The Center for Jobs and the Economy has released our full analysis of the May Employment Report from the California Employment Development Department. For additional information and data about the California economy visit www.centerforjobs.org/ca.

Highlights for policy makers:

- Recovery Progress

- Unemployment Claims at Nearly a Quarter of US Total

- Budget Deal Still Ignores $17.4 b. UI Debt

- CaliFormer Businesses

Recovery Progress

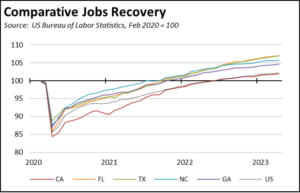

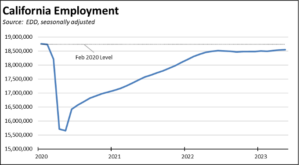

As discussed in our preliminary report, the May jobs and labor force data although down from April remained in positive territory. Nonfarm wage and salary jobs growth at 47,300 was about a fifth higher than the average in the previous 12 months. Employment gains at 9,900 were positive but substantially weaker than in the prior 2 months. Nonfarm jobs are now 2.4% above the pre-pandemic peak. Employment—the number of people working in the state—remains 1.0% below meeting this recovery point.

On a monthly basis, California’s nonfarm wage and salary job gains (seasonally adjusted) were the second highest among the states and DC. Texas was highest at 51,000 and New York third at 30,400. In terms of net jobs created since the pre-pandemic high, California again came in third at 415,600, with Texas at 947,400 and Florida at 658,500. On a comparative basis, California’s jobs recovery rate continues to track just below the overall US average, coming in 21st highest among the states and still well behind when looking at the five states with the highest net job gains.

California also is not creating jobs at a rate fast enough to push significant improvements in the employment numbers. Even with the positive results in now the last three months, total employment has changed little since last June rather than moving the state towards a recovery level.

Unemployment Claims at Nearly a Quarter of US Total

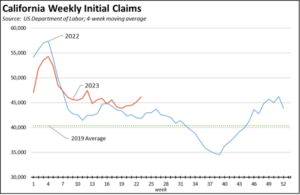

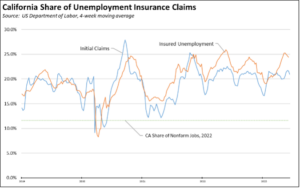

Measured on a four-week moving average, initial unemployment insurance claims again began rising above the comparable levels a year ago.

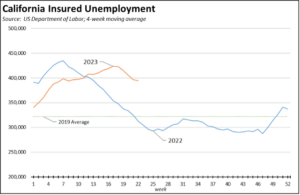

Insured unemployment—a proxy for continuing claims—is even more elevated over the comparable period in 2022, but has eased slightly from the near-term peak reached in the week ending May 6.

Overall, California workers access this program to a far higher degree than workers in the other states, a factor that contributes to the low level of recovery in total employment. On a 4-week moving average basis, California initial claims for the week ending June 10 were 20.9% of the national total. Insured unemployment as of the week ending June 3 was at 24.4%. In contrast, California constitutes only 11.6% of the national economy as measured by nonfarm jobs.

Budget Deal Still Ignores $17.4 b. UI Debt

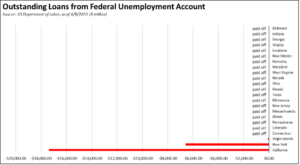

Even though California workers rely on the unemployment insurance program to a far greater degree than workers in the other states, the recently announced preliminary budget deal does nothing to restore the fiscal health of this fund. Contrary to claims that there has been no general tax increase in the state since 2011, failure to address this debt institutes one of the highest tax increases ever on California businesses directly and workers indirectly. California’s federal debt in the latest report for June 9 is $17.4 billion. By failing to address this debt, the state budget ensures that employers will continue paying the state UI tax at its highest rate schedule. In addition, employers will be subject to an increase in the federal UI tax, growing at an additional 0.3% to 2.7% annually until the federal debt is paid off.

Given the scale of the current federal debt, the prospects of ever paying off that debt are now uncertain. During the Great Recession that began in 2008, the state’s UI fund went through similar circumstances as workers turned to this benefit to help them through a period of extended unemployment. The fund’s debt in that period peaked at only $11 billion yet took 9 years to pay off through extending the highest state rate combined with the growing federal rate. The current debt is now 60% higher, and a chance at solvency is being called into question by increasing risks of yet another downturn along with prospects that the state’s population and workforce will continue to shrink as in recent years.

States were given federal monies to pay off their UI debts and restore their state funds to pre-pandemic levels as part of the Covid assistance bills. Every other state except California and New York has consequently eliminated their federal debt and associated higher federal taxes on employers, and restored the fiscal health of their funds in order to be able to weather any upcoming downturn. In the most recent results, California in contrast now accounts for 72% of the outstanding debt to the federal fund.

CaliFormer Businesses

Additional CaliFormer companies identified since our last monthly report are shown below. The listed companies include those that have announced: (1) moving their headquarters or full operations out of state, (2) moving business units out of state (generally back office operations where the employees do not have to be in a more costly California location to do their jobs), (3) California companies that expanded out of state rather than locate those facilities here, and (4) companies turning to permanent telework options, leaving it to their employees to decide where to work and live. The list is not exhaustive but is drawn from a monthly search of sources in key cities.