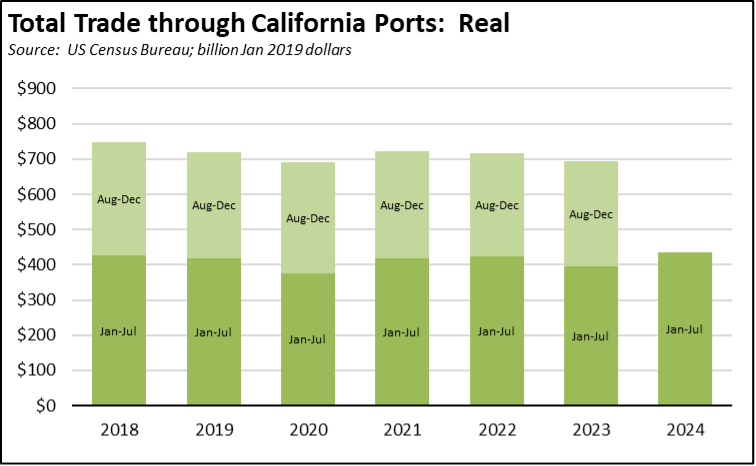

And in real terms:

The economic importance of these trade flows is not just limited to the ports. As we recently analyzed in a special report, the ports and their activities are the base of a nation-leading (and continent-leading) trade jobs cluster supporting 3.2 million jobs, or 17.6% of all jobs in the state. That trade cluster in turn accounted for 14.3% of state GDP in 2023, and $96.3 billion in state and local tax revenues. Jobs within this cluster are largely blue-collar, middle-class wage jobs paying nearly the same as the overall average annual wage in 2023, and was the only such industry showing substantial growth for these workers—especially workers with a high school or less education level, Latinos, and immigrants—during the pandemic.

California Goods Exports

Total California origin goods exports rose $1 billion from July 2023 (up 7.3%). California remained in 2nd place with 8.74% of all US goods exports (12 month moving total), behind Texas at 22.32%.

California Goods Imports

Total California destination goods imports rose $9.1 billion from July 2023 (up 24.9%).

Top 20 Exports, June 2024

Top 20 exports by value are shown below, along with the change from July 2023